Fresenius Sustainability Highlights 2023

Fresenius Sustainability Highlights 2023 - Sustainability at Fresenius

September 04, 2024

New York, USA

When the spine is operated on, mere millimeters can be critical. For such highly complex procedures, surgeons need sound judgment, precise spatial awareness, the capacity for abstraction – and a skilled pair of hands. Yet by their very nature, humans frequently reach the limits of their abilities. That is why many hospitals have for a long time been using high-resolution three-dimensional images and surgical navigation systems, such as spinal navigation, to perform their work. But all of this is only the start.

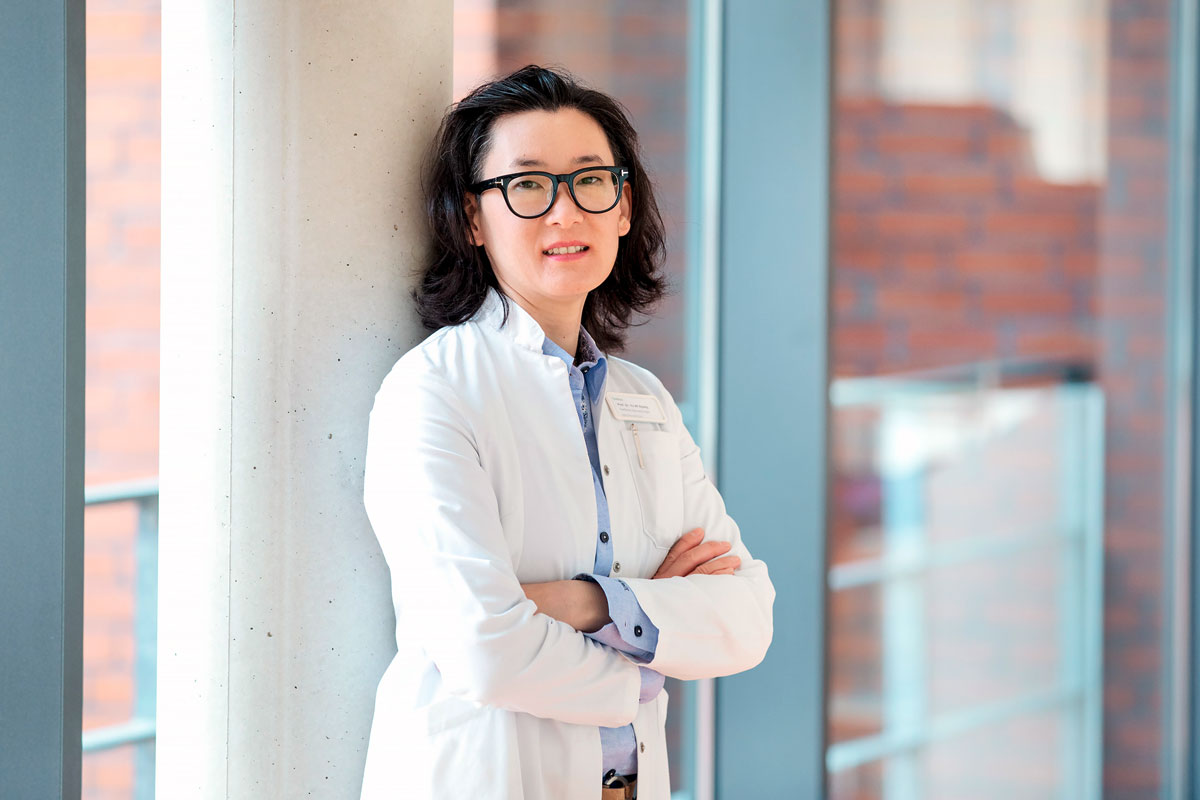

The Department of Neurosurgery and the Center for Spine Therapy at Helios Hospital Berlin-Buch have continued to build on their expertise in spinal surgical procedures: Under the direction of chief physician Professor Yu-Mi Ryang, the department has been using augmented reality (AR) in spinal stabilization surgery for the past two years. Berlin-Buch is thus one of the first hospitals in Germany to use AI in neurosurgery for the benefit of patients. The AR technology makes the procedures more precise, less invasive, and also shorter. A look over the shoulder of Prof. Ryang reveals exactly how AR is used here and why this represents an important step into the future.

There is total concentration in the operation room. Prof. Ryang is leaning over her patient. He is suffering from a spinal tumor that has already partially destroyed the bones and is also pressing on the highly sensitive spinal cord. Over the course of the next two to three hours, the surgeon will remove the tumor from the spinal cord and strengthen the area of the spine destabilized by the tumor using a so-called screw and rod system. It should restabilize the spine and, above all else, free the patient from pain. The neurosurgery teams also use such minimally invasive techniques for other indications, combining them with AR technology – in frequently occurring cases of wear and tear of the spine, for example, as well as when repairing fractured vertebrae after an accident or treating osteoporosis.

In purely visual terms, this screw and rod system resembles a railroad track. Firstly, between four and eight, sometimes significantly more, screws are firmly anchored in the “track bed” – i.e. the vertebral bodies. To this end, the screws are attached to so-called towers, which function as a kind of screw extension. Without these towers, the screws would disappear into the depth of the surgical area when inserted. They would no longer be visible to the surgeon and would hardly be accessible through the back muscles.

All of this is preferably performed in a minimally invasive procedure by making small incisions in the skin in order to preserve the tissue and reduce blood loss. Other advantages of this tissue-preserving procedure include a shorter operating time. This is because there is no longer any need for the complex process of detaching the back muscles from the spine, as is the case with open procedures. The patient also suffers less postoperative pain.

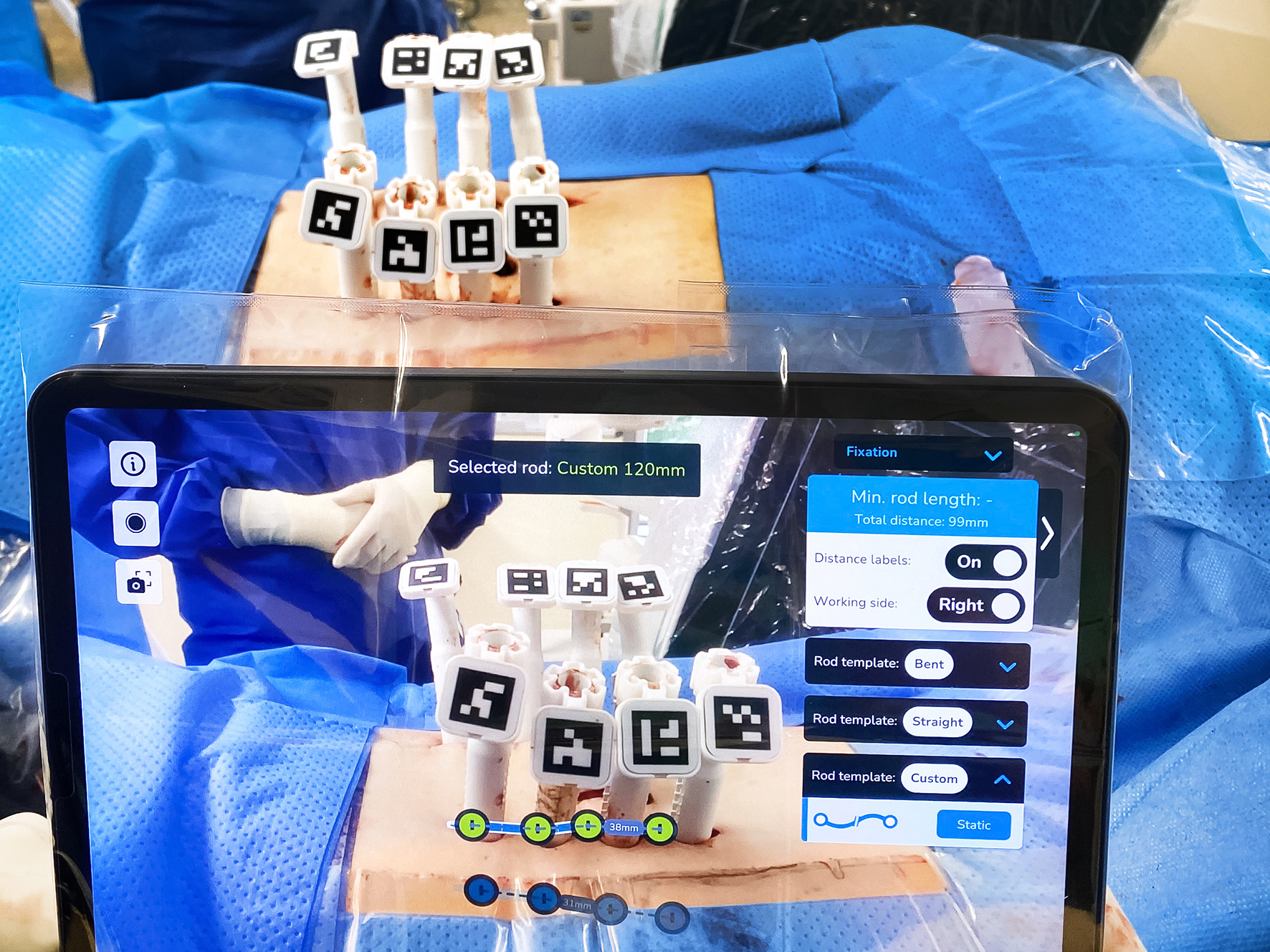

Due to the minimally invasive technique, Prof. Ryang may only be able to see a small section of the surgical area with her own eyes, but this is no obstacle thanks to AI. The precise location where the rods have to be inserted and, above all, the required length and curvature, along with the location of other important structures of the spine – such as the spinal cord or the tumor itself – can all be shown to her with the help of augmented reality. The latter also increases the safety of the procedure.

As the operation progresses, things get tricky again: Depending on the curvature of the spine, Prof. Ryang has to shape the titanium rods in advance so that they fit perfectly into the screw heads. Being even a few millimeters out can make a big difference here. In the past, the team relied purely on operative experience and their own judgment when shaping and fitting the rods. “This can be extremely difficult, however, particularly with severe curvatures of the spine,” explains the surgeon. Furthermore, it is relatively time-consuming. This is precisely where AR can now help: “With the aid of augmented reality, we can determine the ideal position, length, and curvature of the rods during the ongoing operation in a matter of minutes and prepare them accordingly.”

When the term augmented reality (AR) is mentioned, many people tend to think of virtual reality (VR) headsets. In Berlin-Buch, however, the neurosurgery team works with standard tablets equipped with a built-in camera and special software. Dr. Ryang points the tablet camera at the patient’s back. By swiveling the tablet, the surgical area is scanned – and with it the QR codes affixed to the screw tower in advance. The virtual 3D towers and virtual rods then gradually appear on the tablet, which are assigned to the real-time image of the patient. “Changes in position during the procedure are also no problem for me – orientation is guaranteed at all times,” says Prof. Ryang. With the aid of the QR codes, the tablet’s integrated camera can determine the exact position of the inserted screws and the exact length and curvature of the rods. And it can “merge” with the patient’s real-time image as a virtual 3D image. Based on this augmented reality, the surgeon can then use the tablet to create custom rods for each individual patient.

The software works out a kind of template for this, enabling the surgeon to bend the titanium rods into the ideal shape by hand. To allow her to compare, she repeatedly places the rods on the template. In the past, if the rod was not perfectly bent, a screw could be ripped out of its position again after being inserted. The doctor says that this risk is now minimal: “We hope that there will be significantly fewer postoperative complications in the long term, such as a broken rod, a loose screw, or some other material failure. Any of these things would necessitate revision surgery. We also hope that this method will improve the clinical outcome of patients in terms of pain and quality of life.”

The neurosurgery team in Berlin-Buch has been using AR technology for about two years now. At the present time, the interim assessment looks promising: Several studies have shown that it improves operative performance. “Even highly experienced surgeons are not always able to set the ideal curvature radii of the screw and rod systems without augmented reality support,” says Dr. Ryang. “But with the help of AR, practically all surgeons are able to achieve perfect results.”

Yet it gets even better with augmented reality: AR-supported procedures lead to shorter operating times, thereby also reducing the length of time the patient spends under anesthetic. This represents a continuation of the positive trend seen in spinal treatments, with minimally invasive neurosurgical procedures on the back becoming more and more comfortable for the patient.

“Our example from Berlin-Buch shows what it means to bring a medical innovation to patients in a very practical way,” says a delighted Prof. Ryang. “It is not the one major revolution that changes everything overnight. Rather, we combine various innovative solutions to achieve better outcomes for our patients step by step,” says the expert in summary.

Prof. Yu-Mi Ryang studied at Ruhr University Bochum, where she also gained her doctorate. The Düsseldorf-born physician then worked in the field of neurosurgery at University Hospital RWTH Aachen, where she completed her specialist training. Prof. Ryang attained her professorship at the Klinikum rechts der Isar of the Technical University of Munich and was appointed senior physician and deputy director of the Neurosurgical Department and Polyclinic in 2017. The specialist joined Fresenius Helios in Berlin-Buch in 2019. As chief physician, she heads the Neurosurgical Department as well as the Center for Spine Therapy.

She also holds a number of positions in various national and international professional societies, including the German Society of Neurosurgery, or DGNC, where Prof. Ryang is currently head of the spine section. In addition, she is on the board of the German Spine Society (DWG), where she serves on various commissions and is chairwoman of Module 5 of the DWG’s basic courses. In EUROSPINE, Prof. Ryang is also chairwoman of Module 4, and in AO Spine she is a member of the Technical Commission and the “Fracture, Tumor, Deformity Expert Group.”

Fresenius Sustainability Highlights 2023 - Sustainability at Fresenius

The Städel Museum provides unique access to over 700 years of art history. It offers space for a sensuous experience, and it encourages us to explore essential questions from our past, present, and future: The Städel Museum and its work are of utmost importance to society and to Frankfurt. For Fresenius, the partnership with Germany’s oldest museum foundation is part of its social responsibility – and a sign of its solidarity with the Rhine-Main region. After all, it was here that our company was founded and where both our corporate headquarters and many of our employees are based today.

“Fostering and funding the arts is an essential requirement for a diverse, open-minded, and pluralistic society,” says Fresenius CEO, Michael Sen. “Institutions like the Städel Museum ensure that everyone can access world-class works of art – a task that is also close to Fresenius’ heart. ‘Committed to Life’ – improving people’s lives – that is our claim. And both art and the Städel Museum make an important contribution to this.”

Studies show that art can have a positive impact on health. For example, the joy experienced when art is viewed can help to reduce stress. Above all, though, art fosters creativity and encourages people to reflect on social issues and different perspectives. The Städel Museum thus contributes to a diverse society with its work and helps to create the conditions fundamental to innovations that improve people’s lives.

Fresenius and the Städel Museum are thus also closely linked by the goals of innovation and progress. “I believe this attitude goes back to Johann Friedrich Städel and Else Kröner. Both bequeathed their fortunes to foundations that should advance progress in their respective disciplines. In the case of the Städel Museum, this means facilitating access to culture, also with the help of digital media. And in the case of the Else Kröner-Fresenius Foundation, this means furthering cutting-edge medical research,” continues Michael Sen. “I am therefore delighted to be working with such an outstanding cultural institution.”

Quarterly Financial Report Q2 2024 (IFRS)

Conference Call Q2/2024

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

6 Constant currency

Conference call and Audio webcast

As part of the publication of the results for Q2/24, a conference call will be held on July 31, 2024 at 1:30 p.m. CEST (7:30 a.m. EDT). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on our website.

Michael Sen, CEO of Fresenius: “Fresenius had an outstanding Q2 and first half in 2024. We delivered strong top-line growth, higher margins, and even more powerful bottom-line growth. Cash came in extremely strong, materially improving our financial profile. We are well ahead of our plans to deleverage and to take out costs. 2024 is an inflection year where we see how the work we’ve done continues to impact and improve the lives of patients and generate value for all stakeholders. Fresenius is 'Committed to Life' ".

Structural productivity improvements ahead of plan

The Group-wide cost and efficiency measures are progressing faster than planned. Including the first half of 2024, Fresenius has achieved structural cost savings totaling ~€336 million at EBIT level.

For the remainder of the year, Fresenius will continue its efforts to further increase its structural productivity. Some measures that were planned for 2025 will be brought forward to the current financial year. The company aims to achieve the target of annual sustainable cost savings of ~€400 million at EBIT level by year-end 2024. Originally, this was expected in 2025.

The structural cost savings continue to be driven by all business segments and the Corporate Center. Key elements include measures to reduce complexity, optimize supply chains and improve procurement processes.

Group sales and earnings development

Group revenue before special items increased by 6% (8% in constant currency) to €5,414 million (Q2/23: €5,113 million). Organic growth was 8%2 driven by an ongoing strong performance of Kabi and Helios. Currency translation had a negative effect of 2% on revenue growth.

Group EBITDA before special items increased by 14% (14% in constant currency) to €938 million (Q2/23: €822 million).

Group EBIT before special items increased by 16% (15% in constant currency) to €660 million (Q2/23: €571 million) mainly driven by the good earnings development at Kabi and Helios and the continued progress of the groupwide cost savings program. The EBIT margin before special items was 12.2% (Q2/23: 11.2%). Reported Group EBIT was €265 million (Q2/23: €187 million).

Group net interest before special items was -€108 million (Q2/23: -€99 million) mainly due to financing activities in a higher interest rate environment.

Group tax rate before special items was 26.1% (Q2/23: 25.2%).

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

Net income1 from deconsolidated Fresenius Medical Care operations before special items increased by 21% (16% in constant currency) to €69 million (Q2/231: €57 million).

Group net income1 before special items increased by 16% (15% in constant currency) to €457 million (Q2/231: €393 million). The increase was driven by the operating strength.

Group net income1 before special items excluding Medical Care increased by 15% (15% in constant currency) to €388 million (Q2/231: €336 million).

Reported Group net income1 decreased to -€373 million (Q2/231: €80 million) due to effects from special items related to the Vamed exit and the discontinued operations at Vamed.

Earnings per share1 before special items increased by 16% (15% in constant currency) to €0.81 (Q2/231: €0.69). Reported earnings per share1 were -€0.66 (Q2/231: €0.15) effects from special items related to the Vamed exit and the discontinued operations at Vamed.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Group Cash flow development

Group operating cash flow (continuing operations) almost quintupled to €709 million (Q2/23: €148 million). This excellent development is mainly related to working capital efficiencies and the increased focus on cash generation as well as excellent operating performance in Spain at Fresenius Helios. Group operating cash flow margin was 13.1% (Q2/23: 2.9%). Free cash flow before acquisitions, dividends and lease liabilities (continuing operations) increased to €674 million (Q2/23: €40 million). Free cash flow after acquisitions, dividends and lease liabilities (continuing operations) improved to €655 million (Q2/23: -€556 million).

Fresenius Kabi’s operating cash flow increased to €259 million (Q2/23: €180 million) with a margin of 12.3% (Q2/23: 9.0%) mainly driven by an improved working capital management, in particular related to inventories and receivables.

Fresenius Helios’ operating cash flow increased to €604 million (Q2/23: €61 million) in particular due to the strong operating performance in Spain and catch-up effects following a weaker first quarter. The strong focus on cash generation and improved management of working capital is also paying off. The operating cash flow margin was 18.7% (Q2/23: 2.0%).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items was 1.1 in Q2/24 (LTM) (Q1/24: 0.9 LTM). This positive development is due to the increased cash flow focus across the Group.

1 Cash flow before acquisitions and dividends; before interest, tax, and special items

Group leverage

Group debt decreased by 14% (-15% in constant currency) to €13,536 million (Dec. 31, 2023: € 15,830 million) mainly related to the repayment of debt and the €400 million reduction of the leasing liabilities related to the Vamed exit. Group net debt decreased by 6% (-7% in constant currency) to € 12,428 million (Dec. 31, 2023: € 13,268 million).

As of June 30, 2024, the net debt/EBITDA ratio was 3.43x1,2 (Dec. 31, 2023: 3.76x1,2) corresponding to a reduction of 33 bps compared to FY/23. This achievement is due to a combination of the improved operational performance as well as better EBITDA and Free cash flow. The legally required suspension of dividend payments and the Vamed exit further supported the positive development. Compared to Q2/23 (4.19x1,2) this is a 76 bps reduction.

Fresenius expects the net debt/EBITDA3 ratio to be within the self-imposed corridor of 3.0 to 3.5x by the end of 2024. Further improvement in the second half of 2024 is expected. This is expected to be driven by further reducing net debt and by the operational performance at the Operating Companies.

ROIC improved to 6.0% in Q2/24 (FY/23: 5.2%) mainly due to the EBIT improvement and the stringed capital allocation. With that, ROIC reached the lower end of the self-defined target range of 6% to 8%.

For 2024, Fresenius now expects ROIC to be around 6.0% (previous: 5.4% to 6.0%), (2023: 5.2%).

1 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

2 Before special items

3 At expected average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Kabi

Revenue increased by 5% (10% constant currency) to €2,101 million (Q2/23: €2,001 million). The reported revenue growth is mainly driven by negative currency translation effects related to the hyperinflation in Argentina. Organic growth was 11%1. This strong performance was driven by the Growth Vectors and helped by pricing effects in Argentina.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) increased by 8% (19% in constant currency) to €1,149 million (Q2/23: €1,062 million). Organic growth was outstanding at 19%1. In Nutrition, organic growth of 14%1 benefited from the good development in the US, driven by the ongoing roll-out of lipid emulsions. Whereas China continued to be impacted by indirect effects of the government’s countrywide anti-corruption campaign and tender headwinds. Biopharma showed excellent organic growth of 102%1 driven by licensing agreements at mAbxience and the successful product launch of Tyenne in Europe. In MedTech, organic growth was of 9%1 driven by a broad-based positive development across most regions and many products groups.

Revenue in the Pharma (IV Drugs & Fluids) business was flat (0% in constant currency; organic growth: 2%1) and amounted to €951 million (Q2/23: €952 million). Organic growth was mainly driven by the positive development across many regions, particularly Europe.

EBIT2 of Fresenius Kabi increased by 17% (17% in constant currency) to €334 million (Q2/23: €285 million) mainly due to the good revenue development, the EBIT break-even result of the Biopharma business, and ongoing progress of the cost saving initiatives. EBIT margin2 was 15.9% (Q2/23: 14.2%) and thus at the upper end of 2024 outlook.

EBIT2 of the Growth Vectors increased by 93% (constant currency: 47%) to €169 million (Q2/23: €88 million) due to the EBIT break-even result of the Biopharma business and the good revenue development. EBIT2 margin was 14.7% (Q2/23: 8.3%).

EBIT2 in the Pharma business decreased by 10% (constant currency: -11%) to €185 million (Q2/23: €206 million) primarily driven by additional costs due to the start of production at the main US plants in Wilson and Melrose Park. EBIT2 margin was 19.5% (Q2/23: 21.6%).

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

Constant currency growth rates adjusted for Argentina hyperinflation.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Helios

Revenue before special items increased by 7% (6% in constant currency) to €3,230 million (Q2/23: €3,020 million). Organic growth was 6%.

Revenue of Helios Germany increased by 3% (in constant currency: 3%) to €1,882 million (Q2/23: €1,823 million), mainly driven by favourable price effects and moderately increased activity levels. Organic growth was 3%.

Revenue of Helios Spain before special items increased by 13% (11% in constant currency) to €1,348 million (Q2/23: €1,198 million) driven by a positive calendar effect related to the Easter week and related higher activities, as well as positive price effects. Organic growth was 11%. The clinics in Latin America also showed a good performance.

EBIT1 of Fresenius Helios increased by 19% (18% in constant currency) to €357 million (Q2/23: €301 million) with an excellent EBIT margin1 of 11.1% (Q2/23: 10.0%) due to the strong operating performance in Spain.

EBIT1 of Helios Germany increased by 2% to €157 million (Q2/23: €154 million) with an EBIT margin1 of 8.3% (Q2/23: 8.4%) driven by the solid revenue development and helped by Government relief funding for higher energy costs.

EBIT1 of Helios Spain increased by 33% (32% in constant currency) to €201 million (Q2/23: €151 million) driven by the strong revenue growth based on the positive calendar effect related the Easter week as well as positive price effects. The EBIT margin1 reached 14.9% (Q2/23: 12.6%), clearly above the structural margin band ambition. On a more comparable half-year basis, the EBIT margin improved 30 bps to13.3% (H1/23: 13.0%).

Exit Fresenius Vamed

As of Q2 2024, Vamed is no longer a reporting segment of Fresenius. The company’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, will be transferred to Fresenius and has already been included under Corporate / Other in the Group consolidated segment reporting.

The divestment of the rehabilitation business and the Vamed operations in Austria led to non-cash special items of €427 million at Group net income level.

Due to the exit from the project business, a total amount of high triple-digit million euros of special items are expected, which are spread over the next few years and mostly cash-effective. In H1/24, special items related to the gradual scale back of the international project business amounted to €425 million at Group EBIT level and to €343 million2 at Group net income level.

1 Before special items

2 According to 77% ownership share

Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Group and segment outlook for 20241

Fresenius confirms its outlook for FY/24. Based on the excellent first half year, Fresenius is optimistic to get Group constant currency EBIT2,3 growth into the upper half of the 6% to 10% range. For 2024, Group organic revenue growth2,3 is expected to grow between 4% to 7%.

Fresenius Kabi expects organic revenue growth in a mid-to high-single-digit percentage range in 2024. The EBIT margin3 is expected to be in a range of 15% to 16% (structural margin band: 14% to 17%).

Fresenius Helios expects organic revenue3 to grow in mid-single digit percentage range in 2024. The EBIT margin3 is expected to be within 10% to 11% (structural margin band: 10% to 12%).

The Group outlook is given without Fresenius Vamed, i.e. exclusively for the Operating Companies Fresenius Kabi and Fresenius Helios.

1 For the prior-year basis please see table “Basis for Guidance for 2024”

2 2023 base: €2,266 million

3 Before special items

4 2023 base: €20,307 million

Basis for Guidance for 2024

1 Before special items

If no timeframe is specified, information refers to Q2/2024.

An overview of the results for Q2/2024 - before and after special items – is available on our website.

Consolidated results for Q2/24 as well as for Q2/23 include special items. These concern: divestment of the fertility services group Eugin and the hospital stake in Peru, Vamed exit, expenses associated with the Fresenius cost and efficiency program, transaction costs for mAbxience and Ivenix, costs in relation to the change of legal form of Fresenius Medical Care, legacy portfolio adjustments, IT transformation, transformation/exit Vamed, discontinued operations Vamed, special items at Fresenius Medical Care, and impact of PPA due to the application of the equity method to the Fresenius Medical Care investment. The special items shown within the reconciliation tables are reported in the Corporate/Other segment.

Note on the deconsolidation of Fresenius Medical Care

Following the deconsolidation of Fresenius Medical Care, Group financial figures are presented in accordance with IAS 28 (at equity method) since December 1, 2023. The proportionate share of 32% of Fresenius Medical Care is presented as a separate line in Fresenius Group’s P&L and balance sheet. Dividends received from Fresenius Medical Care are reported as a separate line as part of the cash flow statement. Moreover, IAS 28 requires a full purchase price allocation (PPA). The accounting for the PPA is treated as special item. For reasons of simplification and comparability, Fresenius presents net income with and without Fresenius Medical Care`s equity result.

Note on the portfolio optimization at Fresenius Helios

As part of the portfolio optimization, the sale of the fertility services group Eugin was completed on January 31, 2024. The divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru, was completed on April 23, 2024. Therefore, results of Fresenius Helios and accordingly of the Fresenius Group for Q2/24 and Q2/23 are adjusted.

Note on the growth rates Fresenius Kabi

Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, in constant currency growth rates of the Fresenius Group are also adjusted.

Note on the Vamed exit

Due to the application of IFRS 5, the prior year and prior quarter figures of the current year have been adjusted in the consolidated statement of income and the consolidated statement of cash flows. Vamed’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, will be transferred to Fresenius and is included under Corporate / Other in the Group consolidated segment reporting. Details on the financial and accounting implications of the Vamed exit and the portfolio adjustments at Fresenius Helios are available on our website.

Information on the performance indicators are available on our website at

https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.