- Improving Fresenius Helios outlook for FY/24 – Expecting mid-single-digit revenue growth and an EBIT margin of 10% to 11% in FY/24

- Raising ambition level for Fresenius Helios within Fresenius Financial Framework – Targeting organic revenue growth of 4% to 6% p.a. as well as structural EBIT margin band of 10% to 12%

- System-critical and stable businesses – Helios Germany’s and Quirónsalud’s patient-centric, reliable and market-leading provider network driving steady capital-efficient organic growth and consistent cash-flow generation

- Digital and data strategy – Bringing new tools and technologies, such as AI, to clinical practice and tapping opportunities to leverage proprietary data to boost treatment outcomes

- Key value drivers – Clustering and specialization, outpatient integration, and emergency care provision in Germany; technology-focused improvements, enhanced physician value proposition, and selective network expansion in Spain

At its Capital Markets Day in London, global healthcare company Fresenius today presented a strategy update for its Care Provision Platform and improved the outlook for its Operating Company Fresenius Helios. For FY/24, Fresenius Helios now expects organic revenue to grow in a mid-single digit percentage range (previous: low-to-mid-single-digit percentage range) and targets an EBIT margin of 10 to 11% (previous: within structural margin band of 9% to 11%). Furthermore, Fresenius raised its ambition level for Fresenius Helios within the Fresenius Financial Framework, and now targets an annual organic revenue growth of 4% to 6% (previous: 3% to 5%) as well as a structural margin band of 10% to 12% (previous: 9% to 11%). The ambition is to grow EBIT stronger than revenue, hence, underlining accelerated profitable growth. Fresenius Helios further sharpens its focus on optimizing net working capital to improve its sustainable cash flow generation. The expected acceleration of organic revenue growth, targeted productivity improvements, enhanced profitability and rigorous capital allocation measures are contributing to Fresenius Group’s ambition to improve its Return on Invested Capital (ROIC) and its deleveraging efforts.

The improved expectations follow a strong start into 2024 and are based on the key elements and drivers of Fresenius Helios’ growth strategy, which Fresenius outlined to analysts and investors today. The main growth drivers at Helios in Germany are an extended medical cluster & specialization strategy, further improved outpatient integration and a boost of the emergency care provision. At Quirónsalud, the main growth drivers are technology-focused improvements, various physician support initiatives, as well as a selective network expansion. Fresenius Helios is Europe's leading private healthcare provider. It operates around 140 hospitals and more than 400 outpatient facilities under its brands Helios in Germany and Quirónsalud in Spain and Colombia.

Fresenius CEO Michael Sen said: “As a leading therapy-focused company, we are shaping the future of healthcare, which will be digital, data-driven, personalized and human. And this is where our strength lies. We are close to the patients. We are Committed to Life. That is the promise we have made with #FutureFresenius. And we are a simpler and stronger company today. Our sharpened focus on our Operating Companies is paying off. The strong and reliable growth momentum of our Care Provision Platform gives us confidence which is why we are improving the outlook for Fresenius Helios for the full year.”

Hospital markets growing

Hospital markets in Germany and Spain are growing steadily and reliably. In Germany, the total hospital market in 2023 was around €120 billion. It is expected to grow by 3% to 4% per year until 2027, driven by supportive demographic trends including an aging population and inflation-related base rate adjustments. Furthermore, Helios Germany sees itself well positioned to benefit from the planned hospital reform, which fosters hospital network concentration, specialization and a stronger integration of inpatient and outpatient care.

In Spain, where there are distinct public and private healthcare systems, the private provider segment accounted for 20% (€21 billion) of total provider expenditures in 2023 and is expected to grow at an average rate of 4% to 5% annually until 2027. This growth is – like in Germany – also driven by demographic factors, and price adjustments, but also by a continued uptake of private health insurances due to public system pressure, resulting in a growing demand for private provider offerings.

Robert Möller, member of the Fresenius Management Board and CEO of Fresenius Helios, said: “Providing world-class care and high-quality medical outcomes is key to our success. We lead in two steadily growing and highly attractive markets, representing roughly 30% of the EU's total population. It makes us number one in European healthcare provision, and it makes us critical for the systems we serve. With our proven focus on superior medical outcome quality, highly efficient care provision and strong digital and data capabilities, we are well positioned in both countries to drive steady, value-accretive growth.”

Growth strategies for Germany and Spain

In Germany, Helios will further drive its strategy of grouping its hospitals into highly specialized clusters, whereby two to five hospitals in geographic proximity form one multi-site hospital system. Experience shows that these clusters deliver higher medical quality, efficiency and growth by consolidating and better aligning medical and administrative activities as well as promoting specialization among the locations. The cluster and specialization strategy therefore is also well aligned with current and expected future regulatory changes in Germany. This also applies to the stronger integration of inpatient and outpatient care, which Helios expects to support with its own network of around 230 outpatient centers and strong relationships with external partners. These allow for seamless patient journeys and a closer collaboration between physicians resulting in improved patient experience and medical outcome quality.

Quirónsalud in Spain focuses on its core hospital operations and continued value creation based on its leadership position and solid market fundamentals. The Spanish hospital market is highly attractive with a growing private healthcare segment, providing tailwinds to Quirónsalud’s steady and resilient growth going forward. Focus of Quirónsalud will be on further improving clinical pathways, leveraging digital capabilities to optimize processes and performance as well as to boost patient care quality. Already today, Quirónsalud has an outstanding positioning in digitalization in Spain with more than 6 million registered patient portal users and large parts of the patient journey being already fully digitalized. In addition, Quirónsalud will drive value from strengthening its value proposition to attract and retain best-in-market talents as well as in engaging selective network expansion.

Digitalization as enabler to boost medical outcome quality

Given their commitment to highest medical quality, Helios Germany and Quirónsalud highly focus on outcome quality and its continuous further improvement by measurement against internal and external benchmarks. Helios in Germany, for example, delivers better quality performance versus the market average in 89% of its cases and has a patient satisfaction rate of 96%. Meanwhile Quirónsalud is the first private group worldwide to earn the JCI accreditation for healthcare quality at the corporate level and has a 90% patient satisfaction rate. Both Helios Germany and Quirónsalud are currently rolling out a structured benchmarking program to intensify cross company comparison and best practice sharing from best performing hospitals, setting the benchmark for all hospitals in the group.

Leveraging medical data, analytics and AI will further promote improved medical outcomes as well as personalized care and better patient experience. Fresenius Helios aims to systematically utilize medical and clinical data to improve treatment quality and outcomes, as well as unlock experience and efficiency gains for its patients, its people, and its performance at the same time. The clear aim is to have all relevant clinical decision-making supported by digital assistance in the mid-term.

ESG: Zero CO2 emissions by 2040

Fresenius Helios reiterates its ambitious ESG targets across its business activities with clearly defined tracking and connection to management remuneration. Its ESG strategy holistically aims to serve patients, people and the planet and is reflected in respective KPIs. Initiatives focused on patients include the Inpatient Quality Indicator and ISO certifications of Helios hospitals, for instance. The efforts for its people are, for example, captured with the People Engagement Index, reflecting initiatives like employee training. With regard to its planet commitment, Fresenius Helios’ key ambition is to reduce CO2 emissions by 50% by 2030 and to zero by 2040.

Webcast

Presentations will be held on June 5, 2024, starting at 11:30 a.m. CEDT. You are cordially invited to follow the Capital Markets Day in a live webcast at https://www.fresenius.com/capital-markets-day. After the event, a replay will be available on our website.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Excellent start to 2024: Group outlook raised for FY/24 due to the excellent first quarter and a better than originally expected operating performance for the remainder of the financial year 2024: Group organic revenue growth 4 to 7%, EBIT growth in constant currency 6 to 10%.

- Strategic portfolio measures concluded: Structured exit from Investment Company Vamed initiated.

- Strong organic growth in Group revenue of 6%1 to € 5.7 billion in Q1/24; Group EBIT increase in constant currency by 15% to € 633 million reflects the excellent performance of Operating Companies and the group-wide cost savings progressing ahead of plan.

- EPS increases: 11% in constant currency.

- Strong operating cash flow development at Fresenius Kabi driven by working capital efficiencies; Fresenius Helios expects catch-up of outstanding receivables in Germany in the course of the year.

- Fresenius Kabi shows excellent organic revenue growth of 9%1 and an improved EBIT margin at 15.1% in particular driven by the positive development of the Biopharma business.

- Biopharma business picking up: EBIT break-even in Q1/24 driven by licensing business at mAbxience; Tyenne with good progress.

- Fresenius Helios with solid organic revenue growth of 5%2 and EBIT margin of 11.1%; supported by phasing of energy related government relief funding in Germany and strong operating performance.

1 Organic growth rate adjusted for the accounting effects related to Argentina hyperinflation.

2 Organic growth rate adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

If no timeframe is specified, information refers to Q1/2024.

An overview of the results for Q1/2024 - before and after special items – is available on our website.

Following the deconsolidation of Fresenius Medical Care, Group financial figures are presented in accordance with IAS 28 (at equity method) since December 1, 2023. The proportionate share of 32% of Fresenius Medical Care is presented as a separate line in Fresenius Group’s P&L and balance sheet. Dividends received from Fresenius Medical Care will also be reported as a separate line as part of the cash flow statement. Moreover, IAS 28 requires a full purchase price allocation (PPA). The accounting for the PPA is treated as special item. For reasons of simplification and comparability, Fresenius presents net income with and without Fresenius Medical Care`s equity result.

Information on the performance indicators are available on our website at https://www.fresenius.com/alternative-performance-measures.

Consolidated results for Q1/24 as well as for Q1/24 include special items. These concern: revaluations of biosimilars contingent purchase price liabilities, expenses associated with the Fresenius cost and efficiency program, transaction costs for mAbxience and Ivenix, costs in relation to the change of legal form of Fresenius Medical Care, the transformation of Fresenius Vamed, legacy portfolio adjustments, special items at Fresenius Medical Care, and impact of PPA equity method Fresenius Medical Care. The special items shown within the reconciliation tables are reported in the Corporate/Other segment.

Growth rates of Fresenius Kabi and Fresenius Helios are adjusted. Adjustsments relate to the divestment of the fertility services group Eugin and the hospital stake in Peru at Fresenius Helios and Helios Spain as well as to hyperinflation in Argentina at Fresenius Kabi. Accordingly, growth rates of the Fresenius Group are also adjusted.

Conference call and Audio webcast

As part of the publication of the results for Q1/24, a conference call will be held on May 8, 2024 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Michael Sen, CEO of Fresenius: “Fresenius has made an excellent start into the year and our focus on Fresenius Kabi and Fresenius Helios is paying off. We are confident to maintain our growth momentum and raise our outlook for the full year. With the exit from Vamed, our strategic portfolio restructuring is completed as planned. Fresenius is already a simpler, stronger, and more innovative company due to the consistent implementation of #FutureFresenius. We now have even more opportunities to offer world-class therapies and improve people’s health.”

#FutureFresenius: Exit from Investment Company Vamed concludes strategic portfolio measures

The exit from the Investment Company Vamed completes the strategic portfolio restructuring as part of #FutureFresenius. The exit is carried out in three parts: 1) The already announced sale of 67 % of Vamed’s rehabilitation business to the private equity company PAI. Closing of this transaction is expected in the second half of 2024 2) Vamed’s operations in Austria to be sold to an Austrian consortium of the construction companies Porr and Strabag for a total purchase price of €90 million. 3) The Health Tech Engineering (HTE) segment, which is responsible for the international project business and accounts for around 15% of Vamed's revenue, will gradually be scaled back in an orderly manner. The process should largely be completed by 2026. Until then, the business will be reported as a special item outside Fresenius' core business. Current project contracts will be fulfilled.

Vamed’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, will be transferred to Fresenius. HES is a stable business with good growth prospects and accounts for around 30% of Vamed's revenues. The profitability of HES is in the mid-single-digit percentage range.

The divestments of the rehabilitation business and the operations in Austria lead to non-cash special items of around €0.6 billion.

Due to the exit from the project business, a high triple-digit-million euro amount of special items are expected, which are spread over the next few years and mostly cash-effective.

As of Q2 2024, Vamed will no longer be a reporting segment of Fresenius. In addition to reducing complexity, this step is expected to improve the Group's profitability by more than 50 basis points. It will also reduce net debt and increase the Group's return on invested capital (ROIC). Last but not least, the transparency and quality of earnings will be significantly enhanced.

After exiting from Vamed, Fresenius will consist of the two Operating Companies Fresenius Kabi and Fresenius Helios (each with 100% ownership share) and the Investment Company Fresenius Medical Care (32% ownership share).

Cost savings program fully on track

The groupwide cost savings program progressed is fully on track. Under the program, Fresenius realized ~€25 million incremental structural cost savings at EBIT level in Q1/24. In the same period, one-time costs of ~€15 million incurred to achieve these savings.

Fresenius expects to achieve annual sustainable cost savings of ~€400 million at EBIT level by 2025. So far, Fresenius reached ~€305 million of cumulative structural cost savings. To reach this target, one-time costs between ~€80 and €100 million are anticipated between 2024 and 2025.

For 2024, total cost savings of ~€330 to €350 million are expected. This corresponds to incremental cost savings of ~€50 to €70 million in 2024 compared to 2023.

The programs continue to target all business segments and the Corporate Center. Key elements include measures to optimize sales and administrative costs, fostering digitalization as well as improve procurement processes.

Group sales and earnings development

Group revenue increased by 4% (6% in constant currency) to €5,704 million (Q1/23: €5,546 million). Organic growth was 6%1 driven by an ongoing strong performance of our Operating Companies. Currency translation had a negative effect of 2% on revenue growth.

In Q1/24, revenue of the Operating Companies increased by 5% (7% in constant currency) to €5,216 million (Q1/23: €5,039 million).

Group EBITDA before special items increased by 13% (13% in constant currency) to €924 million (Q1/232: €828 million).

Group EBIT before special items increased by 15% (15% in constant currency) to €633 million (Q1/232: €554 million) mainly driven by the good earnings development at the Operating Companies and the continued progress of the groupwide cost savings program. The EBIT margin before special items was 11.1% (Q1/231: 10.0%). Reported Group EBIT was €559 million (Q1/23: €526 million).

The Operating Companies showed an 9% increase of EBIT before special items (9% in constant currency) to €631 million (Q1/232: €581 million) with an EBIT margin of 12.1% (Q1/232: 11.5%).

1 Organic growth rate adjusted for the divestment of the fertility services group Eugin, the hospital stake in Peru, and accounting effects related to Argentina hyperinflation.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Group net interest before special items increased to -€115 million (Q1/231: -€87 million) mainly due to financing activities in a higher interest rate environment.

Group tax rate before special items was 24.5% (Q1/231: 24.4%).

Net income1 from deconsolidated Fresenius Medical Care operations before special items increased by 25% (33% in constant currency) to €60 million (Q1/232: €48 million).

Group net income2 before special items increased by 10% (11% in constant currency) to €429 million (Q1/232: €389 million). The increase was driven by the operating strength which outpaces higher interest.

Group net income1 before special items excluding Medical Care increased by 8% (8% in constant currency) to €369 million (Q1/232: €341 million).

Reported Group net income2 decreased to €278 million (Q1/232: €346 million).

Negative effects from the Purchase Price Allocation (PPA) and other negative special items at Fresenius Medical Care as well as the Vamed transformation had a negative impact on the Group net income income1.

Earnings per share2 before special items increased by 10% (11% in constant currency) to €0.76 (Q1/232: €0.69). Reported earnings per share2 were €0.49 (Q1/23: €0.61).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Group Cash flow development

Group operating cash flow was €2 million (Q1/23: €32 million). The first quarter is usually the softest in the course of the year. In Q1/24 the soft operating cash flow was mainly driven by temporarily higher working capital, in particular due to nursing budget related receivables built ups at Helios Germany. Group operating cash flow margin was 0.0% (Q1/23: 0.6%). Free cash flow before acquisitions, dividends and lease liabilities decreased to -€194 million (Q1/23: -€180 million). Free cash flow after acquisitions, dividends and lease liabilities improved to -€103 million (Q1/23: -€258 million).

Fresenius Kabi’s operating cash flow increased to €157 million (Q1/23: €21 million) with a margin of 7.7% (Q1/23: 1.1%) mainly driven by an improved working capital management.

Fresenius Helios’ operating cash flow decreased to -€117 million (Q1/23: €108 million) and was impacted by higher working capital in particular driven by temporary nursing budget related receivables built-ups at Helios Germany. The operating cash flow margin was -3.7% (Q1/23: 3.5%).

Fresenius Vamed’s operating cash flow improved to -€10 million (Q1/23: -€68 million) with a margin of -1.8% (Q1/23: -11.7%).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items was 1.0 in Q1/24 (LTM) (Q1/23: 0.9 LTM). This positive development is due to the increased cash flow focus across the Group.

1 Cash flow before acquisitions and dividends; before interest, tax, and special items

Group leverage

Group debt decreased by 8% (8% in constant currency) to €14,504 million (Dec. 31, 2023: € 15,830 million) mainly related to the repayment of debt. Group net debt increased by 2% (2% in constant currency) to € 13,485 million (Dec. 31, 2023: € 13,268 million) which is mainly related to the cash flow development at Fresenius Helios, particularly driven by temporary receivables built ups related to the nursing budget at Helios in Germany.

As of March 31, 2024, the net debt/EBITDA ratio was 3.75x1,2 (Dec. 31, 2023: 3.76x1,2), a further reduction compared to Q4/23 and mainly driven by the good EBITDA development. Compared to Q1/23 (3.96x1,2) this is a 21 bps reduction.

Fresenius expects the net debt/EBITDA3 ratio to be within the self-imposed corridor of 3.0 to 3.5x by the end of 2024. This is expected to be driven by reducing net debt and by the operational performance at the Operating Companies.

ROIC increased to 5.5% in Q1/24 (Q1/23: 5.2%) mainly due to the EBIT improvement. The Operating Companies improved ROIC to 5.8% (Q1/23: 5.5%).

1 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

2 Before special items

3 At expected average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Kabi

Revenue increased by 9% in constant currency (3% reported) to €2,051 million (Q1/23: €1,991 million). The reported revenue growth is mainly driven by negative currency translation effects related to the US dollar and the hyperinflation in Argentina. Organic growth was 9%1. This strong performance was driven in particular by the Biopharma business as well as by Nutrition.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) increased by 4% (14% in constant currency) to €1,089 million (Q1/23: €1,051 million). Organic growth was outstanding at 13%. In Nutrition, organic growth of 8% benefited from the good development in the US and was driven by many other international markets. Whereas China continued to be impacted by indirect effects of the government’s countrywide anti-corruption campaign and direct effects of the soft economy. Biopharma showed excellent organic growth of 117% driven by successful product launches in Europe and the US, as well as licensing agreements. MedTech showed organic growth of 1% given the high prior-year level.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

Growth rates adjusted for Argentina hyperinflation.

Revenue in the Pharma (IV Drugs & Fluids) business increased by 2% (4% in constant currency; organic growth: 5%) and amounted to €962 million (Q1/23: €940 million). The solid organic growth was mainly driven by the positive development across many regions including the US.

EBIT1 of Fresenius Kabi increased by 7% (8% in constant currency) to €310 million (Q1/23: €289 million) mainly due to the good revenue development, the EBIT break-even result of the Biopharma business, and ongoing progress of the cost saving initiatives. EBIT margin1 was 15.1% (Q1/23: 14.5%) and thus within the structural EBIT margin band.

EBIT1 of the Growth Vectors increased by 29% (constant currency: 17%) to €124 million (Q1/23: €96 million) due to the EBIT break-even result of the Biopharma business and the good revenue development. EBIT1 margin was 11.4% (Q1/23: 9.2%).

EBIT1 in the Pharma business increased 4% (constant currency: 6%) to €206 million (Q1/23: €197 million) due to the very well-progressing cost saving initiatives and the good revenue development. EBIT1 margin was 21.4% (Q1/23: 21.0%).

1 Before special items

Growth rates adjusted for Argentina hyperinflation.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Helios

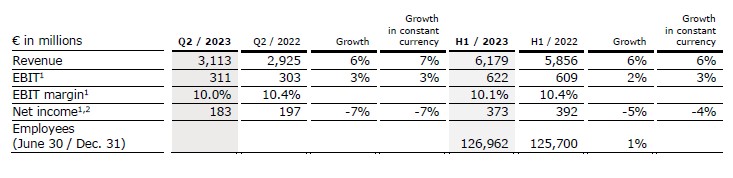

Revenue increased by 6% (5% in constant currency) to €3,184 million (Q1/23: €3,066 million). Organic growth was 5%.

Revenue of Helios Germany increased by 4% (in constant currency: 4%) to €1,903 million (Q1/23: €1,828 million), mainly driven by solid admissions numbers and favourable price effects. Organic growth was 4%.

Revenue of Helios Spain increased by 10% (8% in constant currency) to €1,281 million (Q1/23: €1,170 million) driven by ongoing strong activity levels and positive price effects. Organic growth was 7%1. The clinics in Latin America also showed a good performance.

EBIT2 of Fresenius Helios increased by 14% (14% in constant currency) to €353 million (Q1/23: €311 million) with an EBIT margin2 of 11.1% (Q1/23: 10.1%).

EBIT of Helios Germany increased by 32% to €205 million (Q1/23: €155 million) with an EBIT margin of 10.8% (Q1/23: 8.5%) in particular driven by the phasing of the Government relief funding for higher energy costs as well as the good revenue development and the progressing cost savings program.

1 Before special items

Growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru

For a detailed overview of special items please see the reconciliation tables at Financial Results.

EBIT1 of Helios Spain decreased by 6% (7% in constant currency) to €149 million (Q1/23: €157 million). EBIT1 was impacted by the phasing due to the calendar variation related to the Easter week and related lower activities and mix effects as well as a high prior-year level. Despite the Easter effect, the EBIT margin1 was 11.6% (Q1/23: 13.4%).

As part of the portfolio optimization, the sale of the fertility services group Eugin was completed on January 31, 2024. The divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru, was completed on April 23, 2024. The sale marks Fresenius’ exit from the Peruvian hospital market.

Fresenius Vamed

Further progress was made in Q1/24 with the far-reaching restructuring program to increase Fresenius Vamed’s profitability which was initiated in 2023.

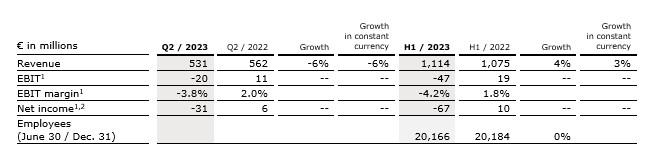

Revenue from continued business was €514 million in Q1/24. Organic growth of the continued business increased 1% driven by the positive development of the Services business offsetting the negative effects of the Project business. Total revenue of Fresenius Vamed was €561 million (Q1/23: €583 million) and declined by 4% (-4% in constant currency).

EBIT1 was at €2 million in Q1/24 (Q1/231: -€27 million), thus showing a significant year-over-year improvement and making it the third consecutive quarter of positive EBIT. The EBIT margin1 in Q1/24 was 0.4% (Q1/231: -4.6%).

The ongoing transformation resulted in negative special items of €47 million in Q1/24 mainly related to cessation of activities, asset re-evaluations and restructuring costs resulting in write-downs and provisions. The negative special items were predominantly booked as non-cash items.

1 Before special items

Growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru

Group and segment outlook for 20241

Fresenius raises its outlook for FY/24 based on the excellent first quarter and improved prospects for the ramainder of the year.

For 2024, Group organic revenue growth2 is now expected to grow between 4% to 7% (previous: 3% to 6%). Group constant currency EBIT3,4 is expected to grow in the rage of 6% to 10% (previous: 4% to 8%).

Fresenius Kabi now expects organic revenue growth in a mid-to high-single-digit percentage range in 2024 (previous: mid-single-digit percentage range). The EBIT margin4 is now expected to be in a range of 15% to 16% (previously: around 15%) (structural margin band: 14% to 17%).

Fresenius Helios expects organic revenue to grow in a low to mid-single digit percentage range in 2024. The EBIT margin4 is expected to be within the structural margin band of 9% to 11%.

The adjustment of the Group outlook also reflects the fact that the forecast is now given without Fresenius Vamed, i.e. exclusively for the Operating Companies Fresenius Kabi and Fresenius Helios. Following the announcement of the planned divestment of Fresenius Vamed's rehabilitation business, Fresenius has initiated its structured exit from its Investment Company Fresenius Vamed.

1 For the prior-year basis please see table “Basis for Guidance for 2024”

2 2023 base: €20,307 million

3 2023 base: €2,266 million

4 Before special items

Basis for Guidance for 2024

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Fresenius achieves the raised outlook for FY/23. Strong fourth quarter with continued good development of the Operating Companies Fresenius Kabi and Fresenius Helios and progress in the turnaround of the Investment Company Fresenius Vamed.

- Group 2024 outlook: Organic revenue growth expected between 3% and 6%; EBIT expected to grow between 4% and 8%.

- Improvement leverage ratio: expected to be within the target corridor of 3.0x to 3.5x by the end of 2024.

- Revenue of €22.3 billion in FY/23: Strong organic Group revenue growth of 6%; Group EBIT increased 2% in constant currency to €2.3 billion; excellent Group operating cashflow totaled €2.1 billion.

- Group cost savings target significantly exceeded by ~40% in 2023 – FY/25 structural productivity savings target raised to ~€400 million at EBIT level (before: ~€350 million).

- Group revenue increased organically by 5% in Q4; Group EBIT increased by 8% in constant currency.

- Fresenius Kabi with excellent organic revenue growth of 7% in Q4 at top-end of structural growth band and EBIT margin of 14.1% within structural band.

- Fresenius Helios with strong organic revenue growth of 5% in Q4 at top-end of structural growth band and excellent EBIT margin of 11.6 % well above structural margin band.

- Fresenius Vamed’s transformation progressing well; ongoing operational improvement with positive EBIT in second consecutive quarter.

- Ongoing divestments: Sale of fertility services group Eugin successfully completed in January 2024.

If no timeframe is specified, information refers to Q4/2023.

An overview of the results for Q4/2023 and the 2023 financial year - before and after special items – is available on our website.

Following the deconsolidation of Fresenius Medical Care, Group financial figures are presented in accordance with IAS 28 (at equity method) since December 1, 2023. Prior-year figures have been adjusted due to the application of IFRS 5 to the deconsolidated operations of Fresenius Medical Care.

Information on the performance indicators are available on our website at https://www.fresenius.com/alternative-performance-measures.

Consolidated results for FY/23 as well as for FY/22 in-clude special items. These concern: revaluations of biosimilars contingent purchase price liabilities, expenses associated with the Fresenius cost and efficiency program, impacts related to the war in Ukraine, transaction costs for mAbxience and Ivenix, hyperinflation in Türkiye, retroactive duties, costs in relation to the change of legal form of Fresenius Medical Care, the transformation of Fresenius Vamed, legacy portfolio adjustment, effects from the valua-tion of the investment in Fresenius Medical Care in ac-cordance with IFRS 5, and expenses PPA equity method Fresenius Medical Care. The special items shown within the reconciliation tables are reported in the Corpo-rate/Other segment.

Conference call and Audio webcast

As part of the publication of the results for FY/23, a conference call will be held on February 21, 2024 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Michael Sen, CEO of Fresenius: “We took decisive actions in fiscal year 2023 and put Fresenius back on track. #FutureFresenius is driving improvements throughout the company and creating value. We added focus, simplified the structure, and delivered better financial performance. We will build on that momentum to further grow our businesses and accelerate earnings growth driven by the Operating Companies Fresenius Kabi and Fresenius Helios. Fresenius is uniquely positioned to address the rising demand for healthcare leveraging innovations also in digitalization and AI. We are deepening our purpose of Advancing Patient Care.”

2024 Strategic priorities

After a year of significant structural progression in the Group and improved operating performance, Fresenius’ priorities in 2024 will focus on financial progression. This includes driving down leverage, execute on raised cost savings target and a rigorous focus on capital efficiency and returns. This bundle of measures is expected to translate into accelerated earnings growth in 2024 and beyond.

Fresenius is uniquely positioned to benefit from the mega trends of the healthcare sector, including growing and ageing populations, and digitalization. With its leading position in the European private hospital market and at a vast number of ambulatory clinics, the company has direct access to about 26 million patients. In addition, innovative MedTech devices and an integrated end-to-end Biopharma platform enable crucial therapies for the future. These strong platforms form a highly robust, earnings-enhancing business model in attractive growth areas.

Deconsolidation of Fresenius Medical Care successfully completed

Fresenius successfully completed the deconsolidation of Fresenius Medical Care. This was a historic step and a landmark on the way forward to #FutureFresenius. The complexity of the Group structure was significantly reduced, and the governance structure simplified, enabling more targeted, faster, and agile decisions at both, Fresenius and Fresenius Medical Care. Fresenius remains the largest shareholder of Fresenius Medical Care with an unchanged 32% stake.

The change in legal form took effect on November 30, 2023. Fresenius Medical Care now operates as Fresenius Medical Care AG. As a result of the deconsolidation, the investment in Fresenius Medical Care is now classified in accordance with IAS 28 (at equity method).

As part of the subsequent IFRS 5 remeasurements as of September 30, 2023 and November 30, 2023, a non-cash special item of €1,115 million attributable to the shareholders of Fresenius SE & Co. KGaA was recognized in the consolidated financial statements of Fresenius as of December 31, 2023.

Going forward, the proportionate share of 32% of Fresenius Medical Care will be presented as a separate line in Fresenius Group’s P&L and balance sheet. Dividends received from Fresenius Medical Care will also be reported as a separate line as part of the cash flow statement.

IAS 28 requires a full purchase price allocation (PPA) from the date on which the investment in Fresenius Medical Care was recognized as an associated company. The accounting for the PPA will be treated as special item.

For reasons of simplification and comparability, Fresenius will present net income with and without the equity result in the future.

Transformation Fresenius Vamed progressing well

Further good progress was made in Q4/23 with the far-reaching restructuring program toincrease Fresenius Vamed’s profitability which was initiated during 2023. After €10 million in Q3/23, Fresenius Vamed has for the second consecutive quarter shown a positive EBIT1 with €21 million in Q4/23 (FY/23: -€16 million). The EBIT margin1 in Q4/23 was 3.5% and -0.7% in 2023 (20221: 0.8%).

Revenue from continued business was €589 million in Q4/23. Organic growth of the continued business declined by5 % mainly due to some contract timing issues as well as more rigorous vetting in the Project Business. In 2023, revenue from continued businesses was €2,201 million.

Total revenue of Fresenius Vamed amounted to €595 million (Q4 2022: €712 million) and declined by 16% (-17% in constant currency). The decline is primarily related to discontinued businesses as part of the transformation and the associated adjustments and postponements in the Project business. In 2023, total revenue of Fresenius Vamed remained flat at €2,356 million (2022: €2,359 million).

The ongoing transformation resulted in negative special items of €113 million in Q4/23 mainly related to cessation of activities, asset re-evaluations and restructuring costs resulting in write-downs and provisions. The negative special items were predominantly booked as non-cash items. In 2023, a total of negative special items of €554 million were incurred.

The positive development is expected to continue in 2024. Fresenius Vamed reiterates its targets and expects to reach the structural EBIT margin band of 4% to 6% by 2025 as set out in the #FutureFresenius Financial Framework.

1 Before special items

Structural productivity targets significantly exceeded – 2025 target raised

The groupwide cost savings program progressed well ahead of plan. Under the program, Fresenius realized ~€280 million of structural cost savings at EBIT level in FY/23. With that, the originally anticipated saving of ~€200 million for FY/23 were significantly exceeded. In the same period, one-time costs of ~€220 million incurred to achieve these savings.

Due to the excellent progress of the measures implemented across the entire Group, Fresenius raises its target for the second time. Fresenius now expects to achieve annual sustainable cost savings of ~€400 million at EBIT level by 2025 (before: ~€350 million). To reach this new target, one-time costs between ~€80 and €100 million are anticipated between 2024 and 2025. For 2024, total cost savings of ~€330 to €350 million are expected. This corresponds to incremental cost savings of ~€50 to €70 million compared to 2023.

The targeted programs involve all business segments and the Corporate Center. Key elements include measures to optimize procurement, processes, sales and administrative costs, as well as fostering digitalization.

Group sales and earnings development

Group revenue remained nearly unchanged (increased by 4% in constant currency) at €5,678 million (Q4/22: €5,670 million). Organic growth was 5% driven by an ongoing strong performance of our Operating Companies. Divestitures reduced revenue growth by 1%. Currency translation had a negative effect of 4% on revenue growth. In FY/23, Group revenue increased by 4% (6% in constant currency) to €22,299 million (2022: €21,532 million). Organic growth was 6%. Currency translation decreased revenue growth by 2%.

In Q4/23, revenue of the Operating Companies increased by 2% (7% in constant currency) to €5,165 million (Q4/22: €5,047 million). In FY/23, revenue of the Operating Companies increased by 4% (7% in constant currency) to €20,255 million (2022: €19,494 million).

Group EBITDA before special items increased by 6% (4% in constant currency) to €942 million (Q4/221: €890 million). In FY/23, Group EBITDA before special items increased by 3% (3% in constant currency) to €3,422 million (20221: €3,315 million).

Group EBIT before special items increased by 13% (8% in constant currency) to €634 million (Q4/221: €559 million) mainly driven by the good earnings development at the Operating Companies and the progress of the operational turnaround at Fresenius Vamed. The EBIT margin before special items was 11.2% (Q4/221: 9.9%). Reported Group EBIT was €85 million (Q4/22: €337 million). In FY/23 Group EBIT before special items increased by 3% (2% in constant currency) at €2,262 million (20221: €2,190 million). The EBIT margin before special items was 10.1% (20221: 10.2%). Reported Group EBIT was €1,143 million (2022: €1,812 million).

The Operating Companies showed an 8% increase of EBIT before special items (2% in constant currency) to €613 million (Q4/221: € 568 million) with an EBIT margin of 11.9% (Q4/221: 11.3%). In FY/23, EBIT before special items of the Operating Companies increased by 5% (4% in constant currency) to €2,278 million (20221: €2,170 million) with an EBIT margin of 11.2% (20221: 11.1%).

Group net interest before special items increased to -€118 million (Q4/221: -€80 million) mainly due to financing activities in a higher interest rate environment. In FY/23, Group net interest before special items increased to -€418 million (20221: -€241 million).

Group tax rate before special items was 36.4% (Q4/221: 23.2%). The higher tax rate in Q4/23 is mainly due to the closing of tax audit procedures as well as a valuation adjustment of a deferred tax asset in Germany. In FY/23, Group tax rate before special items was 28.3% (20221: 22.4%).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Net income1 from deconsolidated Fresenius Medical Care operations before special items remained unchanged (4% increase in constant currency) at €83 million (Q4/222: €83 million). In FY/23 net income1 from deconsolidated Fresenius Medical Care operations before special items decreased by 18% (-16% in constant currency) to €243 million (20222: €295 million).

Group net income1 before special items decreased by 11% (-17% in constant currency) to €397 million (Q4/222: €445 million). The decrease was mainly driven by rising interest expenses and a higher tax rate. Reported Group net income1 decreased to -€614 million (Q4/22: €255 million) and mainly results from the valuation effect of Fresenius Medical Care in accordance with IFRS 5 in the amount of €521 million (see “Deconsolidation of Fresenius Medical Care” on page 4). The effect has no cash impact. Furthermore, legacy portfolio adjustments and expenses for the cost and efficiency program, and the Vamed transformation had a negative impact on the Group net income income1. Group net income1 before special items excluding Medical Care decreased by 13% (-22% in constant currency) to €314 million (Q4/222: €362 million).

In FY/23, Group net income1 before special items decreased by 13% (-14% in constant currency) to €1,505 million (20222: €1,729 million). The decrease was driven by rising interest costs and a higher tax rate. Reported Group net income1 decreased to -€594 million (2022: €1,372 million) and was negative mainly due to the Fresenius Medical Care’s valuation effects according to IFRS 5 of €1,115 million (see chapter “Deconsolidation of Fresenius Medical Care” on page 4). These effects have no cash impact. Furthermore, expenses in connection with the Vamed transformation, legacy portfolio adjustments as well as expenses for the cost and efficiency program had a negative impact on the Group net income1. Group net income1 before special items excluding Medical Care decreased by 12% (-14% in constant currency) to €1,262 million (20222: €1,434 million).

Earnings per share1 before special items decreased by 11% (-17% in constant currency) to €0.70 (Q4/222: €0.79). Reported earnings per share1 were -€1.09 (Q4/22: €0.45).

In FY/23, earnings per share1 before special items decreased by 13% (-15% in constant currency) to €2.67 (20222: €3.08). Reported earnings per share1 were -€1.05 (2022: €2.44).

Group Cash flow development

Group operating cash flow increased by 4% to €1,272 million (Q4/22: €1,225 million) mainly driven by the strong cash flow development across the Group. Group operating cash flow margin was 22.4% (Q4/22: 21.6%). Free cash flow before acquisitions, dividends and lease liabilities increased to €888 million (Q4/22: €822 million). Free cash flow after acquisitions, dividends and lease liabilities increased to €814 million (Q4/22: €742 million).

In FY/23, Group operating cash flow increased by 5% to €2,131 million (2022: €2,031 million) with a margin of 9.6% (2022: 9.4%). Free cash flow before acquisitions, dividends and lease liabilities increased to €1,024 million (2022: €942 million). Free cash flow after acquisitions, dividends and lease liabilities improved to €115 million (2022: -€317 million).

Fresenius Kabi’s operating cash flow increased by 46% to €434 million (Q4/22: €298 million) with a margin of 21.7% (Q4/22: 14.6%) mainly driven by an improved working capital management. In FY/23, operating cash flow increased by 21% to €1,015 million (2022: €841 million) with a margin of 12.7% (2022: 10.7%).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

Fresenius Helios’ operating cash flow decreased by 9% to €867 million (Q4/22: €956 million) mainly due to phasing effects of receivables in Spain and the very strong cash flow in the prior year. The operating cash flow margin was 27.2% (Q4/22: 31.5%). In FY/23, operating cash flow decreased by 9% to €1.244 million (2022: €1.367 million) with a margin of 10.1% (2022: 11.7%).

Fresenius Vamed’s operating cash flow increased to €36 million (Q4/22: €12 million) with a margin of 6.1% (Q4/22: 1.7%) due to positive phasing effects. In FY/23, operating cash flow improved to €20 million (2022: -€44 million) with a margin of 0.8% (2022: -1.9%).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items was 1.0 in FY/23 (2022: 0.9). This positive development is due to the increased cash flow focus across the Group including inventory management, working capital management and cash collection.

Group leverage

Group debt increased by 8% (8% in constant currency) to €15,830 million (Dec. 31, 20222: € 14,708 million). Group net debt remained broadly flat at € 13,268 million (Dec. 31, 20222: € 13,307 million). In constant currency, Group net debt decreased by 1%.

As of December 31, 2023, the net debt/EBITDA ratio was 3.76x3,4 (Dec. 31, 2022: 3.80x2,3,4). This is a strong 27 bps reduction compared to Q3/23 (4.03x3,4) and is mainly driven by the good cash flow development in Q4/23.

1 Cash flow before acquisitions and dividends; before interest, tax, and special items

2 Proforma deconsolidation Fresenius Medical Care

3 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

4 Before special items

Fresenius expects the net debt/EBITDA1 ratio to be within the self-imposed corridor of 3.0 to 3.5x by the end of 2024. This is expected to be driven by reducing net debt and by the operational performance at the Operating Companies.

This assumption does not include further potential divestment activities, however, includes the fact that due to legal restrictions as a result of the use of government compensation and reimbursement payments for increased energy costs provided for in the Hospital Financing Act, however, Fresenius will not propose to the 2024 Annual General Meeting to distribute a dividend for the 2023 fiscal year. Irrespective of the legally required suspension of dividend payments for the 2023 fiscal year, Fresenius will maintain its progressive dividend policy in the future and continues to aim to increase the dividend in line with growth in earnings per share (in constant currency, before special items), or at least maintain the dividend at the previous year's level.

ROIC was 5.2% in FY/23 (FY/22: 5.6%) mainly due to the higher tax rate. The Operating Companies showed a ROIC of 5.6%.

1 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

Operating Company Fresenius Kabi

Revenue decreased by 2% (increased 9% in constant currency) to €1,996 million (Q4/22: €2,036 million) mainly driven by negative currency translation effects related to the US dollar and the hyperinflation in Argentina. Organic growth was 7%1. This strong performance was mainly driven by the strong business development of all Growth Vectors. In FY/23, revenue increased by 2% (9% in constant currency) to €8,009 million (2022: €7,850 million). Organic growth was 7%1.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) decreased by 3% to €997 million (Q4/22: €1,026 million) driven by negative currency exchange effects (increased 14% in constant currency). Organic growth was outstanding at 11%. In Nutrition, organic growth of 6% was driven by the good development in the US and Latin America whereas China was impacted by indirect effects of the government’s countrywide anti-corruption campaign. Biopharma showed very strong organic growth of 66% driven by successful product launches in Europe and the US, as well as licensing agreements. MedTech had an excellent organic growth of 8% driven by a broad-based positive development across most regions and many product groups. In FY/23, revenue of the Growth Vectors increased by 4% (14% in constant currency; organic growth: 10%) to €4,177 million (2022: €4,005 million).

1 To show the underlying business development, the organic growth definition was adjusted to fully exclude the significant inflation accounting effects in Argentina. According to the previous methodology, organic growth for Fresenius Kabi would have been Q1: 7%, Q2: 8%, Q3:7%, Q4: 14% and FY/23: 9%

2 Before special items

Revenue in the Pharma (IV Drugs & Fluids) business decreased by 1% (increased 3% in constant currency; organic growth: 3%) and amounted to €1,000 million (Q4/22: €1,010 million). The solid organic growth was mainly driven by a positive development across many regions. In FY/23, revenue in the Pharma business remained broadly stable (increased 3% in constant currency; organic growth: 3%) and amounted to €3,832 million (2022: €3,845 million).

EBIT1 of Fresenius Kabi increased by 19% (6% in constant currency) to €282 million (Q4/22: €236 million) due to the good revenue development and the well-progressing cost saving initiatives. EBIT margin1 was 14.1% (Q4/22: 11.6%) and thus within the structural EBIT margin band. In FY/23, EBIT1 increased by 6% (constant currency: 3%) to €1,145 million (2022: €1,080 million). EBIT margin1 was 14.3% (2022: 13.8%).

EBIT1 of the Growth Vectors increased by 69% (constant currency: 12%) to €102 million (Q4/22: €60 million) due to the excellent revenue development and the very well-progressing cost saving initiatives. EBIT1 margin was 10.2% (Q4/22: 5.9%). In FY/23, EBIT1 of the Growth Vectors increased by 15% (constant currency: 6%) to €390 million (2022: €339 million) with a margin1 of 9.3% (2022: 8.5%).

EBIT1 in the Pharma business remained nearly stable (increased in constant currency: 2%) to €189 million (Q4/22: €190 million) due to the very well-progressing cost saving initiatives. EBIT1 margin was 18.9% (Q4/22: 18.8%). In FY/23, EBIT1 in the Pharma business increased by 3% (constant currency: 6%) to €792 million (2022: €769 million) with a margin1 of 20.7% (2022: 20.0%).

1 Before special items

Operating Company Fresenius Helios

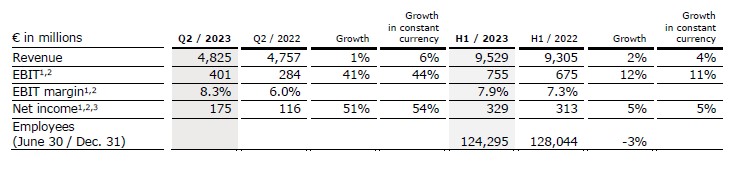

Revenue increased by 5% (5% in constant currency) to €3,188 million (Q4/23: €3,031 million) Organic growth was 5%. In FY/23, revenue increased by 5% (5% in constant currency) to €12,320 million (2022: €11,716 million). Organic growth was 5%.

Revenue of Helios Germany increased by 5% (organic growth: 5%) to €1,828 million (Q4/22: €1,749 million), mainly driven by solid admissions numbers. In FY/23, revenue of Helios Germany increased by 4% (organic growth: 4%) to €7,279 million (2022: €7,021 million).

Revenue of Helios Spain increased despite the already strong prior year quarter by 6% (5% in constant currency) to €1,289 million (Q4/22: €1,214 million) driven by ongoing strong activity levels. The clinics in Latin America also showed a good performance. Organic growth was 5%. In FY/23, revenue of Helios Spain increased by 7% (8% in constant currency, organic growth: 8%) to €4,770 million (2022: €4,441 million).

Revenue of Helios Fertility increased by 8% (17% in constant currency) to €71 million (Q4/22: €66 million) driven by favorable price and mix effects as well as the positive development of activity levels, especially in the US. Organic growth was 22%. In FY/23, revenue of Helios Fertility increased by 8% (14% in constant currency) to €269 million (2022: €250 million).

EBIT1 of Fresenius Helios increased by 5% (5% in constant currency) to €371 million (Q4/22: €354 million) with an EBIT margin1 of 11.6% (Q4/22: 11.7%).

In FY/23, EBIT1 increased by 4% (increased 4% in constant currency) to €1,232 million (2022: €1,185 million) with an EBIT margin1 of 10.0% (2022: 10.1%).

EBIT1 of Helios Germany decreased by 6% to €164 million (Q4/22: €174 million) with an EBIT margin1 of 9.0% (Q4/22: 9.9%) in particular due to the high prior-year basis. The prior-year quarter was not affected by any major negative inflation effects, which, however, had a significant negative impact on Q4/23. This could not be fully compensated despite the good revenue development as well as the progressing cost savings program and the Government compensation for higher energy costs. In FY/23, EBIT1 of Helios Germany increased by 1% to €630 million (2022: €623 million) with an EBIT margin1 at 8.7% (2022: 8.9%).

EBIT1 of Helios Spain increased by 9% due to the strong revenue development as well as the progressing cost savings program (8% in constant currency) to €188 million (Q4/22: €172 million). The EBIT margin1 was 14.6% (Q4/22: 14.2%). In FY/23, EBIT1 of Helios Spain increased by 4% (5% in constant currency) to €580 million (2022: €556 million). The EBIT margin1 was 12.2% (2022: 12.5%).

EBIT1 of Helios Fertility was €10 million (Q4/22: €6 million) with an EBIT margin1 of 14.1% (Q4/22: 9.1%). In FY/23, EBIT1 of Helios Fertility was €26 million (2022: €21 million) with an EBIT margin1 of 9.7% (2022: 8.4%).

Further milestone in the implementation of #FutureFresenius were the divestments of the fertility services group Eugin (Helios Fertility) and the sale of the stake in the hospital Clínica Ricardo Palma in Lima, Peru. Both transactions are line with Fresenius’s commitment to simplify the structure, sharpen the focus and accelerate performance. Furthermore, the sale proceeds will benefit the company’s financial flexibility. The sale of Eugin closed on January 31, 2024. In 2022, the company generated sales of €227 million. The divestment of the stake in the hospital in Peru is expected to close in the first quarter of 2024.2

1 Before special items

Group and segment outlook for 20241

Fresenius expects general cost inflation to continue at a slightly lower level in the 2024 financial year and the current geopolitical tensions to persist. Fresenius also expects interest rates to remain at a similar level to 2023. Irrespective of this, the Management Board considers the business outlook for the Group to be positive and expects a successful financial year 2024.

For 2024, Group organic revenue is expected to grow between 3% to 6%. Group constant currency EBIT2 is expected to grow in the rage of 4% to 8%.

Fresenius Kabi expects organic revenue growth in a mid-single-digit percentage range in 2024. The EBIT margin2 is expected to be around 15% (structural margin band: 14% to 17%). Fresenius Helios expects organic revenue to grow in a low to mid-single digit percentage range in 2024. The EBIT margin2 is expected to be within the structural margin band of 9% to 11%. Fresenius Vamed expects organic revenue to grow (Continued Business) in a mid-single-digit percentage range in 2024. The EBIT margin2 is expected to be 1 to 2 percentage points below the structural margin band of 4% to 6%.

Basis for Guidance for 2024

1 For the prior-year basis please see table “Basis for Guidance for 2024”

2 Before special items

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Application of IFRS 5: Fresenius Group financials for the first time presented excluding Fresenius Medical Care

- Excellent Group revenue growth of 6% in constant currency to €5.5 billion driven by Operating Companies and Fresenius Vamed

- Group EBIT increased 10% in constant currency reflecting strong performance of Operating Companies; Fresenius Vamed with operational improvement

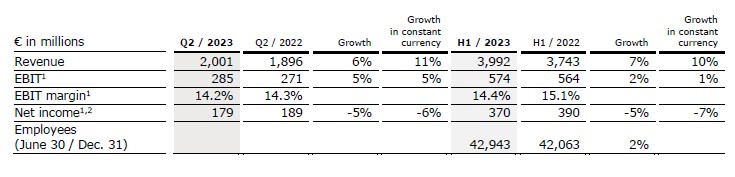

- Fresenius Kabi with strong organic revenue growth of 7% at top-end of structural growth band; EBIT margin remains within structural band at 14.3%

- Fresenius Helios with strong organic revenue growth of 5% at top-end of structural growth band despite usual summer effect in Spain

- Fresenius Vamed’s transformation progressing

- Deconsolidation of Fresenius Medical Care effective by December 2023

- Divestments advancing: exit of hospital operations in Peru

- FY/23 structural productivity savings target of ~€200 million excluding Fresenius Medical Care already achieved in first nine months

- Group revenue outlook confirmed, Group EBIT outlook improved

If no timeframe is specified, information refers to Q3/2023.

The financial figures are presented in accordance with IFRS 5 excluding Fresenius Medical Care. However, this does not apply to net income and earnings per share. In the balance sheet and the cash flow statement, Fresenius Medical Care is presented separately.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Michael Sen, CEO of Fresenius: “Fresenius had a great 3rd Quarter 2023. We made progress on every part of our #FutureFresenius program, including simplification of our corporate structure, and achieved cost savings well ahead of our targets for the full year 2023. At the same time, we are moving ahead with the divestment of non-core businesses. The focus on our two Operating Companies, Kabi and Helios, is paying off, with strong revenue and earnings development. Both businesses again announced important innovations, new products and strong partnerships to improve patient outcomes. And this gets a lot of recognition even beyond the industry. Given our strong performance throughout the first three quarters of the year, we are improving our operating earnings outlook for 2023 and expect constant currency Group EBIT to remain broadly flat year on year. This momentum will allow us to continue to build trust, deliver consistent performance, and stay focused on our purpose: Advancing Patient Care.”

New presentation of financial information

As a result of the approval of the change of legal form by the Extraordinary General Meeting on July 14, 2023, Fresenius Medical Care is for the first time in Q3/23 presented as a single item in the financial statements of the Fresenius Group. Fresenius Medical Care is now classified in accordance with IFRS 5 as "Operations to be deconsolidated” and presented in a single line item in Fresenius’s balance sheet, the P&L and the cash flow statement.

IFRS 5 requires the valuation of Fresenius Medical Care at Fair Value. As of September 30, 2023, the market capitalization of about €12 billion was below the consolidated shareholders‘ equity of Fresenius Medical Care of about €14 billion. This results in a valuation effect of €2 billion, of which ~€0.6 billion are attributable to the shareholders of Fresenius SE & Co. KGaA. This effect is reported as a special item without any cash impact.

Simplification advancing: Deconsolidation of Fresenius Medical Care

The deconsolidation process of Fresenius Medical Care is on track. The competent Higher Regional Court in Bamberg has fully approved the application for release that Fresenius Medical Care had filed with regard to the legal actions brought against the change of the legal form into a stock corporation. Accordingly, the change of the legal form can be registered with the commercial register. Fresenius expects the deconsolidation to become effective by December 2023. From then on, Fresenius Medical Care AG & Co. KGaA will operate as Fresenius Medical Care AG.

Sharpening of focus: Exit from hospital market in Peru

Fresenius sells its 70 percent stake in IDCQ CRP, a co-holding entity of the hospital Clínica Ricardo Palma in Lima, Peru. The stake is acquired by entities of the Verme family which already hold a stake in the hospital, together with other local investors. This exit from the hospital market in Peru is a further step to strengthening #FutureFresenius and is in line with the company's intention to divest certain assets announced earlier this year. Subject to antitrust review, the all-cash transaction is expected to close in the first quarter of 2024.

Transformation Fresenius Vamed

In Q3/23, further progress in the transformation of Fresenius Vamed was achieved. The company is undergoing a comprehensive strategic assessment of its business activities and initiated a far-reaching restructuring program to increase the company’s profitability. With a positive EBIT of €10 million in Q3/23 (Q2/23: -€20 million), Fresenius Vamed is ahead of its originally expected target for Q3/23. The encouraging development was especially driven by the High-End Services (HES) and Health Facility Operations (HFO) businesses. For Q4/23, a further solid development is expected.

In Q3/23, negative special items mainly related to closing down activities, asset re-evaluations and restructuring costs resulted in write-downs and provisions of €109 million. The negative special items were predominantly booked as non-cash items. In Q1-3/23, negative special items of €441 million were incurred.

By 2025, Fresenius Vamed is expected to reach the structural EBIT margin band of 4% to 6% set out in the #FutureFresenius Financial Framework.

Structural productivity improvements significantly ahead of plan

The groupwide cost savings program progresses significantly ahead of plan. Under the program, Fresenius realized ~€200 million of structural cost savings at EBIT level in Q1-3/23. With that, all savings originally expected for 2023 are already realized. In the same period, one-time costs of around €90 million incurred to achieve these savings. This is well below what the Company initially accounted for and testament that our one-time costs are tightly managed.

On Group level including Fresenius Medical Care, the savings in Q1-3/23 amount to ~€430 million. In the same period, one-time costs of ~€190 million incurred to achieve these savings.

FY/23 Group earnings outlook improved

Based on the consistent performance of the Operating Companies through the year, Fresenius improves the 2023 earnings outlook and now expects constant currency Group EBIT1 to remain broadly flat compared to FY/2022 (previous: EBIT1 expected to remain broadly flat to decline up to a mid-single-digit percentage rate). Group organic revenue2 continues to be expected to grow in a mid-single-digit percentage range.

Fresenius expects the net debt/EBITDA3 ratio excluding Fresenius Medical Care to be below 4.0x by the end of 2023, therefore further improving from 4.03x4 as of September 30, 2023 (December 31, 2022: 3.80x4). This assumption does not include potential divestment activities. The self-imposed target corridor for the leverage ratio remains unchanged at 3.0x to 3.5x.

Assumptions for guidance FY/23

For the remaining of 2023, Fresenius assumes no further escalations of geopolitical tensions. Fresenius expects moreover that the increased cost inflation will have a corresponding impact on its business. The company will continue to closely monitor the potential further consequences of the ongoing challenging macroeconomic environment, including balance sheet valuations. All of these assumptions are subject to considerable uncertainty.

1 FY/22 base: €2,190 million, before special items; FY/23: before special items

2 FY/22 base: €21,532 million

3 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

For a detailed overview of special items please see the reconciliation tables starting page 24 of the PDF.

6% revenue increase in constant currency

Group revenue increased by 2% (6% in constant currency) to €5,518 million (Q3/22: €5,386 million). Organic growth was 6%. Acquisitions/divestitures contributed net 0% to growth. In total, currency translation had a negative effect of 4% on revenue growth. The Operating Companies increased revenue by 1% (5% in constant currency).

In Q1-3/23, Group revenue increased by 5% (7% in constant currency) to €16,621 million (Q1-3/22: €15,862 million). Organic growth was 6%. Acquisitions/divestitures contributed net 1% to growth. Currency translation decreased revenue growth by 2%. The Operating Companies increased revenue by 4% (7% in constant currency) in Q1-3/23.

10% EBIT1 increase in constant currency

Group EBITDA before special items increased by 9% (11% in constant currency) to €821 million (Q3/221: €755 million). Reported Group EBITDA was €661 million (Q3/22: €691 million). In Q1-3/23, Group EBITDA before special items increased by 2% (3% in constant currency) to €2,480 million (Q1-3/221: €2,425 million). Reported Group EBITDA was €1,923, million (Q1-3/22: €2,296 million).

Group EBIT before special items increased by 8% (10% in constant currency) to €519 million (Q3/221: €480 million) mainly driven by the good earnings development at the Operating Companies. The EBIT margin before special items was 9.4% (Q3/221: 8.9%). Reported Group EBIT was €346 million (Q3/22: €416 million). The Operating Companies showed an EBIT increase of 8% (10% in constant currency) and an EBIT margin of 10.3%.

In Q1-3/23 Group EBIT before special items remained nearly unchanged (0% in constant currency) at €1,628 million (Q1-3/221: €1,631 million). The EBIT margin before special items was 9.8% (Q1-3/221: 10.3%). Reported Group EBIT was €1,058 million (Q1-3/22: €1,475 million).

Group net interest before special items increased to -€109 million (Q3/221: -€67 million) mainly due to financing activities in a higher interest rate environment. Reported Group net interest was -€100 million (Q3/22: -€67 million).

In Q1-3/23, Group net interest before special items increased to -€300 million (Q1-3/221: -€161 million). Reported Group net interest was -€291 million (Q1-3/22: -€160 million).

Group tax rate before special items was 24.1% (Q3/221: 22.5%). Reported Group tax rate was 37.0% (Q3/22: 23.5%). The higher tax rate in Q3/23 is mainly due to the negative net income at Fresenius Vamed for which deferred tax assets could not be recognized. In Q1-3/23, Group tax rate before special items was 25.2% (Q1-3/221: 22.2%). Reported Group tax rate was 40.7%. The higher tax rate is also mainly due to the negative net income at Fresenius Vamed for which deferred tax assets could not be recognized (Q1-3/22: 23.0%).

Noncontrolling interests before special items were -€22 million (Q3/221: -€24 million). Reported noncontrolling interests were €6 million (Q3/22: -€21 million). In Q1-3/23, Noncontrolling interests before special items were -€46 million (Q1-3/221: -€72 million). Reported noncontrolling interests were €59 million (Q1-3/22: -€68 million).

Net income2 from operations to be deconsolidated decreased by 27% (-24% in constant currency) to €55 million (Q3/222: €75 million). In Q1-3/23 net income1 from operations to be deconsolidated before special items decreased by 25% (-24% in constant currency) to €160 million (Q3/222: €212 million).

Group net income2 before special items decreased by 7% (-5% in constant currency) to €344 million (Q3/221: €371 million). The decrease was driven by rising interest costs and a higher tax rate as well as lower net income from operations to be deconsolidated (Fresenius Medical Care). Reported Group net income2 decreased to -€406 million (Q3/22: €321 million). The negative net income is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect has no cash impact. In Q1-3/23, Group net income2 before special items decreased by 14% (-13% in constant currency) to €1,108 million (Q1-3/221: €1,284 million). Reported Group net income2 decreased to €20 million (Q1-3/22: €1,117 million). The decrease is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect has no cash impact.

Earnings per share2 before special items decreased by 8% (-6% in constant currency) to €0.61 (Q3/221: €0.66). Reported earnings per share2 were -€0.72 (Q3/22: €0.57). The negative net income is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect is without any cash impact. In Q1-3/23, earnings per share2 before special items decreased by 14% (-14% in constant currency) to €1.97 (Q1-3/221: €2.29). Reported earnings per share2 were €0.04 (Q1-3/22: €1.99). The decrease is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect is without any cash impact.

Investments

Spending on property, plant and equipment was €274 million corresponding to 5% of revenue (Q3/22: €255 million; 5% of revenue). These investments served primarily for the modernization and expansion of production facilities as well as hospitals.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables starting page 24 of the PDF.

In Q1-3/23, spending on property, plant and equipment was €725 million corresponding to 4% of revenue (Q1-3/22: €678 million; 4% of revenue).

Total acquisition spending was €179 million (Q3/22: €516 million) mainly for milestone payments in the biosimilars business at Fresenius Kabi.

In Q1-3/23, total acquisition spending was €197 million (Q1-3/22: €819 million).

Cash flow development

Group operating cash flow increased to €648 million (Q3/22: €598 million) mainly driven by the good cash flow development at Fresenius Kabi. Group operating cash flow margin was 11.7% (Q3/22: 11.1%). Operating cash flow from operations to be deconsolidated increased to €760 million (Q3/22: €658 million). Free cash flow before acquisitions, dividends and lease liabilities remained broadly stable at €376 million (Q3/22: €375 million). Free cash flow after acquisitions, dividends and lease liabilities increased to €121 million (Q3/22: -€155 million). Free cash flow after acquisitions, dividends and lease liabilities from operations to be deconsolidated increased to €358 million (Q3/22: €301 million).

In Q1-3/23, Group operating cash flow increased to €859 million (Q1-3/22: €806 million) with a margin of 5.2% (Q1-3/22: 5.1%). Operating cash flow from operations to be deconsolidated increased to €1,910 million (Q1-3/22: €1,568 million). Free cash flow before acquisitions, dividends and lease liabilities increased to €136 million (Q1-3/22: €120 million). Free cash flow after acquisitions, dividends and lease liabilities improved to -€699 million (Q1-3/22: -€1,059 million). Free cash flow after acquisitions, dividends and lease liabilities from operations to be deconsolidated increased to €396 million (Q1-3/22: -€63 million).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items, was 0.9 (LTM) in Q1-3/23.

1 Cash flow before acquisitions and dividends; before interest, tax, and special items

Solid balance sheet structure

Total assets including Fresenius Medical Care decreased by 1% (-1% in constant currency) to €75,328 million (Dec. 31, 2022: €76,400 million).

Assets related to Fresenius Medical Care to be deconsolidated under IFRS 5 were at €33,520 million (Dec. 31, 2022: n.a.). Liabilities related to Fresenius Medical Care to be deconsolidated under IFRS 5 €20,111 million (Dec. 31, 2022: n.a.).

Total shareholders’ equity including Fresenius Medical Care decreased by 6% (-6% in constant currency) to €30,282 million (Dec. 31, 2022: €32,218 million). The equity ratio was 40.2% (Dec. 31, 2022: 42.2%).

Group debt1 increased by 3% (3% in constant currency) to €15,116 million (Dec. 31, 2022: € 14,708 million). Group net debt1 increased by 5% (5% in constant currency) to € 14,021 million (Dec. 31, 2022: € 13,307 million).

As of September 30, 2023, the net debt/EBITDA ratio was 4.03x2,3 (Dec. 31, 2022: 3.80x2,3). This is a 15 bps reduction compared to Q2/23.

In Q3/23, ROIC was 5.0% (Q4/22: 5.6%).

1 Value as of December 31, 2022 adjusted (excluding Fresenius Medical Care)

2 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

3 Before special items

Business Segments

Operating Company Fresenius Kabi

Fresenius Kabi specializes in products for the therapy and care of critically and chronically ill patients. The portfolio includes biopharmaceuticals, clinical nutrition, MedTech products, intravenously administered generic drugs (generic IV drugs), and IV fluids.

- Growth Vectors combined contributing strong 12% organic revenue growth

- Pharma business with robust development

- EBIT margin1 strong above 14% driven by operating improvements and cost savings significantly ahead of plan

Revenue decreased by 2% to €2,021 million (Q3/22: €2,071 million) driven by negative currency exchange effects (increased 7 % in constant currency). Organic growth was 7%. The good performance was mainly driven by the strong business development of all growth vectors.

In Q1-3/23, revenue increased by 3% (8% in constant currency) to €6,013 million (Q1-3/22: €5,814 million). Organic growth was 7%.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) decreased by 1% to €1,067 million (Q3/22: €1,075million) driven by negative currency exchange effects (increased 11% in constant currency, organic growth: 12%). In Q1-3/23, revenue of the Growth Vectors increased by 7% (14% in constant currency; organic growth: 11%) to €3,180 million (Q1-3/22: €2,978 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables starting page 24 of the PDF.

Revenue in MedTech remained broadly stable due to negative currency exchange effects (increased 7% in constant currency) and amounted to €369 million (Q3/22: €368 million). Organic growth was 8% and driven by a broad-based positive development across most regions and many product groups. In Q1-3/23, revenue in MedTech increased by 5% (8% in constant currency; organic growth: 9%) to €1,113 million (Q1-3/22: €1,055 million).