Fresenius Medical Care’s financial performance in Q2/22 was significantly impacted by worsened labor shortages and related meaningfully increased wage inflation in the U.S. The further deterioration of the macro-economic environment resulted in accelerated non-wage inflation, particularly higher supply chain costs.

Against this backdrop and growing indications for a persistent unfavorable development of these and other factors, Fresenius Medical Care has revised its outlook for FY/22.

All other Fresenius Group segments confirm their respective outlook for FY/22 for both revenue and EBIT.

However, as a consequence of the development at Fresenius Medical Care, and despite all other Fresenius Group segments confirming their respective outlook for both revenue and EBIT, Fresenius now also revises its Group outlook for FY/22. At constant currency, the Company now anticipates Group sales1 to grow in a low-to-mid single-digit percentage range (previously: mid-single digit percentage range) and Group net income2,3 to decline in a low-to-mid single-digit percentage range (previously: increase in a low-single-digit percentage range).

1 FY/21 base: €37,520 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €1,867 million; before special items; FY/22: before special items

Stephan Sturm, CEO of Fresenius, said: “As a globally active healthcare group, we, too, have inevitably been impacted by – in many cases massive – cost increases, growing problems in the global supply chains, and staff shortages. And unlike companies in other industries, we cannot simply pass on the resulting cost burdens in the short term by raising our prices. To the extent possible and foreseeable, we factored these burdens into the guidance we provided in February and May. In the meantime, though, it has become apparent that patient-facing healthcare services in the United States are affected even more heavily, hence also Fresenius Medical Care. It will take fortitude and energy to overcome this particularly challenging phase, and I am therefore very pleased that Carla Kriwet will assume her new position as CEO of Fresenius Medical Care quite a bit earlier than initially planned. I am confident that, together with her colleagues, she will find the right solutions and lead Fresenius Medical Care into a successful future.”

“Our goal at Fresenius is, and remains, to create more value: for our patients, our employees and our shareholders,” added Sturm. “We are working tirelessly, guided by our clear strategic priorities, to achieve this. And we continue to see good prospects, despite the current burdens and difficulties resulting from global crises. Not least because, from our strong market positions, we moved early to capitalize on the right trends, such as home dialysis. Healthcare is a market of the future that we want to play an important role in shaping, and where we intend to continue our sustained, profitable growth.”

Assumptions for guidance FY/22

Due to the meaningfully increased uncertainty and volatility related to the war in Ukraine, the ongoing impacts of the COVID-19 pandemic, and a rapidly worsening global macro-economic development, Fresenius now expects significantly more pronounced headwinds in 2022 from supply chain disruptions and cost inflation, including energy prices. Furthermore, Fresenius expects significant negative effects from ongoing labor shortages and associated wage inflation, especially at Fresenius Medical Care in the U.S.

The war in Ukraine is directly and indirectly affecting Fresenius Group operations. The direct adverse effects of the war amounted to €20 million at net income1 level of Fresenius Group in H1/22 and are treated as a special item. Fresenius will continue to closely monitor the potential further consequences of the war, including balance sheet valuations. The guidance does not consider a significant disruption of gas or electricity supplies in Europe.

COVID-19 will continue to impact Fresenius Group operations in 2022. An unlikely but possible significant deterioration of the situation triggering containment measures that could have a significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/22 guidance.

Furthermore, the updated assumptions for Fresenius Medical Care's FY/22 guidance are also fully applicable to Fresenius Group's FY/22 guidance. All of these assumptions are subject to considerable uncertainty. The acquisition of Ivenix and the announced acquisition of the majority stake in mAbxience as well as any further potential acquisitions remain excluded from guidance.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Group medium-term targets

As a result of the updated expectations for FY/22, Fresenius now believes its medium-term net income1 target is no longer achievable. Fresenius had expected Group organic net income1 growth to be at the bottom end of the 5% to 9% compounded annual growth rate (CAGR) range for 2020 to 2023. At the same time, Fresenius specifies its Group organic sales growth target to reach the low-end of the targeted 4% to 7% compounded annual growth rate (CAGR) range for 2020 to 2023.

Cost and efficiency program

The Group’s cost and efficiency program is running according to plan and Fresenius confirms its increased savings targets provided in February 2022 of at least €150 million p.a. after tax and minority interest in 2023. For the years thereafter, a further significant increase in sustainable cost savings is expected.

Management Board change at Fresenius Medical Care

Dr. Carla Kriwet will now join Fresenius Medical Care as CEO on October 1, 2022, earlier than previously announced and Rice Powell will step down as CEO effective September 30, 2022.

Preliminary Q2 and H1/22 results2

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 EBIT and net income before special items

3 Excluding Ivenix acquisition

Fresenius Kabi preliminary financial results

Sales in Q2/22 increased by 8% (2% in constant currency) to €1,896 million (Q2/21: €1,755 million). Organic growth was 2%. The positive currency translation effects of 6% in Q2/22 were mainly related to the U.S. dollar and Chinese yuan.

Sales in North America increased by 16% (organic growth: 3%) to €606 million (Q2/21: €522 million), strongly supported by U.S. Dollar-related currency translation effects. Sales in Europe increased by 4% (organic growth: 4%) to €658 million (Q2/21: €634 million). Sales in Asia-Pacific increased by 4% (organic growth: -4%) to €425 million (Q2/21: €409 million). Positive currency translation effects contributed to reported sales growth. Sales in Latin America/Africa increased by 9% (organic growth: 2%) to €207 million (Q2/21: €190 million). Sales for the Biosimilars business were €29 million.

EBIT1 decreased by 9% (-15%2 in constant currency) to €271 million (Q2/21: €298 million). The EBIT margin1 was 14.3% (Q2/21: 17.0%).

Fresenius Kabi EBIT by region

Fresenius Kabi confirms its FY/22 outlook and expects organic sales3 growth in a low-single-digit percentage range. Constant currency EBIT2,4 is expected to decline in a high-single- to low-double-digit percentage range. The sales and EBIT outlook ranges include expected COVID-19 effects and exclude the effects of the acquisitions Ivenix and mAbxience.

1 Before special items

2 Excluding Ivenix acquisition

3 FY/21 base: €7,193 million

4 FY/21 base: €1,153 million, before special items, FY/22 before special items

Fresenius Helios preliminary financial results

Sales increased by 7% (6% in constant currency) to €2,925 million (Q2/21: €2,738 million). Organic growth was 5%. Acquisitions contributed 1% to sales growth.

Sales of Helios Germany increased by 5% (organic growth: 4%) to €1,758 million (Q2/21: €1,675 million). Sales of Helios Spain increased by 8% (7% in constant currency) to €1,101 million (Q2/21: €1,020 million). Organic growth was 6%. Sales of Helios Fertility were €65 million (Q2/21: €42 million).

EBIT1 of Fresenius Helios increased by 2% (1% in constant currency) to €303 million (Q2/21: €298 million) with an EBIT margin1 of 10.4% (Q2/21: 10.9%).

EBIT of Helios Germany increased by 1% to €154 million (Q2/21: €152 million) with an EBIT margin of 8.8% (Q2/21: 9.1%). EBIT of Helios Spain increased by 1% (0% in constant currency) to €148 million (Q2/21: €147 million). The EBIT margin was 13.4% (Q2/21: 14.4%). EBIT1 of Helios Fertility was €7 million with an EBIT1 margin of 10.8% (Q2/21: €5 million).

Fresenius Helios confirms its FY/22 outlook and expects organic sales2 growth in a low- to mid-single-digit percentage range and constant currency EBIT3 growth in a mid-single-digit percentage range. The sales and EBIT outlook ranges include expected COVID-19 effects.

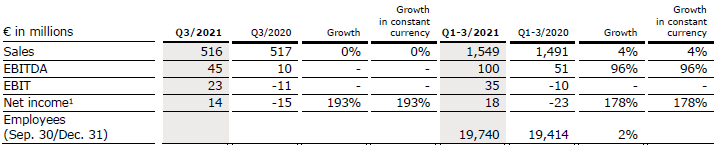

Fresenius Vamed preliminary financial results

Sales increased by 1% (1% in constant currency) to €562 million (Q2/21: €556 million). Organic growth was 1%.

Sales in the service business increased by 6% (6% in constant currency) to €417 million (Q2/21: €392 million). Sales in the project business decreased by 12% (-12% in constant currency) to €145 million (Q2/21: €164 million).

EBIT1 decreased by 31% to €11 million (Q2/21: €16 million) with an EBIT margin1 of 2.0% (Q2/21: 2.9%).

Order intake was €253 million (Q2/21: €713 million). As of June 30, 2022, order backlog was at €3,732 million (December 31, 2021: €3,473 million).

Fresenius Vamed confirms its FY/22 outlook and expects organic sales4 growth in a high-single to low-double-digit percentage range and constant currency EBIT5 to return to absolute pre-COVID-19 levels (FY/19: €134 million). The sales and EBIT outlook ranges include expected COVID-19 effects.

1 Before special items

2 FY/21 base: €10,891 million

3 FY/21 base: €1,127 million, before special items, FY/22 before special items

4 FY/21 base: €2,297 million

5 FY/21 base: €101 million, before special items; FY/22 before special items

Detailed financial results publication and Conference Call

As part of the publication of the preliminary results for Q2/2022, a conference call will be held on July 28, 2022 at 1:30 p.m. CEDT (7:30 a.m. EDT) replacing the originally planned call from August 2, 2022.

All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

On August 2, 2022, Fresenius will publish detailed Q2/22 and H1/22 financials.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

• Fresenius Medical Care in line with its expectations countering significant headwinds

• Fresenius Kabi’s solid financial performance based on strong Emerging Markets growth

• Fresenius Helios’ strong performance driven by growing admissions in Germany and Spain

• Fresenius Vamed with continued progress towards normal operations, very good performance in the service business

• Ongoing headwinds from cost inflation and supply chain challenges, with uncertainty and volatility fueled by the Ukraine war

• Guidance for 2022 confirmed

• Fresenius appoints Sara Hennicken as Chief Financial Officer – Rachel Empey to leave company at own request1

• Dr. Carla Kriwet to succeed Rice Powell on January 1, 2023, as Chief Executive Officer of Fresenius Medical Care and member of the Fresenius Management Board1

1 Please see separate Fresenius and Fresenius Medical Care press releases

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Stephan Sturm, CEO of Fresenius, said: “We have made a solid start into 2022 – somewhat better, even, than expected at Fresenius Helios and Fresenius Kabi. The first quarter was burdened by the ongoing coronavirus pandemic, the war in Ukraine, supply chain bottlenecks and, above all, cost increases that are in some cases significant. We will have to watch all these factors very closely. Still, our businesses developed well. With the announced transactions at Fresenius Kabi and Fresenius Medical Care we’ve taken important steps in the realization of our growth strategy, thereby improving the foundations for our future business success. We therefore continue to expect overall healthy sales and earnings growth, and to look ahead with confidence to the rest of our business year and beyond.”

FY/22 Group guidance confirmed

For FY/22, Fresenius confirms its guidance and projects sales growth1 in a mid-single-digit percentage range in constant currency. Net income2,3 is expected to grow in a low-single-digit percentage range in constant currency. Implicitly, net income2 for the Group excluding Fresenius Medical Care is also expected to grow in a low-single-digit percentage range in constant currency.

Without further acquisitions4, Fresenius projects an improvement of the net debt/EBITDA5 ratio (December 31, 2021: 3.51x6) into the self-imposed target corridor of 3.0x to 3.5x by the end of 2022. Fresenius expects the net debt/EBITDA ratio to slightly increase once the acquisitions of Ivenix and the majority stake in mAbxience are closed.

The Group’s cost and efficiency program is evolving according to plan and Fresenius confirms its increased savings targets provided in February 2022 of at least €150 million p.a. after tax and minority interest in 2023. For the years thereafter, a further significant increase in sustainable cost savings is expected.

1 FY/21 base: €37,520 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €1,867 million; before special items; FY/22: before special items

4 Cut-off date 22 February 2022

5 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures;

excluding further potential acquisitions; before special items; including lease liabilities

6 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures;

before special items; including lease liabilities

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Assumptions for guidance FY/22

COVID-19 will continue to impact Fresenius’ operations in 2022. Fresenius expects COVID-19 case numbers to decline going forward and consequently the number of elective treatments and staff availability to improve. An unlikely but possible significant deterioration of the situation triggering containment measures that could have a significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/22 guidance.

The war in Ukraine is affecting Fresenius Group’s operations. The adverse effect of the war amounted to €14 million at net income level of Fresenius Group in the first quarter and is treated as a special item. Fresenius will continue to monitor closely the potential effects of the war.

With the increased uncertainty and volatility related to the Ukraine war, Fresenius now expects more pronounced cost inflationary effects and supply chain disruptions in 2022.

The Management Board assumes an unchanged corporate tax rate in the United States.

Furthermore, the assumptions for Fresenius Medical Care's FY/22 guidance are also fully applicable to Fresenius Group's FY/22 guidance.

All of these assumptions are subject to considerable uncertainty.

The recently announced acquisitions of Ivenix and the majority stake in mAbxience as well as any further potential acquisitions are excluded from guidance.

5% sales increase in constant currency

Group sales increased by 8% (5% in constant currency) to €9,720 million (Q1/21: €8,984 million). Organic growth was 3%. Acquisitions/divestitures contributed net 2% to growth. Currency translation increased sales growth by 3%. Excluding estimated COVID-19 effects1, Group sales growth would have been 5% to 6% in constant currency (Q1/21: 4% to 5%).

3% net income2,3 growth in constant currency

Group EBITDA before special items increased by 2% (-2% in constant currency) to €1,658 million (Q1/212: €1,631 million). Reported Group EBITDA was €1,595 million (Q1/21: €1,628 million).

Group EBIT before special items decreased by 1% (-5% in constant currency) to €996 million (Q1/212: €1,009 million) driven by the COVID-19-related excess mortality among Fresenius Medical Care’s patients as well as elevated labor, material and logistic costs. The EBIT margin before special items was 10.2% (Q1/212: 11.2%). Reported Group EBIT was €902 million (Q1/21: €1,006 million).

Group net interest before special items improved to -€119 million (Q1/212: -€137 million) mainly due to successful refinancing activities. Reported Group net interest also improved to -€118 million (Q1/21: -€137 million).

Group tax rate before special items was 22.7% (Q1/212: 22.8%) while the reported Group tax rate was 23.6% (Q1/21: 22.8%).

Noncontrolling interests before special items were -€216 million (Q1/212: -€237 million) of which 88% were attributable to the noncontrolling interests in Fresenius Medical Care. Reported noncontrolling interests were -€186 million (Q1/21: -€236 million).

1 For estimated COVID-19 effects in Q1/22 and Q1/21 please see table on page 16 in the PDF.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Group net income1 before special items increased by 6% (3% in constant currency) to €462 million (Q1/212: €436 million). Excluding estimated COVID-19 effects3, Group net income1 before special items would have been broadly stable (-2% to 2% in constant currency (Q1/21: 0% to 4%)). Reported Group net income1 decreased to €413 million (Q1/21: €435 million).

Earnings per share1 before special items increased by 6% (3% in constant currency) to €0.83 (Q1/212: €0.78). Reported earnings per share1 were €0.74 (Q1/21: €0.78).

Continued investment in growth

Spending on property, plant and equipment was €338 million corresponding to 3% of sales (Q1/21: €384 million; 4% of sales). These investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics.

Total acquisition spending was €162 million (Q1/21: €149 million), mainly for the acquisition of dialysis clinics by Fresenius Medical Care and hospitals by Helios Spain.

Cash flow development

Group operating cash flow decreased to €101 million (Q1/21: €652 million) with a margin of 1.0% (Q1/21: 7.3%), mainly driven by working capital build-up from higher raw material inventories and receivables, among others, as well as phasing effects. Free cash flow before acquisitions and dividends decreased to -€255 million (Q1/21: €241 million). Free cash flow after acquisitions and dividends decreased to -€403 million (Q1/21: €117 million).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

3 For estimated COVID-19 effects in Q1/22 and Q1/21 please see table on page 16 in the PDF.

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Solid balance sheet structure

Group total assets increased by 2% (0% in constant currency) to €73,114 million (Dec. 31, 2021: €71,962 million) given currency translation effects and the expansion of business activities. Current assets increased by 3% (2% in constant currency) to €18,002 million (Dec. 31, 2021: €17,461 million), mainly driven by the increase of trade accounts receivables. Non-current assets increased by 1% (0% in constant currency) to €55,112 million (Dec. 31, 2021: €54,501 million).

Total shareholders’ equity increased by 4% (3% in constant currency) to €30,584 million (Dec. 31, 2021: €29,288 million). The equity ratio was 41.8% (Dec. 31, 2021: 40.7%).

Group debt remained stable (0% in constant currency) at €27,211 million (Dec. 31, 2021: € 27,155 million). Group net debt increased by 3% (2% in constant currency) to € 25,134 million (Dec. 31, 2021: € 24,391 million).

As of March 31, 2022, the net debt/EBITDA ratio increased to 3.60x1,2 (Dec. 31, 2021: 3.51x1,2) mainly driven by COVID-19 effects weighing on operating cash flow.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of March 31, 2022, Fresenius Medical Care was treating 343,493 patients in 4,153 dialysis clinics. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care.

• Higher than anticipated COVID-19-related excess mortality, but declining throughout the quarter

• Earnings development affected by ongoing significantly elevated labor costs compounded by effects from Omicron in Health Care Services and by increased material and logistic costs in Health Care Products

• Earnings development in EMEA additionally impacted by the war in Ukraine

Sales increased by 8% (3% in constant currency) to €4,548 million (Q1/21: €4,210 million). Organic growth was 2%. Currency translation increased sales growth by 5%.

EBIT decreased by 27% (-30% in constant currency) to €348 million (Q1/21: €474 million) resulting in a margin of 7.6% (Q1/21: 11.3%). EBIT before special items, i.e. costs incurred for FME25 and the impact related to the war in Ukraine, decreased by 15% (-19% in constant currency) to €403 million (Q1/21: €477 million), resulting in a margin1 of 8.9% (Q1/21: 11.3%). At constant currency, the decline was mainly due to higher labor costs, adverse COVID-19-related effects, as well as inflationary and supply chain cost increases. These effects were only partially mitigated by the partial reversal of an accrual related to a revenue recognition adjustment for accounts receivable in legal dispute.

1 Before special items

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Net income1 decreased by 37% (-39% in constant currency) to €157 million (Q1/21: €249 million). Net income1 before special items decreased by 20% (-23% in constant currency) to €200 million (Q1/21: €251 million) mainly due to the mentioned negative effects on operating income.

Operating cash flow was €159 million (Q1/21: €208 million) with a margin of 3.5% (Q1/21: 4.9%). The decrease was mainly due to continued recoupment of the U.S. government’s payments received in 2020 under the CARES Act and a decrease in net income, partially offset by a favorable impact from trade accounts and other receivables.

For FY/22, Fresenius Medical Care confirms its outlook and expects revenue2 and net income1,3 to grow at low- to mid-single-digit percentage rates in constant currency4.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 FY/21 base: €17,619 million

3 FY/21 base: €1,018 million, before special items; FY/22 before special items

4 These targets are based on the 2021 results excluding the costs related to FME25 of €49 million (for net income). They are based on the assumptions outlined in the press release on the Q4 and FY 2021 results (Feb.22, 2022), in constant currency and exclude special items. Special items include further costs related to FME25, the impacts related to the war in Ukraine, and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

• North America performance impacted by persistent headwinds

• Emerging Markets showed strong earnings growth

• Acquisition of Ivenix and majority stake in mAbxience expected to accelerate growth

Sales increased by 5% (1% in constant currency) to €1,847 million (Q1/21: €1,761 million). Organic growth was 1%. Positive currency translation effects of 4% were mainly related to the U.S. dollar and Chinese yuan.

Sales in North America increased by 4% (organic growth: -3%) to €579 million (Q1/21: €558 million). The organic revenue decrease was mainly due to high level of COVID-related absenteeism of production staff and ongoing competitive pressure.

Sales in Europe increased by 2% (organic growth: 2%) to €640 million (Q1/21: €626 million) mainly driven by increasingly normalizing volume demand given progressing recovery of elective treatments.

Sales in Asia-Pacific increased by 10% (organic growth: 3%) to €433 million (Q1/21: €392 million), due to solid growth across the region. In China, higher sales of products not affected by the NVBP (National Volume-Based Procurement) tenders contributed positively.

Sales in Latin America/Africa increased by 5% (organic growth: 2%) to €195 million (Q1/21: €185 million), over a high prior-year COVID-19-related base.

Sales in the Biosimilars business was €23 million, consistent with Fresenius Kabi’s expectations.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

EBIT1 increased by 6% (0% in constant currency) to €293 million (Q1/21: €276 million) with an EBIT margin1 of 15.9% (Q1/21: 15.7%). The high level of absenteeism of production staff primarily due to COVID-19, ongoing competitive pressure, supply chain challenges as well as input cost inflation weighed on the financial performance.

Net income1,2 increased by 6% (increased by 1% in constant currency) to €201 million (Q1/21: €190 million).

Operating cash flow decreased to €133 million (Q1/21: €278 million) with a margin of 7.2% (Q1/21: 15.8%) mainly driven by a working capital build-up from e.g. higher raw material inventories.

For FY/22, Fresenius Kabi confirms its outlook and expects organic sales3 growth in a low single- digit percentage range. Constant currency EBIT4 is expected to decline in a high single- to low-double-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

In March, the acquisitions of Ivenix and a majority stake in mAbxience were announced. mAbxience significantly enhances Fresenius Kabi’s presence in the high-growth biopharmaceuticals market. The acquisition of Ivenix, closed at the beginning of May, strengthens the company’s MedTech business. The financial effects from both acquisitions are excluded from guidance.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €7,193 million

4 FY/21 base: €1,153 million, before special items, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany, Helios Spain and Helios Fertility. Helios Germany operates 88 hospitals, ~130 outpatient centers and 6 prevention centers. Helios Spain operates 50 hospitals, 97 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 8 hospitals and as a provider of medical diagnostics. Helios Fertility offers a wide spectrum of state-of the-art services in the field of fertility treatments.

• Helios Germany with solid organic growth based on increased number of admissions

• Helios Spain delivered excellent organic sales and earnings growth given continued strong activity levels

• Helios Fertility with solid financial performance

Sales increased by 11% (11% in constant currency) to €2,931 million (Q1/21: €2,649 million). Organic growth was 8%. Acquisitions, mainly at Helios Fertility, contributed 3% to sales growth.

Sales of Helios Germany increased by 7% (organic growth: 5%) to €1,783 million (Q1/21: €1,673 million), mainly driven by increasing admissions, which are however still below prepandemic levels. Hence growth was supported by COVID-19-related reimbursement schemes. Acquisitions contributed 1% to sales growth.

Sales of Helios Spain increased by 12% (12% in constant currency) to €1,089 million (Q1/21: €976 million). Organic growth of 11% was driven by consistently high activity levels. The hospitals in Latin America also contributed to sales growth. Acquisitions contributed 1% to sales growth.

Sales of the Helios Fertility were €57 million.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

EBIT1 increased by 14% (15% in constant currency) to €306 million (Q1/21: €268 million) with an EBIT margin1 of 10.4% (Q1/21: 10.1%).

EBIT1 of Helios Germany increased by 3% to €154 million (Q1/21: €150 million) with an EBIT margin1 of 8.6% (Q1/21: 9.0%). COVID-related elevated staff absenteeism at the beginning of the quarter weighed on profitability. Inflationary effects had only a small negative impact.

EBIT1 of Helios Spain increased by 21% (22% in constant currency) to €153 million (Q1/21: €126 million) due to the consistently high level of treatments. The Latin American business also showed a good performance. The EBIT margin1 was 14.0% (Q1/21: 12.9%).

EBIT1 of Helios Fertility was €4 million with an EBIT1 margin of 7.0%.

Net income1,2 increased by 13% (13% in constant currency) to €195 million (Q1/21: €173 million).

Operating cash flow decreased to -€136 million (Q1/21: €215 million) with a margin of -4.6% (Q1/21: 8.1%) following a strong Q4/21 and COVID-19-related delays in budget negotiations in Germany.

For FY/22, Fresenius Helios confirms its outlook and expects organic sales3 growth in a low to mid-single-digit percentage range and constant currency EBIT4 growth in a mid-single digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €10,891 million

4 FY/21 base: €1,127 million, before special items, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

• Project business still marked by COVID-19-related headwinds as well as global supply chain challenges and cost inflation

• Service business supported by increasing elective treatment activity

• Excellent order intake

Sales increased by 8% (7% in constant currency) to €513 million (Q1/21: €477 million). Organic growth was 7%.

Sales in the service business increased by 12% (11% in constant currency) to €405 million (Q1/21: €363 million) due to recovering elective treatments. Sales in the project business decreased by 5% (-5% in constant currency) to €108 million (Q1/21: €114 million), driven by COVID-19-related headwinds as well as global supply chain challenges.

EBIT1 increased to €8 million (Q1/21: -€4 million) mainly driven by the service business with an EBIT margin1 of 1.6% (Q1/21: -0.8%).

1 Before special items

2 Net income attributable to shareholders of VAMED AG

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Net income1,2 increased to €4 million (Q1/21: -€7 million).

Order intake was €263 million (Q1/21: €138 million). As of March 31, 2022, order backlog was at €3,626 million (December 31, 2021: €3,473 million).

Operating cash flow decreased to -€45 million (Q1/21: -€44 million) with a margin of -8.8% (Q1/21: -9.2%), due to phasing effects and COVID-19-related delays in the project business as well as some working capital build-ups.

For FY/22, Fresenius Vamed confirms its outlook and expects organic sales3 growth in a high single to low-double-digit percentage range and constant currency EBIT4 to return to absolute pre-COVID-19 levels (FY/19: €134 million). Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of VAMED AG

3 FY/21 base: €2,297 million

4 FY/21 base: €101 million, before special items; FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF.

Conference Call

As part of the publication of the results for Q1/2022, a conference call will be held on May 4, 2022 at 1:30 p.m. CEDT (7:30 a.m. EDT). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Further earnings growth in 2022 expected despite ongoing COVID-19 effects, and cost inflation impact

- Accelerated execution of cost and efficiency program leading to earlier and significantly higher savings

- Medium-term growth targets confirmed and specified

- 29th consecutive dividend increase – scrip dividend proposed

- Fresenius to be climate neutral by 2040

If no timeframe is specified, information refers to Q4/2021.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Stephan Sturm, CEO of Fresenius, said: “Our mission is to protect people’s health. Fulfilling that mission has rarely been as difficult as during this pandemic. But we have done our part and have lived up to our responsibility. In business terms, too, 2021 was challenging yet successful: We delivered a strong final quarter and fully met our targets for the year. In 2022 we expect continued profitable growth, despite rising inflation and the ongoing burdens caused by the pandemic. In our cost and efficiency program, we have made faster than expected progress. This is an important factor enabling us to confirm the medium-term targets we set well before the pandemic, giving us all the more reason to look ahead with optimism.”

Path to accelerated growth

Fresenius has defined a strategic path to pursue accelerated profitable growth and hence to sustainably strengthen the Group and each of its business segments by tapping new sources of capital and prioritizing segment capital allocation. All our stakeholders continue to benefit from the advantages of the Group’s current structure, which offers stability through diversification as well as efficiency through economies of scale, access to attractive debt financing and tax savings.

All of Fresenius’ business segments have excellent market positions and ample meaningful growth opportunities. Properly balancing the objectives of all our stakeholder groups requires an even more targeted approach to capital allocation. While Fresenius continues to believe in the virtues of vertical integration, the Company is keen to gradually re-balance the relative weights of its products and service businesses.

Primarily based on its superior profitability and excellent growth prospects, Fresenius Kabi is defined as top priority. With respect to Fresenius Medical Care, which has been particularly hard hit by the pandemic, the transformation program FME25 is expected to result in ever improving profitability and accelerated growth, driving improved valuation for Fresenius’ controlling stake. For Fresenius Helios and Fresenius Vamed, smaller inorganic growth opportunities will continue to be financed from Fresenius Group funds. For larger growth opportunities, Fresenius is open to value-enhancing external equity investments at the level of these business segments. An equity increase on Group level would then be redundant and is hence not foreseen.

By setting this course, Fresenius will accelerate the growth of each of our business segments for the benefit of all stakeholders.

“We are moving Fresenius ahead at speed, with a measured and well-managed transformation of our company. All our business segments have strong market positions, and great growth potential. We intend to harness this potential – guided by clear strategic priorities that will combine additional sources of more dynamic growth with the advantages of a broad business structure. Fresenius remains a diversified healthcare group, with a sharper profile, that will be active in wide-ranging and very exciting areas of medicine,” said Stephan Sturm, CEO of Fresenius.

FY/22 Group guidance

For FY/22, Fresenius projects sales growth1 in a mid-single-digit percentage range in constant currency. Net income2,3 is expected to grow in a low-single-digit percentage range in constant currency. Implicitly, net income2 for the Group excluding Fresenius Medical Care is expected to grow in a low-single-digit percentage range in constant currency.

Without further acquisitions, Fresenius projects an improvement of the net debt/EBITDA4 ratio (December 31, 2021: 3.51x5) into the self-imposed target corridor of 3.0x to 3.5x by the end of 2022.

Assumptions for guidance FY/22

COVID-19 will continue to impact Fresenius’ operations in 2022. The extent of the impact on the Group is to a large degree dependent on the vaccination coverage in Fresenius’ relevant markets and the potential evolution of new virus mutants.

Fresenius closely monitors the development of the COVID-19 pandemic and the associated various containment measures enacted in the Company’s relevant markets. Fresenius expects COVID-19 case numbers to decline from spring 2022 onwards and consequently the number of elective treatments and staff availability to improve. A possible significant deterioration of the situation associated with further containment measures that could have a significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/22 guidance.

1 FY/21 base: €37,520 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €1,867 million; before special items; FY/22: before special items

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions; before special items; including lease liabilities

5 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; before special items; including lease liabilities

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Headwinds from cost inflation are reflected. However, Fresenius expects no significant acceleration of inflation effects and supply chain challenges versus the current environment. The Management Board assumes an unchanged corporate tax rate in the United States.

Furthermore, the assumptions for Fresenius Medical Care's FY/22 guidance are also fully applicable to Fresenius Group's FY/22 guidance.

All of these assumptions are subject to considerable uncertainty.

Cost and efficiency program leading to significantly higher savings

Fresenius has successfully completed the first phase of its cost and efficiency program aiming to further safeguard the Group’s medium-term targets and to sustainably enhance profitability. This has led to initial cost savings of ~€20 million and one-time expenses of ~€80 million in 2021. Given the good progress, especially driven by the accelerated implementation of initiatives, Fresenius significantly increases its savings target and now expects cost savings of at least €150 million p.a. after tax and minority interest in 2023. Initially, more than €100 million p.a. after tax and minority interest were projected. For the years thereafter, a further significant increase in sustainable cost savings is expected. The savings will be achieved by all four business segments and the corporate center.

Fresenius anticipates that achieving these sustainable efficiency improvements will require up-front expenses of more than €200 million in 2022 and further expenses of around €100 million in 2023, in each case after taxes and minority interest. No further significant expenses are expected thereafter. In line with previous practice, these expenses are classified as special items.

Growth targets for 2020 – 2023 confirmed and specified

Based on the anticipated positive contributions from the cost and efficiency program as well as the attractive growth opportunities across all business segments, Fresenius expects Group earnings growth to meaningfully accelerate until 2023. The company hence confirms its medium-term targets set in 2019 despite the ongoing challenges posed by COVID-19. At the same time, Fresenius specifies its expectations and now anticipates Group organic sales growth to reach the bottom to middle of the targeted 4% to 7% compounded annual growth rate (CAGR) and Group organic net income1,2 growth to be at the bottom end of the 5% to 9% CAGR during 2020 to 2023. Due to the COVID-19 pandemic, Fresenius now expects small and medium-sized acquisitions to contribute an incremental CAGR of less than 1% to both sales and net income growth.

29th consecutive dividend increase proposed

Consistent with Fresenius’ stated policy, the Management Board of Fresenius will propose to the Supervisory Board a dividend increase of 5% to €0.92 per share for FY/21 (FY/20: €0.88). Provided the proposal is approved by the Supervisory Board and the Annual General Meeting, this will be the 29th consecutive dividend increase.

The Management Board will propose a scrip dividend to the Supervisory Board, thereby giving shareholders the option to receive their dividend (except for the tax portion of the dividend) in the form of new Fresenius shares. The Else Kröner-Fresenius-Foundation has informed Fresenius that it intends to fully participate in the scrip dividend.

Fresenius to be climate neutral by 2040

Fresenius has set a climate target for the Group complementing its existing sustainability targets and programs. The company aims to be climate neutral by 2040 and to reduce 50% of absolute scope 1 and scope 2 emissions by 2030 compared to 2020 levels. Fresenius will continuously assess scope 3 emission impacts for inclusion in targets. Further information at www.fresenius.com/sustainability and in today’s separate press release at www.fresenius.com/news.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

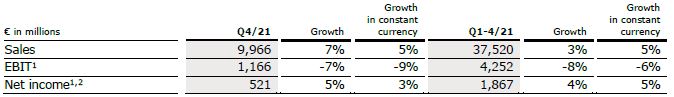

5% sales growth in constant currency

Group sales increased by 7% (5% in constant currency) to €9,966 million (Q4/20: €9,304 million). Organic growth was 4%. Acquisitions/divestitures contributed net 1% to sales growth. Currency translation increased sales growth by 2%. Excluding estimated COVID-19 effects1, Group sales growth would have been 5% to 6% in constant currency.

In FY/21, Group sales increased by 3% (5% in constant currency) to €37,520 million (FY/20: €36,277 million). Organic growth was 4%. Acquisitions/divestitures contributed net 1% to sales growth. Currency translation reduced sales growth by 2%. Excluding estimated COVID-19 effects1, Group sales growth would have been 5% to 6% in constant currency.

5% net income2,3 growth in constant currency

Group EBITDA before special items decreased by 2% (-5% in constant currency) to €1,846 million (Q4/202: €1,886 million). Reported Group EBITDA was €1,868 million (Q4/20: €1,854 million).

In FY/21, Group EBITDA before special items decreased by 4% (-2% in constant currency) to €6,854 million (FY/202: €7,132 million). Reported Group EBITDA was €6,825 million (FY/20: €7,100 million).

Group EBIT before special items decreased by 7% (-9% in constant currency) to €1,166 million (Q4/202: €1,251 million). The decrease is primarily due to COVID-19 related headwinds at Fresenius Medical Care. The EBIT margin before special items was 11.7% (Q4/202: 13.4%). Reported Group EBIT was €1,123 million (Q4/20: €1,024 million).

In FY/21, Group EBIT before special items decreased by 8% (-6% in constant currency) to €4,252 million (FY/202: €4,612 million). The decrease is primarily due to COVID-19 related headwinds at Fresenius Medical Care. The EBIT margin before special items was 11.3% (FY/202: 12.7%). Reported Group EBIT was €4,158 million (FY/20: €4,385 million).

1 For estimated COVID-19 effects in Q4/21 and FY/21 please see table on page 19 in the PDF.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Group net interest before special items improved to -€120 million (Q4/202: -€159 million) mainly due to successful refinancing activities. Reported Group net interest improved to -€122 million (Q4/20: -€156 million).

In FY/21, Group net interest before special items improved to -€504 million (FY/201: - €654 million) while reported Group net interest improved to -€506 million (FY/20: -€659 million).

The Group tax rate before special items was 23.1% (Q4/201: 24.1%) while the reported Group tax rate was 24.2% (Q4/20: 29.4%). In FY/21, the Group tax rate before special items was 22.6% (FY/201: 23.1%) while the reported Group tax rate was 22.8% (FY/20: 24.2%).

Noncontrolling interests before special items were €283 million (Q4/201: €335 million) of which 90% were attributable to the noncontrolling interests in Fresenius Medical Care. Reported noncontrolling interests were €260 million (Q4/20 reported: €203 million).

In FY/21, noncontrolling interests before special items were €1,033 million (FY/201: €1,248 million) of which 91% were attributable to the noncontrolling interests in Fresenius Medical Care. Reported noncontrolling interests were €1,001 million (FY/20 reported: €1,116 million).

Group net income2 before special items increased by 5% (3% in constant currency) to €521 million (Q4/201: €494 million). The increase is driven by the strong development of Fresenius Kabi’s Emerging Market business, a good performance at Helios Germany, an excellent finish to the year by Fresenius Vamed and the favorable net interest development. Excluding estimated COVID-19 effects3, Group net income2 before special items would have grown 3% to 7% in constant currency. Reported Group net income2 increased to €499 million (Q4/20: €410 million).

In FY/21, Group net income2 before special items increased by 4% (5% in constant currency) to €1,867 million (FY/201: €1,796 million). Excluding estimated COVID-19 effects3, Group net income2 before special items would have grown 6% to 10% in constant currency. Reported Group net income2 increased to €1,818 million (FY/20: €1,707 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 For estimated COVID-19 effects in Q4/21 and FY/21 please see table on page 19 in the PDF.

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Earnings per share1 before special items increased by 5% (2% in constant currency) to €0.94 (Q4/202: €0.88). Reported earnings per share1 were €0.90 (Q4/20: €0.73). In FY/21, earnings per share1 before special items increased by 4% (5% in constant currency) to €3.35 (FY/202: €3.22). Reported earnings per share1 were €3.26 (FY/20: €3.06).

Continued investment in growth

Spending on property, plant and equipment was €690 million corresponding to 7% of sales (Q4/20: €856 million; 9% of sales). These investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics. In FY/21, spending on property, plant and equipment was €2,032 million corresponding to 5% of sales (FY/20: €2,398 million; 7% of sales).

Total acquisition spending was €278 million (Q4/20: €251 million). In FY/21, total acquisition spending was €1,085 million (FY/20: €902 million) mainly for the acquisition of the Eugin Group at Fresenius Helios which has been consolidated since April 1, 2021, and the acquisition of dialysis clinics at Fresenius Medical Care.

Strong cash flow development in Q4/21

Group operating cash flow increased by 26% to €1,749 million (Q4/20: €1,390 million) with an improved margin of 17.5% (Q4/20: 14.9%) mainly due to stringent working capital management. The good operating performance at Helios Spain, Fresenius Vamed and Fresenius Kabi also contributed to the positive development. Free cash flow before acquisitions and dividends increased to €1,075 million (Q4/20: €590 million). Free cash flow after acquisitions and dividends increased to €841 million (Q4/20: €329 million).

In FY/21, Group operating cash flow decreased to €5,078 million (FY/20: €6,549 million) with a margin of 13.5% (FY/20: 18.1%) mainly due to the U.S. government’s advanced payments received in 2020 and the partial recoupment of these payments in 2021 at Fresenius Medical Care.

Free cash flow before acquisitions and dividends decreased to €3,061 million (FY/20: €4,183 million). Free cash flow after acquisitions and dividends decreased to €1,193 million (FY/20: €2,478 million).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Solid balance sheet structure

Group total assets increased by 8% (4% in constant currency) to €71,962 million (Dec. 31, 2020: €66,646 million). The increase is mainly due to currency translation effects, acquisitions as well as the expansion of business activities. Current assets increased by 11% (8% in constant currency) to €17,461 million (Dec. 31, 2020: €15,772 million) driven by the increase of cash and cash equivalents, trade accounts receivables and inventories. Non-current assets increased by 7% (3% in constant currency) to €54,501 million (Dec. 31, 2020: €50,874 million).

Total shareholders’ equity increased by 13% (7% in constant currency) to €29,288 million (Dec. 31, 2020: €26,023 million). The increase is due to currency translation effects as well as the good net income development. The equity ratio was 40.7% (Dec. 31, 2020: 39.0%).

Group debt increased by 5% (2% in constant currency) to €27,155 million (Dec. 31, 2020: € 25,913 million). Group net debt increased by 1% (-1% in constant currency) to € 24,391 million (Dec. 31, 2020: € 24,076 million).

As of December 31, 2021, the net debt/EBITDA ratio increased to 3.51x1,2 (Dec. 31, 2020: 3.44x1,2) driven by COVID-19 effects weighing on EBITDA.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; including lease liabilities

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of December 31, 2021, Fresenius Medical Care was treating 345,425 patients in 4,171 dialysis clinics. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care.

• Business development significantly impacted by COVID-19 in 2021, effects are expected to continue into 2022

• Decline in excess mortality in the fourth quarter

• Return to earnings growth in 2022 targeted

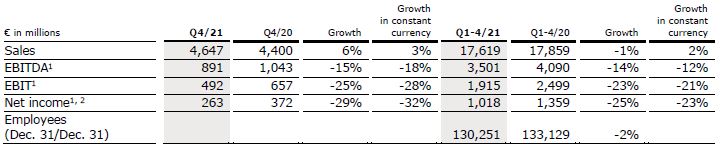

Sales increased by 6% (3% in constant currency) to €4,647 million (Q4/20: €4,400 million). Currency translation increased sales growth by 3%. Organic growth was 2%. Acquisitions/divestitures contributed net 1% to sales growth.

In FY/21, sales decreased by 1% (increased by 2% in constant currency) to €17,619 million (FY/20: €17,859 million). Currency translation decreased sales growth by 3%. Organic growth was 1%. Acquisitions/divestitures contributed net 1% to sales growth.

EBIT decreased by 3% (-7% in constant currency) to €449 million (Q4/20: €462 million) resulting in a margin of 9.7% (Q4/20: 10.5%). EBIT before special items decreased by 25% (-28% in constant currency) to €492 million (Q4/20: €657 million), resulting in a margin of 10.6% (Q4/20: 14.9%). The decline was mainly due to a remeasurement effect on the fair value of investments, higher labor cost, the adverse COVID-19-related net effects and inflationary materials cost increases. These effects were only slightly mitigated by an improved U.S. payor mix, in particular due to an increased number of patients with Medicare Advantage coverage.

1 Before special items

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

In FY/21, EBIT decreased by 20% (-17% in constant currency) to €1,852 million (FY/20: €2,304 million) resulting in a margin of 10.5% (FY/20: 12.9%). EBIT before special items decreased by 23% (-21% in constant currency) to €1,915 million (FY/20: €2,499 million), resulting in a margin of 10.9% (FY/20: 14.0%).

Net income1 increased by 29% (23% in constant currency) to €229 million (Q4/20: €177 million). Net income1 before special items decreased by 29% (-32% in constant currency) to €263 million (Q4/20: €372 million) mainly due to the mentioned negative effects on operating income. In FY/21, net income1 decreased by 17% (-14% in constant currency) to €969 million (FY/20: €1,164 million). Net income1 before special items decreased by 25% (-23% in constant currency) to €1,018 million (FY/20: €1,359 million).

Operating cash flow was €669 million (Q4/20: €584 million) with a margin of 14.4% (Q4/20: 13.3%). The increase was mainly due to improved working capital including contributions from FME25 and U.S. federal relief funding, partially offset by continued recoupment of the U.S. government’s payments received in 2020 under the CARES Act and lower tax payments related to COVID-19 reliefs in the prior year. In FY/21, operating cash flow was €2,489 million (FY/20: €4,233 million) with a margin of 14.1% (FY/20: 23.7%).

For FY/22, Fresenius Medical Care expects revenue2 and net income1,3 to grow at low- to mid-single-digit percentage rates in constant currency4. For the underlying assumptions please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 FY/21 base: €17,619 million

3 FY/21 base: €1,018 million, before special items; FY/22 before special items

4 These targets are based on the 2021 results excluding the costs related to FME25 of €49 million (for net income). They are based on the outlined assumptions (http://www.freseniusmedicalcare.com), in constant currency and exclude special items. Special items include further costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

• Good performance in Q4 supported by COVID-driven demand, not expected to continue through 2022

• North America with positive organic sales and EBIT growth despite supply chain challenges

• Asia-Pacific with anticipated organic sales decline due to price effects in China post successful participation in NVBP tenders

• Separate reporting of Biosimilars sales starting Q1/22

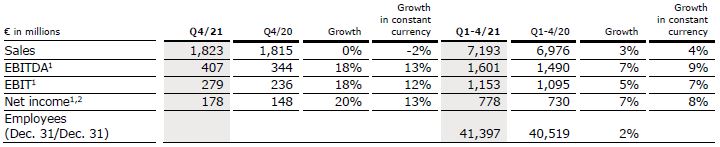

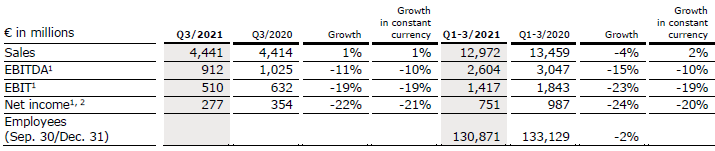

Sales remained on previous year’s level (decreased by -2% in constant currency) at €1,823 million (Q4/20: €1,815 million). Organic growth was -1%. Divestitures reduced sales growth by 1%. Positive currency translation effects (2%) were mainly related to the appreciation of the U.S. dollar and the Chinese yuan against the Euro.

In FY/21, sales increased by 3% (4% in constant currency) to €7,193 million (FY/20: €6,976 million). Organic growth was 4%. Negative currency translation effects of 1% were mainly related to the weakness of the U.S. dollar.

Sales in North America increased by 7% (organic growth: 2%) to €589 million (Q4/20: €549 million) driven by COVID-19 related extra demand. In FY/21, sales in North America decreased by 5% (organic growth: -2%) to €2,258 million (FY/20: €2,376 million).

Sales in Europe decreased by 2% (organic growth: 0%) to €664 million (Q4/20: €680 million) mainly due to the high prior-year base. In FY/21, sales in Europe increased by 3% (organic growth: 3%) to €2,544 million (FY/20: €2,458 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Sales in Asia-Pacific decreased by 8% (organic growth: -13%) to €395 million (Q4/20: €428 million) due to the anticipated negative price effects from successful participation in NVBP (National Volume-Based Purchasing) tenders as well as the exceptionally high prior-year base. In FY/21, sales in Asia-Pacific increased by 10% (organic growth: 8%) to €1,643 million (FY/20: €1,497 million).

Sales in Latin America/Africa increased by 11% (organic growth: 12%) to €175 million (Q4/20: €158 million) due to ongoing COVID-19 related extra demand. In FY/21, sales in Latin America/Africa increased by 16% (organic growth: 23%) to €748 million (FY/20: €645 million).

EBIT before special items increased by 18% (12% in constant currency) to €279 million (Q4/201: €236 million) with a margin of 15.3% (Q4/201:13.0%). The excellent performance is primarily due to COVID-19 related extra demand, and cost savings in the Asia-Pacific region, mainly in China. The ongoing competitive situation, supply chain challenges, the flow-through effects of tenders in China were headwinds. There were broadly offsetting one time effects across the regions. In FY/21, EBIT before special items increased by 5% (7% in constant currency) to €1,153 million (FY/201: €1,095 million) with a margin of 16.0% (FY/201: 15.7%).

Net income1,2 increased by 20% (13% in constant currency) to €178 million (Q4/201: €148 million). In FY/21, net income1,2 increased by 7% (8% in constant currency) to €778 million (FY/201: €730 million).

Operating cash flow increased by 9% to €335 million (Q4/20: €307 million) with a margin of 18.4% (Q4/20: 16.9%) mainly due to a healthy operational performance. In FY/21, operating cash flow increased by 5% to €1,203 million (FY/20: €1,143 million) with a margin of 16.7% (FY/20: 16.4%).

For FY/22, Fresenius Kabi expects organic sales3 growth in a low-single-digit percentage range. Constant currency EBIT4 is expected to decline in a high-single- to low-double-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

Starting Q1/22, the sales of the Biosimilars business will be reported on a quarterly basis.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €7,193 million

4 FY/21 base: €1,153 million, before special items, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain (Quirónsalud) and the Eugin Group. Helios Germany operates 90 hospitals, ~130 outpatient centers and 6 prevention centers. Quirónsalud operates 49 hospitals in Spain as well as 88 outpatient centers and ~300 occupational risk prevention centers. In addition, the company is active in Latin America with 7 hospitals and as a provider of medical diagnostics.

• Sales growth at Helios Germany driven by increasing admissions and acquisitions

• Helios Spain with strong organic sales growth; EBIT growth influenced by exceptionally high prior-year base

• Separate reporting of Fertility Services starting Q1/22

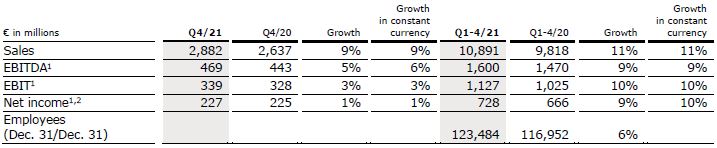

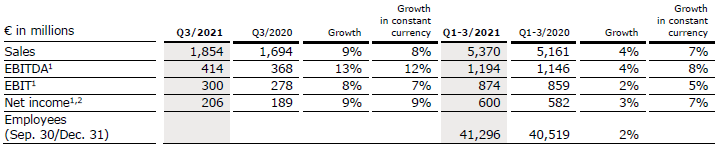

Sales increased by 9% (9% in constant currency) to €2,882 million (Q4/20: €2,637 million). Organic growth was 5%. Acquisitions contributed 4% to sales growth. In FY/21, sales increased by 11% (11% in constant currency) to €10,891 million (FY/20: €9,818 million). Organic growth was 7%. Acquisitions contributed 4% to sales growth.

Sales of Helios Germany increased by 7% (organic growth: 4%) to €1,745 million (Q4/20: €1,637 million) primarily driven by increasing admissions. Acquisitions contributed 3% to sales growth. In FY/21, sales of Helios Germany increased by 6% (organic growth: 2%) to €6,733 million (FY/20: €6,340 million). Acquisitions contributed 4% to sales growth.

Sales of Helios Spain increased by 9% (9% in constant currency) to €1,084 million (Q4/20: €999 million). Organic growth of 9% was driven by the continuous high level of treatment activity and a consistently high level of demand for the occupational risk prevention services as well as good contributions from Latin America. In FY/21, sales of Helios Spain increased by 16% (17% in constant currency) to €4,021 million (FY/20: €3,475 million). Organic growth was 15%. Acquisitions contributed 2% to sales growth.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

EBIT1 of Fresenius Helios increased by 3% (3% in constant currency) to €339 million (Q4/20: €328 million) with a margin1 of 11.8% (Q4/20: 12.4%). In FY/21, EBIT1 of Fresenius Helios increased by 10% (10% in constant currency) to €1,127 million (FY/20: €1,025 million) with a margin1 of 10.3% (FY/20: 10.4%).

EBIT1 of Helios Germany increased by 9% to €171 million (Q4/20: €157 million) with a margin1 of 9.8% (Q4/20: 9.6%) driven by the positive business development as well as the compensation for COVID-19 related revenue shortfalls. In FY/21, EBIT1 of Helios Germany increased by 2% to €613 million (FY/20: €602 million) with a margin1 of 9.1% (FY/20: 9.5%).

EBIT1 of Helios Spain increased by 2% (3% in constant currency) to €162 million (Q4/20: €159 million) with a margin1 of 14.9% (Q4/20: 15.9%). EBIT growth was influenced by the exceptionally high prior-year base. In addition, higher costs for personnel, personal protective equipment and selected medical products, among others, had a negative impact.

In FY/21, EBIT1 of Helios Spain increased by 22% (24% in constant currency) to €514 million (FY/20: €420 million) with a margin1 of 12.8% (FY/20: 12.1%).

Net income1,2 increased by 1% to €227 million (Q4/20: €225 million). In FY/21, net income1,2 increased by 9% to €728 million (FY/20: €666 million).

Operating cash flow increased to €609 million (Q4/20: €434 million) with a margin of 21.1% (Q4/20: 16.5%) driven by the positive business development as well as stringent working capital management. In FY/21, operating cash flow increased to €1,204 million (FY/20: €1,149 million) with a margin of 11.1% (FY/20: 11.7%).

For FY/22, Fresenius Helios expects organic sales3 growth in a low- to mid-single-digit percentage range and constant currency EBIT4 growth in a mid-single-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

The Eugin Group contributed €133 million to sales and €19 million EBIT in 2021, with first-time consolidation effective April 1, 2021. Starting Q1/22, sales and EBIT of the Eugin Group will be reported under “Fertility Services” on a quarterly basis.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €10,891 million

4 FY/21 base: €1,127 million, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

• Strong finish to the year with excellent organic sales and EBIT growth

• Project business recovering - back to the typical phasing with a strong Q4

• Rehabilitation business developing steadily despite continuous COVID-19 impact; technical service business remains robust

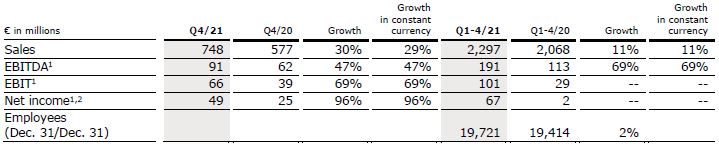

Sales increased by 30% (29% in constant currency) to €748 million (Q4/20: €577 million). Organic growth was 29%. In FY/21, sales increased by 11% (11% in constant currency) to €2,297 million (FY/20: €2,068 million). Organic growth was 11%.

Sales in the service business increased by 12% to €415 million (Q4/20: €372 million). Sales in the project business increased by 62% to €333 million (Q4/20: €205 million), driven by the good operating performance across all regions. In FY/21, sales in the service business increased by 10% to €1,580 million (FY/20: €1,435 million). Sales in the project business increased by 13% to €717 million (FY/20: €633 million).

1 Before special items

2 Net income attributable to shareholders of VAMED AG

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

EBIT1 increased by 69% (69% in constant currency) to €66 million (Q4/20: €39 million) with a margin1 of 8.8% (Q4/20: 6.8%). This significant recovery is due to the good business performance in all regions. In FY/21, EBIT1 more than tripled (248% in constant currency) to €101 million (FY/20: €29 million) with a margin1 of 4.4% (FY/20: 1.4%).

Net income1,2 increased to €49 million (Q4/20: €25 million). In FY/21, net income1,2 increased to €67 million (FY/20: €2 million).

Order intake was €319 million in Q4/21 (Q4/20: €648 million) and €1,290 million in FY/21 (FY/20: €1,010 million). As of December 31, 2021, order backlog was at €3,473 million (December 31, 2020: €3,055 million).

Operating cash flow increased to €128 million (Q4/20: €74 million) with a margin of 17.1% (Q4/20: 12.8%) mainly due to an improved working capital development. In FY/21, operating cash flow increased to €151 million (FY/20: €78 million) with a margin of 6.6% (FY/20: 3.8%).

For FY/22, Fresenius Vamed expects organic sales3 growth in a high-single to low-double-digit percentage range and constant currency EBIT4 to return to absolute pre-COVID-19 levels (FY/19: €134 million). Both sales and EBIT outlook include expected negative COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of VAMED AG

3 FY/21 base: €2,297 million

4 FY/21 base: €101 million; FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 21-25 in the PDF.

Conference Call

As part of the publication of the results for FY 2021, a conference call will be held on February 22, 2022 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Fresenius Medical Care with stronger than projected COVID-19 related headwind

- Fresenius Kabi improves EBIT1 outlook; North America returning to growth; Emerging Markets business with continued healthy financial performance

- Helios Germany with ongoing upward trend for elective treatments; activity levels at Helios Spain above pre-pandemic levels

- Fresenius Vamed with good performance in the service business; order book in the project business remains at all-time high

- Cost and efficiency program on track; savings targets confirmed for FY/23

- Fresenius raises FY/21 Group sales outlook; earnings now expected to be around the top-end of guidance

If no timeframe is specified, information refers to Q3/21.

1 In constant currency

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation table in the PDF document.

Stephan Sturm, CEO of Fresenius, said: “More and more people being vaccinated against COVID-19 is good news. However, the pandemic remains very relevant. It has also more strongly impacted Fresenius and for longer than could have been foreseen. Yet despite this, we continue to grow and remain on track to achieve this year’s, again raised, targets. Launching the Group cost and efficiency program has proved to be the right decision: Our initiatives will help us to better absorb the burdens caused by the pandemic. At the same time, they will strengthen our foundations to thrive, long-term, in a challenging environment. The demand for high-quality, affordable healthcare will be even greater in the future. Fresenius will continue making an important contribution, while creating value for all stakeholders.”

COVID-19 assumptions for guidance FY/21

Negative COVID-19 effects at Fresenius have increased sequentially in Q3/21, driven by significant excess patient mortality at Fresenius Medical Care. Fresenius expects also Q4/21 to be impacted by COVID-19 effects. Meaningfully rising COVID-19 case numbers, the further evolution of virus mutations as well as stalling vaccination progress could impact Fresenius’ ability to achieve its FY/21 guidance. Additionally, Fresenius expects headwinds from cost inflation including rising commodity and shipping prices, increasing energy costs, as well as supply chain constraints in Q4/21. Hence, Fresenius remains vigilant.

Whilst the risk of renewed far-reaching containment measures in one or more of Fresenius’ major markets cannot be excluded, it now appears unlikely. Any resulting significant and direct impact on the health care sector without appropriate compensation is not reflected in the Group’s FY/21 guidance. These assumptions are subject to considerable uncertainty.

FY/21 Group sales guidance raised, earnings guidance improved

Based on the Group’s good Q3/21 results and the progress to improve Group-wide efficiencies, Fresenius raises its sales guidance and improves its earnings guidance. The Company now projects constant currency sales1 to grow in a mid single-digit range in FY/21. Previously, the Company projected sales1 growth in a low-to-mid single-digit percentage range in constant currency. Earnings2,3 growth in constant currency is now expected to be around the top-end of the low single-digit percentage range.

Implicitly, net income2 for the Group excluding Fresenius Medical Care is now expected to grow in a low double-digit percentage range in constant currency. Previously, Fresenius expected high single-digit percentage growth in constant currency.

The guidance implies ongoing COVID-19 related headwinds, primarily at Fresenius Medical Care, and increasingly noticeable cost inflation across selected markets in Q4/21. It also reflects negative pricing effects related to tender activity at Fresenius Kabi in China.

Based on expected lower contributions to Group EBITDA from Fresenius Medical Care as well as assumed cash phasing effects in Q4/21, Fresenius does not expect the net debt/EBITDA4 ratio of 3.55x as of September 30, 2021 to improve in Q4/21.

1 FY/20 base: €36,277 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/20 base: €1,796 million, before special items; FY/21: before special items

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions; before special items

For a detailed overview of special items please see the reconciliation table in the PDF document.

Progress on efficiency measures to sustainably improve profitability

During Q3/21, Fresenius finalized the concept phase of its cost and efficiency program. At the same time, first initiatives were already implemented. Fresenius Medical Care is providing an update on its FME25 transformation program in addition to its Q3/21 results presentation. Fresenius confirms its expectation that the measures to sustainably enhance profitability and operational excellence to reach cost savings of more than €100 million p.a. after tax and minority interest in 2023, with some potential to increase thereafter.

Achieving these sustainable efficiencies will require significant up-front expenses. For the years 2021 to 2023, those expenses are expected to average more than €100 million p.a. after tax and minority interest, with the largest portion currently expected to materialize in 2022. They will be classified as special items, consistent with previous practice.

Fresenius expects significant contributions from all four business segments and from the corporate center in the 2021 to 2023 period. For FY/21, low double-digit million Euro savings after tax and minority interest from the Group’s cost and efficiency measures are expected to support the Group’s profitability. These savings and efficiency gains derive from activities in all four business segments.

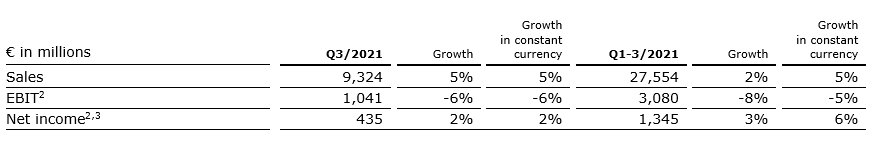

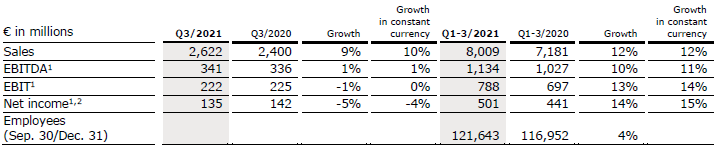

5% sales increase in constant currency

Group sales increased by 5% (5% in constant currency) to €9,324 million (Q3/20: €8,918 million). Organic growth was 3%. Acquisitions/divestitures contributed net 2% to growth. Currency translation had no effect on sales growth. Excluding estimated COVID-19 effects1, Group sales growth would have been 7% to 8% in constant currency.

In Q1-3/21, Group sales increased by 2% (5% in constant currency) to €27,554 million (Q1-3/20: €26,973 million). Organic growth was 4%. Acquisitions/divestitures contributed net 1% to growth. Currency translation reduced sales growth by 3%. Excluding estimated COVID-19 effects1, Group sales growth would have been 5% to 6% in constant currency.