Berenberg & Goldman Sachs – 10th German Corporate Conference

Baader Investment Conference 2021

Bank of America – Global Healthcare Conference

The price increase for hospital services in Germany has been set at 2.29% for 2022. As it is subject to negotiations at the state level as well as individual hospital discounts, the final price increase on the individual hospital level will, however, be lower.

The price increase for hospital services in Germany has been set at 2.29% for 2022. As it is subject to negotiations at the state level as well as individual hospital discounts, the final price increase on the individual hospital level will, however, be lower.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, is celebrating its 25th anniversary. The company, founded in 1996 when Fresenius merged its dialysis business with the U.S.-based dialysis services provider National Medical Care, now has more than 120,000 employees, operates approximately 4,100 dialysis clinics in more than 65 countries and treats about 345,000 patients. Over the past 25 years the number of patients treated in company dialysis clinics has risen more than six-fold. The production of dialysis filters (dialyzers) has increased ten-fold.

Rice Powell, CEO of Fresenius Medical Care: “Fresenius Medical Care was founded 25 years ago with the aim of continuously improving the quality of life of our patients by offering them high-quality products as well as innovative technologies and treatment concepts. We will continue to pursue these goals in the future. As the global market leader in dialysis therapies and dialysis products, we are taking every opportunity to develop further, from digitization to the development of entirely new treatment options.”

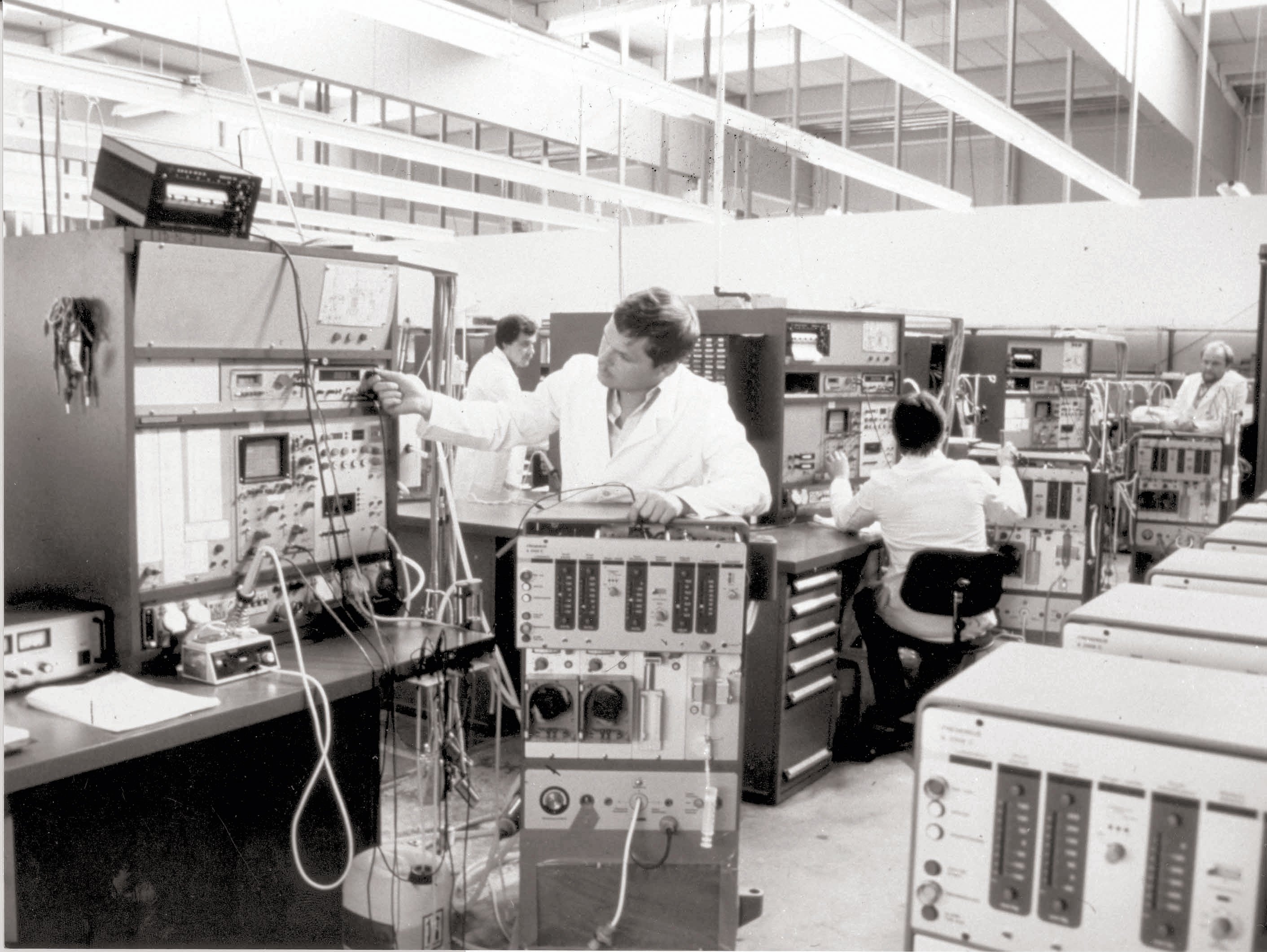

The roots of this success story go back to 1960, when Fresenius began importing dialysis machines and dialyzers from various foreign companies and distributing them in Germany, gaining a substantial market share. In 1979 the company launched its own dialysis machine, the A2008, which set a quality standard and became the world’s top seller. This role as market leader grew with the introduction of successor models from Fresenius Medical Care. Today, nearly every second dialysis machine sold worldwide is made by Fresenius Medical Care. In the early 1980s the company developed the first polysulfone dialysis filters, opening up a new era in the treatment of kidney disease. Polysulfone dialyzers are particularly effective at cleaning the patient’s blood and still set the industry standard to this day. Fresenius Medical Care has, to date, manufactured more than two billion dialyzers.

Success in dialysis products ultimately paved the way for the entry into dialysis services. In 1996, Fresenius acquired National Medical Care and combined it with its own dialysis business, a move that marked the birth of Fresenius Medical Care. That same year, the fledgling company was listed on the Frankfurt and New York exchanges that year. In 1999, Fresenius Medical Care shares gained a listing in Germany’s benchmark index, the DAX.

Since its founding, Fresenius Medical Care has been the world’s leading provider of products and services for people with renal disease. The company has steadily strengthened this position as it consistently set new milestones: In 1999, the number of dialysis machines made at company’s Schweinfurt, Germany, plant reached the 100,000 mark. In 2003, the company set two “firsts” by treating more than 100,000 patients and producing more than 50 million dialyzers that year. Total dialyzers produced reached the 500-million mark in 2007 and rose to one billion by 2013. The year before, dialysis device number 500,000 came off the Fresenius Medical Care assembly line in Schweinfurt.

Fresenius Medical Care is constantly improving dialysis technology and introducing new, innovative treatment concepts. In 2016, it launched the latest generation in hemodialysis machines, the 6008, which optimizes dialysis treatment and delivers it even more economically. In 2019, Fresenius Medical Care launched the 4008A dialysis machine developed specially to meet the needs of developing countries. The device offers Fresenius Medical Care’s highest treatment standard while keeping the cost to national health systems as low as possible.

Strong growth at Fresenius Medical Care has time and again been accompanied by large, strategic acquisitions: In 2006, the company acquired Renal Care Group, the third-largest operator of dialysis centers in the United States. That was followed, in 2011, by the purchase of Liberty Dialysis, another major U.S. dialysis center operator. With the acquisition of Euromedic that same year, Fresenius Medical Care significantly expanded its presence in Central and Eastern Europe. In 2019, the company expanded its presence in home dialysis with the acquisition of NxStage, which offered patients even more therapy options. By 2020, 12 percent of Fresenius Medical Care patients received their dialysis treatments at home.

The company expects strong growth will continue in the future. Until 2025 the company expects compounded annual growth rates in the mid-single-digit percentage range for revenue and in the high-single-digit percentage range for net income. Fresenius Medical Care believes that what until now has been very fragmented treatment of chronic kidney disease patients should be much more closely integrated through the entire course of the disease. To accomplish this, the company wants to make more effective use of core competencies in the areas of innovative products, ambulatory facilities operation, standardization of medical procedures and patient coordination.

Fresenius Medical Care has compiled a wide range of information and materials on its 25th anniversary on a special web page:

https://www.freseniusmedicalcare.com/en/25-years/

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Helios Germany has published its second sustainability report. The 60 pages report "Strong into the future" looks back on the complex challenges of the Corona year 2020 and shows in which areas the pandemic has driven developments for Germany’s largest private hospital operator. Helios Germany has defined four fields for its sustainability strategy: Patients, employees, the environment and compliance. Like the first report in 2019, it was drawn up based on the GRI standards of the Global Reporting Initiative and is now available in German on www.helios-gesundheit.de/nachhaltigkeit. An English version will be published soon.

Helios Germany has published its second sustainability report. The 60 pages report "Strong into the future" looks back on the complex challenges of the Corona year 2020 and shows in which areas the pandemic has driven developments for Germany’s largest private hospital operator. Helios Germany has defined four fields for its sustainability strategy: Patients, employees, the environment and compliance. Like the first report in 2019, it was drawn up based on the GRI standards of the Global Reporting Initiative and is now available in German on www.helios-gesundheit.de/nachhaltigkeit. An English version will be published soon.

Fresenius Kabi has reached a milestone on the road to approval for another biosimilar. MSB11456, a tocilizumab biosimilar candidate, successfully met the primary and secondary endpoints in two consecutively conducted clinical trials. For more information, please visit the Fresenius Kabi website.