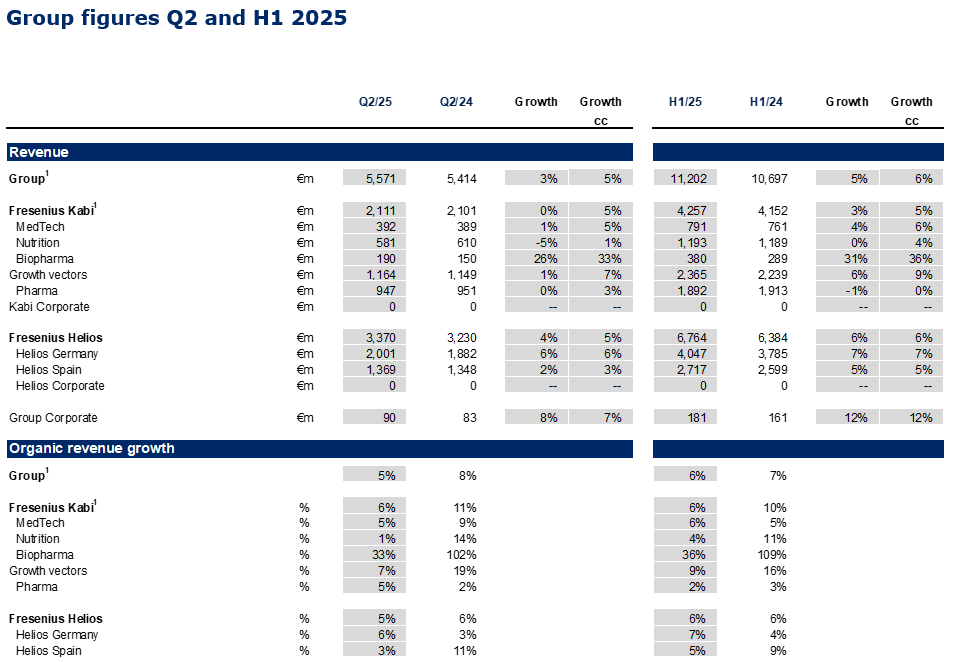

Q2/2025: Ongoing strong revenue and EPS growth, guidance for organic revenue growth raised

- Group revenue1 at €5,571 million with organic growth of 5%1,2 driven by consistent delivery across the core businesses Fresenius Kabi and Fresenius Helios as well as ongoing execution of #FutureFresenius.

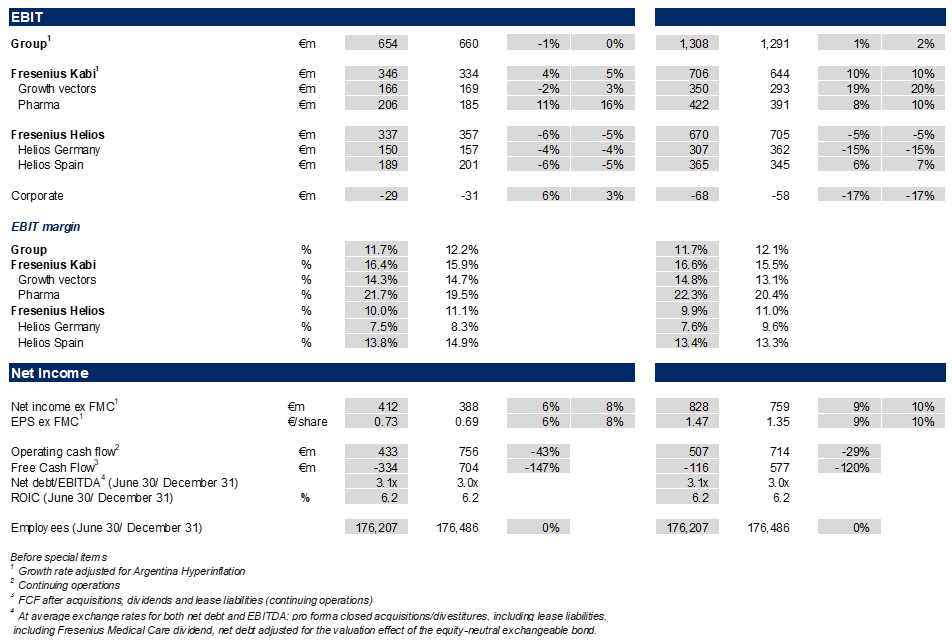

- Group EBIT1 broadly stable3 in constant currency at €654 million impacted by the headwinds from ceased energy relief payments at Helios Germany and the loss of the volume-based procurement tender for the nutrition product Ketosteril in China at Fresenius Kabi; Group EBIT margin1 at 11.7%.

- Net income1,4 with strong 8%3 growth in constant currency to €412 million outpacing revenue growth.

- EPS1,4 rose by strong 8%3 in constant currency to €0.73 demonstrating continued bottom-line delivery based on operating strength and significantly decreased interest expenses.

- Net debt/EBITDA ratio at 3.1x1,5 driven by resumed dividend payment in Q2/25.

- Pro rata sale of Fresenius Medical Care shares to maintain current stake in response to the announced Fresenius Medical Care share buyback program.

1Before special items

2Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3Growth rate adjusted for Argentina hyperinflation

4Excluding Fresenius Medical Care

5At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond

Michael Sen, CEO of Fresenius: “Fresenius has demonstrated a resilient and consistent performance in the first half of 2025, with another quarter of strong momentum reflected by 8% Core EPS growth. Fresenius Kabi and Fresenius Helios continue to deliver strong results despite macroeconomic challenges, thanks to our focused strategy and disciplined execution. This performance enables us to raise our guidance, increasing our full-year expectations for revenue growth to between 5% and 7%. #FutureFresenius is paying off.

Our ambitions remain unchanged: Our current strategy phase Rejuvenate will focus on organic growth through disciplined capital allocation - upgrading our core, and scaling our platforms to enhance performance further. We are committed to delivering profitable growth through targeted investments in health and digital innovation, which together will create and enhance value for our stakeholders."

Guidance raised for Fiscal Year 20251

Based on the consistent growth at the top-end of the 2025 guidance in H1/25, organic revenue guidance was raised:

Fresenius Group2: organic revenue growth3 now expected in the range of 5 to 7% (previous: 4 to 6%); constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1Before special items

22024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4Growth rate adjusted for Argentina hyperinflation

52024 base: €8,414 million (revenue) and €1,319 million (EBIT)

62024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q2/25

In Q2/2025, the good operating performance of Fresenius Kabi and Fresenius Helios led to a 5%1 Group organic revenue increase to €5,571 million.

As expected, Group EBIT before special items was broadly stable3 in constant currency, and amounted to €654 million. This is related to the headwinds from the absence of energy relief payments at Helios Germany and the Volume Based Procurement of the nutrition product Ketosteril in China at Fresenius Kabi. Despite the negative effects, Group EBIT margin was 11.7% (Q2/24: 12.2%). The Helios Performance Programme is advancing with increasing contributions expected in the second half of the year.

Earnings per share2,4 rose by a strong 8%3 in constant currency to €0.73, driven by the operating strength and the significantly decreased interest expenses.

Following the announcement of Fresenius Medical Care AG (FME) in June 2025 to initiate a share buyback program, Fresenius intends to sell shares of FME on a pro rata basis to maintain its current stake of around 28.6% in FME. The final size and tranching of the sale of shares will be determined based on the structure of the share buyback program of FME. As previously announced, Fresenius remains a committed shareholder and will retain no less than 25 per cent plus one share of FME.

Fresenius will use the proceeds to invest in its core business in line with the #FutureFresenius strategy and Fresenius' stated capital allocation priorities, including further strengthening the balance sheet, reducing leverage, and delivering shareholder value and long-term growth.

1Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2Before special items

3Growth rate adjusted for Argentina hyperinflation

4Excluding Fresenius Medical Care

Operating Companies – Business development Q2/25

Fresenius Kabi delivered a strong performance; Growth Vectors with ongoing momentum, continued Biopharma strength; licensing agreement to commercialize a proposed vedolizumab biosimilar candidate

Organic revenue growth of 6%3 mainly driven by the Growth Vectors and the good contribution from Pharma; reflecting the less pronounced positive Argentina pricing effects; revenue was broadly flat at €2,111 million due to currency effects; increased by 5%2 in constant currency.

- Growth Vectors with good organic revenue3 increase of 7%: MedTech 5%, Nutrition 1%, Biopharma 33%.

- Nutrition revenue: €581 million, growth clearly influenced by the tender impact from the Volume Based Procurement (VBP) on Ketosteril in China (ex Ketosteril healthy organic growth in line with ambition range), good development in Latin America and Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

- Biopharma revenue: €190 million, positive development mainly driven by the Tyenne biosimilar ramp up in Europe and the U.S. as well as Idacio; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) launched in the U.S. and approved in Europe; expansion of autoimmune biosimilars portfolio: licensing agreement with Polpharma Biologics to commercialize a proposed vedolizumab biosimilar candidate (excluding region MENA).

- MedTech revenue: €392 million, increase driven by the expansion in Cell Therapy in the U.S., and solid growth in Europe.

- Pharma revenue: €947 million, strong organic revenue development3 with 5% growth based on good volumes including I.V. fluids in the U.S., and Europe with favourable pricing.

- EBIT1 of Fresenius Kabi with 5%2 constant currency increase to €346 million, driven by the strong margin development of the Pharma, MedTech and Biopharma business and ongoing improvements in the cost base. The EBIT margin1 was at the upper end of the guidance range at 16.4% despite transaction exchange rate effects and headwinds on the Nutrition business in China.

- EBIT1 of the Growth Vectors increased 3%2 in constant currency against the backdrop of the Ketosteril effect, and amounted to €166 million; EBIT margin1 at 14.3%.

- EBIT1 of Pharma increased 16%2 in constant currency to €206 million. EBIT margin1 was strong at 21.7% due to ongoing cost savings and some one-timers.

Fresenius Helios with solid organic revenue growth; expected softness in profitability at Helios Germany partially offset by good development at Helios Spain; Helios Performance Programme is advancing.

Strong 5% organic revenue growth driven by Helios Germany (6% organic growth); Helios Spain at 3% organic growth (H1/25: 5%) linked to the Easter effect, which resulted into less activity at the beginning of Q2/25 and impacted growth predominantly at Helios Spain; revenue before special items increased by 5% in constant currency to €3,370 million.

- Helios Germany with revenue1 of €2,001 million; growth mainly driven by price effects, as well as good activity levels and case mix.

- Helios Spain with revenue of €1,369 million, impacted by the Easter timing and currency translation effects related to the clinics in Latin America. The clinics in Latin America showed a good operational performance.

- EBIT1 of Fresenius Helios as expected declined -5% in constant currency to €337 million impacted by the absence of energy relief funds in Germany. This expected softness was partially compensated by the excellent profitability at Helios Spain. EBIT margin1 of Fresenius Helios was resilient at 10.0%.

- EBIT1 of Helios Germany decreased by -4% to €150 million against the high prior-year base which included energy relief funds; EBIT margin at 7.5% improved by 90 bps compared to Q4/24 (6.6%), the first quarter without energy relief funds.

- EBIT1 of Helios Spain decreased by -5% in constant currency to €189 million related to a very strong prior-year base and the Easter effect; EBIT margin1 at a strong 13.8%.

- Helios performance programme is advancing; ramp-up in H2/25 expected with more meaningful EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1Before special items

2Growth rate adjusted for Argentina hyperinflation.

3Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

Conference call and Audio webcast

As part of the publication of the Q2/2025 results, a conference call will be held on August 6, 2025 at

1:30 p.m. CEST / 7:30 a.m. EDT. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Contact for shareholders

Investor Relations

Telephone: + 49 61 72 6 08-24 87

Telefax: + 49 61 72 6 08-24 88

E-mail: ir-fre@fresenius.com

Information on Fresenius share and ADRs

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q2/2025.

- Consolidated results for Q2/25 as well as for Q2/24 include special items. An overview of the results for Q2/2025 - before and after special items – is available on our website.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q2/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius announced today that the European Commission has granted approval for their denosumab biosimilars Conexxence®* and Bomyntra®* in Europe.

The two approvals cover all indications of the reference products including osteoporosis in postmenopausal women and at-risk men, treatment-related bone loss, prevention of skeletal complications from cancer metastasis to bone, and giant cell tumor of bone.

This milestone marks a significant advancement in Fresenius Kabi’s mission to expand access to high-quality biosimilar therapies. It also reinforces the business’ commitment to strengthening its Biopharma platform, a key pillar of the #FutureFresenius strategy.

*Conexxence and *Bomyntra are registered trademarks of Fresenius Kabi Deutschland GmbH in selected countries.

Fresenius has published the Aide Memoire ahead of its Q2 2025 financial reporting. The Aide Memoire is a summary of relevant information that Fresenius has previously communicated previously to the capital market or otherwise made publicly available . The document may prove helpful in assessing Fresenius' financial performance ahead of the publication of quarterly results.

The Q2 2025 Aide Memoire is now available on the Fresenius Investor Relations website. The results of the second quarter and first half of 2025 of Fresenius SE & Co. KGaA will be published on 6 August 2025. The Quiet Period will start on 24 July 2025.

Q1/2025: Strong top line and excellent EPS growth, outlook confirmed

- Group revenue1 at €5.63 billion with strong organic growth of 7%1,2 driven by consistent delivery of Fresenius Kabi and a strong performance at Fresenius Helios.

- Group EBIT1 at €654 million, increase of 4%3 in constant currency on the back of strong operating performance at Kabi; absence of energy relief payments weighing on Helios Germany; Group EBIT margin1 of 11.6%.

- Net income1,4 grew by an excellent 12%3 in constant currency to €416 million significantly outpacing revenue growth.

- EPS1,4 rose by excellent 12%3 in constant currency to €0.74 resulting from broad based operational strength and lower interest expenses.

- Operating cash flow from continuing operations of €74 million significantly improved year-on-year driven by operating development and increased focus on cash generation.

- Leverage ratio within target corridor: Net debt/EBITDA ratio at 3.0x1,5 showing 80 bps improvement in the last twelve months.

- #FutureFresenius REJUVENATE phase: Pivotal milestone delivered with the reduction of participation in Fresenius Medical Care stake enhancing strategic flexibility while setting basis for long-term profitable growth.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation.

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond.

Michael Sen, CEO of Fresenius: “We've kick-started 2025 with an excellent performance across the business and confirm our full-year guidance. Organic revenue increased by 7% driven by the consistent delivery of Fresenius Kabi and Fresenius Helios. This along with continued improvements in operations and lower interest costs led to an impressive EPS growth of 12%. Following the reduction of our stake in Fresenius Medical Care, a first and pivotal milestone in our history, we now start the REJUVENATE phase of #FutureFresenius from an even stronger position; this step underscores our commitment to creating long-term value. With a strengthened balance sheet and capital allocation priorities to further invest in our growth platforms, while also increasing our US presence, Fresenius is well positioned to deliver future profitable growth and innovation.”

Outlook confirmed for Fiscal Year 20251

Fresenius Group2: organic revenue growth3 of 4% to 6%,

constant currency EBIT growth in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as potential impacts from tariffs to the extent they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1 Before special items

2 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

4 Growth rate adjusted for Argentina hyperinflation

5 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q1/25

Fresenius entered with excellent momentum into the year with strong organic growth above the top-end of the 2025 guidance. The consistent positive delivery of Fresenius Kabi and the strong performance at Fresenius Helios drove a 7%1 Group organic revenue2 increase to €5.63 billion. Due to a continued strong operating performance, Group EBIT before special items increased 4%3 in constant currency to €654 million despite the high prior-year quarter which included energy relief fundings at Helios Germany. Particularly, a strong performance at Kabi and Helios in Spain contributed to the EBIT growth. The Helios Performance Programme delivers some first contributions with more significant contributions expected in the second half of the year. Earnings per share2,4 rose by an excellent 12%3 in constant currency to €0.74, driven by a broad-based operational strength and improved interest costs against the backdrop of a strong cash flow development and successful deleveraging.

In Q1/25, Fresenius reached a pivotal milestone in #FutureFresenius with the reduction of participation in Fresenius Medical Care and the issuance of an exchangeable bond with Fresenius Medical Care shares underlying. These transactions underline Fresenius' clear commitment to long-term value creation and were the first visible signs of the REJUVENATE phase, which will focus on three key aspects in the coming years:

- Upgrade Core: Fresenius will continue to strengthen its core businesses. This includes, for example, reinforcing R&D pipelines, further increasing financial strength, and enhancing corporate culture.

- Scale Platforms: By strategically scaling its (Bio)Pharma, MedTech, and Care Provision platforms, Fresenius can make an important contribution to meeting the challenges facing healthcare systems around the world. The priorities are:

- Driving innovation at (Bio-)Pharma

- Expand MedTech to provide and connect technology solutions for critical clinical areas such as emergency rooms, operating rooms and intensive care units.

- Accelerate digitization of care provision

- Elevate Performance: Overall, REJUVENATE is designed to help the company achieve higher levels of performance and make Fresenius even more innovative and relevant.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Operating Companies – Business development Q1/25

Fresenius Kabi delivered a strong start to the year, Biopharma moving close to structural EBIT margin band

- Organic revenue growth of 6%1 clearly driven by the Growth vectors; revenue increased by 5% to €2,146 million; positive Argentina pricing effects continued but less pronounced.

- Growth vectors with strong organic revenue1 increase of 11%: MedTech 7%, Nutrition 7%, Biopharma 40%.

- Nutrition revenue: €612 million, benefited from positive pricing effects in Argentina and the good development in Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

- Biopharma revenue: €190 million, mainly driven by the growth of Tyenne in Europe and the U.S.; launch of Ustekinumab biosimilar Otulfi® in EU and the U.S.; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) approved by FDA.

- MedTech revenue: €399 million, driven by strong growth related to the Ivenix pump rollout in the U.S, and broad-based positive development across most regions.

- Pharma revenue: €946 million, flat organic revenue development1 against a high prior-year base; positive pricing development in Europe was offset by a softer development in the U.S. and China.

- China business continued to be impacted by a general economic weakness, price declines in connection with tenders, and hospital budget controls.

- EBIT2 of Fresenius Kabi with 16%3 constant currency increase to €360 million, driven by the strong revenue development of the Growth vectors and ongoing improvements in the cost base. The EBIT-margin2 was very strong at 16.8%, a 170 bps yoy expansion.

- EBIT2 of the Growth Vectors increased 45%3 in constant currency to €184 million against the backdrop of a broad-based positive development; EBIT margin2 at 15.3% increased by 390 bps year-on-year, Biopharma moving close to structural EBIT margin band.

- EBIT2 of Pharma increased 5%3 in constant currency to €216 million. EBIT margin2 was strong at 22.9% driven in particular by ongoing cost savings and a strong pricing development in Europe.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation.

Fresenius Helios with excellent organic revenue growth; Helios Performance Programme evolving in-line with expectations.

- Very strong 8% organic revenue growth clearly above the structural growth band driven equally by Helios Germany (8% organic growth) and Helios Spain (8% organic growth); From a year-on-year perspective, Q1 also benefitted from the Easter effect falling in the second quarter this year; revenue before special items increased by 8% to €3,394 million.

- Helios Germany with revenue of €2,046 million; growth mainly driven by price effects: positive development of admissions and case mix.

- Helios Spain with revenue of €1,348 million, driven by strong activity levels and favourable price effects. The clinics in Latin America also showed a good performance.

- EBIT1 of Fresenius Helios declined 4% to €333 million as the support from energy relief funds phased out by the end of Q3/24. This expected softness was partially compensated by excellent profitability at Helios Spain. EBIT margin1 was solid at 9.8% driven by Helios Spain with a margin of 13.1% and 23% EBIT growth.

- EBIT1 of Helios Germany decreased by 23% to €157 million against the high prior-year base which included energy relief funds; EBIT margin at 7.7% improved by 110 bps sequentially (Q4/24: 6.6%).

- Helios performance programme delivers some first contributions; ramp-up in H2/25 with more significant EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1 Before special items

2 Growth rate adjusted for Argentina hyperinflation.

Conference call and Audio webcast

As part of the publication First Quarter 2025 results, a conference call will be held on May 7, 2025 at 1:30 p.m. CEST / 7:30 a.m. EST. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Contact for shareholders

Investor Relations

Telephone: + 49 61 72 6 08-24 87

Telefax: + 49 61 72 6 08-24 88

E-mail: ir-fre@fresenius.com

Information on Fresenius share and ADRs

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q1/2024

- Consolidated results for Q1/25 as well as for Q1/24 include special items. An overview of the results for Q1/2025 - before and after special items – is available on our website.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q1/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius has completed the divestment of Vamed’s international project business to Worldwide Hospitals Group (WWH), that was announced in February 2025.

The divestment is part of Fresenius’ structured exit from its Investment Company Vamed and enables Fresenius to further increase focus and management capacity on the ongoing progress of its core businesses Fresenius Kabi and Fresenius Helios, in line with #FutureFresenius.

Today, Fresenius published its 2024 Annual Report. As already announced in February, the healthcare group grew profitably in the past year and achieved its outlook, which was raised twice, through consistently good business performance. Group revenue before special items increased to €21.5 billion, with organic growth of 8%. Fresenius was also able to reduce net debt by €2 billion in 2024.

“Our #FutureFresenius program, which we launched at the end of 2022, is having an impact. The “new” Fresenius is much more focused. We are concentrating on Fresenius Kabi and Fresenius Helios. These are growing profitably and under their own steam,” said Michael Sen, Chairman of the Management Board of Fresenius. “Growth, higher margins, more cash, lower debt – all this has created value: From the beginning of October 2022, when we prepared the ReSet, until February 28, 2025, the share price rose by 76%.”

For the first time, the Annual Report includes a sustainability report in accordance with the European Sustainability Reporting Standards (ESRS). This replaces the Non-financial Report of previous Annual Reports and expands and supplements reporting topics and details. In addition, the ESRS report, like the financial report, is audited externally.

The 2024 Annual Report is available in German and English as a PDF file and as an online version.

Further publication and event dates for 2025:

· 04/24/2025: Publication of Sustainability Highlights Magazine

· 05/07/2025: Publication of the financial results for Q1 2025

· 05/23/2025: Annual General Meeting

· 08/06/2025: Publication of the financial results for Q2 2025

· 11/05/2025: Publication of the financial results for Q3 2025

FY/24: Upgraded outlook achieved, consistent financial performance with profitable growth.

- Group revenue1 at €21.5 billion with strong organic growth of 8%1,2

- Group EBIT1 at €2.5 billion, increase of 10%3 in constant currency; EBIT margin1 of 11.6%, 40 bps above prior year

- Net income1,4 grew by 13%3 in constant currency to €1,461 million, outpacing revenue growth

- EPS1,4 grew to €2.59

- Accumulative Group structural productivity savings ahead of plan reached €474 million (planned €400 million)

- Excellent Group operating cash flow of €2.4 billion resulting from focused cash management

- Deleveraging continued, net debt/EBITDA ratio further improved to 3.0x1,5 driven by excellent cash flow. Improvement of more than 70 bps since YE/23

- Dividend proposal of €1.00 per share

Q4/2024: Continued growth and further deleveraging

- Group revenue1 at €5.5 billion with organic growth of 7%1,2 driven by consistent positive development of Kabi and a strong performance at Helios

- Group EBIT1 at €646 million with solid constant currency growth of 7%3 on the back of significant operational improvements at Kabi; end of energy relief payments weighing on Helios Germany; Group EBIT margin1 of 11.7%

- EPS1,4 with outstanding constant currency growth of 29%3 to €0.69, upward impact due to high tax rate in prior-year quarter

- Strong operating cashflow of close to €1 billion in Q4

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation.

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

Michael Sen, CEO of Fresenius: “Thanks to a tremendous team effort, Fresenius delivered outstanding results in 2024 with high-single-digit organic revenue growth and double-digit EBIT and EPS growth. Our growth vectors – Nutrition, MedTech and Biopharma – and consistent performance from Helios paced this strong development. On top of this operating success, we ended the year with a significant reduction in leverage, which is at the lowest level in seven years. The momentum for success will continue through 2025, as we move to the next phase of #FutureFresenius and take the company to the next level of performance. For 2025 we expect 4% to 6% in revenue growth and 3% to 7% in EBIT growth. We have also upgraded our ambition level of the Fresenius Financial Framework. This includes higher margin ambitions for Kabi, and for the Group a lower leverage corridor. We also want to pass on our improving financial strength to our shareholders. Thus, we want to recommend a dividend payment for the year of 1 Euro per share. As we move forward, we continue to focus on performance and delivery. Our mission to save and improve human lives is unwavering: Fresenius is Committed to Life."

Outlook for Fiscal Year 2025

Fresenius Group5: Organic revenue growth1,2 of 4% to 6%,

constant currency EBIT growth3 in the range of 3% to 7%

Fresenius Kabi1: Organic revenue growth2,3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios4: Organic revenue growth2 in the mid-single-digit percentage range; EBIT margin3 around 10%

Assumptions to guidance: Guidance assumes current factors and known uncertainties, but it does not reflect potential extreme scenarios from a fast-moving geopolitical environment.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation.

4 Excluding Fresenius Medical Care

5 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

Fresenius Financial Framework – Ambitions further raised

- Structural EBIT margin3 ambition raised for Kabi to 16 to 18% (previously 14 to 17%).

- Self-imposed leverage target corridor upgraded to 2.5 to 3.0x net debt/EBITDA (previously 3.5 to 3.0x)

New dividend policy reflects capital allocation priorities

Fresenius’ new dividend policy is designed to ensure attractive shareholder returns while at the same time providing strategic flexibility. Going forward, Fresenius will pay out 30 to 40% of its Group core net income excluding Fresenius Medical Care and before special items as dividend. For fiscal year 2024, Fresenius will propose a dividend of €1.00 per share. The dividend proposal is a strong increase over the 2022 base and demonstrates Fresenius’ improving financial strength and its commitment to delivering shareholder value. For fiscal year 2023, Fresenius’ dividend payment was interrupted by legal restrictions due to the receipt of the energy relief payments at Helios in Germany.

1 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Before special items

4 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

5 At expected average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

Fresenius Group – Business development FY/24

Fresenius closed fiscal year 2024 with a strong fourth quarter and achieved its twice-upgraded full-year guidance. The consistent positive delivery of Fresenius Kabi and the strong performance at Fresenius Helios, drove an 8%1 year-on-year Group organic revenue1 increase to €21.5 billion. Due to an improved operating business performance, Group EBIT before special items increased 10%3 in constant currency to €2.5 billion. Earnings per share2,4 rose by 13%3 in constant currency to €2.59.

End of 2024, the #FutureFresenius Revitalize phase has been successfully concluded, resulting in significant financial progress driven by a simpler Group structure, improved steering, an optimized portfolio and a refined operating model. In 2025, the focus will be on continued value creation by entering the Rejuvenate phase, which also aims to pursue platform-driven growth. In 2025 the emphasis will be on further debt reduction, delivering higher Kabi margins, drive Helios’ programme and fostering innovation.

A dedicated performance programme for Helios has been set up to increase efficiency and productivity, and to counteract the end of the energy relief funding. The programme is expected to contribute ~€100 million at EBIT level by 2025 at Helios Germany. Combined with further incremental growth of Helios in Germany and Spain, the Fresenius Helios EBIT margin is expected to be around 10% in FY/25. Contributions from the performance programme will be weighted to the second half of 2025, in particular, as some of the levers are process-related and will take time to deliver and realize benefits. Some of the performance measures are likely to materialize fully beyond 2025. This sets an excellent basis for further improving productivity within the 10 to 12% structural margin band in 2026 and beyond.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Ex Fresenius Medical Care

Operating Companies – Business development FY/24 and Q4

Fresenius Kabi

In FY/24, Fresenius Kabi delivered consistent financial performance over the course of the year with excellent organic revenue growth of 10% above the top-end of the structural growth band and an impressive EBIT margin expansion of 140 bps to 15.7%.

Q4/24: Fresenius Kabi delivered a strong finish to the year

- Organic revenue growth of 9%1 driven by positive pricing effects, particularly in Argentina, revenue increased by 8% to €2,148 million.

- Growth vectors with strong organic revenue1 increase of 18%: MedTech 7%, Nutrition 21%, Biopharma 39%.

- Nutrition revenue: €614 million, benefited from positive pricing effects in Argentina and the good development in the U.S., driven by the ongoing roll-out of lipid emulsions.

- Biopharma revenue: €144 million, driven by the overall good rollout of Tyenne in Europe and the U.S.

- MedTech revenue: €424 million, driven by a broad-based positive development across most regions, including the U.S. and Europe

- Pharma revenue: €966 million, flat organic revenue development1; the positive development in many regions was offset by a softer development in China.

- China business continued to be impacted by a general economic weakness, price declines in connection with tenders, and indirect effects of the government’s countrywide anti-corruption campaign.

- EBIT2 of Fresenius Kabi grew 21% to €340 million, driven by good revenue development and improved structural productivity. The EBIT-margin2 was 15.8%, a 170 bps expansion.

- EBIT2 of the Growth Vectors increased by 71% on a positive development across the board; EBIT margin2 was 14.7%. EBIT positive in Biopharma in FY/24.

- EBIT2 of Pharma increased by 5% to €198 million. EBIT margin2 was 20.5% driven in particulars by cost discipline.

1 Organic growth rate adjusted for the accounting effects related to Argentina hyperinflation.

2 Before special items

Fresenius Helios

In FY 2024, Fresenius Helios delivered organic revenue growth of 6% driven by solid activity growth and favorable price developments in Germany and Spain. EBIT margin of 10.1%1 within the structural margin band ambition.

Q4/24: Fresenius Helios with strong EBIT development in Spain; end of energy relief payments weighing on Helios Germany

- Strong 6% organic revenue growth at the top-end of structural growth band driven equally by Helios Germany (6% organic growth) and Helios Spain (6% organic growth); revenue before special items increased 6% to €3,273 million.

- Helios Germany with revenue of €1,937 million; growth driven by pricing effects and admissions growth.

- Helios Spain with revenue before special items of €1,336 million, driven by solid activity levels and favourable price effects. The clinics in Latin America also showed a good performance.

- EBIT1 of Fresenius Helios declined 5% to €339 million as the energy relief funds ended in Q4. EBIT margin1 was solid at 10.4% driven by the excellent profitability at Helios Spain with a margin of 15.8% and 15% EBIT growth.

- EBIT1 of Helios Germany decreased by 22% to €128 million as the prior-year quarter was significantly supported by energy relief funds.

- Dedicated Helios performance programme initiated to drive further operational excellence and compensate end of energy relief funding in Germany. Fresenius Helios EBIT margin is expected to be around 10% in FY/25.

1 Before special items

Group figures Q4 & FY 2024

Conference call and Audio webcast

As part of the publication Fourth Quarter and Full Year 2024 results, a conference call will be held on February 26, 2025 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on our website.

Contact for shareholders

Investor Relations

Telephone: + 49 61 72 6 08-24 87

Telefax: + 49 61 72 6 08-24 88

E-mail: ir-fre@fresenius.com

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q4/2024.

- Consolidated results for Q4/24 as well as for Q4/23 include special items. An overview of the results for Q4/2024 - before and after special items – is available on our website.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q4/24 and Q4/23 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, in constant currency growth rates of the Fresenius Group are also adjusted.

- Information on the performance indicators is available on our website at www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Group organic revenue growth of 9%1,2 to €5.3 billion2 driven by a strong Kabi performance and good organic growth at Helios.

- Strong bottom-line traction with Group EBIT2 increase in constant currency of 9%3 to €552 million and EPS growth of 7%2,3,4.

- Group outlook for fiscal 2024 upgraded; Organic revenue growth1,2 is now expected to grow between 6% to 8% (previous: between 4% to 7%) and EBIT growth2 in constant currency is now targeted to be in the 8 to 11% range (previous: between 6% to 10%).

- Group-wide cost and productivity savings ahead of plan with target for FY/24 already achieved YTD.

- Excellent operating cash flow resulting from focused cash management.

- Deleveraging continued, and leverage ratio further improved to 3.24x2,5 driven by excellent cash flow; Leverage target corridor under review.

- Fresenius Kabi delivering above the top-end of the structural growth band with organic revenue growth of 11%6; strong EBIT margin at 15.9%2.

- Growth Vectors at Kabi show continued strong performance, led by dynamic growth at Biopharma, which had yet again positive EBIT in Q3. Tyenne is in line with expectations, building on strong momentum.

- Fresenius Helios with excellent organic revenue growth of 8% driven by solid performance in Spain and supported by some favorable technical reclassifications in Germany; EBIT margin of 7.9%2 in line with expectations due to anticipated lower seasonal demand in Spain; last quarter of energy relief funding support.

- Dedicated Helios performance program underway to drive further operational excellence and compensate ending energy relief funding in Germany.

Michael Sen, CEO of Fresenius: Team Fresenius delivered an excellent third quarter in 2024 – all financial metrics improved versus the prior year. Revenues grew strongly, with margin expansion across the Group, and significantly improved cash flow generation. Both Kabi and Helios continue to deliver consistent and sustained financial performance. We are more focused and stronger, deploying our cash to reduce debt further, while growing earnings per share and driving shareholder returns. Quarter after quarter we are showing how our #FutureFresenius strategy is paying off. Our mission remains at the core of our activities: saving and improving human lives. Fresenius is: Committed to Life.” Sen continued, “Given the strength of our first nine months, we are upgrading our revenue and earnings guidance for the year.”

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

6 Organic growth rate adjusted for the accounting effects related to Argentina hyperinflation.

Conference call and Audio webcast

As part of the publication of the results for Q3/24, a conference call will be held on November 6, 2024 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on

our website.

Note on the presentation of financial figures

An overview of the presentation of the financial figures are available on page 14 of this Investor News.

Structural productivity improvements: Target achieved ahead of plan

The Group-wide cost and efficiency measures are progressing faster than planned. The target for annual sustainable cost savings of ~€400 million at EBIT level has already been achieved with accumulative savings totaling €408 million until the end of Q3/24. Originally, it was expected to achieve the target by year-end 2025.

Fresenius will continue its efforts to increase structural productivity. So far, Kabi has delivered the majority of the savings. Going forward, it will be Fresenius Helios with its dedicated efficiency program focused on operations excellence including reduction of process and waiting times and digitalization of processes, resource optimization and synergies in particular in logistics and procurement. An update will be provided as part of the FY/24 results in February 2025.

Further efforts to enhance structural efficiency will, however, also be driven forward by Fresenius Kabi and the Corporate Center. Key elements include measures to reduce complexity, optimize supply chains and improve procurement processes.

Group sales and earnings development

Group revenue before special items increased by 7% (9% in constant currency) to €5,303 million (Q3/23: €4,967 million). Organic growth was 9%2, driven by Kabi and Helios's ongoing strong performance. Currency translation had a negative effect of 2% on revenue growth.

Group EBITDA before special items increased by 4% (5% in constant currency) to €814 million (Q3/23: €783 million).

Group EBIT before special items increased by 8% (9% in constant currency) to €552 million (Q3/23: €509 million), mainly driven by the strong organic revenue growth at Kabi and Helios and the continued progress of the groupwide cost savings program. The EBIT margin before special items was 10.4% (Q3/23: 10.2%). Reported Group EBIT was €492 million (Q3/23: €362 million).

Group net interest before special items increased to -€116 million (Q3/23: -€102 million) mainly due to financing activities in a higher interest rate environment.

Group tax rate before special items was 24.5% (Q3/23: 23.1%).

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

Net income1 from deconsolidated Fresenius Medical Care operations before special items increased by 38% (42% in constant currency) to €76 million (Q3/231: €55 million).

Group net income1 before special items increased by 12% (13% in constant currency) to €388 million (Q3/231: €347 million). The increase was driven by operating strength. Reported Group net income1 increased to €326 million (Q3/231: -€406 million) mainly due to Fresenius Medical Care's positive net income contribution. The negative net income in the prior year period was due to the non-cash valuation effect of Fresenius Medical Care in accordance with IFRS 5.

Group net income1 before special items excluding Medical Care increased by 7% (7% in constant currency) to €312 million (Q3/231: €292 million).

Earnings per share1 before special items increased by 12% (13% in constant currency) to €0.69 (Q3/231: €0.62). Reported earnings per share1 were €0.58 (Q3/231: -€0.72).

1Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Group Cash flow development

Group operating cash flow (continuing operations) increased to €763 million (Q3/23: €603 million) mainly driven by the very good operational business development and improvements in working capital at Helios and Kabi. Group operating cash flow margin was 14.4% (Q3/23: 12.1%). Before acquisitions, dividends and lease liabilities, free cash flow (continuing operations) increased to €532 million (Q3/23: €346 million). After acquisitions, dividends and lease liabilities, free cash flow (continuing operations) improved to €623 million (Q3/23: €102 million).

Fresenius Kabi’s operating cash flow remained almost stable at €374 million (Q3/23: €380 million) with a margin of 17.7% (Q3/23: 18.8%).

Fresenius Helios’ operating cash flow increased to €454 million (Q3/23: €208 million) due to the strong focus on cash and working capital management in Germany and Spain. The operating cash flow margin improved to 14.7% (Q3/23: 7.3%).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items was 1.2 in Q3/24 (LTM) (Q3/23: 0.9, LTM). This positive development is due to the strong cash flow focus across the Group.

The CCR is expected to be around 1 in FY/24.

1Cash flow before acquisitions and dividends; before interest, tax, and special items

Group leverage

Group debt decreased by -16% (-16% in constant currency) to €13,317 million

(Dec. 31, 2023: € 15,830 million) mainly related to the repayment of debt based on the excellent cash flow development and the around €400 million reduction of the leasing liabilities related to the Vamed exit. Group net debt decreased by -11%

(-11% in constant currency) to € 11,823 million (Dec. 31, 2023: € 13,268 million).

As of September 30, 2024, the net debt/EBITDA ratio was 3.24x1,2 (Dec. 31, 2023: 3.76x1,2) corresponding to a reduction of 52 bps compared to Dec. 31, 2023. This achievement is due to a combination of better EBITDA and Free cash flow. The legally required suspension of dividend payments and the Vamed exit further supported the positive development. Compared to Q3/23 (4.03x1,2) this is a 79 bps reduction.

Fresenius anticipates improving net debt/EBITDA ratio further3 towards the lower end of the self-imposed corridor of 3.0 to 3.5x by year-end 2024. This is expected to be driven by further reducing net debt and operational performance of the Operating Companies.

ROIC was 6.1% in Q1-3/24 (FY/23: 5.2%) mainly driven by the improvement in EBIT and the stringent capital allocation. With that, ROIC is within the ambition range of 6% to 8%. For 2024, Fresenius expects ROIC to be above 6.0% (previous: around 6.0%).

1 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

2 Before special items

3 At expected average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Operating Company Fresenius Kabi

Revenue increased by 5% (10% constant currency) to €2,114 million (Q3/23: €2,021 million). Organic growth was 11%1. This performance was driven by positive pricing effects, particularly in Argentina, and the excellent operating performance of the Growth Vectors.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) increased by 9% (16% in constant currency) to €1,158 million (Q3/23: €1,067 million). Organic growth was excellent at 16%1.

In Nutrition, organic growth of 11%1 benefited from positive pricing effects in Argentina and the good development in the US, driven by the ongoing roll-out of lipid emulsions. China continued to be impacted by a general economic weakness, price declines in connection with tenders, and indirect effects of the government’s countrywide anti-corruption campaign. Biopharma showed excellent organic growth of 66%1 driven by the overall good Biosimilars rollout in Europe and the U.S., with Tyenne standing out. Moreover, mAbxience also performed strongly, driven by bevacizumab and milestone payments. In MedTech, organic growth was of 7%1 driven by a broad-based positive development in the US, Europe and International, reflecting strong performances for infusion and nutrition systems.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

Constant currency growth rates adjusted for Argentina hyperinflation.

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Revenue in the Pharma (IV Drugs & Fluids) business increased by 2% (3% in constant currency; organic growth: 6% ) and amounted to €957 million (Q3/23: €941 million). Organic growth was mainly driven by a strong performance in Europe and International and solid growth in the U.S., driven by an improved backorder situation, compensating the softer development in China.

EBIT2 of Fresenius Kabi increased by 16% (16% in constant currency) to €335 million (Q3/23: €289 million) mainly due to the good revenue development, the positive EBIT result of the Biopharma business, and ongoing progress of the cost saving initiatives. EBIT margin2 was 15.9% (Q3/23: 14.3%) and thus at the upper end of 2024 outlook.

EBIT2 of the Growth Vectors increased by 62% (constant currency: 53%) to €168 million (Q3/23: €104 million) due to the positive EBIT of the Biopharma business and the good revenue development. EBIT margin2 was 14.5% (Q3/23: 9.8%). The Biopharma business is now expected to be EBIT break even also in the FY/24.

EBIT2 in the Pharma business decreased by -9% (constant currency: -8%) to €182 million (Q3/23: €200 million) primarily driven by additional costs due to the start of production at the main US plants in Wilson and Melrose Park. EBIT margin2 was 19.0% (Q3/23: 21.3%).

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

Constant currency growth rates adjusted for Argentina hyperinflation.

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Operating Company Fresenius Helios

Revenue before special items increased by 8% (8% in constant currency) to €3,082 million (Q3/23: €2,863 million). Organic growth was 8%.

Revenue of Helios Germany increased by 8% (in constant currency: 8%) to €1,940 million (Q3/23: €1,800 million) due to pricing effects coupled with volume growth and supported by some favourable technical reclassifications. Organic growth was 8%.

Revenue of Helios Spain before special items increased by 8% (8% in constant currency) to €1,142 million (Q3/23: €1,062 million) driven by solid activity levels despite the anticipated lower seasonal demand, and favourable price effects. Organic growth was 8%. The clinics in Latin America also showed a good performance, additionally supported by currency exchange rate effects.

EBIT1 of Fresenius Helios increased by 7% (6% in constant currency) to €244 million (Q3/23: €229 million) with an EBIT margin1 of 7.9% (Q3/23: 8.0%).

EBIT1 of Helios Germany increased by 8% to €170 million (Q3/23: €157 million) with an EBIT margin1 of 8.8% (Q3/23: 8.7%). Q3/24 marked the last quarter in which energy relief funding was recognized in the income statement supporting profitability.

EBIT1 of Helios Spain decreased by -3% (0% in constant currency) to €73 million (Q3/23: €75 million) due to the expected seasonal softness and some phasing effects. The EBIT margin1 was 6.4% (Q3/23: 7.1%). On a more comparable nine-months basis, the EBIT margin1 was 11.2% (Q1-3/23: 11.2%).

1 Before special items

Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Implications of the Fresenius Vamed exit

As of Q2 2024, Vamed is no longer a reporting segment of Fresenius. The company’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, is included under Corporate / Other in the Group consolidated segment reporting.

In Q1-3/24, the divestment of the rehabilitation business and the Vamed operations in Austria led to non-cash special items of €406 million at Group net income level.

Special items related to the gradual scale back of the international project business amounted to €441 million at Group EBIT level in Q1-3/24, and to €357 million2 at Group net income level. A total amount of high triple-digit million euros of special items is expected, which is spread over the next few years and will be mostly cash-effective.

1 Before special items

2 According to ownership share

Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at

Financial Results | FSE (fresenius.com).

Group and segment outlook for 20241

Fresenius upgrades its outlook for FY/24. Based on the excellent first nine months of 2024, Group organic revenue growth2,4,5 is now expected to grow between

6% to 8% (previous: between 4% to 7%) in 2024 and Group constant currency EBIT3,4 is anticipated to grow in a 8% to 11% range (previous: between 6% to 10%).

Fresenius Kabi expects organic revenue growth5 in a mid-to high-single-digit percentage range in 2024. The EBIT margin4 is expected to be in a range of 15% to 16% (structural margin band: 14% to 17%).

Fresenius Helios expects organic revenue4 to grow in mid-single digit percentage range in 2024. The EBIT margin4 is expected to be within 10% to 11% (structural margin band: 10% to 12%).

The Group outlook is given without Fresenius Vamed, i.e. exclusively for the Operating Companies Fresenius Kabi and Fresenius Helios.

1 For the prior-year basis please see table “Basis for Guidance for 2024”

2 2023 base: €20,307 million

3 2023 base: €2,266 million

4 Before special items

5 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

Basis for Guidance for 2024

If no timeframe is specified, information refers to Q3/2024.

An overview of the results for Q3/2024 - before and after special items – is available on our website.

Consolidated results for Q3/24 as well as for Q3/23 include special items. These concern: divestment of the fertility services group Eugin and the hospital stake in Peru, Vamed exit, expenses associated with the Fresenius cost and efficiency program, transaction costs for mAbxience and Ivenix, costs in relation to the change of legal form of Fresenius Medical Care, legacy portfolio adjustments, IT transformation, transformation/exit Vamed, discontinued operations Vamed, special items at Fresenius Medical Care, and impact of PPA due to the application of the equity method to the Fresenius Medical Care investment. The special items shown within the reconciliation tables are reported in the Corporate/Other segment.

Note on the deconsolidation of Fresenius Medical Care

Following the deconsolidation of Fresenius Medical Care, Group financial figures are presented in accordance with IAS 28 (at equity method) since December 1, 2023. The proportionate share of 32% of Fresenius Medical Care is presented as a separate line in Fresenius Group’s P&L and balance sheet. Dividends received from Fresenius Medical Care are reported as a separate line as part of the cash flow statement. Moreover, IAS 28 requires a full purchase price allocation (PPA). The accounting for the PPA is treated as special item. For reasons of simplification and comparability, Fresenius presents net income with and without Fresenius Medical Care`s equity result.

Note on the portfolio optimization at Fresenius Helios

As part of the portfolio optimization, the sale of the fertility services group Eugin was completed on January 31, 2024. The divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru, was completed on April 23, 2024. Therefore, results of Fresenius Helios and accordingly of the Fresenius Group for Q3/24 and Q3/23 are adjusted.

Note on the growth rates Fresenius Kabi

Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, in constant currency growth rates of the Fresenius Group are also adjusted.

Note on the Vamed exit

Due to the application of IFRS 5, the prior year and prior quarter figures of the current year have been adjusted in the consolidated statement of income and the consolidated statement of cash flows. Vamed’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, will be transferred to Fresenius and is included under Corporate / Other in the Group consolidated segment reporting. Details on the financial and accounting implications of the Vamed exit and the portfolio adjustments at Fresenius Helios are available on our website.

Information on the performance indicators are available on our website at www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Strong organic growth in Group revenue of 8%1 to €5.4 billion2; excellent Group EBIT2 increase in constant currency of 15%3 to €660 million reflects strong operating performance and group-wide cost savings progressing ahead of plan.

- Strong bottom-line delivery: 15%2,3,4 EPS growth in constant currency.

- Major progress on deleveraging: Leverage ratio at 3.43x2,5 and therefore within the target corridor, in particular due to operating strength and the excellent cash flow.

- Structural productivity improvements ahead of plan.

- Strong operating cash flow development driven by working capital efficiencies and the increased focus on cash generation as well as excellent operating performance.

- Group outlook for fiscal 2024 confirmed based on excellent first half; Optimistic to get Group EBIT growth2,6 into upper half of 6 to 10% range.

- Fresenius Kabi clearly above the top-end of the structural growth band with very strong organic revenue growth of 11%1 ; excellent EBIT margin at 15.9%2.

- Growth Vectors at Kabi pacing performance: very strong organic growth of 19%1; EBIT margin of 14.7%2 within structural margin band.

- Biopharma accelerating momentum: very strong revenue growth and yet again positive EBIT in Q2 driven by the licensing business at mAbxience and ongoing ramp up of Tyenne.

- Fresenius Helios with strong organic revenue growth of 6%; EBIT margin of 11.1%2 driven by an excellent operating performance in Spain.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

6 Constant currency

Conference call and Audio webcast

As part of the publication of the results for Q2/24, a conference call will be held on July 31, 2024 at 1:30 p.m. CEST (7:30 a.m. EDT). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on our website.

Michael Sen, CEO of Fresenius: “Fresenius had an outstanding Q2 and first half in 2024. We delivered strong top-line growth, higher margins, and even more powerful bottom-line growth. Cash came in extremely strong, materially improving our financial profile. We are well ahead of our plans to deleverage and to take out costs. 2024 is an inflection year where we see how the work we’ve done continues to impact and improve the lives of patients and generate value for all stakeholders. Fresenius is 'Committed to Life' ".

Structural productivity improvements ahead of plan

The Group-wide cost and efficiency measures are progressing faster than planned. Including the first half of 2024, Fresenius has achieved structural cost savings totaling ~€336 million at EBIT level.

For the remainder of the year, Fresenius will continue its efforts to further increase its structural productivity. Some measures that were planned for 2025 will be brought forward to the current financial year. The company aims to achieve the target of annual sustainable cost savings of ~€400 million at EBIT level by year-end 2024. Originally, this was expected in 2025.

The structural cost savings continue to be driven by all business segments and the Corporate Center. Key elements include measures to reduce complexity, optimize supply chains and improve procurement processes.

Group sales and earnings development

Group revenue before special items increased by 6% (8% in constant currency) to €5,414 million (Q2/23: €5,113 million). Organic growth was 8%2 driven by an ongoing strong performance of Kabi and Helios. Currency translation had a negative effect of 2% on revenue growth.

Group EBITDA before special items increased by 14% (14% in constant currency) to €938 million (Q2/23: €822 million).

Group EBIT before special items increased by 16% (15% in constant currency) to €660 million (Q2/23: €571 million) mainly driven by the good earnings development at Kabi and Helios and the continued progress of the groupwide cost savings program. The EBIT margin before special items was 12.2% (Q2/23: 11.2%). Reported Group EBIT was €265 million (Q2/23: €187 million).

Group net interest before special items was -€108 million (Q2/23: -€99 million) mainly due to financing activities in a higher interest rate environment.

Group tax rate before special items was 26.1% (Q2/23: 25.2%).

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

Net income1 from deconsolidated Fresenius Medical Care operations before special items increased by 21% (16% in constant currency) to €69 million (Q2/231: €57 million).

Group net income1 before special items increased by 16% (15% in constant currency) to €457 million (Q2/231: €393 million). The increase was driven by the operating strength.

Group net income1 before special items excluding Medical Care increased by 15% (15% in constant currency) to €388 million (Q2/231: €336 million).

Reported Group net income1 decreased to -€373 million (Q2/231: €80 million) due to effects from special items related to the Vamed exit and the discontinued operations at Vamed.

Earnings per share1 before special items increased by 16% (15% in constant currency) to €0.81 (Q2/231: €0.69). Reported earnings per share1 were -€0.66 (Q2/231: €0.15) effects from special items related to the Vamed exit and the discontinued operations at Vamed.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Constant currency growth rates adjusted for Argentina hyperinflation. Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Group Cash flow development

Group operating cash flow (continuing operations) almost quintupled to €709 million (Q2/23: €148 million). This excellent development is mainly related to working capital efficiencies and the increased focus on cash generation as well as excellent operating performance in Spain at Fresenius Helios. Group operating cash flow margin was 13.1% (Q2/23: 2.9%). Free cash flow before acquisitions, dividends and lease liabilities (continuing operations) increased to €674 million (Q2/23: €40 million). Free cash flow after acquisitions, dividends and lease liabilities (continuing operations) improved to €655 million (Q2/23: -€556 million).

Fresenius Kabi’s operating cash flow increased to €259 million (Q2/23: €180 million) with a margin of 12.3% (Q2/23: 9.0%) mainly driven by an improved working capital management, in particular related to inventories and receivables.

Fresenius Helios’ operating cash flow increased to €604 million (Q2/23: €61 million) in particular due to the strong operating performance in Spain and catch-up effects following a weaker first quarter. The strong focus on cash generation and improved management of working capital is also paying off. The operating cash flow margin was 18.7% (Q2/23: 2.0%).

The cash conversion rate (CCR), which is defined as the ratio of adjusted free cash flow1 to EBIT before special items was 1.1 in Q2/24 (LTM) (Q1/24: 0.9 LTM). This positive development is due to the increased cash flow focus across the Group.

1 Cash flow before acquisitions and dividends; before interest, tax, and special items

Group leverage

Group debt decreased by 14% (-15% in constant currency) to €13,536 million (Dec. 31, 2023: € 15,830 million) mainly related to the repayment of debt and the €400 million reduction of the leasing liabilities related to the Vamed exit. Group net debt decreased by 6% (-7% in constant currency) to € 12,428 million (Dec. 31, 2023: € 13,268 million).

As of June 30, 2024, the net debt/EBITDA ratio was 3.43x1,2 (Dec. 31, 2023: 3.76x1,2) corresponding to a reduction of 33 bps compared to FY/23. This achievement is due to a combination of the improved operational performance as well as better EBITDA and Free cash flow. The legally required suspension of dividend payments and the Vamed exit further supported the positive development. Compared to Q2/23 (4.19x1,2) this is a 76 bps reduction.

Fresenius expects the net debt/EBITDA3 ratio to be within the self-imposed corridor of 3.0 to 3.5x by the end of 2024. Further improvement in the second half of 2024 is expected. This is expected to be driven by further reducing net debt and by the operational performance at the Operating Companies.

ROIC improved to 6.0% in Q2/24 (FY/23: 5.2%) mainly due to the EBIT improvement and the stringed capital allocation. With that, ROIC reached the lower end of the self-defined target range of 6% to 8%.

For 2024, Fresenius now expects ROIC to be around 6.0% (previous: 5.4% to 6.0%), (2023: 5.2%).

1 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

2 Before special items

3 At expected average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Kabi

Revenue increased by 5% (10% constant currency) to €2,101 million (Q2/23: €2,001 million). The reported revenue growth is mainly driven by negative currency translation effects related to the hyperinflation in Argentina. Organic growth was 11%1. This strong performance was driven by the Growth Vectors and helped by pricing effects in Argentina.

Revenue of the Growth Vectors (MedTech, Nutrition and Biopharma) increased by 8% (19% in constant currency) to €1,149 million (Q2/23: €1,062 million). Organic growth was outstanding at 19%1. In Nutrition, organic growth of 14%1 benefited from the good development in the US, driven by the ongoing roll-out of lipid emulsions. Whereas China continued to be impacted by indirect effects of the government’s countrywide anti-corruption campaign and tender headwinds. Biopharma showed excellent organic growth of 102%1 driven by licensing agreements at mAbxience and the successful product launch of Tyenne in Europe. In MedTech, organic growth was of 9%1 driven by a broad-based positive development across most regions and many products groups.

Revenue in the Pharma (IV Drugs & Fluids) business was flat (0% in constant currency; organic growth: 2%1) and amounted to €951 million (Q2/23: €952 million). Organic growth was mainly driven by the positive development across many regions, particularly Europe.

EBIT2 of Fresenius Kabi increased by 17% (17% in constant currency) to €334 million (Q2/23: €285 million) mainly due to the good revenue development, the EBIT break-even result of the Biopharma business, and ongoing progress of the cost saving initiatives. EBIT margin2 was 15.9% (Q2/23: 14.2%) and thus at the upper end of 2024 outlook.

EBIT2 of the Growth Vectors increased by 93% (constant currency: 47%) to €169 million (Q2/23: €88 million) due to the EBIT break-even result of the Biopharma business and the good revenue development. EBIT2 margin was 14.7% (Q2/23: 8.3%).

EBIT2 in the Pharma business decreased by 10% (constant currency: -11%) to €185 million (Q2/23: €206 million) primarily driven by additional costs due to the start of production at the main US plants in Wilson and Melrose Park. EBIT2 margin was 19.5% (Q2/23: 21.6%).

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

2 Before special items

Constant currency growth rates adjusted for Argentina hyperinflation.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Operating Company Fresenius Helios

Revenue before special items increased by 7% (6% in constant currency) to €3,230 million (Q2/23: €3,020 million). Organic growth was 6%.

Revenue of Helios Germany increased by 3% (in constant currency: 3%) to €1,882 million (Q2/23: €1,823 million), mainly driven by favourable price effects and moderately increased activity levels. Organic growth was 3%.

Revenue of Helios Spain before special items increased by 13% (11% in constant currency) to €1,348 million (Q2/23: €1,198 million) driven by a positive calendar effect related to the Easter week and related higher activities, as well as positive price effects. Organic growth was 11%. The clinics in Latin America also showed a good performance.

EBIT1 of Fresenius Helios increased by 19% (18% in constant currency) to €357 million (Q2/23: €301 million) with an excellent EBIT margin1 of 11.1% (Q2/23: 10.0%) due to the strong operating performance in Spain.

EBIT1 of Helios Germany increased by 2% to €157 million (Q2/23: €154 million) with an EBIT margin1 of 8.3% (Q2/23: 8.4%) driven by the solid revenue development and helped by Government relief funding for higher energy costs.

EBIT1 of Helios Spain increased by 33% (32% in constant currency) to €201 million (Q2/23: €151 million) driven by the strong revenue growth based on the positive calendar effect related the Easter week as well as positive price effects. The EBIT margin1 reached 14.9% (Q2/23: 12.6%), clearly above the structural margin band ambition. On a more comparable half-year basis, the EBIT margin improved 30 bps to13.3% (H1/23: 13.0%).

Exit Fresenius Vamed

As of Q2 2024, Vamed is no longer a reporting segment of Fresenius. The company’s High-End-Services (HES) which offers services for Fresenius Helios and other hospitals, will be transferred to Fresenius and has already been included under Corporate / Other in the Group consolidated segment reporting.

The divestment of the rehabilitation business and the Vamed operations in Austria led to non-cash special items of €427 million at Group net income level.

Due to the exit from the project business, a total amount of high triple-digit million euros of special items are expected, which are spread over the next few years and mostly cash-effective. In H1/24, special items related to the gradual scale back of the international project business amounted to €425 million at Group EBIT level and to €343 million2 at Group net income level.

1 Before special items

2 According to 77% ownership share

Financial figures and growth rates adjusted for the divestment of the fertility services group Eugin and the hospital stake in Peru.

For a detailed overview of special items please see the reconciliation tables at Financial Results.

Group and segment outlook for 20241