February 25, 2026 - 10:00 am

Bad Homburg, Germany

Press Conference Full Year Results 2025

Fresenius Kabi, an operating company of Fresenius, has entered a first-of-its-kind partnership with U.S. manufacturer Phlow Corp. to establish a fully domestic, end-to-end supply chain for Epinephrine Injection, USP — an FDA designated essential medicine frequently at risk of shortage in the United States.

Under the collaboration, Phlow will produce the U.S.-based API, while Fresenius Kabi manufactures the finished doses for hospitals and clinics across the country. With this initiative, Fresenius advances its local-for-local manufacturing strategy and supports national efforts to strengthen pharmaceutical security. The partnership reinforces the ambitions of #FutureFresenius as it expands Fresenius’ role as a leading global provider of lifesaving therapies, advancing resilient manufacturing that improves patient care and health-system stability.

Pending regulatory approvals, epinephrine produced through this collaboration could be available to U.S. hospitals in 2027.

Fresenius Kabi, an operating company of Fresenius, has entered a first-of-its-kind partnership with U.S. manufacturer Phlow Corp. to establish a fully domestic, end-to-end supply chain for Epinephrine Injection, USP — an FDA designated essential medicine frequently at risk of shortage in the United States.

Under the collaboration, Phlow will produce the U.S.-based API, while Fresenius Kabi manufactures the finished doses for hospitals and clinics across the country. With this initiative, Fresenius advances its local-for-local manufacturing strategy and supports national efforts to strengthen pharmaceutical security. The partnership reinforces the ambitions of #FutureFresenius as it expands Fresenius’ role as a leading global provider of lifesaving therapies, advancing resilient manufacturing that improves patient care and health-system stability.

Pending regulatory approvals, epinephrine produced through this collaboration could be available to U.S. hospitals in 2027.

Grit Otto-Moritz is not sitting in the treatment room at Helios Hanseklinikum Stralsund for the first time. The 60-year-old agricultural engineer was diagnosed with breast cancer back in 2013. At the end of 2025, she was diagnosed with lung cancer; she has overcome both diseases. In mid-January, however, another serious diagnosis followed: the former breast cancer had metastasized and spread to her bones.

At Helios Hanseklinikum Stralsund, her medical history is therefore being reviewed once again in its entirety. Findings are reassessed, assumptions questioned—nothing can be overlooked now. For her treating physician, Dr. med. Hussein Abdallah, Senior Consultant in General, Thoracic and Visceral Surgery, diagnostic precision is paramount. The patient experiences firsthand that at Helios, doctors do not look at individual diagnoses in isolation, but focus on identifying connections.

Her story is emblematic of many people affected by cancer, particularly patients with complex or multiple diagnoses. It illustrates why individualized cancer care is crucial—and why World Cancer Day offers an opportunity to reassess this commitment time and again.

Fresenius’ role – cancer care along the entire patient journey

On World Cancer Day, Fresenius highlights its contribution to cancer care and shows how colleagues across the company work every day to support people living with cancer in the best possible way.

Fresenius accompanies patients throughout all phases of their disease. Fresenius Kabi, Helios and Quirónsalud provide care that brings together medical treatment, innovative medical products, modern technologies and supportive services.

Support ranges from prevention and early detection to diagnostics and personalized therapies, acute clinical treatment, as well as aftercare, long-term follow-up and palliative or home-based care.

At the center is always the person—patients as well as employees. Physicians, nurses, therapists, researchers and many other professional groups jointly take responsibility for cancer care that is individualized and reliable.

Fresenius Kabi: Efforts tailored to address the changing needs and challenges faced by cancer patients

Cancer rarely follows a straight path—and neither does care. Therapy phases change, recovery occurs in waves. This reality repeatedly confronts patients with new challenges. Fresenius Kabi employees align their work precisely with this reality.

In addition to tumor treatment itself, this includes reducing side effects and pain, maintaining physical strength.

Fresenius Kabi contributes to this with a broad portfolio of treatments and services. This includes biologic medicines and essential drugs used in both treatment and supportive care.

These are complemented by infusion technologies, devices and technical expertise that ensure safe and reliable administration.

Biosimilars improve security of supply and access to effective targeted therapies, particularly for complex and multiple cancer conditions. Another key component is clinical nutrition, which supports patients whose nutritional status is impaired by illness or therapy.

Clinical oncology at Helios – individualized care for complex diseases

At Helios, cancer treatment is also far more than a single therapy. Across more than 90 hospitals nationwide, every course of treatment begins with a careful review of the patient’s medical history and current life situation. Based on this, specialized teams develop individually tailored treatment concepts. Helios draws on the expertise of a nationwide network of certified cancer centers.

Grit Otto-Moritz’s story shows how important this approach is. Dr. med. Hussein Abdallah explains: “When a patient has already had multiple cancer diagnoses, particularly careful evaluation of all findings is essential to ensure that an additional tumor is not overlooked. In interdisciplinary tumor conferences, colleagues from different specialties contribute their expertise to define the best possible treatment.”

Priv.-Doz. Dr. med. Daniel Pink, Head of the Oncology Center at Helios, also emphasizes the importance of close collaboration: “The best treatment outcomes for the diverse and often complex cancer diseases are achieved through close interdisciplinary cooperation among many experts. At Helios, we also work closely with office-based physicians during follow-up care.”

March 11, 2026

Miami, USA

Barclays 28th Annual Global Healthcare Conference

March 11 – 12, 2026

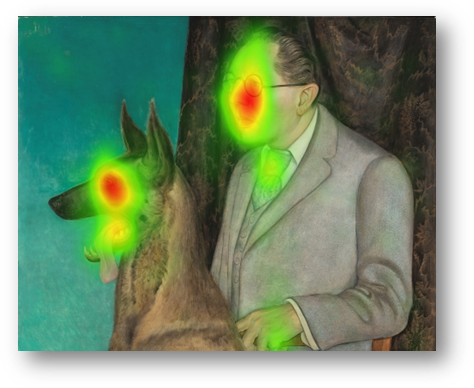

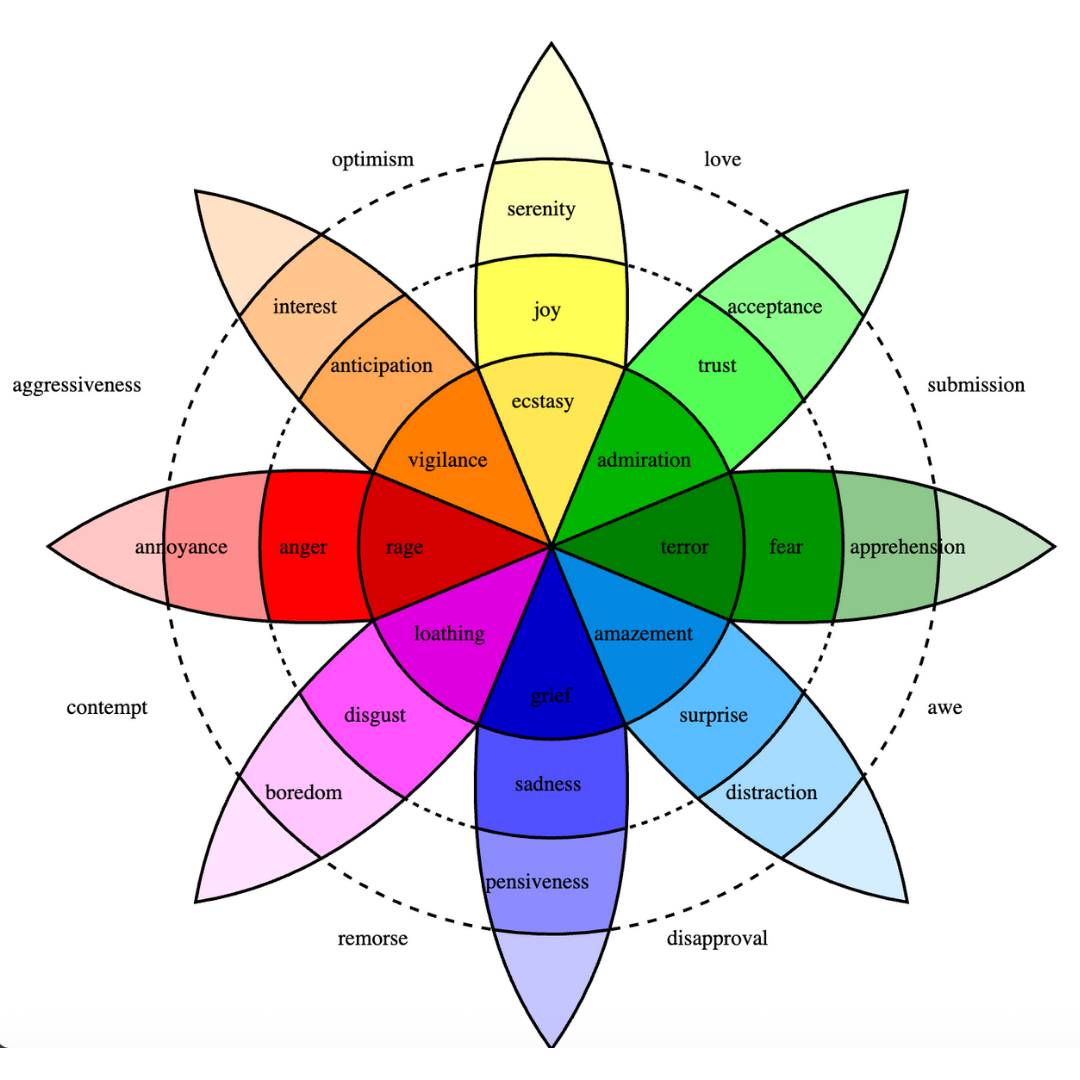

A face in front of a screen. A brief glance at a painting. A barely perceptible twitch of the facial muscles; subtle changes in skin response; the eyes lingering on specific details of the image. These subtle cues, which often go unnoticed in everyday life, are precisely captured in the research project “Emociones a través del arte.” In May 2024, Quirónsalud, our Spanish hospital business, launched the project in collaboration with Museo Nacional Thyssen-Bornemisza and Universidad Rey Juan Carlos, both in Madrid. The central question was: What emotions does art trigger in us? And can this impact be measured objectively and quantitatively? This was the first scientific study of its kind.

Over a period of eight weeks, researchers examined the reactions of 127 individuals, including patients form Quirónsalud. Selected paintings from different periods and various collections of the museum were presented to them digitally. Using a range of methods, the researchers analyzed which visual elements attracted particular attention and which emotions the artworks evoked in viewers.

The results are clear: color, composition, and lighting play a decisive role in influencing emotions in measurable ways. Some images produced surprisingly consistent emotional responses, while others defied common expectations. And: some works predominantly triggered positive emotions, while others exclusively elicited negative ones. The study thus provides solid, data-based evidence for the long-debated assumption: that art does not only work subjectively, but can deliberately influence viewers’ emotional states, with potential implications for well-being and health.

Relevant here is that the individuals came into contact with the artworks exclusively within the framework of the study, i.e., in a controlled research environment.

“The experiences of our patients are a central component of our understanding of health. Initiatives such as the ‘Emociones a través del arte’ project not only help us to deepen our knowledge based on scientific evidence. They also open up entirely new perspectives, enabling us to continuously work towards excellence in care and improving people’s well-being,” says Dr. Cristina Caramés, Quirónsalud's Director of Healthcare and Research.

The results of the research project, published in spring 2025, by no means mark the end of the investigation. Plans include further analysis of the collected data and translating it into various formats, such as scientific publications or digital applications, as well as using it for new research approaches. The aim is to deepen understanding of the precise relationship between art, emotion, and health.

In the longer term, this is expected to open up new ways of making the positive effects of art accessible to patients – in a structured, evidence-based manner.

Whether in a scientific setting or in everyday hospital care, both Quirónsalud initiatives follow the same conviction: health encompasses more than just medical parameters and guideline-based treatment. Emotional stability and people’s subjective sense of well-being are equally important factors, particularly in the context of serious illness. Quirónsalud therefore combines innovative research and professional practice. Art thus becomes a building block of an expanded, holistic understanding of health.

https://www.museothyssen.org/en/special/emotions-art