Physicians, researchers, and partner institutions across Europe aim to deliver innovative, personalized therapies more quickly

Development project focused on a hospital-based modular platform, based on technology initially developed by Fresenius Kabi

The EASYGEN project is a public-private partnership, with €8 million backed by EU funding through the Innovative Health Initiative

Important step in #FutureFresenius program

The global healthcare company Fresenius is collaborating with other companies and academic institutions with the goals of accelerating the manufacturing of CAR-T cell therapy, making it more cost-effective, and improving patient access across Europe. Led by Fresenius, the newly launched EASYGEN (Easy workflow integration for gene therapy) consortium will focus on efforts to develop a modular, hospital-based platform capable of manufacturing personalized cell therapies in just a few days, rather than weeks. The project is a public-private partnership, with €8 million in funding provided by the EU through the Innovative Health Initiative (IHI). It leverages technology originally developed by the Cell and Gene Therapy team of Fresenius Kabi, part of Fresenius.

Dr. Christian Hauer, President MedTech at Fresenius Kabi, said: “This project contributes to expanding our MedTech platform, making it an important step on our path to #FutureFresenius. The aim is not only to develop cutting-edge medical technologies, but also to make them available quickly, safely, and close to the patient. In this way, we are actively working to shape the healthcare of tomorrow.”

“EASYGEN brings together physicians, researchers, and partner institutions from across Europe with the goal of collaboratively advancing innovative, personalized therapies such as CAR-T cells for cancer treatment. Automation can help reduce production complexity of these therapies, with the aim of making it easier to scale these life-saving treatments and improve patient access,” added Prof. Dr. med. Ralf Kuhlen, Chief Medical Officer at Fresenius.

CAR-T therapy is a breakthrough treatment that involves genetically modifying a patient’s T cells to target cancer. It requires complex, time-intensive production in specialized facilities often far from patients. Limited manufacturing capacity and supply chain delays can potentially prevent timely patient access. Despite clinical eligibility, access to CAR-T cell therapy remains limited for patients across Europe. This is particularly evident in diffuse large B-cell lymphoma (LBCL), a type of cancer that is one of the most common indications: Across five European countries, the average treatment rate is below 20%. While approximately 30% of eligible patients receive CAR-T therapy in France, the figure drops to just 11% in Italy.1

Fresenius is actively involved in cell and gene therapy. Fresenius Kabi provides medical technology for these therapies, including automated cell processing systems such as Lovo and Cue. Fresenius Helios, for example, at its Helios Hospital Berlin-Buch, has been offering CAR-T cell therapy as a standard treatment for relapsed cases since 2019. The clinic is also conducting clinical trials to further explore the potential of CAR-T therapies. Quirónsalud, Fresenius’ Spanish hospital business, has established specialized oncology units that offer CAR-T cell therapy as part of their advanced cancer treatment portfolio, particularly for hematologic malignancies.

EASYGEN is led by Fresenius and academically co-led by Fraunhofer Institute, IZI, Leipzig – one of Europe’s foremost immunotherapy research centers in collaboration with Prof. Dr. Michael Hudecek, a leader in CAR-T cell engineering and Prof. Dr. Ulrike Köhl, a pioneer in translational cellular immunotherapies.

1 IQVIA Institute for Human Data Science. (03/ 2025). Achieving CAR T-cell Therapy Health System Readiness: An Assessment of Barriers and Opportunities.

Consortium partners – 18 organizations across 8 countries

Industry & clinical leaders: Fresenius (Coordinator, Germany), Helios Hospital Berlin-Buch (Germany), Quirónsalud (Spain), Fenwal Inc. (USA), Cellix Ltd. (Ireland), Charles River (Germany), Pro-Liance Global Solutions (Germany), TQ Therapeutics (Germany), Philips Electronics Nederland B.V. (Netherlands).

Academic & research institutions: Fraunhofer IESE (Germany), Fraunhofer IZI (Germany), Helmholtz-Zentrum Dresden-Rossendorf (Germany), Technical University of Denmark (Denmark), Frankfurt School of Finance & Management (Germany), European Society for Blood & Marrow Transplantation (Netherlands), Bar-Ilan University (Israel), University of Glasgow (UK), University of Navarra (Spain).

* * *

Learn more about CAR-T cell therapy: Interview Prof. Bertram Glaß, Chief Physician for Hematology and Cell Therapy at Helios Hospital Berlin-Buch: www.fresenius.com/car-t-cell-therapy

* * *

About EASYGEN

EASYGEN is a five-year research project supported by the Innovative Health Initiative Joint Undertaking (IHI JU) under grant agreement No 101194710. The JU receives support from the European Union’s Horizon Europe research and innovation programme and COCIR, EFPIA, Europa Bío, MedTech Europe, Vaccines Europe and industry partners. Selected under the IHI call “User-centric technologies and optimized hospital workflows for a sustainable healthcare workforce”, the project aims to develop an integrated, automated platform that enables point-of-care CAR-T cell manufacturing—cutting production time, reducing costs, and expanding access to next-generation immunotherapies.

Disclaimer: Funded by the European Union, the private members, and those contributing partners of the IHI JU. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the aforementioned parties. Neither of the aforementioned parties can be held responsible for them.

Copyright: Johannes Krzeslack

Image Description

In the front row, from left to right: Dr. Sonja Steppan (Easygen Principal Investigator, Fresenius SE), Prof. Dr. Michael Hudecek (Fraunhofer IZI), Theresa Kagerbauer (TQ Therapeutics), Dr. Agnes Vosen (HZDR), Christopher Wegener (Fresenius Kabi), Vaclovas Radvilas (EBMT), Dr. Julia Schüler (Charles River), Dr. Julia Busch-Casler (HZDR), Nicole Spanier-Baro (Fraunhofer IESE), Vivienne Williams (Cellix Limited), Prof. Dr. Bertram Glaß (Helios), Prof. Dr. Ulrike Köhl (Fraunhofer IZI), Rebecca Scheiwe (Fresenius SE). In the back row, from left to right: Prof. Dr. Ralf Kuhlen (Fresenius SE), Prof. Dr. Jens O. Brunner (DTU), Dominik Narres (Fresenius SE), Thomas Brzoska (Pro-Liance Global Solutions), Dr. David Krones (Fraunhofer IZI), Dr. Sabine Bertsch (Pro-Liance Global Solutions), Dr. Ralf Hoffmann (Philips), Christin Zündorf (TQ Therapeutics), Dr. Anna Dünkel (Fraunhofer IZI).

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

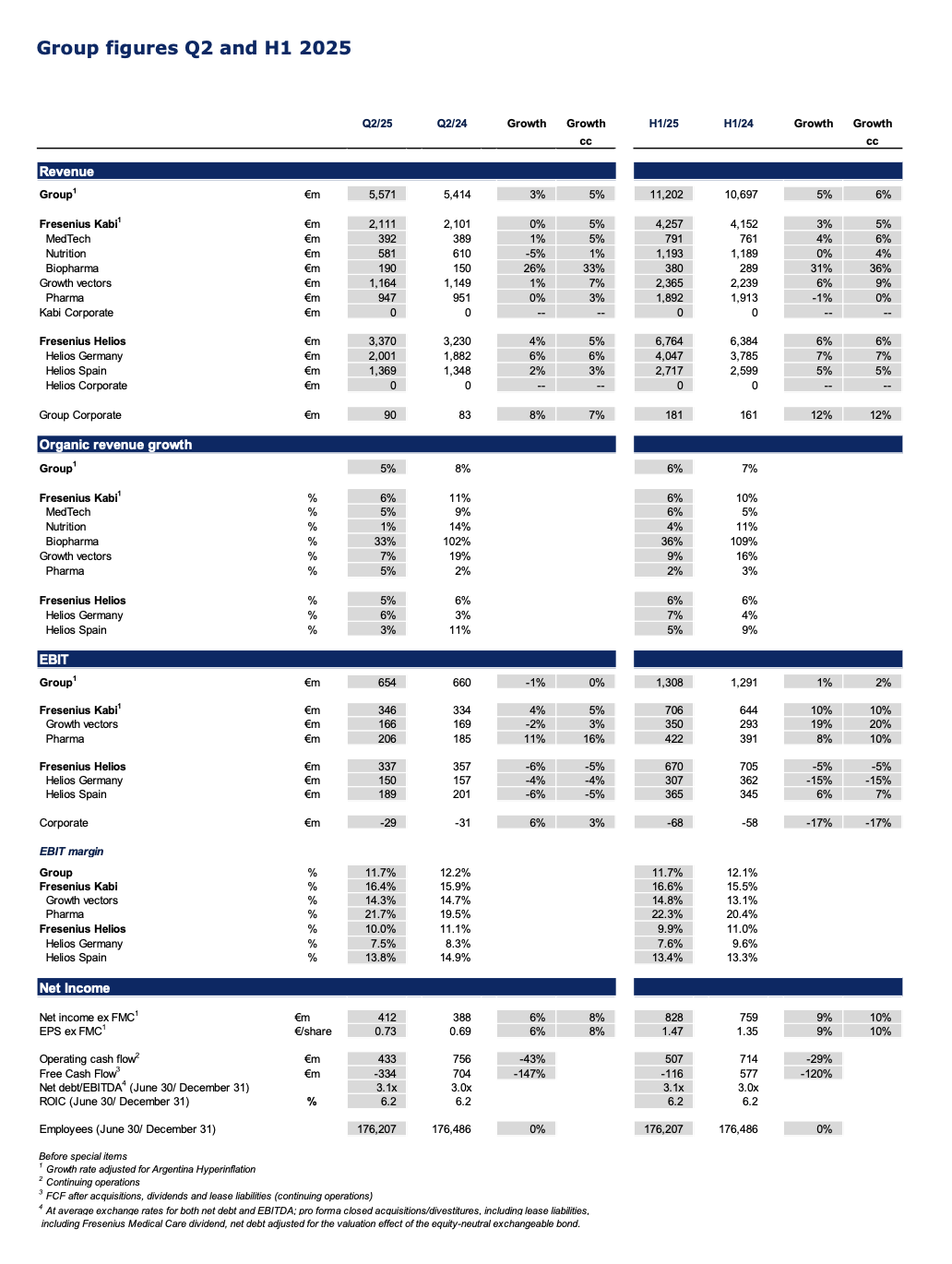

An overview of key financial figures is available at the end of the release.

Q2/2025: Ongoing strong revenue and EPS growth, guidance for organic revenue growth raised

Group revenue1 at €5,571 million with organic growth of 5%1,2 driven by consistent delivery across the core businesses Fresenius Kabi and Fresenius Helios as well as ongoing execution of #FutureFresenius.

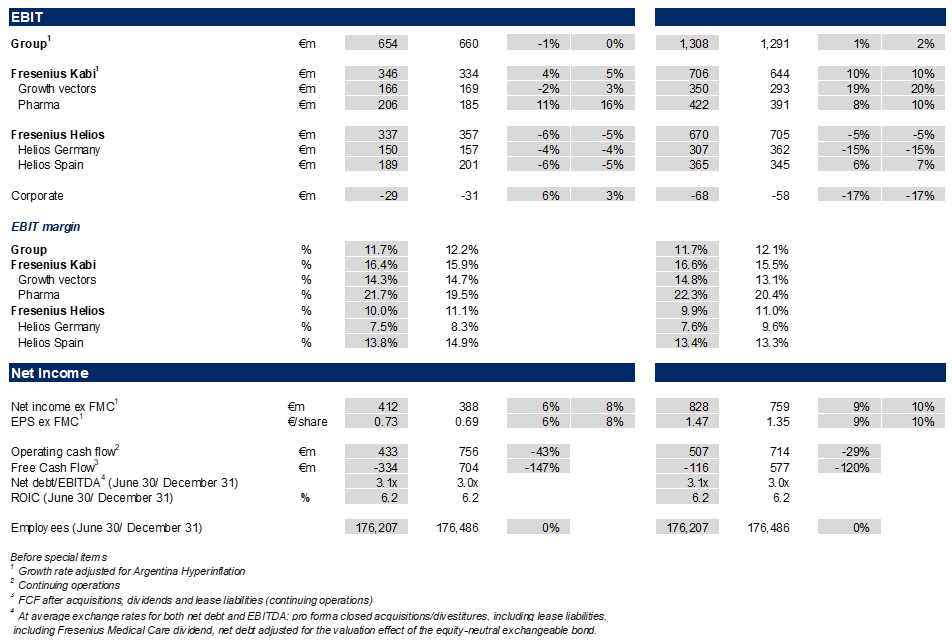

Group EBIT1 broadly stable3 in constant currency at €654 million impacted by the headwinds from ceased energy relief payments at Helios Germany and the loss of the volume-based procurement tender for the nutrition product Ketosteril in China at Fresenius Kabi; Group EBIT margin1 at 11.7%.

Net income1,4 with strong 8%3 growth in constant currency to €412 million outpacing revenue growth.

EPS1,4 rose by strong 8%3 in constant currency to €0.73 demonstrating continued bottom-line delivery based on operating strength and significantly decreased interest expenses.

Net debt/EBITDA ratio at 3.1x1,5 driven by resumed dividend payment in Q2/25.

Pro rata sale of Fresenius Medical Care shares to maintain current stake in response to the announced Fresenius Medical Care share buyback program.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond

Michael Sen, CEO of Fresenius: “Fresenius has demonstrated a resilient and consistent performance in the first half of 2025, with another quarter of strong momentum reflected by 8% Core EPS growth. Fresenius Kabi and Fresenius Helios continue to deliver strong results despite macroeconomic challenges, thanks to our focused strategy and disciplined execution. This performance enables us to raise our guidance, increasing our full-year expectations for revenue growth to between 5% and 7%. #FutureFresenius is paying off.

Our ambitions remain unchanged: Our current strategy phase Rejuvenate will focus on organic growth through disciplined capital allocation - upgrading our core, and scaling our platforms to enhance performance further. We are committed to delivering profitable growth through targeted investments in health and digital innovation, which together will create and enhance value for our stakeholders."

Guidance raised for Fiscal Year 20251

Based on the consistent growth at the top-end of the 2025 guidance in H1/25, organic revenue guidance was raised:

Fresenius Group2: organic revenue growth3 now expected in the range of 5 to 7% (previous: 4 to 6%); constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1 Before special items

2 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4 Growth rate adjusted for Argentina hyperinflation

5 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q2/25

In Q2/2025, the good operating performance of Fresenius Kabi and Fresenius Helios led to a 5%1 Group organic revenue2 increase to €5,571 million.

As expected, Group EBIT before special items was broadly stable3 in constant currency, and amounted to €654 million. This is related to the headwinds from the absence of energy relief payments at Helios Germany and the Volume Based Procurement of the nutrition product Ketosteril in China at Fresenius Kabi. Despite the negative effects, Group EBIT margin was 11.7% (Q2/24: 12.2%). The Helios Performance Programme is advancing with increasing contributions expected in the second half of the year.

Earnings per share2,4 rose by a strong 8%3 in constant currency to €0.73, driven by the operating strength and the significantly decreased interest expenses.

Following the announcement of Fresenius Medical Care AG (FME) in June 2025 to initiate a share buyback program, Fresenius intends to sell shares of FME on a pro rata basis to maintain its current stake of around 28.6% in FME. The final size and tranching of the sale of shares will be determined based on the structure of the share buyback program of FME. As previously announced, Fresenius remains a committed shareholder and will retain no less than 25 per cent plus one share of FME.

Fresenius will use the proceeds to invest in its core business in line with the #FutureFresenius strategy and Fresenius' stated capital allocation priorities, including further strengthening the balance sheet, reducing leverage, and delivering shareholder value and long-term growth.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Operating Companies – Business development Q2/25

Fresenius Kabi delivered a strong performance; Growth Vectors with ongoing momentum, continued Biopharma strength; licensing agreement to commercialize a proposed vedolizumab biosimilar candidate

Organic revenue growth of 6%1 mainly driven by the Growth Vectors and the good contribution from Pharma; reflecting the less pronounced positive Argentina pricing effects; revenue was broadly flat at €2,111 million due to currency effects; increased by 5%2 in constant currency.

Growth Vectors with good organic revenue1 increase of 7%: MedTech 5%, Nutrition 1%, Biopharma 33%.

- Nutrition revenue: €581 million, growth clearly influenced by the tender impact from the Volume Based Procurement (VBP) on Ketosteril in China (ex Ketosteril healthy organic growth in line with ambition range), good development in Latin America and Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

- Biopharma revenue: €190 million, positive development mainly driven by the Tyenne biosimilar ramp up in Europe and the U.S. as well as Idacio; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) launched in the U.S. and approved in Europe; expansion of autoimmune biosimilars portfolio: licensing agreement with Polpharma Biologics to commercialize a proposed vedolizumab biosimilar candidate (excluding region MENA).

- MedTech revenue: €392 million, increase driven by the expansion in Cell Therapy in the U.S., and solid growth in Europe.

Pharma revenue: €947 million, strong organic revenue development1 with 5% growth based on good volumes including I.V. fluids in the U.S., and Europe with favourable pricing.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Growth rate adjusted for Argentina hyperinflation

EBIT1 of Fresenius Kabi with 5%2 constant currency increase to €346 million, driven by the strong margin development of the Pharma, MedTech and Biopharma business and ongoing improvements in the cost base. The EBIT margin1 was at the upper end of the guidance range at 16.4% despite transaction exchange rate effects and headwinds on the Nutrition business in China.

EBIT1 of the Growth Vectors increased 3%2 in constant currency against the backdrop of the Ketosteril effect, and amounted to €166 million; EBIT margin1 at 14.3%.

EBIT1 of Pharma increased 16%2 in constant currency to €206 million. EBIT margin1 was strong at 21.7% due to ongoing cost savings and some one-timers.

Fresenius Helios with solid organic revenue growth; expected softness in profitability at Helios Germany partially offset by good development at Helios Spain; Helios Performance Programme is advancing.

Strong 5% organic revenue growth driven by Helios Germany (6% organic growth); Helios Spain at 3% organic growth (H1/25: 5%) linked to the Easter effect, which resulted into less activity at the beginning of Q2/25 and impacted growth predominantly at Helios Spain; revenue before special items increased by 5% in constant currency to €3,370 million.

Helios Germany with revenue1 of €2,001 million; growth mainly driven by price effects, as well as good activity levels and case mix.

Helios Spain with revenue of €1,369 million, impacted by the Easter timing and currency translation effects related to the clinics in Latin America. The clinics in Latin America showed a good operational performance.

EBIT1 of Fresenius Helios as expected declined -5% in constant currency to €337 million impacted by the absence of energy relief funds in Germany. This expected softness was partially compensated by the excellent profitability at Helios Spain. EBIT margin1 of Fresenius Helios was resilient at 10.0%.

1 Before special items

2 Growth rate adjusted for Argentina hyperinflation.

EBIT1 of Helios Germany decreased by -4% to €150 million against the high prior-year base which included energy relief funds; EBIT margin at 7.5% improved by 90 bps compared to Q4/24 (6.6%), the first quarter without energy relief funds.

EBIT1 of Helios Spain decreased by -5% in constant currency to €189 million related to a very strong prior-year base and the Easter effect; EBIT margin1 at a strong 13.8%.

Helios performance programme is advancing; ramp-up in H2/25 expected with more meaningful EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1 Before special items

* * *

Conference call and Audio webcast

As part of the publication of the Q2/2025 results, a conference call will be held on August 6, 2025 at 1:30 p.m. CEST / 7:30 a.m. EDT. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

* * *

* * *

Note on the presentation of financial figures

If no timeframe is specified, information refers to Q2/2025.

Consolidated results for Q2/25 as well as for Q2/24 include special items. An overview of the results for Q2/2025 - before and after special items – is available on our website.

Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

The results of Fresenius Helios and accordingly of the Fresenius Group for Q2/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

Q2/2025: Ongoing strong revenue and EPS growth, guidance for organic revenue growth raised

- Group revenue1 at €5,571 million with organic growth of 5%1,2 driven by consistent delivery across the core businesses Fresenius Kabi and Fresenius Helios as well as ongoing execution of #FutureFresenius.

- Group EBIT1 broadly stable3 in constant currency at €654 million impacted by the headwinds from ceased energy relief payments at Helios Germany and the loss of the volume-based procurement tender for the nutrition product Ketosteril in China at Fresenius Kabi; Group EBIT margin1 at 11.7%.

- Net income1,4 with strong 8%3 growth in constant currency to €412 million outpacing revenue growth.

- EPS1,4 rose by strong 8%3 in constant currency to €0.73 demonstrating continued bottom-line delivery based on operating strength and significantly decreased interest expenses.

- Net debt/EBITDA ratio at 3.1x1,5 driven by resumed dividend payment in Q2/25.

- Pro rata sale of Fresenius Medical Care shares to maintain current stake in response to the announced Fresenius Medical Care share buyback program.

1Before special items

2Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3Growth rate adjusted for Argentina hyperinflation

4Excluding Fresenius Medical Care

5At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond

Michael Sen, CEO of Fresenius: “Fresenius has demonstrated a resilient and consistent performance in the first half of 2025, with another quarter of strong momentum reflected by 8% Core EPS growth. Fresenius Kabi and Fresenius Helios continue to deliver strong results despite macroeconomic challenges, thanks to our focused strategy and disciplined execution. This performance enables us to raise our guidance, increasing our full-year expectations for revenue growth to between 5% and 7%. #FutureFresenius is paying off.

Our ambitions remain unchanged: Our current strategy phase Rejuvenate will focus on organic growth through disciplined capital allocation - upgrading our core, and scaling our platforms to enhance performance further. We are committed to delivering profitable growth through targeted investments in health and digital innovation, which together will create and enhance value for our stakeholders."

Guidance raised for Fiscal Year 20251

Based on the consistent growth at the top-end of the 2025 guidance in H1/25, organic revenue guidance was raised:

Fresenius Group2: organic revenue growth3 now expected in the range of 5 to 7% (previous: 4 to 6%); constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1Before special items

22024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4Growth rate adjusted for Argentina hyperinflation

52024 base: €8,414 million (revenue) and €1,319 million (EBIT)

62024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q2/25

In Q2/2025, the good operating performance of Fresenius Kabi and Fresenius Helios led to a 5%1 Group organic revenue increase to €5,571 million.

As expected, Group EBIT before special items was broadly stable3 in constant currency, and amounted to €654 million. This is related to the headwinds from the absence of energy relief payments at Helios Germany and the Volume Based Procurement of the nutrition product Ketosteril in China at Fresenius Kabi. Despite the negative effects, Group EBIT margin was 11.7% (Q2/24: 12.2%). The Helios Performance Programme is advancing with increasing contributions expected in the second half of the year.

Earnings per share2,4 rose by a strong 8%3 in constant currency to €0.73, driven by the operating strength and the significantly decreased interest expenses.

Following the announcement of Fresenius Medical Care AG (FME) in June 2025 to initiate a share buyback program, Fresenius intends to sell shares of FME on a pro rata basis to maintain its current stake of around 28.6% in FME. The final size and tranching of the sale of shares will be determined based on the structure of the share buyback program of FME. As previously announced, Fresenius remains a committed shareholder and will retain no less than 25 per cent plus one share of FME.

Fresenius will use the proceeds to invest in its core business in line with the #FutureFresenius strategy and Fresenius' stated capital allocation priorities, including further strengthening the balance sheet, reducing leverage, and delivering shareholder value and long-term growth.

1Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2Before special items

3Growth rate adjusted for Argentina hyperinflation

4Excluding Fresenius Medical Care

Operating Companies – Business development Q2/25

Fresenius Kabi delivered a strong performance; Growth Vectors with ongoing momentum, continued Biopharma strength; licensing agreement to commercialize a proposed vedolizumab biosimilar candidate

Organic revenue growth of 6%3 mainly driven by the Growth Vectors and the good contribution from Pharma; reflecting the less pronounced positive Argentina pricing effects; revenue was broadly flat at €2,111 million due to currency effects; increased by 5%2 in constant currency.

- Growth Vectors with good organic revenue3 increase of 7%: MedTech 5%, Nutrition 1%, Biopharma 33%.

- Nutrition revenue: €581 million, growth clearly influenced by the tender impact from the Volume Based Procurement (VBP) on Ketosteril in China (ex Ketosteril healthy organic growth in line with ambition range), good development in Latin America and Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

- Biopharma revenue: €190 million, positive development mainly driven by the Tyenne biosimilar ramp up in Europe and the U.S. as well as Idacio; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) launched in the U.S. and approved in Europe; expansion of autoimmune biosimilars portfolio: licensing agreement with Polpharma Biologics to commercialize a proposed vedolizumab biosimilar candidate (excluding region MENA).

- MedTech revenue: €392 million, increase driven by the expansion in Cell Therapy in the U.S., and solid growth in Europe.

- Pharma revenue: €947 million, strong organic revenue development3 with 5% growth based on good volumes including I.V. fluids in the U.S., and Europe with favourable pricing.

- EBIT1 of Fresenius Kabi with 5%2 constant currency increase to €346 million, driven by the strong margin development of the Pharma, MedTech and Biopharma business and ongoing improvements in the cost base. The EBIT margin1 was at the upper end of the guidance range at 16.4% despite transaction exchange rate effects and headwinds on the Nutrition business in China.

- EBIT1 of the Growth Vectors increased 3%2 in constant currency against the backdrop of the Ketosteril effect, and amounted to €166 million; EBIT margin1 at 14.3%.

- EBIT1 of Pharma increased 16%2 in constant currency to €206 million. EBIT margin1 was strong at 21.7% due to ongoing cost savings and some one-timers.

Fresenius Helios with solid organic revenue growth; expected softness in profitability at Helios Germany partially offset by good development at Helios Spain; Helios Performance Programme is advancing.

Strong 5% organic revenue growth driven by Helios Germany (6% organic growth); Helios Spain at 3% organic growth (H1/25: 5%) linked to the Easter effect, which resulted into less activity at the beginning of Q2/25 and impacted growth predominantly at Helios Spain; revenue before special items increased by 5% in constant currency to €3,370 million.

- Helios Germany with revenue1 of €2,001 million; growth mainly driven by price effects, as well as good activity levels and case mix.

- Helios Spain with revenue of €1,369 million, impacted by the Easter timing and currency translation effects related to the clinics in Latin America. The clinics in Latin America showed a good operational performance.

- EBIT1 of Fresenius Helios as expected declined -5% in constant currency to €337 million impacted by the absence of energy relief funds in Germany. This expected softness was partially compensated by the excellent profitability at Helios Spain. EBIT margin1 of Fresenius Helios was resilient at 10.0%.

- EBIT1 of Helios Germany decreased by -4% to €150 million against the high prior-year base which included energy relief funds; EBIT margin at 7.5% improved by 90 bps compared to Q4/24 (6.6%), the first quarter without energy relief funds.

- EBIT1 of Helios Spain decreased by -5% in constant currency to €189 million related to a very strong prior-year base and the Easter effect; EBIT margin1 at a strong 13.8%.

- Helios performance programme is advancing; ramp-up in H2/25 expected with more meaningful EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1Before special items

2Growth rate adjusted for Argentina hyperinflation.

3Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

Conference call and Audio webcast

As part of the publication of the Q2/2025 results, a conference call will be held on August 6, 2025 at

1:30 p.m. CEST / 7:30 a.m. EDT. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Contact for shareholders

Investor Relations

Telephone: + 49 61 72 6 08-24 87

Telefax: + 49 61 72 6 08-24 88

E-mail: ir-fre@fresenius.com

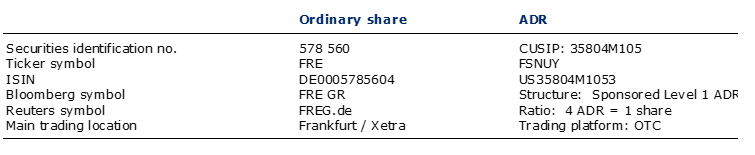

Information on Fresenius share and ADRs

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q2/2025.

- Consolidated results for Q2/25 as well as for Q2/24 include special items. An overview of the results for Q2/2025 - before and after special items – is available on our website.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q2/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius has published the Aide Memoire ahead of its Q2 2025 financial reporting. The Aide Memoire is a summary of relevant information that Fresenius has previously communicated previously to the capital market or otherwise made publicly available . The document may prove helpful in assessing Fresenius' financial performance ahead of the publication of quarterly results.

The Q2 2025 Aide Memoire is now available on the Fresenius Investor Relations website. The results of the second quarter and first half of 2025 of Fresenius SE & Co. KGaA will be published on 6 August 2025. The Quiet Period will start on 24 July 2025.

Fresenius announced today that its Operating Company Fresenius Kabi has introduced two new biosimilars in the U.S., Conexxence®(1) (denosumab-bnht) and Bomyntra®(2) (denosumab-bnht).

These denosumab biosimilars are approved by the FDA for all indications of the reference products, Prolia®(3) (denosumab) and Xgeva®(4) (denosumab), respectively. The biological medicines are used for the treatment of osteoporosis and other bone-related conditions.

This milestone represents Fresenius’ fifth and sixth biosimilars available in the U.S. It is a showcase of the company’s efforts to drive patient access to high-quality biological medicines. Earlier this year, Fresenius announced a global settlement with Amgen concerning its denosumab biosimilars. The company thereby continues the growth path of its BioPharma platform in line with #FutureFresenius.

Conexxence®(1) and Bomyntra®(2) are registered trademarks of Fresenius Kabi Deutschland GmbH in selected countries. Prolia®(3) and Xgeva®(4) are registered trademarks of Amgen Inc.

Read the full press release here.

Fresenius announced today that its Operating Company Fresenius Kabi has introduced two new biosimilars in the U.S., Conexxence®(1) (denosumab-bnht) and Bomyntra®(2) (denosumab-bnht).

These denosumab biosimilars are approved by the FDA for all indications of the reference products, Prolia®(3) (denosumab) and Xgeva®(4) (denosumab), respectively. The biological medicines are used for the treatment of osteoporosis and other bone-related conditions.

This milestone represents Fresenius’ fifth and sixth biosimilars available in the U.S. It is a showcase of the company’s efforts to drive patient access to high-quality biological medicines. Earlier this year, Fresenius announced a global settlement with Amgen concerning its denosumab biosimilars. The company thereby continues the growth path of its BioPharma platform in line with #FutureFresenius.

Conexxence®(1) and Bomyntra®(2) are registered trademarks of Fresenius Kabi Deutschland GmbH in selected countries. Prolia®(3) and Xgeva®(4) are registered trademarks of Amgen Inc.

Read the full press release here.

Fresenius‘ Sustainability Advisory Board met at Quirónsalud to experience how digital innovation and value-based healthcare are transforming medical care

Fresenius’ Sustainability Advisory Board (SAB) convened for its second meeting this year, with a focus on how our sustainability ambitions impact patients. Spanning June 2nd and 3rd, Michael Moser, member of the Fresenius management board and responsible for sustainability management, invited the SAB to Madrid, where our external sustainability experts were joined by representatives of the Fresenius Supervisory Board and experts from Group and Quirónsalud.

“Delivering the highest quality in our products and services – always with a clear focus on patient needs and satisfaction — is a core pillar of our sustainability strategy. It’s inspiring to see how our colleagues at Quirónsalud are embracing digitalization to enhance diagnostics and treatments while elevating the patient experience. We’re not just improving care, we’re transforming it - for the benefit of our patients,“ emphasized Michael Moser.

Firsthand insights into leading healthcare institutions

During their visit, the participants gained hands-on insights into how our commitment to high-quality, human-centered care is brought to life. They toured two Quirónsalud hospitals, both of which rank among Spain’s leading healthcare institutions: the Jiménez Díaz Foundation University Hospital, with over 90 years of history and a legacy as a pioneer in research and surgery, offering highly specialized, multidisciplinary care; and the University Hospital Rey Juan Carlos, known for its modern infrastructure and patient-focused design, which continues to attract a growing number of patients each year.

A highlight of the visit was a tour of the operating rooms. There, participants observed how surgical workflows are managed with exceptional precision. Processes are optimized for timing, minimized wait times, improved patient safety, and full traceability through digital health tools. “This high level of efficiency not only ensures excellent clinical outcomes but also enables the hospital to increase the number of patients who trust us year after year, ultimately improving access to care for those who need it,” said Javier Arcos, General Manager of the Fundación Jiménez Díaz.

Another standout moment was the live demonstration of Casiopea, an integrated digital platform, and Scribe, an AI-powered tool designed to automate doctor-patient interview transcriptions. The implementation of these solutions boosts operational efficiency and enhances the quality of care and patient experience.

The meeting also focused on Quirónsalud’s strategic approach to quality management and its experience in implementing the Value-Based Healthcare (VBHC) model. This care model is characterized by a holistic treatment approach - enabled by cross-functional collaboration and a consistent focus on treatment outcomes, supported by measurable goals and metrics, and digital tools. Quirónsalud has been implementing this model since 2020.

Fiona Adshead, member of the SAB and current Chair of the Sustainable Healthcare Coalition, welcomed the company’s efforts: “From my perspective, Quirónsalud is on the right path putting patients at the center of care by embracing the value-based care model. Their inspirational approach of using data and technology to transform care is delivering tangible benefits for patients, optimizing health system resource use, and supporting sustainable business success.”

The Sustainability Advisory Board

The Sustainability Advisory Board is aiding Fresenius in further developing our sustainability program. It consists of four leading international experts – Anahita Thoms (Baker McKenzie), Fiona Adshead (Sustainability Healthcare Coalition), Fabian Kienbaum (Kienbaum) and Judith Walls (University of St. Gallen), who are highly knowledgeable in Fresenius' key areas of action in the field of sustainability: from the design and implementation of health concepts and climate protection, through corporate sustainability principles, to future-oriented management, sustainable leadership, and sustainability transformation.

To provide the best possible guidance, the SAB meets regularly with Fresenius experts and conducts on-site visits to gain a direct understanding of local practices and progress.

We are Fresenius

Anke Schmidt (55) has been appointed Head of Corporate Communications at Fresenius, effective June 1, 2025. She will succeed Dennis Hofmann, who has headed the global communications function at Fresenius since September 2022 and has decided to leave the company on his own request to pursue new opportunities. Anke Schmidt will report directly to the CEO of Fresenius, Michael Sen.

“With Anke Schmidt we have won an internationally experienced and highly recognized communications expert for Fresenius. With her many years of experience at DAX 40 companies, she will further strengthen our positioning as a leading global healthcare company and continue to build our brand, while also driving the strategic development of the communications function. Especially in this current phase of #FutureFresenius, Rejuvenate, it is about setting new impulses to shape an innovative, relevant, and sustainably successful Fresenius,” says Michael Sen, CEO of Fresenius. “Dennis Hofmann has reorganized and strengthened the global communications function at Fresenius in recent years. Under his leadership, the communications team played a decisive role in positioning Fresenius in the initial phase of its transformation. I would like to sincerely thank him for his great work and commitment and to wish him all the best for his future endeavors.”

Before joining Fresenius, Anke Schmidt served as Global Vice President Corporate Communications & Government Relations at Beiersdorf from 2020 onwards. Prior to that, she spent 24 years in various senior roles in Communications, Government Relations, and Human Resources at BASF, both in Germany and abroad. From 2016 to 2020, she was responsible for BASF Group’s Corporate Communications & Government Relations. Anke Schmidt studied French, economics, and political science at the University of Hamburg and the Université de Nantes in France.

# # #

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) is a global healthcare company headquartered in Bad Homburg v. d. Höhe, Germany. In the 2024 fiscal year, Fresenius generated €21.5 billion in annual revenue. Fresenius currently counts over 176,000 employees. The Fresenius Group comprises the operating companies Fresenius Kabi and Fresenius Helios as well as an investment in Fresenius Medical Care. With around 140 hospitals and countless outpatient facilities, Fresenius Helios is the leading private hospital operator in Germany and Spain, treating around 26 million patients every year. Fresenius Kabi’s product portfolio touches the lives of 450 million patients annually and includes a range of highly complex biopharmaceuticals, clinical nutrition, medical technology, and intravenous generic drugs and fluids. Fresenius was established in 1912 by the Frankfurt pharmacist Dr. Eduard Fresenius. After his death, Else Kröner took over management of the company in 1952. She laid the foundations for a global enterprise that today pursues the goal of improving people’s health. The largest shareholder is the non-profit Else Kröner-Fresenius Foundation, which is dedicated to advancing medical research and supporting humanitarian projects.

For more information visit the Company’s website at www.fresenius.com.

Visit our media center: www.fresenius.com/media-center

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

Pagination

- Previous page

- Page 3

- Next page