September 13, 2018

New York, USA

Morgan Stanley – 16th Annual Global Healthcare Conference

September 05, 2018

London, UK

Goldman Sachs – 15th Annual European Medtech and Healthcare Services Conference

September 5 – 6, 2018

August 23, 2018

Stockholm, Sweden

Deutsche Bank – dbAccess European Corporate Days Stockholm

If no timeframe is specified, information refers to H1/2018

Q2/2018:

- Sales: €8.4 billion (-2%, +5% in constant currency1)

- EBIT2: €1,145 million (-3%, +2% in constant currency)

- EBIT2 (excl. biosimilars business): €1,182 million (0%, +5% in constant currency)

- Net income2,3: €472 million (+3%, +7% in constant currency)

- Net income2,3 (excl. biosimilars business): €499 million (+9%, +12% in constant currency)

H1/2018:

- Sales: €16.5 billion (-2%, +6% in constant currency1)

- EBIT2: €2,199 million (-8%, -2% in constant currency)

- EBIT2: (excl. biosimilars business) €2,271 million (-5%, +1% in constant currency)

- Net income2,3: €922 million (+1%, +7% in constant currency)

- Net income2,3 (excl. biosimilars business): €975 million (+6%, +12% in constant currency)

1 Growth rate adjusted for IFRS 15 adoption (Q2/17 base: €8,401 million; H1/2017 base: €16,624 million)2 Before special items (i.e., expenses related to the Akorn transaction, gains related to divestitures of Care Coordination activities)3 Net income attributable to shareholders of Fresenius SE & Co. KGaAFor a detailed overview of special items please see the reconciliation tables on pages 19 - 20 in the PDF document.

Stephan Sturm, CEO of Fresenius, said: “The first half of 2018 was a very good one for Fresenius. After our successful start, we have delivered a strong second quarter with continued healthy growth in sales and earnings. All four business segments contributed to this, and all four business segments display outstanding prospects for the future. For Fresenius Kabi, we are even a bit more optimistic than before. We are therefore fully on track to achieve our ambitious growth targets as we steer toward another excellent year for Fresenius.”

Group guidance1 for 2018 confirmed

Fresenius confirms its guidance for 2018. Group sales are expected to increase by 5% to 8%2 in constant currency. Net income3,4 is expected to grow by 6% to 9% in constant currency. Excluding expenditures for the further development of the biosimilars business, net income3,5 is expected to grow by ~10% to 13% in constant currency.

Fresenius expects to further reduce its net debt/EBITDA ratio6 by year-end 2018.

6% sales growth in constant currency7

Group sales decreased by 1%7 (increased by 6%7 in constant currency) to €16,503 million (H1/2017: €16,894 million). Organic sales growth was 4%. Acquisitions/divestitures contributed net 2% to growth. Negative currency translation effects (7%) were mainly driven by the devaluation of the U.S. dollar and the Chinese yuan against the euro. In Q2/2018, Group sales were nearly unchanged7 (increased 5%7 in constant currency) at €8,382 million (Q2/2017: €8,532 million). Organic sales growth was 4%. Acquisitions/divestitures contributed net 1% to growth.

1 Excluding expenses related to the Akorn and NxStage transactions and gains from divestitures of Care Coordination activities 2 2017 base adjusted for IFRS 15 adoption (deduction of €486 million at Fresenius Medical Care) and divestitures of Care Coordination activities (deduction of €558 million at Fresenius Medical Care) 3 Net income attributable to shareholders of Fresenius SE & Co. KGaA4 2017 base: €1,804 million; 2018 before special items; including expenditures for further development of biosimilars business (€43 million after tax in FY/17 and ~€120 million after tax in FY/18)5 2017 base: €1,847 million; 2018 before special items6 Calculated at expected annual average exchange rates for both net debt and EBITDA; excluding effects of the Akorn and NxStage transactions and gains from divestitures of Care Coordination activities; excluding further potential acquisitions; at current IFRS rules7 Growth rates adjusted for IFRS 15 adoption (H1/17 base: €16,624 million; Q2/17 base: €8,401 million)

Group sales by region:

7% net income1,2 growth in constant currency

Group EBITDA2 decreased by 6% (0% in constant currency) to €2,912 million (H1/2017: €3,098 million). Group EBIT2 decreased by 8% (-2% in constant currency) to €2,199 million (H1/2017: €2,393 million). The prior-year period saw the compensation for treatments of U.S. war veterans (“VA agreement”) contributing €91 million as a one-time effect. Excluding the VA agreement, EBIT2 increased by 2% in constant currency in H1/2018. The EBIT margin2 was 13.3% (13.1% before IFRS 15; H1/17: 14.2%). Group EBIT2 before expenses for the further development of the biosimilars business decreased by 5% (increased 1% in constant currency) to €2,271 million. Group EBIT2 excluding the VA agreement and expenses for the biosimilars business increased by 5% in constant currency.

In Q2/2018, Group EBIT2 decreased by 3% (increased 2% in constant currency) to €1,145 million (Q2/2017: €1,177 million), with an EBIT margin2 of 13.7% (13.4% before IFRS 15; Q2/2017: 13.8%). Group EBIT2 excluding expenses for the biosimilars business increased by 5% in constant currency.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Group net interest2 was -€297 million (H1/2017: -€326 million). The decrease is mainly driven by currency effects and reduced interest following refinancing activities.

The decrease of the Group tax rate before special items to 22.3% (H1/2017: 28.5%) was mainly due to the U.S. tax reform. In Q2/2018, the Group tax rate2 was 23.4% (Q2/2017: 27.9%).

Noncontrolling interest2 was €556 million (H1/2017: €562 million), of which 95% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income1,2 increased by 1% (7% in constant currency) to €922 million (H1/2017: €916 million). Earnings per share1,2 increased by 1% (7% in constant currency) to €1.66 (H1/2017: €1.65). In Q2/2018, Group net income1,2 increased by 3% (7% in constant currency) to €472 million (Q2/2017: €459 million). Earnings per share1,2 increased by 3% (7% in constant currency) to €0.85 (Q2/2017: €0.82).

Group net income1,2 before expenses for the further development of the biosimilars business increased by 6% (12% in constant currency) to €975 million (H1/2017: €916 million). Earnings per share1,2 before expenses for the further development of the biosimilars business increased by 6% (12% in constant currency) to €1.76 (H1/2017: €1.65). In Q2/2018, Group net income1,2 before expenses for the further development of the biosimilars business increased by 9% (12% in constant currency) to €499 million (Q2/2017: €459 million). Earnings per share1,2 before expenses for the further development of the biosimilars business increased by 9% (12% in constant currency) to €0.90 (Q2/2017: €0.82).

Group net income1 after special items increased by 20% (29% in constant currency) to €1,092 million (H1/2017: €907 million), mainly due to gains related to divestitures in Care Cordination activities at Fresenius Medical Care. Earnings per share1 after special items increased by 20% (29% in constant currency) to €1.97 (H1/2017: €1.64). In Q2/2018, Group net income1 after special items increased by 45% (54% in constant currency) to €652 million (Q2/2017: €450 million). Earnings per share1 after special items increased by 45% (54% in constant currency) to €1.18 (Q2/2017: €0.81).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Continued investment in growth

Spending on property, plant and equipment was €831 million (H1/2017: €709 million), primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics. This corresponds to 5.0% of sales.

Total acquisition spending was €386 million (H1/2017: €6,421 million). The prior-year period included the acquisition of Quirónsalud.

Cash flow development

Operating cash flow decreased by 25% to €1,256 million (H1/2017: €1,683 million) with a margin of 7.6% (H1/2017: 10.0%). The decrease is mainly due to two effects at Fresenius Medical Care in North America: Receipt of a ~€200 million payment under the VA agreement in the prior-year period as well as increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle. Moreover negative currency translation effects weighed on the cash flow development in H1/2018. Operating cash flow in Q2/2018 decreased by 15% to €1,020 million (Q2/2017: €1,207 million), with a margin of 12.2% (Q2/2017: 14.1%). Negative currency translation effects weighed on the cash flow development in Q2/2018.

Given the effects described above and growing investments, free cash flow before acquisitions and dividends decreased to €425 million (H1/2017: €998 million). Free cash flow after acquisitions and dividends was €942 million (H1/2017: -€5,645 million).

Solid balance sheet structure

The Group’s total assets increased by 3% (3% in constant currency) to €54,982 million (Dec. 31, 2017: €53,133 million). Current assets grew by 13% (13% in constant currency) to €14,287 million (Dec. 31, 2017: €12,604 million). Non-current assets were nearly unchanged (decreased by 1% in constant currency) at €40,695 million (Dec. 31, 2017: € 40,529 million).

Total shareholders’ equity increased by 7% (6% in constant currency) to €23,269 million (Dec. 31, 2017: €21,720 million). The equity ratio increased to 42.3% (Dec. 31, 2017: 40.9%).

Group debt was nearly unchanged (decreased by 1% in constant currency) at €18,989 million (Dec. 31, 2017: € 19,042 million). Group net debt decreased by 4% (-5% in constant currency) to € 16,722 million (Dec. 31, 2017: € 17,406 million) mainly due to the proceeds from divestitures of Care Coordination activities.

As of June 30, 2018, the net debt/EBITDA ratio was 2.801,2 (December 31, 2017: 2.841,2). Excluding the proceeds from divestitures of Care Coordination activities the net debt/EBITDA ratio was 3.021,2.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, excluding Akorn and NxStage transactions2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Increased number of employees

As of June 30, 2018, the number of employees was 273,632 (Dec. 31, 2017: 273,249).

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of June 30, 2018, Fresenius Medical Care was treating 325,188 patients in 3,815 dialysis clinics. Along with its core business, the company provides related medical services in the field of Care Coordination.

- Q2/2018 reported results significantly positively influenced by divestitures of Care Coordination activities

- 5% adjusted1,2 sales growth in constant currency in Q2

- 6% adjusted4,6 net income growth in constant currency in Q2

- 22% net income growth in constant currency on a comparable basis4,7 in Q2

Reported sales were strongly impacted by headwinds from foreign exchange rates and by the already anticipated decline in Fresenius Medical Care North America’s pharmacy business. Sales decreased by 9% (increased by 3%1 in constant currency) to €8,189 million (H1/2017: €9,019 million). Organic sales growth was 3%. Currency translation effects reduced sales by 9%. Adoption of IFRS 15 reduced sales by 3%. Excluding the VA agreement in the prior-year quarter, sales growth1 was 4% in constant currency.

1 Growth rate adjusted for IFRS 15 implementation (Q2/17 base: €4,340 million; H1/17 base: €8,749 million)2 Excluding VA agreement: Q2/2018: 5%; H1/2018: 4%3 Adjusted for gains from divestitures of Care Coordination activities: Q2/2018: 4%;H1/2018: -5%4 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA5 Adjusted for gains from divestitures of Care Coordination activities and the effect of the U.S. Tax Reform: Q2/2018: 8%; H1/2018: -3%6 Consistent with guidance, i.e. excluding gains from divestitures of Care Coordination activities, excluding the effect of the U.S. Tax Reform and excluding VA agreement7 Consistent with guidance, i.e. excluding gains from divestitures of Care Coordination activities, including the effect of the U.S. Tax Reform and including VA agreement

In Q2/2018, sales decreased by 6% (increased 5%1 in constant currency) to €4,214 million (Q2/2017: €4,471 million). Organic sales growth was 4%. Currency translation effects reduced sales by 8%. Adoption of IFRS 15 reduced sales by 3%.

Health Care services sales (dialysis services and care coordination) decreased by 8%1 (increased by 3%1 in constant currency) to €6,594 million (H1/2017: €7,418 million). With €1,595 million (H1/2017: €1,601 million), Health Care product sales were on prior-year’s level (increased by 6% in constant currency).

In North America, sales decreased by 9%1 (increased by 1%1 in constant currency) to €5,746 million (H1/2017: €6,600 million). Health Care services sales decreased by 9%1 (increased by 1%1 in constant currency) to €5,351 million (H1/2017: €6,182 million). Excluding the 2017 effect from the VA Agreement (€98 million), Health Care services sales increased by 3%1 in constant currency. Health Care product sales decreased by 5% (increased by 6% in constant currency) to €395 million (H1/2017: €418 million).

Sales outside North America increased by 1% (8% in constant currency) to €2,436 million (H1/2017: €2,410 million). Health Care services sales increased by 1% (10% in constant currency) to €1,243 million (H1/2017: €1,236 million). Health Care product sales increased by 2% (7% in constant currency) to €1,193 million (H1/2017: €1,174 million).

Fresenius Medical Care’s EBIT increased by 54% (68% in constant currency) to €1,898 million (H1/2017: €1,235 million), driven by the divestitures of Care Coordination activities in Q2/18. The EBIT margin increased to 23.2% (H1/2017: 13.7%). Adjusted for the implementation of IFRS 15 and excluding the gains from divestitures of Care Coordination activities and the VA agreement in the prior-year period, EBIT increased by 3% in constant currency and EBIT margin was 13.2% (H1/2017: 13.2%). In Q2/2018, EBIT increased by 140% (increased by 162% in constant currency) to €1,401 million (Q2/2017: €583 million). The EBIT margin increased to 33.3% (Q2/2017: 13.0%). Adjusted for the adoption of IFRS 15 and excluding the gains from divestitures of Care Coordination activities, EBIT increased by 4% in constant currency and EBIT margin increased to 13.5%.

1 Growth rate adjusted for IFRS 15 implementation (Q2/17: -€131 million; H1/17: -€270 million)

Net income1 increased by 121% (141% in constant currency) to €1,273 million (H1/2017: €577 million). Consistent with full-year guidance, i.e. excluding the gains from divestitures of Care Coordination activities, the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, net income growth1 was 7% in constant currency. Net income1 growth on a comparable basis, i.e. excluding the gains from divestitures of Care Coordination activities, but including the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, was 13% in constant currency.

In Q2/2018, net income1 grew by 270% (303% in constant currency) to €994 million (Q2/2017: €269 million). Consistent with full-year guidance, i.e. excluding the gains from divestitures of Care Coordination activities, the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, net income growth1 was 6% in constant currency. Net income1 growth on comparable basis, i.e. excluding the gains from divestitures of Care Coordination activities, but including the effect of the U.S. Tax Reform and the VA agreement in the prior-year period was 22% in constant currency.

Operating cash flow was €611 million (H1/2017: €1,052 million). The cash flow margin was 7.5% (H1/2017: 11.7%). The decrease is mainly due to two effects in North America: Receipt of a ~€200 million payment under the VA agreement in the prior-year period as well as increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle. In Q2/2018, operating cash flow was €656 million (Q2/2017: €882 million) with a cash flow margin of 15.6% (Q2/2017: 19.7%).

Fresenius Medical Care confirms its outlook for 2018 and expects sales growth of 5 to 7%2 in constant currency and net income1 comparable growth of 13% to 15%3 in constant currency (7% to 9%4 adjusted net income growth).

The 2018 growth targets are based on 2017 figures and exclude effects from the planned acquisition of NxStage Medical and gains from divestitures of Care Coordination activities.

For further information, please see Fresenius Medical Care’s Press Release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 2017 base: €16,739 million (adjusted for IFRS 15 adoption (-€486 million) and excluding Sound´s revenue for H2/2017 (-€558 million))

3 2017 base: €1,242 million, excluding Sound´s H2/17 net income (-€38 million); 2018 including benefits from U.S. tax reform but excluding gains from divestitures of Care Coordination activities

4 Excluding gains from divestitures of Care Coordination activities, excluding the effect of the U.S. Tax Reform natural disaster, FCPA related charge and excluding VA agreement

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, we are developing products with a focus on oncology and autoimmune diseases.

- 6% organic sales growth and 11% EBIT1 growth in constant currency (excluding biosimilars business) in Q2

- European Commission confirms marketing authorizations of HES subject to the implementation of risk minimization measures

- Sales outlook confirmed: 4% to 7% organic sales growth expected

- EBIT outlook raised: -2% to +1%5 EBIT growth in constant currency expected (~6% to 9%6 excl. biosimilars expenses)

Sales of €3,207 million (H1/2017: €3,202 million) were on prior-year level (increased by 7% in constant currency). Organic sales growth was 7%. Strong negative currency translation effects (-7%) were mainly related to the devaluation of the U.S. dollar, the Brazilian real and the Chinese yuan against the euro. In Q2/2018, sales of €1,604 million were nearly unchanged (increased by 6% in constant currency) from the prior-year level (Q2/2017: €1,598 million). Organic sales growth was 6%.

Sales in Europe grew by 2% (organic growth: 3%) to €1,120 million (H1/2017: €1,097 million). In Q2/2018, sales increased by 2% (organic growth: 3%) to €563 million (Q2/2017: €553 million).

Sales in North America decreased by 4% (organic growth: 7%) to €1,140 million (H1/2017: €1,187 million). In Q2/2018, sales decreased by 3% (organic growth: 4%) to €549 million (Q2/2017: €568 million).

1 Before special items2 Before expenses for the further development of the biosimilars business: Q2/2018: 11%; H1/2018: 10%3 Net income attributable to shareholders of Fresenius SE & Co. KGaA4 Before expenses for the further development of the biosimilars business: Q2/2018: 19%; H1/2018: 17%5 2017 base: €1,177 million; 2017 & 2018 before special items, including expenditures for the further development of the biosimilars business (€60 million in FY/17, and expected expenditures of ~€160 million in FY/18)6 2017 base: €1,237 million; 2017 & 2018 before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Sales in Asia-Pacific increased by 8% (organic growth: 13%) to €627 million (H1/2017: €582 million). In Q2/2018, sales increased by 8% (organic growth: 11%) to €326 million (Q2/2017: €302 million). Sales in Latin America/Africa decreased by 5% (organic growth: 10%) to €320 million (H1/2017: €336 million). In Q2/2018, sales decreased by 5% (organic growth: 10%) to €166 million (Q2/2017: €175 million).

EBIT1 decreased by 10% (-1% in constant currency) to €557 million (H1/2017: €622 million) with an EBIT margin1 of 17.4% (H1/2017: 19.4%). In Q2/2018, EBIT1 decreased by 6% (-1% in constant currency) to €289 million (Q2/2017: €309 million) with an EBIT margin1 of 18.0% (Q2/2017: 19.3%).

EBIT1 before expenses for the further development of the biosimilars business increased by 1% (10% in constant currency) to €629 million (H1/2017: €622 million) with an EBIT margin1 of 19.6% (H1/2017: 19.4%). In Q2/2018, EBIT1 before expenses for the further development of the biosimilars business increased by 6% (11% in constant currency) to €326 million (Q2/2017: €309 million) with an EBIT margin1 of 20.3% (Q2/2017: 19.3%).

Net income1,2 decreased by 6% (increased by 4% in constant currency) to €355 million (H1/2017: €379 million). In Q2/2018, net income1,2 decreased by 2% (increased by 5% in constant currency) to €185 million (Q2/2017: €188 million).

Operating cash flow increased by 15% to €454 million (H1/2017: €395 million). The cash flow margin grew to 14.2% (H1/2017: 12.3%). In Q2/2018, operating cash flow increased by 12% to €228 million (Q2/2017: €203 million) with a cash flow margin of 14.2% (Q2/2017: 12.7%).

1 Before special items2 Net income attributable to shareholders of Fresenius SE & Co. KGaAFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Based on the strong development of Fresenius Kabi in H1/2018 and the reversal of some HES1 associated risk adjustments, Fresenius Kabi raises its EBIT outlook for 2018 by 4%-points and now expects EBIT growth in constant currency of -2% to +1%2 (previously: -6% to -3%2 in constant currency). Excluding expenditures for the further development of the biosimilars business, EBIT is now expected to grow by ~6% to 9%3 in constant currency (previously: ~2% to 5%3 in constant currency). Fresenius Kabi confirms its sales guidance of 4% to 7% organic growth.

1 Hydroxyethyl starch (HES)2 2017 base: €1,177 million; 2017 & 2018 before special items, including expenditures for the further development of the biosimilars business (€60 million in FY/17 and expected expenditures of ~€160 million in FY/18)3 2017 base: €1,237 million; 2017 & 2018 before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain (Quirónsalud). Helios Germany operates 87 acute care hospitals, 89 outpatient centers and treats approximately 5.2 million patients annually. Quirónsalud operates 45 hospitals, 56 outpatient centers and around 300 occupational risk prevention centers, and treats approximately 11.6 million patients annually.

- 4% organic sales growth in Q2

- DRG catalogue effects and preparatory structural activities for anticipated regulatory measures weigh on financial performance of Helios Germany

- Helios Spain with accelerated growth: 8% organic sales growth and 19% EBIT growth in Q2

- 2018 outlook confirmed

Fresenius Helios increased sales by 10% to €4,674 million (H1/2017: €4,256 million). Organic sales growth was 4%. In Q2/2018, sales increased by 5% (organic growth: 4%) to €2,343 million (Q2/2017: €2,238 million).

Sales of Helios Germany increased by 3% (organic growth: 3%) to €3,121 million (H1/2017: €3,038 million). In Q2/2018, sales increased by 2% (organic growth: 3%) to €1,547 million (Q2/2017: €1,510 million). Helios Spain increased sales by 28% (organic growth: 5%) to €1,553 million (H1/2017: €1,218 million), mainly due to the additional month of consolidation compared to the prior-year period (Quirónsalud is consolidated since February 1, 2017). In Q2/2018 Helios Spain increased sales by 9% (organic growth: 8%) to €796 million (Q2/2017: €728 million).

Fresenius Helios grew EBIT by 6% to €571 million (H1/2017: €537 million) with a margin of 12.2% (H1/2017: 12.6%). In Q2/2018, EBIT increased by 4% to €293 million (Q2/2017: €282 million) with a margin of 12.5% (Q2/2017: 12.6%).

EBIT of Helios Germany decreased by 4% to €345 million (H1/2017: €359 million) with a margin of 11.1% (H1/2017: 11.8%). The decline is mainly due to additional catalogue effects, preparatory structural activities for anticipated regulatory requirements (i.e. clustering) as well as a lack of privatization opportunities in the German market. In Q2/2018, EBIT decreased by 6% to €168 million (Q2/2017: €178 million) with a margin of 10.9% (Q2/2017: 11.8%).

EBIT of Helios Spain increased by 28% to €227 million (H1/2017: €178 million), mainly due to the additional month of consolidation compared to the prior-year period, with a margin of 14.6% (H1/2017: 14.6%). In Q2/2018, EBIT increased by 19% to €124 million (Q2/2017: €104 million) with a margin of 15.6% (Q2/2017: 14.3%).

Net income1 of Fresenius Helios increased by 4% to €388 million (H1/2017: €373 million). In Q2/2018, net income1 increased by 3% to €197 million (Q2/2017: €192 million).

Operating cash flow was €259 million (H1/2017: €304 million) with a margin of 5.5% (H1/2017: 7.1%).

The already announced transfer of the in-patient post-acute care business from Fresenius Helios to Fresenius Vamed has become effective as of July 1, 2018. As a consequence, Fresenius Helios’ EBIT growth outlook for 2018 was adjusted to 5% to 8% (previously: 7% to 10%).

Fresenius Helios confirms its outlook for 2018 and expects organic sales growth of 3% to 6% and EBIT growth of 5% to 8%.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management.

- Service business with continued good momentum: 11% sales growth in Q2

- Project business with good order intake of €195 million in Q2

- Transfer of inpatient post-acute care business from Helios Germany to Vamed as of July 1, 2018

- 2018 outlook confirmed

Sales increased by 7% (7% in constant currency) to €515 million (H1/2017: €481 million). Organic sales growth was 5%. Sales in the project business increased by 4% to €191 million (H1/2017: €184 million). Sales in the service business grew by 9% to €324 million (H1/2017: €297 million). In Q2/2018, sales increased by 3% (organic growth: 1%) to €266 million (Q2/2017: €258 million).

EBIT increased by 6% to €18 million (H1/2017: €17 million) with a margin of 3.5% (H1/2017: 3.5%). In Q2/2018, EBIT increased by 9% to €12 million (Q2/2017: €11 million) with a margin of 4.5% (Q2/2017: 4.3%).

Net income1 of €11 million was unchanged from prior-year’s level. In Q2/2018, net income1 was also unchanged at €7 million.

Order intake increased by 10% to €455 million (H1/2017: €412 million). As of June 30, 2018, order backlog was €2,372 million (December 31, 2017: €2,147 million).

The already announced transfer of the in-patient post-acute care business from Fresenius Helios to Fresenius Vamed has become effective as of July 1, 2018. As a consequence, Fresenius Vamed’s EBIT growth outlook for 2018 was adjusted to 32% to 37% (previously: 5% to 10%).

Fresenius Vamed confirms its outlook for 2018 and expects organic sales growth in the range of 5% to 10% and EBIT growth of 32% to 37%.

1 Net income attributable to shareholders of VAMED AG

Conference Call

As part of the publication of the results for the second quarter / first half of 2018, a conference call will be held on July 31, 2018 at 2 p.m. CET (8 a.m. EST). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/media-calendar. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

If no timeframe is specified, information refers to H1/2018

Q2/2018:

- Sales: €8.4 billion (-2%, +5% in constant currency2 )

- EBIT2: €1,145 million (-3%, +2% in constant currency)

- EBIT2 (excl. biosimilars business): €1,182 million (0%, +5% in constant currency)

- Net income2,3: €472 million (+3%, +7% in constant currency)

- Net income2,3 (excl. biosimilars business): €499 million (+9%, +12% in constant currency)

H1/2018:

- Sales: €16.5 billion (-2%, +6% in constant currency1)

- EBIT2: €2,199 million (-8%, -2% in constant currency)

- EBIT2: (excl. biosimilars business) €2,271 million (-5%, +1% in constant currency)

- Net income2,3: €922 million (+1%, +7% in constant currency)

- Net income2,3 (excl. biosimilars business): €975 million (+6%, +12% in constant currency)

1 Growth rate adjusted for IFRS 15 adoption (Q2/17 base: €8,401 million; H1/2017 base: €16,624 million)2 Before special items (i.e., expenses related to the Akorn transaction, gains related to divestitures of Care Coordination activities) 3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Group guidance1 for 2018 confirmed

Fresenius confirms its guidance for 2018. Group sales are expected to increase by 5% to 8%2 in constant currency. Net income3,4 is expected to grow by 6% to 9% in constant currency. Excluding expenditures for the further development of the biosimilars business, net income3,5 is expected to grow by ~10% to 13% in constant currency.

Fresenius expects to further reduce its net debt/EBITDA ratio6 by year-end 2018.

6% sales growth in constant currency7

Group sales decreased by 1%7 (increased by 6%7 in constant currency) to €16,503 million (H1/2017: €16,894 million). Organic sales growth was 4%. Acquisitions/divestitures contributed net 2% to growth. Negative currency translation effects (7%) were mainly driven by the devaluation of the U.S. dollar and the Chinese yuan against the euro. In Q2/2018, Group sales were nearly unchanged7 (increased 5%7 in constant currency) at €8,382 million (Q2/2017: €8,532 million). Organic sales growth was 4%. Acquisitions/divestitures contributed net 1% to growth.

1 Excluding expenses related to the Akorn and NxStage transactions and gains from divestitures of Care Coordination activities2 2017 base adjusted for IFRS 15 adoption (deduction of €486 million at Fresenius Medical Care) and divestitures of Care Coordination activities (deduction of €558 million at Fresenius Medical Care)3 Net income attributable to shareholders of Fresenius SE & Co. KGaA4 2017 base: €1,804 million; 2018 before special items; including expenditures for further development of biosimilars business (€43 million after tax in FY/17 and ~€120 million after tax in FY/18) 5 2017 base: €1,847 million; 2018 before special items 6 Calculated at expected annual average exchange rates for both net debt and EBITDA; excluding effects of the Akorn and NxStage transactions and gains from divestitures of Care Coordination activities; excluding further potential acquisitions; at current IFRS rules 7 Growth rates adjusted for IFRS 15 adoption (H1/17 base: €16,624 million; Q2/17 base: €8,401 million)

7% net income1,2 growth in constant currency

Group EBITDA2 decreased by 6% (0% in constant currency) to €2,912 million (H1/2017: €3,098 million). Group EBIT2 decreased by 8% (-2% in constant currency) to €2,199 million (H1/2017: €2,393 million). The prior-year period saw the compensation for treatments of U.S. war veterans (“VA agreement”) contributing €91 million as a one-time effect. Excluding the VA agreement, EBIT2 increased by 2% in constant currency in H1/2018. The EBIT margin2 was 13.3% (13.1% before IFRS 15; H1/17: 14.2%). Group EBIT2 before expenses for the further development of the biosimilars business decreased by 5% (increased 1% in constant currency) to €2,271 million. Group EBIT2 excluding the VA agreement and expenses for the biosimilars business increased by 5% in constant currency.

In Q2/2018, Group EBIT2 decreased by 3% (increased 2% in constant currency) to €1,145 million (Q2/2017: €1,177 million), with an EBIT margin2 of 13.7% (13.4% before IFRS 15; Q2/2017: 13.8%). Group EBIT2 excluding expenses for the biosimilars business increased by 5% in constant currency.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA 2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Group net interest2 was -€297 million (H1/2017: -€326 million). The decrease is mainly driven by currency effects and reduced interest following refinancing activities.

The decrease of the Group tax rate before special items to 22.3% (H1/2017: 28.5%) was mainly due to the U.S. tax reform. In Q2/2018, the Group tax rate2 was 23.4% (Q2/2017: 27.9%).

Noncontrolling interest2 was €556 million (H1/2017: €562 million), of which 95% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income1,2 increased by 1% (7% in constant currency) to €922 million (H1/2017: €916 million). Earnings per share1,2 increased by 1% (7% in constant currency) to €1.66 (H1/2017: €1.65). In Q2/2018, Group net income1,2 increased by 3% (7% in constant currency) to €472 million (Q2/2017: €459 million). Earnings per share1,2 increased by 3% (7% in constant currency) to €0.85 (Q2/2017: €0.82).

Group net income1,2 before expenses for the further development of the biosimilars business increased by 6% (12% in constant currency) to €975 million (H1/2017: €916 million). Earnings per share1,2 before expenses for the further development of the biosimilars business increased by 6% (12% in constant currency) to €1.76 (H1/2017: €1.65). In Q2/2018, Group net income1,2 before expenses for the further development of the biosimilars business increased by 9% (12% in constant currency) to €499 million (Q2/2017: €459 million). Earnings per share1,2 before expenses for the further development of the biosimilars business increased by 9% (12% in constant currency) to €0.90 (Q2/2017: €0.82).

Group net income1 after special items increased by 20% (29% in constant currency) to €1,092 million (H1/2017: €907 million), mainly due to gains related to divestitures in Care Cordination activities at Fresenius Medical Care. Earnings per share1 after special items increased by 20% (29% in constant currency) to €1.97 (H1/2017: €1.64). In Q2/2018, Group net income1 after special items increased by 45% (54% in constant currency) to €652 million (Q2/2017: €450 million). Earnings per share1 after special items increased by 45% (54% in constant currency) to €1.18 (Q2/2017: €0.81).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Continued investment in growth

Spending on property, plant and equipment was €831 million (H1/2017: €709 million), primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics. This corresponds to 5.0% of sales.

Total acquisition spending was €386 million (H1/2017: €6,421 million). The prior-year period included the acquisition of Quirónsalud.

Cash flow development

Operating cash flow decreased by 25% to €1,256 million (H1/2017: €1,683 million) with a margin of 7.6% (H1/2017: 10.0%). The decrease is mainly due to two effects at Fresenius Medical Care in North America: Receipt of a ~€200 million payment under the VA agreement in the prior-year period as well as increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle. Moreover negative currency translation effects weighed on the cash flow development in H1/2018. Operating cash flow in Q2/2018 decreased by 15% to €1,020 million (Q2/2017: €1,207 million), with a margin of 12.2% (Q2/2017: 14.1%). Negative currency translation effects weighed on the cash flow development in Q2/2018.

Given the effects described above and growing investments, free cash flow before acquisitions and dividends decreased to €425 million (H1/2017: €998 million). Free cash flow after acquisitions and dividends was €942 million (H1/2017: -€5,645 million).

Solid balance sheet structure

The Group’s total assets increased by 3% (3% in constant currency) to €54,982 million (Dec. 31, 2017: €53,133 million). Current assets grew by 13% (13% in constant currency) to €14,287 million (Dec. 31, 2017: €12,604 million). Non-current assets were nearly unchanged (decreased by 1% in constant currency) at €40,695 million (Dec. 31, 2017: €40,529 million).

Total shareholders’ equity increased by 7% (6% in constant currency) to €23,269 million (Dec. 31, 2017: €21,720 million). The equity ratio increased to 42.3% (Dec. 31, 2017: 40.9%).

Group debt was nearly unchanged (decreased by 1% in constant currency) at €18,989 million (Dec. 31, 2017: €19,042 million). Group net debt decreased by 4% (-5% in constant currency) to €?16,722 million (Dec. 31, 2017: €?17,406 million) mainly due to the proceeds from divestitures of Care Coordination activities.

As of June 30, 2018, the net debt/EBITDA ratio was 2.801,2 (December 31, 2017: 2.841,2). Excluding the proceeds from divestitures of Care Coordination activities the net debt/EBITDA ratio was 3.021,2.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, excluding Akorn and NxStage transactions2 Before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of June 30, 2018, Fresenius Medical Care was treating 325,188 patients in 3,815 dialysis clinics. Along with its core business, the company provides related medical services in the field of Care Coordination.

- Q2/2018 reported results significantly positively influenced by divestitures of Care Coordination activities

- 5% adjusted1,2 sales growth in constant currency in Q2

- 6% adjusted4,6 net income growth in constant currency in Q2

- 22% net income growth in constant currency on a comparable basis4,7 in Q2

Reported sales were strongly impacted by headwinds from foreign exchange rates and by the already anticipated decline in Fresenius Medical Care North America’s pharmacy business. Sales decreased by 9% (increased by 3%1 in constant currency) to €8,189 million (H1/2017: €9,019 million). Organic sales growth was 3%. Currency translation effects reduced sales by 9%. Adoption of IFRS 15 reduced sales by 3%. Excluding the VA agreement in the prior-year quarter, sales growth1 was 4% in constant currency.

1 Growth rate adjusted for IFRS 15 implementation (Q2/17 base: €4,340 million; H1/17 base: €8,749 million) 2 Excluding VA agreement: Q2/2018: 5%; H1/2018: 4%3 Adjusted for gains from divestitures of Care Coordination activities: Q2/2018: 4%; H1/2018: -5% 4 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA 5 Adjusted for gains from divestitures of Care Coordination activities and the effect of the U.S. Tax Reform: Q2/2018: 8%; H1/2018: -3% 6 Consistent with guidance, i.e. excluding gains from divestitures of Care Coordination activities, excluding the effect of the U.S. Tax Reform and excluding VA agreement 7 Consistent with guidance, i.e. excluding gains from divestitures of Care Coordination activities, including the effect of the U.S. Tax Reform and including VA agreement

In Q2/2018, sales decreased by 6% (increased 5%1 in constant currency) to €4,214 million (Q2/2017: €4,471 million). Organic sales growth was 4%. Currency translation effects reduced sales by 8%. Adoption of IFRS 15 reduced sales by 3%.

Health Care services sales (dialysis services and care coordination) decreased by 8%1 (increased by 3%1 in constant currency) to €6,594 million (H1/2017: €7,418 million). With €1,595 million (H1/2017: €1,601 million), Health Care product sales were on prior-year’s level (increased by 6% in constant currency).

In North America, sales decreased by 9%1 (increased by 1%1 in constant currency) to €5,746 million (H1/2017: €6,600 million). Health Care services sales decreased by 9%1 (increased by 1%1 in constant currency) to €5,351 million (H1/2017: €6,182 million). Excluding the 2017 effect from the VA Agreement (€98 million), Health Care services sales increased by 3%1 in constant currency. Health Care product sales decreased by 5% (increased by 6% in constant currency) to €395 million (H1/2017: €418 million).

Sales outside North America increased by 1% (8% in constant currency) to €2,436 million (H1/2017: €2,410 million). Health Care services sales increased by 1% (10% in constant currency) to €1,243 million (H1/2017: €1,236 million). Health Care product sales increased by 2% (7% in constant currency) to €1,193 million (H1/2017: €1,174 million).

Fresenius Medical Care’s EBIT increased by 54% (68% in constant currency) to €1,898 million (H1/2017: €1,235 million), driven by the divestitures of Care Coordination activities in Q2/18. The EBIT margin increased to 23.2% (H1/2017: 13.7%). Adjusted for the implementation of IFRS 15 and excluding the gains from divestitures of Care Coordination activities and the VA agreement in the prior-year period, EBIT increased by 3% in constant currency and EBIT margin was 13.2% (H1/2017: 13.2%). In Q2/2018, EBIT increased by 140% (increased by 162% in constant currency) to €1,401 million (Q2/2017: €583 million). The EBIT margin increased to 33.3% (Q2/2017: 13.0%). Adjusted for the adoption of IFRS 15 and excluding the gains from divestitures of Care Coordination activities, EBIT increased by 4% in constant currency and EBIT margin increased to 13.5%.

1 Growth rate adjusted for IFRS 15 implementation (Q2/17: -€131 million; H1/17: -€270 million)

Net income1 increased by 121% (141% in constant currency) to €1,273 million (H1/2017: €577 million). Consistent with full-year guidance, i.e. excluding the gains from divestitures of Care Coordination activities, the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, net income growth1 was 7% in constant currency. Net income1 growth on a comparable basis, i.e. excluding the gains from divestitures of Care Coordination activities, but including the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, was 13% in constant currency.

In Q2/2018, net income1 grew by 270% (303% in constant currency) to €994 million (Q2/2017: €269 million). Consistent with full-year guidance, i.e. excluding the gains from divestitures of Care Coordination activities, the effect of the U.S. Tax Reform and the VA agreement in the prior-year period, net income growth1 was 6% in constant currency. Net income1 growth on comparable basis, i.e. excluding the gains from divestitures of Care Coordination activities, but including the effect of the U.S. Tax Reform and the VA agreement in the prior-year period was 22% in constant currency.

Operating cash flow was €611 million (H1/2017: €1,052 million). The cash flow margin was 7.5% (H1/2017: 11.7%). The decrease is mainly due to two effects in North America: Receipt of a ~€200 million payment under the VA agreement in the prior-year period as well as increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle. In Q2/2018, operating cash flow was €656 million (Q2/2017: €882 million) with a cash flow margin of 15.6% (Q2/2017: 19.7%).

Fresenius Medical Care confirms its outlook for 2018 and expects sales growth of 5 to 7%2 in constant currency and net income1 comparable growth of 13% to 15%3 in constant currency (7% to 9%4 adjusted net income growth).

The 2018 growth targets are based on 2017 figures and exclude effects from the planned acquisition of NxStage Medical and gains from divestitures of Care Coordination activities.

For further information, please see Fresenius Medical Care’s Press Release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 2017 base: €16,739 million (adjusted for IFRS 15 adoption (-€486 million) and excluding Sound´s revenue for H2/2017 (-€558 million))

3 2017 base: €1,242 million, excluding Sound´s H2/17 net income (-€38 million); 2018 including benefits from U.S. tax reform but excluding gains from divestitures of Care Coordination activities

4 Excluding gains from divestitures of Care Coordination activities, excluding the effect of the U.S. Tax Reform natural disaster, FCPA related charge and excluding VA agreement

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, we are developing products with a focus on oncology and autoimmune diseases.

- 6% organic sales growth and 11% EBIT1 growth in constant currency (excluding biosimilars business) in Q2

- European Commission confirms marketing authorizations of HES subject to the implementation of risk minimization measures

- Sales outlook confirmed: 4% to 7% organic sales growth expected

- EBIT outlook raised: -2% to +1%5 EBIT growth in constant currency expected (~6% to 9%6 excl. biosimilars expenses)

Sales of €3,207 million (H1/2017: €3,202 million) were on prior-year level (increased by 7% in constant currency). Organic sales growth was 7%. Strong negative currency translation effects (-7%) were mainly related to the devaluation of the U.S. dollar, the Brazilian real and the Chinese yuan against the euro. In Q2/2018, sales of €1,604 million were nearly unchanged (increased by 6% in constant currency) from the prior-year level (Q2/2017: €1,598 million). Organic sales growth was 6%.

Sales in Europe grew by 2% (organic growth: 3%) to €1,120 million (H1/2017: €1,097 million). In Q2/2018, sales increased by 2% (organic growth: 3%) to €563 million (Q2/2017: €553 million).

Sales in North America decreased by 4% (organic growth: 7%) to €1,140 million (H1/2017: €1,187 million). In Q2/2018, sales decreased by 3% (organic growth: 4%) to €549 million (Q2/2017: €568 million).

1 Before special items 2 Before expenses for the further development of the biosimilars business: Q2/2018: 11%; H1/2018: 10% 3 Net income attributable to shareholders of Fresenius SE & Co. KGaA 4 Before expenses for the further development of the biosimilars business: Q2/2018: 19%; H1/2018: 17%5 2017 base: €1,177 million; 2017 & 2018 before special items, including expenditures for the further development of the biosimilars business (€60 million in FY/17, and expected expenditures of ~€160 million in FY/18)6 2017 base: €1,237 million; 2017 & 2018 before special items

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Sales in Asia-Pacific increased by 8% (organic growth: 13%) to €627 million (H1/2017: €582 million). In Q2/2018, sales increased by 8% (organic growth: 11%) to €326 million (Q2/2017: €302 million). Sales in Latin America/Africa decreased by 5% (organic growth: 10%) to €320 million (H1/2017: €336 million). In Q2/2018, sales decreased by 5% (organic growth: 10%) to €166 million (Q2/2017: €175 million).

EBIT1 decreased by 10% (-1% in constant currency) to €557 million (H1/2017: €622 million) with an EBIT margin1 of 17.4% (H1/2017: 19.4%). In Q2/2018, EBIT1 decreased by 6% (-1% in constant currency) to €289 million (Q2/2017: €309 million) with an EBIT margin1 of 18.0% (Q2/2017: 19.3%).

EBIT1 before expenses for the further development of the biosimilars business increased by 1% (10% in constant currency) to €629 million (H1/2017: €622 million) with an EBIT margin1 of 19.6% (H1/2017: 19.4%). In Q2/2018, EBIT1 before expenses for the further development of the biosimilars business increased by 6% (11% in constant currency) to €326 million (Q2/2017: €309 million) with an EBIT margin1 of 20.3% (Q2/2017: 19.3%).

Net income1,2 decreased by 6% (increased by 4% in constant currency) to €355 million (H1/2017: €379 million). In Q2/2018, net income1,2 decreased by 2% (increased by 5% in constant currency) to €185 million (Q2/2017: €188 million).

Operating cash flow increased by 15% to €454 million (H1/2017: €395 million). The cash flow margin grew to 14.2% (H1/2017: 12.3%). In Q2/2018, operating cash flow increased by 12% to €228 million (Q2/2017: €203 million) with a cash flow margin of 14.2% (Q2/2017: 12.7%).

1 Before special items 2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 18-19 in the PDF document.

Based on the strong development of Fresenius Kabi in H1/2018 and the reversal of some HES1 associated risk adjustments, Fresenius Kabi raises its EBIT outlook for 2018 by 4%-points and now expects EBIT growth in constant currency of -2% to +1%2 (previously: -6% to -3%2 in constant currency). Excluding expenditures for the further development of the biosimilars business, EBIT is now expected to grow by ~6% to 9%3 in constant currency (previously: ~2% to 5%3 in constant currency). Fresenius Kabi confirms its sales guidance of 4% to 7% organic growth.

1 Hydroxyethyl starch (HES) 2 2017 base: €1,177 million; 2017 & 2018 before special items, including expenditures for the further development of the biosimilars business (€60 million in FY/17 and expected expenditures of ~€160 million in FY/18) 3 2017 base: €1,237 million; 2017 & 2018 before special items

For a detailed overview of special items please see the reconciliation tables on pages 19-20 in the PDF document.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain (Quirónsalud). Helios Germany operates 87 acute care hospitals, 89 outpatient centers and treats approximately 5.2 million patients annually. Quirónsalud operates 45 hospitals, 56 outpatient centers and around 300 occupational risk prevention centers, and treats approximately 11.6 million patients annually.

- 4% organic sales growth in Q2

- DRG catalogue effects and preparatory structural activities for anticipated regulatory measures weigh on financial performance of Helios Germany

- Helios Spain with accelerated growth: 8% organic sales growth and 19% EBIT growth in Q2

- 2018 outlook confirmed

Fresenius Helios increased sales by 10% to €4,674 million (H1/2017: €4,256 million). Organic sales growth was 4%. In Q2/2018, sales increased by 5% (organic growth: 4%) to €2,343 million (Q2/2017: €2,238 million).

Sales of Helios Germany increased by 3% (organic growth: 3%) to €3,121 million (H1/2017: €3,038 million). In Q2/2018, sales increased by 2% (organic growth: 3%) to €1,547 million (Q2/2017: €1,510 million). Helios Spain increased sales by 28% (organic growth: 5%) to €1,553 million (H1/2017: €1,218 million), mainly due to the additional month of consolidation compared to the prior-year period (Quirónsalud is consolidated since February 1, 2017). In Q2/2018 Helios Spain increased sales by 9% (organic growth: 8%) to €796 million (Q2/2017: €728 million).

Fresenius Helios grew EBIT by 6% to €571 million (H1/2017: €537 million) with a margin of 12.2% (H1/2017: 12.6%). In Q2/2018, EBIT increased by 4% to €293 million (Q2/2017: €282 million) with a margin of 12.5% (Q2/2017: 12.6%).

EBIT of Helios Germany decreased by 4% to €345 million (H1/2017: €359 million) with a margin of 11.1% (H1/2017: 11.8%). The decline is mainly due to additional catalogue effects, preparatory structural activities for anticipated regulatory requirements (i.e. clustering) as well as a lack of privatization opportunities in the German market. In Q2/2018, EBIT decreased by 6% to €168 million (Q2/2017: €178 million) with a margin of 10.9% (Q2/2017: 11.8%).

EBIT of Helios Spain increased by 28% to €227 million (H1/2017: €178 million), mainly due to the additional month of consolidation compared to the prior-year period, with a margin of 14.6% (H1/2017: 14.6%). In Q2/2018, EBIT increased by 19% to €124 million (Q2/2017: €104 million) with a margin of 15.6% (Q2/2017: 14.3%).

Net income1 of Fresenius Helios increased by 4% to €388 million (H1/2017: €373 million). In Q2/2018, net income1 increased by 3% to €197 million (Q2/2017: €192 million).

Operating cash flow was €259 million (H1/2017: €304 million) with a margin of 5.5% (H1/2017: 7.1%).

The already announced transfer of the in-patient post-acute care business from Fresenius Helios to Fresenius Vamed has become effective as of July 1, 2018. As a consequence, Fresenius Helios’ EBIT growth outlook for 2018 was adjusted to 5% to 8% (previously: 7% to 10%).

Fresenius Helios confirms its outlook for 2018 and expects organic sales growth of 3% to 6% and EBIT growth of 5% to 8%.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management.

- Service business with continued good momentum: 11% sales growth in Q2

- Project business with good order intake of €195 million in Q2

- Transfer of inpatient post-acute care business from Helios Germany to Vamed as of July 1, 2018

- 2018 outlook confirmed

Sales increased by 7% (7% in constant currency) to €515 million (H1/2017: €481 million). Organic sales growth was 5%. Sales in the project business increased by 4% to €191 million (H1/2017: €184 million). Sales in the service business grew by 9% to €324 million (H1/2017: €297 million). In Q2/2018, sales increased by 3% (organic growth: 1%) to €266 million (Q2/2017: €258 million).

EBIT increased by 6% to €18 million (H1/2017: €17 million) with a margin of 3.5% (H1/2017: 3.5%). In Q2/2018, EBIT increased by 9% to €12 million (Q2/2017: €11 million) with a margin of 4.5% (Q2/2017: 4.3%).

Net income1 of €11 million was unchanged from prior-year’s level. In Q2/2018, net income1 was also unchanged at €7 million.

Order intake increased by 10% to €455 million (H1/2017: €412 million). As of June 30, 2018, order backlog was €2,372 million (December 31, 2017: €2,147 million).

The already announced transfer of the in-patient post-acute care business from Fresenius Helios to Fresenius Vamed has become effective as of July 1, 2018. As a consequence, Fresenius Vamed’s EBIT growth outlook for 2018 was adjusted to 32% to 37% (previously: 5% to 10%).

Fresenius Vamed confirms its outlook for 2018 and expects organic sales growth in the range of 5% to 10% and EBIT growth of 32% to 37%.

1 Net income attributable to shareholders of VAMED AG

Conference Call

As part of the publication of the results for the second quarter / first half of 2018, a conference call will be held on July 31, 2018 at 2 p.m. CET (8 a.m. EST). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website https://www.fresenius.com/alternative-performance-measures

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Healthy organic growth across the board, North American Products business continues strong growth

- Underlying Care Coordination margin improved

- Results continue to be impacted by strong currency headwinds

- Calcimimetics continue to evolve

- Divestiture of Sound Inpatient Physicians successfully closed

- NxStage acquisition expected to close in the second half of 2018

1 For a detailed reconciliation, please refer to the table at the end of the press release2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Rice Powell, Chief Executive Officer of Fresenius Medical Care, stated: “In the second quarter, we have seen solid growth resulting in a strong net income increase of 22 percent at constant currency – excluding the positive impact of the successful and efficient closing of the Sound Inpatient Physicians divestment. On the back of the strong development of our Products business and continued growth of our Services business, we expect growth to further accelerate in the second half of 2018.”

Strong Products growth

Revenue in the second quarter of 2018 was again significantly impacted by foreign currency effects, resulting in a 2% increase at constant currency to EUR 4,214 million (-6% at current rates). Adjusting the second quarter of 2017 for the impact from the IFRS 15 implementation, revenue in the second quarter of 2018 was up by 5% at constant currency. Health Care Services revenue increased by 1% at constant currency to EUR 3,385 million, driven by growth in same market treatments and contributions from acquisitions, partially offset by the effects from the implementation of IFRS 15. Excluding the negative effects from the implementation of IFRS 15 Health Care Service revenue increased by 4% at constant currency. Health Care Products revenue grew by 6% at constant currency to EUR 829 million. The increase was driven by higher sales of hemodialysis products and renal pharmaceuticals. Organic growth for Health Care Services was 3% and for Health Care Products 6%. Dialysis treatments increased by 3%, mainly as a result of growth in same-market treatments.

In the first half of 2018, revenue was stable at constant currency with EUR 8,189 million (-9% at current rates). Excluding the effect from the implementation of IFRS 15 revenue was up by 3% at constant currency. Health Care Services revenue decreased by 1% at constant currency (-11% at current rates) based on a strong comparable first half of 2017 and unfavourably affected by the implementation of IFRS 15 and the VA Agreement. Health Care Products revenue increased by 6% at constant currency (flat at current rates).

Significant contribution from divestitures of Care Coordination activities

Total operating income (EBIT) reached EUR 1,401 million, an increase of 162% at constant currency (+140% at current rates) in the second quarter of 2018. The strongest contributor was the gain related to the divestitures of Care Coordination activities. The significant contribution of EUR 833 million also includes the positive effect of gains from currency translation adjustments. Adjusting for the gain as well as the prior year impact from the VA Agreement, EBIT grew by 2% at constant currency (-4% at current rates) with an EBIT margin of 13.5%.

In the first half of 2018, EBIT increased by 68% at constant currency to EUR 1,898 million (+54% at current rates). Adjusted for the effects described above, EBIT increased by 3% at constant currency (-6% at current rates) and the EBIT margin was 13.2%.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was exceptionally strong in the second quarter of 2018 with EUR 994 million (+270% at current rates), mainly driven by the gain related to the divestitures of Care Coordination activities. Excluding the gain related to the divestitures of Care Coordination activities, the increase in net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was 22% at constant currency (+15% at current rates). Further adjusting for the prior year impact from the VA Agreement and the positive effect from the U.S. Tax Reform, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA grew by 6% on a constant currency basis to EUR 273 million (flat at current rates). Based on the number of approximately 306.4 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) amounted to EUR 3.24 (+270% at current rates). On a comparable basis the company generated an EPS of EUR 1.00, up by 22% at constant currency and 15% at current rates. On an adjusted basis EPS increased by 6% to EUR 0.89 at constant currency (flat at current rates).

For the first half of 2018, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 141% at constant currency (+121% at current rates) to EUR 1,273 million, mainly driven by the gain related to the divestitures of Care Coordination activities. Adjusted for this effect, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA reached EUR 599 million, an increase of 13% at constant currency (+4% at current rates). Further adjusting for the prior year impact from the VA Agreement and the positive effect from the U.S. Tax Reform, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA reached EUR 517 million in the first half of 2018, an increase of 7% at constant currency (-1% at current rates).

Organic growth across all Reporting Segments

North America revenue, which represents 71% of total revenue in the second quarter of 2018, was stable at constant currency and reached EUR 2,971 million (-8% at current rates). Excluding the effect from the implementation of IFRS 15 revenue was up by 4% at constant currency. Organic growth was 3%.

Dialysis Care revenue increased by 4% to EUR 2,232 million at constant currency (-4% at current rates). The growth at constant currency was mainly driven by an increase in organic revenue per treatment, same market treatment growth and contributions from acquisitions, to some extent diluted by the implementation of IFRS 15 and the VA Agreement in the prior year. Adjusted for the implementation of IFRS 15, Dialysis Care revenue increased by 7% at constant currency. Organic revenue per treatment increased by 4%, same-market treatments grew by 2% and acquisitions contributed 1%. At constant currency, Care Coordination revenue decreased by 18% (-24% at current rates), driven by the shift of calcimimetic drugs into the clinical environment and the implementation of IFRS 15, partially offset by improved performance in certain services prior to divestiture. Excluding the effect from the implementation of IFRS 15 Care Coordination revenue decreased by 10% at constant currency.

In the U.S., the average revenue per treatment, adjusted for the implementation of IFRS 15 and excluding the 2017 impact of the VA Agreement, increased by USD 13 from USD 341 to USD 354. The increase was mainly driven by the introduction of calcimimetic drugs in the clinical environment, which is still evolving. The increase was partially offset by lower revenue from commercial payors, as expected, and higher implicit price concessions (IFRS 15).

Cost per treatment in the U.S., adjusted for the implementation of IFRS 15, increased by USD 14 from USD 272 to USD 286. This development was largely a result of the introduction of calcimimetic drugs in the clinical environment as well as increased property and other occupancy related costs, partially offset by lower costs for health care supplies.

At constant currency, Health Care Products revenue showed a strong increase of 10% to EUR 210 million due to higher sales of renal pharmaceuticals, machines and hemodialysis concentrates. Lower external sales in peritoneal dialysis products affected the overall positive development.

Total operating income for the North America segment was EUR 1,286 million in the second quarter of 2018, an increase of 200% at constant currency (+174% at current rates). This increase was mainly driven by the gain related to divestitures of Care Coordination activities. Adjusted for this impact and the 2017 effects from the VA Agreement, operating income (EBIT) was EUR 453 million compared to EUR 471 million in the second quarter of 2017. The adjusted operating income margin was stable at 15.2%.

For the first half of 2018, North America revenue decreased by 3% at constant currency to EUR 5,746 million (-13% at current rates). Adjusted for the implementation of IFRS 15 (EUR 270 million), revenue increased by 1% at constant currency (-9% at current rates). Mainly driven by the gain related to divestitures of Care Coordination activities operating income went up by 83% at constant currency (+66% at current rates) to EUR 1,648 million in the first half of 2018.

As of the end of June 2018, the company was treating 199,527 patients (+3%) at its 2,439 clinics (+4%) in North America. Dialysis treatments increased by 3%.

EMEA revenue increased by 5% at constant currency (+2% at current rates) to EUR 652 million in the second quarter of 2018, mainly driven by the positive development in Health Care Services revenue and Health Care Products revenue, which increased by 5% and 4%, respectively, at constant currency. The increase in Health Care Services revenue was driven by same-market treatment growth and acquisitions. Dialysis Products revenue grew by 5% at constant currency (+2% at current rates) to EUR 319 million, due to higher sales of dialyzers, machines, bloodlines, products for acute care treatments and renal pharmaceuticals.

Non-dialysis Products revenue decreased by 8% at constant currency (-8 % at current rates) to EUR 18 million, primarily due to slightly lower sales volumes.

Operating income was EUR 105 million in the second quarter of 2018. The operating income margin decreased from 17.6% to 16.1%, mainly due to unfavorable impacts from lower income from equity method investees, higher personnel costs in certain countries and an increase in bad debt expenses.

For the first half of 2018, EMEA revenue increased by 5% at constant currency to EUR 1,288 million (+3% at current rates), while operating income of EUR 214 million was 5% below last year´s level at constant currency (-6% at current rates).

As of the end of June 2018, the company had 63,589 patients (+4%) being treated at 758 clinics (+4%) in the EMEA region. Dialysis treatments increased by 4%.

Asia-Pacific revenue grew by 7% at constant currency to EUR 422 million (+1% at current rates) in the second quarter of 2018. Health Care Services revenue in the region increased by 7% at constant currency to EUR 191 million (flat at current rates). Care Coordination activities contributed EUR 49 million (+32% at constant currency, +24% at current rates) to Health Care Services revenue. This strong Care Coordination growth in Asia Pacific was mainly related to acquisitions and a strong organic revenue growth. Health Care Products showed again a solid business performance, growing 6% at constant currency to revenues of EUR 231 million (+2% at current rates). This growth was mainly driven by higher sales of hemodialysis products, partially offset by lower sales of products for acute care treatments. Operating income reached the same level as the previous year’s quarter (EUR 78 million). The operating income margin decreased slightly to 18.4%, driven by unfavorable foreign currency impacts and increased costs for the business growth, mainly in China.

For the first half of 2018, Asia-Pacific revenue increased by 10% at constant currency to EUR 814 million. Operating income decreased by 1% at constant currency with EUR 152 million (-5% at current rates).

As of the end of June 2018, the company had 30,578 patients (+2%) being treated at 385 clinics in Asia-Pacific. Dialysis treatments increased by 2%.

Latin America delivered revenue of EUR 164 million in the second quarter of 2018, an improvement of 11% at constant currency (-10% at current rates). This growth was mainly driven by a strong growth in Health Care Services (+15% at constant currency) due to an increase in organic revenue per treatment, acquisitions and growth in same market treatments. Health Care Products revenue in Latin America increased by 2% at constant currency to EUR 46 million, due to higher sales of machines and peritoneal dialysis products and negatively affected by lower sales of dialyzers. With an operating income of EUR 11 million the segment generated an operating income on previous year’s level. The operating income margin remained at 6.8%.

For the first half of 2018, Latin America revenue increased by 14% at constant currency to EUR 334 million (-7% at current rates). Operating income was EUR 25 million, an increase of 5% at constant currency (-6% at current rates).

As of the end of June 2018, the company was treating 31,494 patients (+4%) at 233 clinics in Latin America (+1%). Dialysis treatments increased by 4%.

Net interest expense was EUR 84 million compared to EUR 95 million in the second quarter of 2017, a decrease of 6% at constant currency (-11% at current rates). The decrease was driven by a replacement of high interest-bearing senior notes by debt instruments at lower rates as well as a decreased debt level. Income tax expense was EUR 262 million for the second quarter of 2018, which translates into an effective tax rate of 19.9%, compared to last year’s Q2 with a tax rate of 30.8%. The strong reduction was largely driven by the U.S. Tax Reform and the gain related to divestitures of Care Coordination activities.

Strong cash flow generation

In the second quarter of 2018, the company generated EUR 656 million of operating cash flow, compared to EUR 883 million provided by operating activities in last year’s second quarter. This decrease was mainly driven by increased accounts receivable related to the addition of calcimimetics into the Medicare ESRD payment bundle and unfavorable foreign currency effects. The number of days sales outstanding (DSOs) decreased sequentially by three days compared with Q1 2018 to reach 82 days. Free cash flow (Net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR 429 million for the three months ended June 30, 2018 compared to EUR 690 million for the same period of 2017. Free cash flow in percent of revenue was 10.2% and 15.4% for the three months ended June 2018 and 2017, respectively.

Sound Physicians divestiture successfully closed

On June 28, Fresenius Medical Care announced the closing of the divestiture of Sound Inpatient Physicians Holdings, LLC to an investment consortium led by Summit Partners. In the second half of 2017, the Sound Physicians business generated revenue of EUR 559 million and a net income of EUR 38 million. The 2017 basis has been adjusted accordingly for measuring the performance against the 2018 outlook.

Closing of NxStage Medical acquisition expected for second half 2018

In August 2017, Fresenius Medical Care signed an agreement with NxStage Medical, a U.S.-based medical technology and services company, to acquire all outstanding shares of NxStage Medical through a merger. The merger, which has been approved by NxStage’s board, NxStage stockholders and authorities in Germany, is still subject to regulatory approval by the Federal Trade Commission under the Hart-Scott-Rodino Act. Fresenius Medical Care has exercised its contractual right under the merger agreement to extend the original closing deadline by 90 days from August 7, 2018 to November 5, 2018. Fresenius Medical Care expects to close the transaction in 2018.

Employees

As of June 30, 2018, Fresenius Medical Care had 111,263 employees (full-time equivalents) worldwide, compared to 112,163 employees at the end of June 2017. This decrease was mainly attributable to divestitures of certain Care Coordination activities.

Outlook 2018

The company expects revenue1 growth between 5% and 7% at constant currency. Net income on a comparable basis2 is expected to increase by 13% to 15% at constant currency and on an adjusted basis2,3 to increase by 7% to 9% at constant currency.

The targets exclude the effect from the planned acquisition of NxStage Medical and the gain (loss) related to divestitures of Care Coordination activities.

1 2017 adjusted for the effect of IFRS 15 implementation and the contribution of Sound Physicians in H2 20172 Attributable to shareholders of Fresenius Medical Care AG & Co. KGaA, adjusted for the contribution from Sound Physicians in H2 20173 VA Agreement, Natural Disaster Costs, FCPA related charge, U.S. Tax Reform

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the second quarter today at 3:30 p.m. CEDT / 9:30 a.m. EDT. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the PDF for a complete overview of the results for the second quarter and first half year 2018.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

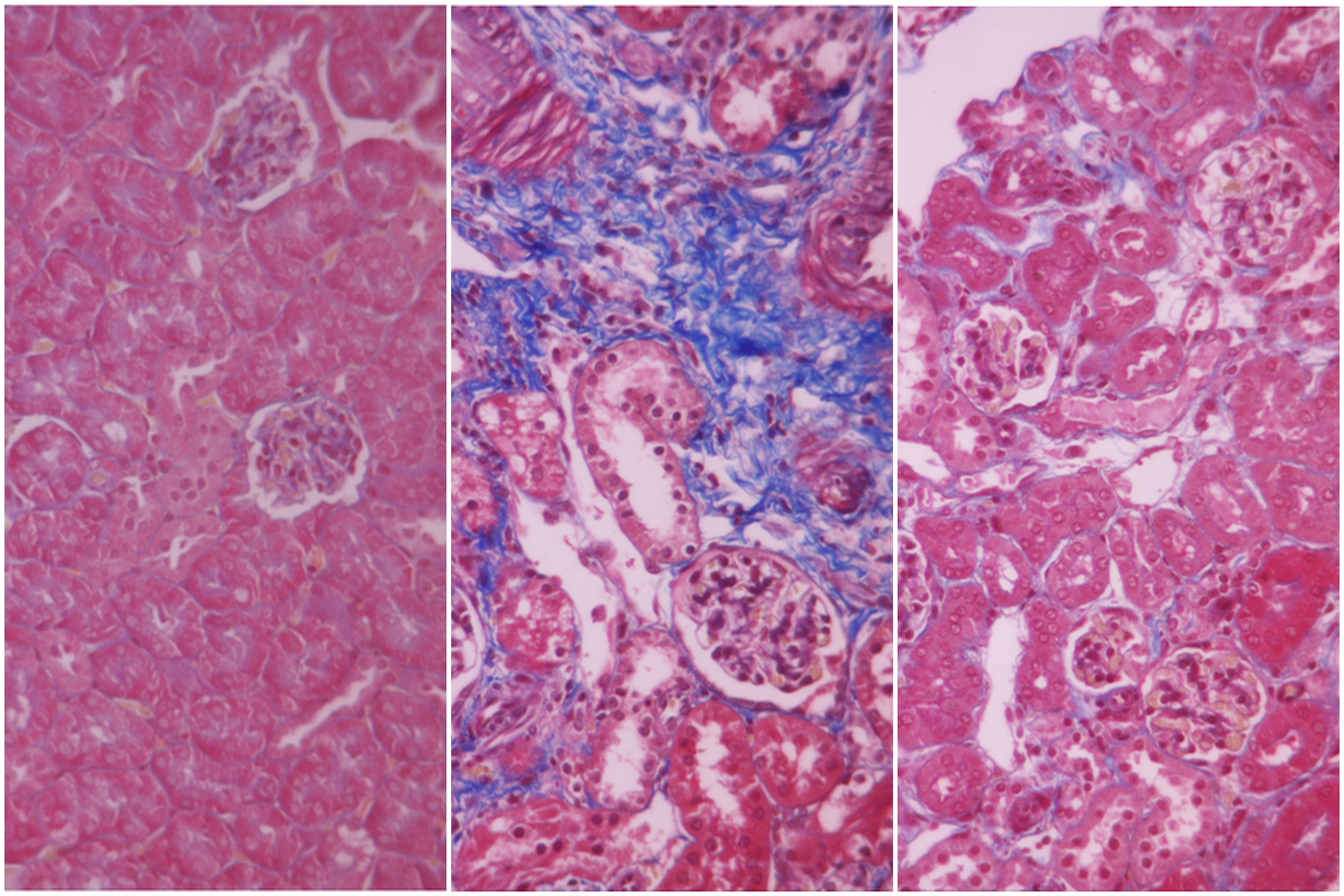

Fresenius Medical Care, the world’s largest provider of dialysis products and services, announced today that its subsidiary Unicyte AG has achieved a key preclinical milestone in its regenerative medicine program for chronic kidney disease. The company was able to confirm a disease modifying potential for its proprietary nano-Extracellular Vesicles (“nEVs” are stem cell-derived particles that support communication between cells) in a second preclinical model of chronic kidney disease.

When administered to mice with fast progressing kidney disease, Unicyte’s nEVs prevented renal fibrosis, a hallmark of chronic kidney disease. In particular, nEVs significantly reduced interstitial fibrosis and tubular necrosis while also inhibiting infiltration of various cells. This resulted in near-to-normal recovery of kidney function. The study conducted in collaboration with Prof. Giovanni Camussi of the University of Turin, Italy, has been accepted for publication in the peer-reviewed journal Frontiers of Immunology (https://doi.org/10.3389/fimmu.2018.01639).

These new results support previous findings in a preclinical model of slowly progressing kidney disease (diabetic nephropathy), a major pathology that often leads to end-stage renal disease. Combined results of these studies demonstrate the efficacy and the underlying mechanism of action of nEVs in preventing renal fibrosis and subsequent progression to end-stage renal disease. Unicyte will continue the preclinical and clinical development of its proprietary nEVs for treatment of chronic and acute kidney diseases.

Dr. Olaf Schermeier, Fresenius Medical Care’s CEO for Global Research and Development, said: “We are very excited about the progress we have made with our research and development activities over the last 30 months since we have established Unicyte. Based on these achievements, Unicyte will continue to explore the potential of nEVs for the treatment of patients in pre-dialysis stages of chronic kidney disease.”

Prof. Giovanni Camussi, Professor Emeritus at the University of Turin and Member of Unicyte’s Scientific Advisory Board, said, “nEVs are a promising regenerative medicine technology platform. Our aim is to develop new and better treatment options for severely and chronically ill patients over time. Achieving this preclinical milestone represents an important step towards testing nEVs in the clinical setting.”