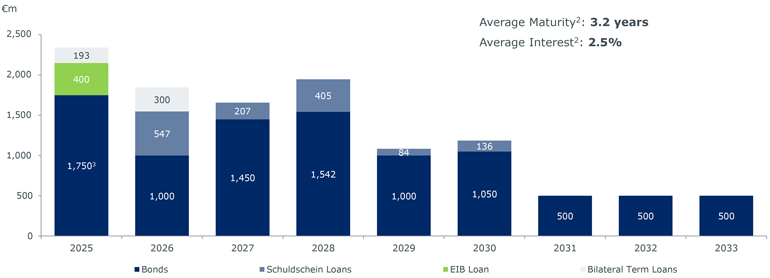

Maturities

The Group’s maturity profile is characterized by a broad spread of maturities with a large proportion of mid- to long-term financing.

Well-balanced maturity profile of the Fresenius Group1

1 As of December 31, 2024, and based on utilization of major financing instruments, excl. Commercial Paper and other cash management lines

2 Calculations based on total financial debt, excluding Lease & Purchase Money Obligations

3 €500m bond 2019/2025 has been repaid at maturity in February 2025

Download debt maturity profile and additional information

Related Links

Financing Mix