Financing Strategy & Targets

Ensure financial flexibility, maintain our investment grade rating, limit refinancing risks and optimize the cost of capital are the main objectives in Fresenius’s financing strategy.

To remain financially flexible, we maintain adequate liquidity headroom. We are committed to our investment grade rating, which provides us with advantages with respect to market access and funding costs.

Our refinancing risks are limited due to a balanced maturity profile that is characterized by a broad range of maturities with a high proportion of mid- and long-term debt up to 2034. Relevant financing instruments include bonds, Schuldschein Loans and bank loans. In addition, Fresenius maintains a commercial paper program.

Another key objective of Fresenius’ financing strategy is to optimize the cost of capital by employing an adequate mix of equity and debt.

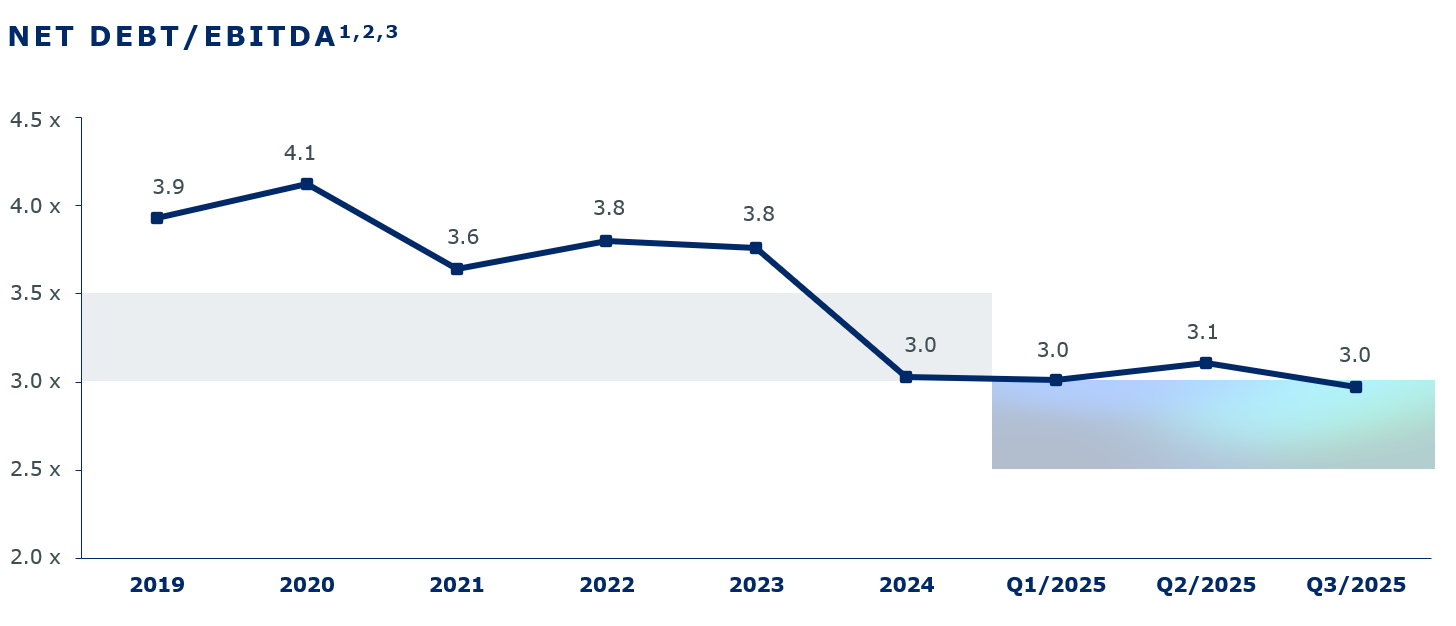

In 2025, deleveraging will remain a key priority. Fresenius has upgraded its leverage target corridor to 2.5 to 3.0x net debt/EBITDA (previously 3.5 to 3.0x). This allows us to stay financially flexible while solidifying our solid investment grade rating.

Fresenius Group

1 Prior-year figures have been adjusted due to the deconsolidation of Fresenius Medical Care operations

2 Before special items

3 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend; Net debt adjusted for valuation effect of equity-neutral exchangeable bond

Contact

Director Investor Relations

T: +49 (0) 6172 608-2486

elisabeth.truckenbrodt@fresenius.com

Related Links

Interactive Tool