FY/25 Annual Press Conference

FY/25 – Strong organic revenue and excellent Core EPS growth; REJUVENATE phase spurs profitable growth, drives stronger balance sheet, and creates significant value.

Q4/25 – Closing the year with an outstanding quarter; excellent organic revenue and EBIT growth; excellent operating cashflow.

Michael Sen, CEO of Fresenius: "2025 was a pivotal year for Fresenius. With disciplined execution of our #FutureFresenius strategy and a strong performance from Team Fresenius, we met our upgraded full-year guidance by delivering another quarter of competitive growth, increasing organic revenue by 9%, EBIT by 13% and Core EPS by 16% at constant currency. 2025 capped a year of continued momentum across the Company: We further strengthened the balance sheet, and upgraded our guidance, while preparing the business through targeted investment for the next phase of growth. All of this leads to a proposed dividend of €1.05 per share, underscoring our commitment to creating shareholder value. With #FutureFresenius we have transformed our Company, positioning ourselves to deliver future success in a new world order. Looking ahead, we enter 2026 with strong foundations and clear priorities. We are confident in our ability to deliver profitable, sustainable growth with the guidance of organic revenue growth of 4% to 7% and constant currency Core EPS growth of 5% to 10%, while continuing to create long term value across the healthcare ecosystem for patients, customers, partners, and shareholders."

Fresenius Group6: organic revenue growth2 in the range of 4% to 7%; constant currency Core EPS1,4 growth expected in the range of 5% to 10%; EBIT margin9 of ~11.5%.

Fresenius Kabi7: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin1 of 16.5% to 17.0%.

Structural EBIT margin1 ambition raised to 17% to 19% (previously 16% to 18%) following Kabi’s rigorous strategy execution leading to consistent margin expansion over the past several years.

Fresenius Helios8: organic revenue growth in the mid-single-digit percentage range; EBIT margin of 10.0% to 10.5%.

Assumptions to guidance: The company acknowledges that the prevailing trends of fast- moving macroeconomic and geopolitical environment continue, resulting in increased volatility and a higher level of operational uncertainty. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole. Potential implications of the United States Supreme Court ruling as of February 20, 2026, are currently being evaluated but cannot be fully assessed at this stage and are hence not reflected in the FY/26 guidance.

Fresenius remains fully commitment to delivering attractive shareholder returns. For fiscal year 2025, the Company will propose a dividend of €1.05 per share. This corresponds to a payout ratio of 37%, at the upper half of the 30% to 40% range of core net income1,4 , as specified in the Fresenius Financial Framework.

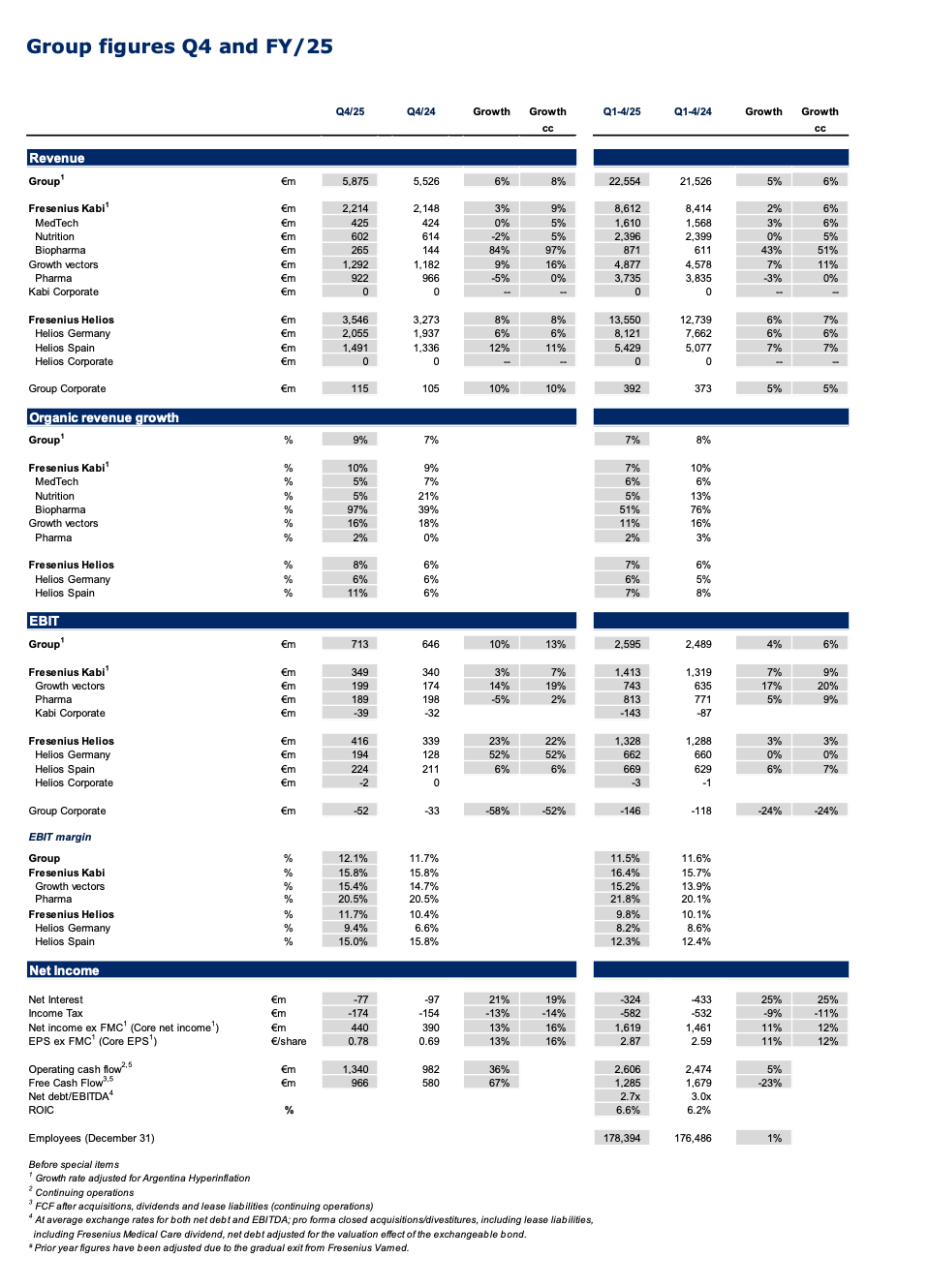

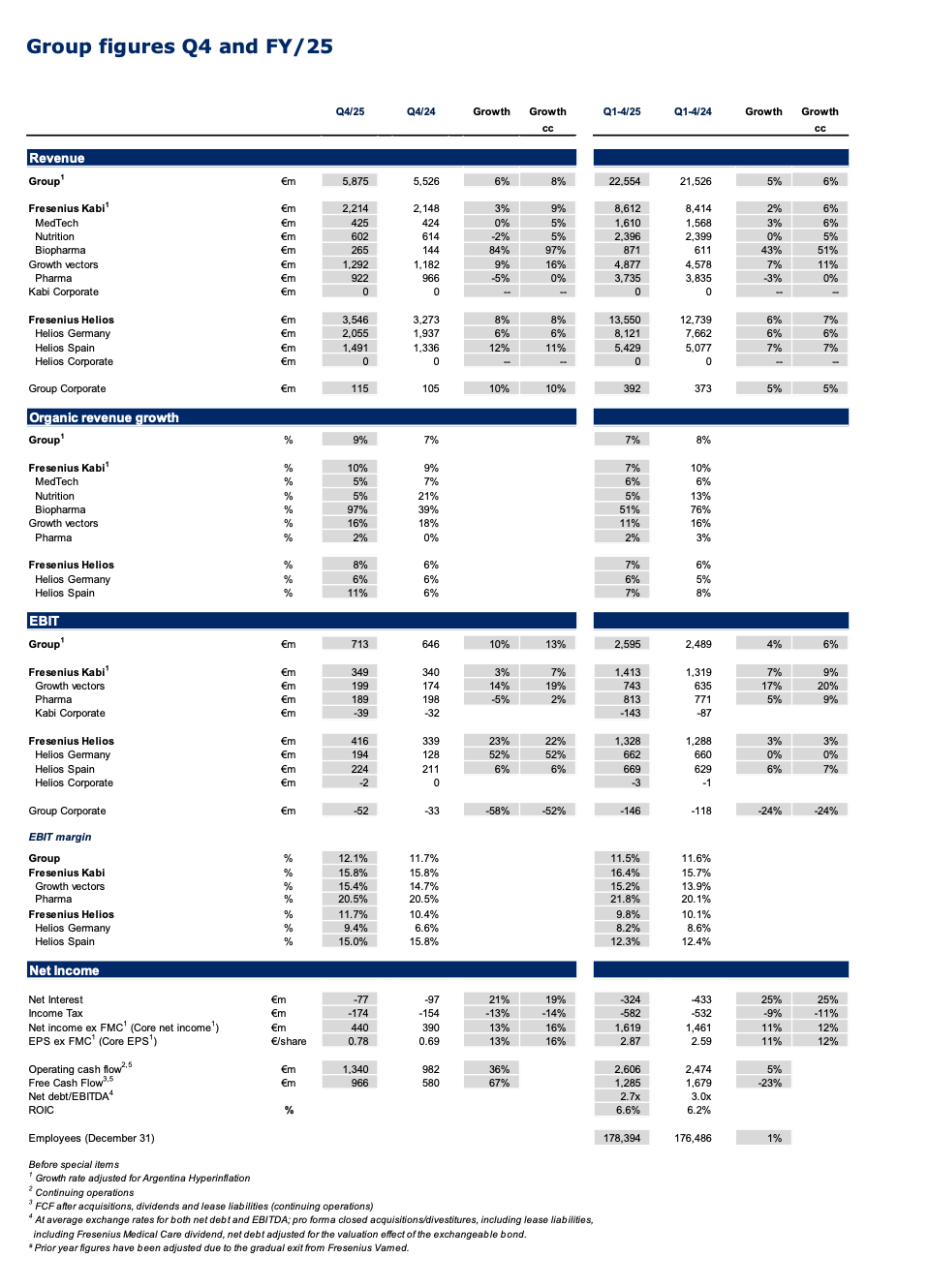

FY/25: Strong performance despite significant macroeconomic headwinds; twice upgraded guidance delivered.

Organic revenue1 grew 7%2 reaching the top-end of the 5% to 7% guide while the 6%3 constant currency Group EBIT growth before special items secured the midpoint of the guided range of 4% to 8%. The Company achieved this despite significant headwinds including the impact from the absence of energy relief funding at Fresenius Helios, the Volume Based Procurement (VBP) of the nutrition product Ketosteril in China at Fresenius Kabi, as well as FX effects and U.S. tariffs.

Q4/25: Closing the year with an outstanding quarter which led to an increase of Group organic revenue1 growth of 9%2 and revenues reaching €5,875 million.

Group EBIT before special items amounted to €713 million, a significant acceleration with an increase of 13%3 in constant currency fuelled by Fresenius Kabi’s continued powerful operating performance and the expected strong development at Fresenius Helios. The strong acceleration at Helios is due to the very strong top-line development and was supported by strong execution on the Performance Program in Q4/25 as well as the positive effects from the surcharge on invoices of publicly insured patients recognized under other operating income. At Kabi, the operating leverage and additional productivity gains more than compensated the impact from the VBP of the nutrition product Ketosteril in China, and some targeted investments.

Group EBIT margin1 improved by 40 bp to 12.1%.

Group Core net income1,4 increased by 16%3 in constant currency to €440 million strongly outpacing revenue growth. The good operating performance of both, Fresenius Kabi and Fresenius Helios, further productivity gains as well as the decreased year-over-year interest expenses drove this performance.

Group Core earnings per share1,4 rose by 16%3 in constant currency to €0.78.

Fresenius Kabi

FY/25: Consistent financial performance delivered over the course of the year with excellent organic revenue growth of 7% at the top-end of the structural growth band and an EBIT margin expansion of 70 bps to 16.4%.

Q4/25: Strong finish to the year with organic growth well above the structural growth band of 4% to 7%; Growth Vectors driving the performance headed by continued Biopharma strength; EBIT margin reflects targeted investments, and year-end effects.

Organic revenue growth of 10%2 in Q4 driven by the Growth Vectors and led by Biopharma with strong product roll-outs; revenue rose to €2,214 million, making it the highest quarterly revenue amount in Fresenius Kabi’s history; growth as reported was significantly impacted by currency translation effects, primarily from the US Dollar and the Argentinian Peso.

Fresenius Helios

FY/25: Fresenius Helios delivered organic revenue growth of 7% driven by solid activity growth and favourable pricing in Germany and Spain; EBIT margin1 of 9.8% consistent with the target for FY/25.

Q4/25: Fresenius Helios with very strong organic revenue growth and outstanding year-on-year margin improvement.

8% organic revenue growth in Q4 mainly driven by year-over-year activity levels increase at both, Helios Germany and Helios Spain, and positive pricing; revenue increased by 8% in constant currency to €3,546 million.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the exchangeable bond

6 2025 base: €22,554 million (revenue), €2.87 (Core EPS1,4)

7 2025 base: €8,612 million (revenue) and €1,413 million (EBIT)

8 2025 base: €13,550 million (revenue) and €1,328 million (EBIT)

9 This metric (EBIT margin) is provided solely for modelling purposes and does not form part of the official guidance; 2025 Base: €2,595 million

Conference call and Audio webcast

As part of the publication of the Q4 and FY 2025 results, a conference call will be held on February 25, 2026 at 1:30 p.m. CET / 7:30 a.m. EST. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Note on the presentation of financial figures

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673 Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

FY/25 – Strong organic revenue and excellent Core EPS growth; REJUVENATE phase spurs profitable growth, drives stronger balance sheet, and creates significant value.

Q4/25 – Closing the year with an outstanding quarter; excellent organic revenue and EBIT growth; excellent operating cashflow.

Michael Sen, CEO of Fresenius: "2025 was a pivotal year for Fresenius. With disciplined execution of our #FutureFresenius strategy and a strong performance from Team Fresenius, we met our upgraded full-year guidance by delivering another quarter of competitive growth, increasing organic revenue by 9%, EBIT by 13% and Core EPS by 16% at constant currency. 2025 capped a year of continued momentum across the Company: We further strengthened the balance sheet, and upgraded our guidance, while preparing the business through targeted investment for the next phase of growth. All of this leads to a proposed dividend of €1.05 per share, underscoring our commitment to creating shareholder value. With #FutureFresenius we have transformed our Company, positioning ourselves to deliver future success in a new world order. Looking ahead, we enter 2026 with strong foundations and clear priorities. We are confident in our ability to deliver profitable, sustainable growth with the guidance of organic revenue growth of 4% to 7% and constant currency Core EPS growth of 5% to 10%, while continuing to create long term value across the healthcare ecosystem for patients, customers, partners, and shareholders."

Fresenius Group6: organic revenue growth2 in the range of 4% to 7%; constant currency Core EPS1,4 growth expected in the range of 5% to 10%; EBIT margin9 of ~11.5%.

Fresenius Kabi7: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin1 of 16.5% to 17.0%.

Structural EBIT margin1 ambition raised to 17% to 19% (previously 16% to 18%) following Kabi’s rigorous strategy execution leading to consistent margin expansion over the past several years.

Fresenius Helios8: organic revenue growth in the mid-single-digit percentage range; EBIT margin of 10.0% to 10.5%.

Assumptions to guidance: The company acknowledges that the prevailing trends of fast- moving macroeconomic and geopolitical environment continue, resulting in increased volatility and a higher level of operational uncertainty. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole. Potential implications of the United States Supreme Court ruling as of February 20, 2026, are currently being evaluated but cannot be fully assessed at this stage and are hence not reflected in the FY/26 guidance.

Fresenius remains fully commitment to delivering attractive shareholder returns. For fiscal year 2025, the Company will propose a dividend of €1.05 per share. This corresponds to a payout ratio of 37%, at the upper half of the 30% to 40% range of core net income1,4 , as specified in the Fresenius Financial Framework.

FY/25: Strong performance despite significant macroeconomic headwinds; twice upgraded guidance delivered.

Organic revenue1 grew 7%2 reaching the top-end of the 5% to 7% guide while the 6%3 constant currency Group EBIT growth before special items secured the midpoint of the guided range of 4% to 8%. The Company achieved this despite significant headwinds including the impact from the absence of energy relief funding at Fresenius Helios, the Volume Based Procurement (VBP) of the nutrition product Ketosteril in China at Fresenius Kabi, as well as FX effects and U.S. tariffs.

Q4/25: Closing the year with an outstanding quarter which led to an increase of Group organic revenue1 growth of 9%2 and revenues reaching €5,875 million.

Group EBIT before special items amounted to €713 million, a significant acceleration with an increase of 13%3 in constant currency fuelled by Fresenius Kabi’s continued powerful operating performance and the expected strong development at Fresenius Helios. The strong acceleration at Helios is due to the very strong top-line development and was supported by strong execution on the Performance Program in Q4/25 as well as the positive effects from the surcharge on invoices of publicly insured patients recognized under other operating income. At Kabi, the operating leverage and additional productivity gains more than compensated the impact from the VBP of the nutrition product Ketosteril in China, and some targeted investments.

Group EBIT margin1 improved by 40 bp to 12.1%.

Group Core net income1,4 increased by 16%3 in constant currency to €440 million strongly outpacing revenue growth. The good operating performance of both, Fresenius Kabi and Fresenius Helios, further productivity gains as well as the decreased year-over-year interest expenses drove this performance.

Group Core earnings per share1,4 rose by 16%3 in constant currency to €0.78.

Fresenius Kabi

FY/25: Consistent financial performance delivered over the course of the year with excellent organic revenue growth of 7% at the top-end of the structural growth band and an EBIT margin expansion of 70 bps to 16.4%.

Q4/25: Strong finish to the year with organic growth well above the structural growth band of 4% to 7%; Growth Vectors driving the performance headed by continued Biopharma strength; EBIT margin reflects targeted investments, and year-end effects.

Organic revenue growth of 10%2 in Q4 driven by the Growth Vectors and led by Biopharma with strong product roll-outs; revenue rose to €2,214 million, making it the highest quarterly revenue amount in Fresenius Kabi’s history; growth as reported was significantly impacted by currency translation effects, primarily from the US Dollar and the Argentinian Peso.

Fresenius Helios

FY/25: Fresenius Helios delivered organic revenue growth of 7% driven by solid activity growth and favourable pricing in Germany and Spain; EBIT margin1 of 9.8% consistent with the target for FY/25.

Q4/25: Fresenius Helios with very strong organic revenue growth and outstanding year-on-year margin improvement.

8% organic revenue growth in Q4 mainly driven by year-over-year activity levels increase at both, Helios Germany and Helios Spain, and positive pricing; revenue increased by 8% in constant currency to €3,546 million.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the exchangeable bond

6 2025 base: €22,554 million (revenue), €2.87 (Core EPS1,4)

7 2025 base: €8,612 million (revenue) and €1,413 million (EBIT)

8 2025 base: €13,550 million (revenue) and €1,328 million (EBIT)

9 This metric (EBIT margin) is provided solely for modelling purposes and does not form part of the official guidance; 2025 Base: €2,595 million

Conference call and Audio webcast

As part of the publication of the Q4 and FY 2025 results, a conference call will be held on February 25, 2026 at 1:30 p.m. CET / 7:30 a.m. EST. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Contact for shareholders

Investor Relations phone: + 49 6172 608-24 87

e-mail: ir-fre@fresenius.com

Note on the presentation of financial figures

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852 Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673 Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser Chairman of the Supervisory Board: Wolfgang Kirsch

The Fresenius Supervisory Board has unanimously extended ahead of schedule the mandate of CEO Michael Sen (57) by five years. This will help to ensure continuity in the company’s leadership for the next phase in its #FutureFresenius strategy. His contract will now run until 2031.

Wolfgang Kirsch, Chair of the Supervisory Board of Fresenius, said: “Michael Sen has been instrumental in driving the company’s development with #FutureFresenius in the past three years. Today, Fresenius is more innovative and relevant – well positioned to leverage the significant opportunities in the healthcare industry. Michael Sen and his team have placed Fresenius on a growth path offering long-term profitability that benefits all stakeholders. We want to maintain this continuity. Both the Supervisory Board and I personally look forward to continuing our collaboration in the coming years.”

“I would like to thank the Supervisory Board for its trust and look forward to continuing to work with all Supervisory Board members, my management team, and our outstanding employees as well as our customers, partners, and shareholders. Over the past few years, we have made the company more innovative while remaining focused on delivering profitable growth. Today, Fresenius is more relevant than ever before. We want to continue this success Seite 1/3 story. In times of fundamental change shaped by rapid advances in new technologies such as AI and a transactional world order, we bear even greater responsibility as a leading global healthcare company. Now more than ever, our goal is to provide high-quality, reliable healthcare while making healthcare systems even more efficient and resilient,” adds Michael Sen, CEO of Fresenius.

Dr. Christian Pawlu succeeds Robert Möller

The Fresenius Supervisory Board has also unanimously appointed Dr. Christian Pawlu (48) to the Fresenius Management Board, effective July 1, 2026. He will oversee the businesses of Fresenius Helios, which includes the two private hospital chains, Quirónsalud in Spain and Helios Kliniken in Germany. He will succeed Robert Möller (59) on the Management Board, who will establish the company’s Office of the Management in Berlin and Brussels.

“On behalf of the Supervisory Board, I would like to sincerely thank Robert Möller for the excellent cooperation and successful leadership of Fresenius Helios in recent years. Through the formation of medical clusters and the focus on digitalization and excellent patient care, the two hospital chains are excellently positioned in Germany and Spain. I am therefore delighted that Robert Möller will continue to contribute his expertise to the company,” says Wolfgang Kirsch. He adds: “With Christian Pawlu, we have been able to acquire a physician and strategist with a broad international network for the Group’s Management Board. I am especially pleased that we could find an outstanding internal candidate who has already contributed significantly to the hospital business as Chief Operating Officer of Fresenius Helios. I wish Christian Pawlu a strong start in his new role.”

Michael Sen (57) has been CEO of Fresenius since October 1, 2022. He is also Chairman of the Supervisory Board of the listed dialysis provider Fresenius Medical Care. In April 2021, Michael Sen was appointed CEO of Fresenius Kabi. Before joining Fresenius, he was a member of the Management Board at Siemens AG, responsible for the healthcare and energy business. He took Siemens Healthineers public during this time. Prior to this, he was Chief Financial Officer at the energy group E.ON SE.

Dr. Christian Pawlu has been Chief Operating Officer (COO) of Helios in Germany since March 2025, and in September 2025 expanded his responsibilities as COO of Fresenius Helios including Helios in Germany and Quirónsalud in Spain. Prior to this, he served as Head of Corporate Development at Fresenius after joining Fresenius Kabi in Bad Homburg as Head of Corporate Development in April 2021. Page 2/3 From 2022 to 2025, he was a member of the Supervisory Board of the Fresenius subsidiary mAbxience, based in Spain. In his early career, Christian Pawlu was a member of Sandoz Group AG’s Executive Board, CEO of a private high-tech start-up, and a partner at McKinsey & Company management consultancy.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673 Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

The Fresenius Supervisory Board has unanimously extended ahead of schedule the mandate of CEO Michael Sen (57) by five years. This will help to ensure continuity in the company’s leadership for the next phase in its #FutureFresenius strategy. His contract will now run until 2031.

Wolfgang Kirsch, Chair of the Supervisory Board of Fresenius, said: “Michael Sen has been instrumental in driving the company’s development with #FutureFresenius in the past three years. Today, Fresenius is more innovative and relevant – well positioned to leverage the significant opportunities in the healthcare industry. Michael Sen and his team have placed Fresenius on a growth path offering long-term profitability that benefits all stakeholders. We want to maintain this continuity. Both the Supervisory Board and I personally look forward to continuing our collaboration in the coming years.”

“I would like to thank the Supervisory Board for its trust and look forward to continuing to work with all Supervisory Board members, my management team, and our outstanding employees as well as our customers, partners, and shareholders. Over the past few years, we have made the company more innovative while remaining focused on delivering profitable growth. Today, Fresenius is more relevant than ever before. We want to continue this success story. In times of fundamental change shaped by rapid advances in new technologies such as AI and a transactional world order, we bear even greater responsibility as a leading global healthcare company. Now more than ever, our goal is to provide high-quality, reliable healthcare while making healthcare systems even more efficient and resilient,” adds Michael Sen, CEO of Fresenius.

Dr. Christian Pawlu succeeds Robert Möller

The Fresenius Supervisory Board has also unanimously appointed Dr. Christian Pawlu (48) to the Fresenius Management Board, effective July 1, 2026. He will oversee the businesses of Fresenius Helios, which includes the two private hospital chains, Quirónsalud in Spain and Helios Kliniken in Germany. He will succeed Robert Möller (59) on the Management Board, who will establish the company’s Office of the Management in Berlin and Brussels.

“On behalf of the Supervisory Board, I would like to sincerely thank Robert Möller for the excellent cooperation and successful leadership of Fresenius Helios in recent years. Through the formation of medical clusters and the focus on digitalization and excellent patient care, the two hospital chains are excellently positioned in Germany and Spain. I am therefore delighted that Robert Möller will continue to contribute his expertise to the company,” says Wolfgang Kirsch. He adds: “With Christian Pawlu, we have been able to acquire a physician and strategist with a broad international network for the Group’s Management Board. I am especially pleased that we could find an outstanding internal candidate who has already contributed significantly to the hospital business as Chief Operating Officer of Fresenius Helios. I wish Christian Pawlu a strong start in his new role.”

Michael Sen (57) has been CEO of Fresenius since October 1, 2022. He is also Chairman of the Supervisory Board of the listed dialysis provider Fresenius Medical Care. In April 2021, Michael Sen was appointed CEO of Fresenius Kabi. Before joining Fresenius, he was a member of the Management Board at Siemens AG, responsible for the healthcare and energy business. He took Siemens Healthineers public during this time. Prior to this, he was Chief Financial Officer at the energy group E.ON SE.

Dr. Christian Pawlu has been Chief Operating Officer (COO) of Helios in Germany since March 2025, and in September 2025 expanded his responsibilities as COO of Fresenius Helios including Helios in Germany and Quirónsalud in Spain. Prior to this, he served as Head of Corporate Development at Fresenius after joining Fresenius Kabi in Bad Homburg as Head of Corporate Development in April 2021. From 2022 to 2025, he was a member of the Supervisory Board of the Fresenius subsidiary mAbxience, based in Spain. In his early career, Christian Pawlu was a member of Sandoz Group AG’s Executive Board, CEO of a private high-tech start-up, and a partner at McKinsey & Company management consultancy.

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) is a global healthcare company headquartered in Bad Homburg v. d. Höhe, Germany. The Fresenius Group comprises the operating companies Fresenius Kabi and Fresenius Helios as well as an investment in Fresenius Medical Care. With around 140 hospitals and countless outpatient facilities, Fresenius Helios is the leading private hospital operator in Germany and Spain. Fresenius Kabi’s product portfolio touches the lives of 450 million patients annually and includes a range of highly complex biopharmaceuticals, clinical nutrition, medical technology, and intravenous generic drugs and fluids. Fresenius was established in 1912 by the Frankfurt pharmacist Dr. Eduard Fresenius. After his death, Else Kröner took over management of the company in 1952. She laid the foundations for a global enterprise that today pursues the goal of improving people’s health. The largest shareholder is the non-profit Else Kröner- Fresenius Foundation, which is dedicated to advancing medical research and supporting humanitarian projects.

Up-to-date video footage for television and online reporting. We have put together a selection of video material for journalists covering various Fresenius-related topics. This compilation provides representative insights into key locations and core capabilities of the company:

00:00–00:47: Company headquarters

00:48–01:00: Production of Pharmaceuticals infusion solutions, logistics (Fresenius Kabi)

01:01–01:52: Biopharmaceutical production and research (Fresenius Kabi)

01:53–03:07: Care – bronchoscopy, MRI, AIsupported diagnostics, and neonatal care for premature infants (Fresenius Helios)

Michael Sen

CEO Fresenius

Michael Sen

CEO Fresenius

SAP and Fresenius today announced that both companies intend to enter a strategic partnership to accelerate innovation for stronger digital healthcare delivery. Together, the companies plan to create the digital backbone for a sovereign, interoperable, and AI-supported healthcare system. The solutions will combine the expertise of Fresenius, one of the world’s largest healthcare companies, with future-oriented SAP technologies and meet high requirements for data sovereignty, security, and regulatory compliance. The plan is to provide an open, integrated, and data‑driven digital health ecosystem that enables hospitals and medical facilities worldwide to use AI securely and to handle health data responsibly.

SAP and Fresenius plan to jointly build an individual, scalable healthcare platform that enables connected, data-driven healthcare processes. Based on this, the companies will develop joint, future-oriented, and AI-supported healthcare solutions to sustainably increase quality, transparency, and efficiency across the entire care chain and set new standards for digital innovation in the healthcare sector. The foundation will be proven SAP technologies and products such as SAP Business Suite, SAP Business Data Cloud (SAP BDC), SAP Business Technology Platform (SAP BTP), and SAP Business AI. These core elements help create a unified, compliant, open, and expandable base for the more-secure exchange and use of data as well as for operating AI models in a controlled environment.

Together, the companies also plan to build a sovereign, European solution for an integrated healthcare ecosystem that supports the integration of modern hospital information systems (HIS) based on SAP’s “AnyEMR” strategy. Interfaces based on open industry standards such as HL7 FHIR will enable the more-seamless connection of HIS, electronic medical records (EMRs), and other medical applications.

“Together with SAP, we can accelerate the digital transformation of the German and European healthcare systems and enable a sovereign European solution that is so important in today’s global landscape. We are making data and AI everyday companions that are secure, simple, and scalable for doctors and hospital teams. This creates more room for what truly matters: caring for patients,” says Michael Sen, CEO of Fresenius.

“With SAP’s leading technology and Fresenius’ deep healthcare expertise, we aim to create a sovereign, interoperable healthcare platform for Fresenius worldwide. Together, we want to set new standards for data sovereignty, security, and innovation in healthcare. Thanks to SAP, Fresenius can harness the full potential of digital and AI-supported processes and sustainably improve patient care,” says Christian Klein, CEO and Member of the Executive Board of SAP SE.

As part of the joint transformation project, both companies plan to invest a mid three-digit million euro amount in the medium term to consistently drive the digital transformation of the German and European healthcare system through the use of digital and AI-supported solutions.

The partnership is implemented through several forms of collaboration. These include joint investments in startups and scaleups, joint technological developments, and close cooperation within coordinated governance structures between the two companies.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

SAP and Fresenius today announced that both companies intend to enter a strategic partnership to accelerate innovation for stronger digital healthcare delivery. Together, the companies plan to create the digital backbone for a sovereign, interoperable, and AI-supported healthcare system. The solutions will combine the expertise of Fresenius, one of the world’s largest healthcare companies, with future-oriented SAP technologies and meet high requirements for data sovereignty, security, and regulatory compliance. The plan is to provide an open, integrated, and data‑driven digital health ecosystem that enables hospitals and medical facilities worldwide to use AI securely and to handle health data responsibly.

SAP and Fresenius plan to jointly build an individual, scalable healthcare platform that enables connected, data-driven healthcare processes. Based on this, the companies will develop joint, future-oriented, and AI-supported healthcare solutions to sustainably increase quality, transparency, and efficiency across the entire care chain and set new standards for digital innovation in the healthcare sector. The foundation will be proven SAP technologies and products such as SAP Business Suite, SAP Business Data Cloud (SAP BDC), SAP Business Technology Platform (SAP BTP), and SAP Business AI. These core elements help create a unified, compliant, open, and expandable base for the more-secure exchange and use of data as well as for operating AI models in a controlled environment.

Together, the companies also plan to build a sovereign, European solution for an integrated healthcare ecosystem that supports the integration of modern hospital information systems (HIS) based on SAP’s “AnyEMR” strategy. Interfaces based on open industry standards such as HL7 FHIR will enable the more-seamless connection of HIS, electronic medical records (EMRs), and other medical applications.

“Together with SAP, we can accelerate the digital transformation of the German and European healthcare systems and enable a sovereign European solution that is so important in today’s global landscape. We are making data and AI everyday companions that are secure, simple, and scalable for doctors and hospital teams. This creates more room for what truly matters: caring for patients,” says Michael Sen, CEO of Fresenius.

“With SAP’s leading technology and Fresenius’ deep healthcare expertise, we aim to create a sovereign, interoperable healthcare platform for Fresenius worldwide. Together, we want to set new standards for data sovereignty, security, and innovation in healthcare. Thanks to SAP, Fresenius can harness the full potential of digital and AI-supported processes and sustainably improve patient care,” says Christian Klein, CEO and Member of the Executive Board of SAP SE.

As part of the joint transformation project, both companies plan to invest a mid three-digit million euro amount in the medium term to consistently drive the digital transformation of the German and European healthcare system through the use of digital and AI-supported solutions.

The partnership is implemented through several forms of collaboration. These include joint investments in startups and scaleups, joint technological developments, and close cooperation within coordinated governance structures between the two companies.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.