- Results unchanged compared with preliminary figures published on July 27, 2022

- Business development impacted by unprecedented U.S. labor market situation and worsening macroeconomic environment driving cost inflation and supply chain disruptions

- Meaningful decline in COVID-19-related excess mortality

- Solid support by positive exchange rates

- FME25: transformation to new operating model and savings generation on track

Decline in COVID-19-related excess mortality

In the second quarter of 2022, COVID-19-related excess mortality among Fresenius Medical Care’s patients declined and amounted to approximately 300 (Q3 2021: ~2,900; Q4 2021: ~2,000; Q1 2022: ~2,4003). Thus, excess mortality accumulated to approximately 7,600 patients over the past twelve months and to approximately 23,000 since the start of the pandemic.

While excess mortality sequentially declined in line with the Company’s projections, infection rates remained on a high level resulting in a continued need and costs for isolation clinics and shifts as well as personal protective equipment.

The overall estimated adverse effect of accumulated excess mortality on organic growth in the Health Care Services business amounted to around 260 basis points in the second quarter.

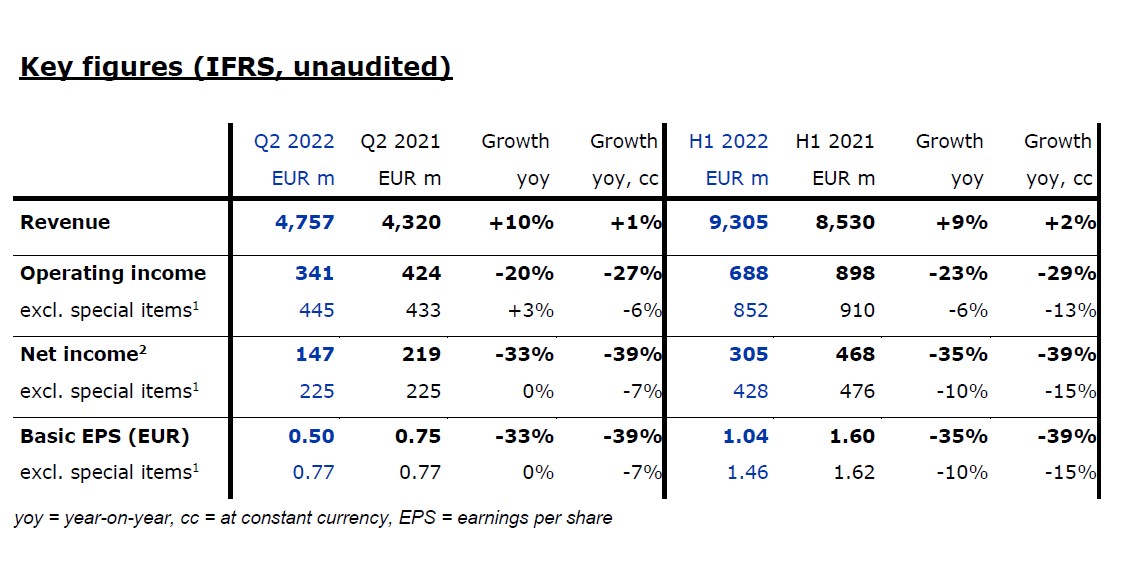

1 Special items include costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the remeasurement effect on the fair value of the investment in Humacyte, Inc. (Humacyte investment remeasurement) and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the Company’s financial targets which have been defined excluding special items.

2 Attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 Historical excess mortality updated for late entries

Increased headwinds from labor and inflation

The unprecedented U.S. labor market challenges materially worsened in the second quarter. For Fresenius Medical Care, this resulted in meaningfully higher than assumed wage inflation, surcharges, retention payments and additional costs for contract labor to contain the increasing staff shortages. Despite these additional investments in labor, including application of monies received from the U.S. government's Provider Relief Fund, staff shortages and turnover rates have continued to increase. The Company’s growth in the second quarter was affected by the number of clinics with constrained ability to accept new patients for treatment.

The already existing challenging macroeconomic environment has further significantly deteriorated in the second quarter as well, driving accelerated non-wage cost inflation. This has been exacerbated by the ongoing war in Ukraine and its global economic impact and results in higher logistics costs, raw material and energy prices as well as further supply chain disruptions.

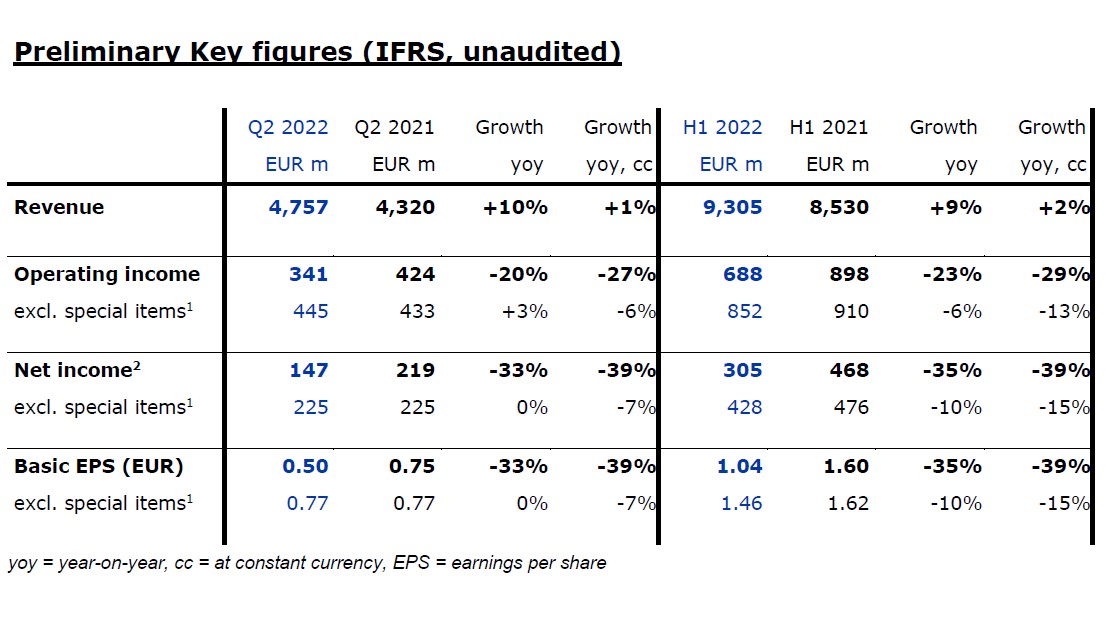

Revenue increased by 10% to EUR 4,757 million (+1% at constant currency, +0% organic) in the second quarter.

Health Care Services revenue grew by 11% to EUR 3,782 million (+1% at constant currency, +0% organic). Growth at constant currency was mainly driven by contributions from acquisitions.

Health Care Products revenue increased by 6% to EUR 975 million (+1% at constant currency, +1% organic). Constant currency growth was mainly driven by higher sales of in-center disposables, partially offset by lower sales of acute cardiopulmonary products.

In the first half, revenue grew by 9% to EUR 9,305 million (+2% at constant currency, +1% organic). Health Care Services revenue increased by 10% to EUR 7,389 million (+2% at constant currency, +1% organic); Health Care Products revenue grew by 6% to EUR 1,916 million (+2% at constant currency, +2% organic).

Operating income decreased by 20% to EUR 341 million (-27% at constant currency) in the second quarter, resulting in a margin of 7.2% (Q2 2021: 9.8%). Operating income excluding special items, i.e. costs incurred for FME25, the impacts related to the war in Ukraine, the impact of hyperinflation in Turkiye, and the remeasurement effect on the fair value of the investment in Humacyte, Inc. (Humacyte investment remeasurement), increased by 3% to EUR 445 million (-6% at constant currency), resulting in a margin of 9.4% (Q2 2021: 10.0%). At constant currency, the decline was mainly due to higher labor costs as well as inflationary and supply chain cost increases. This was partially offset by Provider Relief Funding received from the U.S. government to compensate for certain COVID-19-related costs.

In the first half, operating income declined by 23% to EUR 688 million (-29% at constant currency), resulting in a margin of 7.4% (H1 2021: 10.5%). Excluding special items, operating income decreased by 6% to EUR 852 million (-13% at constant currency), resulting in a margin of 9.2% (H1 2021: 10.7%).

Net income2 decreased by 33% to EUR 147 million (-39% at constant currency). Excluding special items, net income2 was stable and amounted to EUR 225 million (-7% at constant currency). At constant currency, the decline was mainly due to the mentioned negative effects on operating income. Basic earnings per share (EPS) decreased by 33% to EUR 0.50 (-39% at constant currency). Excluding special items, EPS was stable and amounted to EUR 0.77 (-7% at constant currency).

In the first half, net income2 declined by 35% to EUR 305 million (-39% at constant currency). Excluding special items, net income2 decreased by 10% to EUR 428 million

(-15% at constant currency). EPS decreased by 35% to EUR 1.04 (-39% at constant currency). Excluding special items, EPS declined by 10% to EUR 1.46 (-15% at constant currency).

Regional developments

In North America, revenue increased by 12% to EUR 3,294 million (-1% at constant currency, -2% organic) in the second quarter. At constant currency, this was mainly due to a decline in organic growth – which was driven by COVID-19 as well as by declines in co-insurance, increases in patient choice of higher deductibles plans, and lower than expected collections in aged accounts receivable in the Health Care Services business – and due to lower sales of in-center disposables, machines for chronic treatment, renal pharmaceuticals and home hemodialysis products. These effects were only partially offset by contributions from acquisitions. In the first half, revenue grew by 10% to

EUR 6,464 million (+0% at constant currency, -1% organic).

Operating income in North America decreased by 14% to EUR 340 million (-24% at constant currency) in the second quarter, resulting in a margin of 10.3% (Q2 2021: 13.5%). At constant currency, the decline in operating income was mainly due to higher labor costs, the Humacyte investment remeasurement, declines in co-insurance, increases in patient choice of higher deductibles plans, and lower than expected collections in aged accounts receivable, the impact of COVID-19, as well as inflationary and supply chain costs. This was partially offset by provider relief funding received from the U.S. government to compensate for certain COVID-19-related costs. In the first half, operating income declined by 19% to EUR 644 million (-26% at constant currency), resulting in a margin of 10.0% (H1 2021: 13.6%).

Revenue in the EMEA region increased by 5% to EUR 727 million in the second quarter (+7% at constant currency, +6% organic). At constant currency, this was mainly due to organic growth in Health Care Services and Health Care Products, both including the effects of hyperinflation in Turkiye. Growth in Health Care Products was driven by higher sales of in-center disposables, machines for chronic treatment and renal pharmaceuticals, partially offset by lower sales of acute cardiopulmonary products. In the first half, revenue grew by 3% to EUR 1,401 million (+5% at constant currency, +4% organic).

Operating income in EMEA decreased by 19% to EUR 60 million (-18% at constant currency) in the second quarter, resulting in a margin of 8.2% (Q2 2021: 10.6%). At constant currency, the decline in operating income was mainly due to inflationary cost increases, the impact of hyperinflation in Turkiye and costs associated with the FME25 program, partially offset by favorable currency transaction effects. In the first half, operating income declined by 21% to EUR 121 million (-18% at constant currency), resulting in a margin of 8.6% (H1 2021: 11.2%).

In Asia-Pacific, revenue increased by 6% to EUR 516 million (+2% at constant currency, +2% organic) in the second quarter. At constant currency, this was mainly driven by organic growth in the Health Care Services business. In the first half, revenue increased by 7% to EUR 1,023 million (+3% at constant currency, +3% organic).

Operating income decreased by 16% to EUR 71 million (-16% at constant currency) in the second quarter, resulting in a margin of 13.8% (Q2 2021: 17.3%). At constant currency, the decline in operating income was mainly due to the unfavorable impact of growth in lower margin businesses and inflationary cost increases. In the first half, operating income was stable and amounted to EUR 170 million (-1% at constant currency), resulting in a margin of 16.6% (H1 2021: 17.7%).

Latin America revenue increased by 21% to EUR 207 million (+17% at constant currency, +18% organic) in the second quarter, mainly driven by organic growth in the Health Care Services business, as well as higher sales of in-center disposables and machines for chronic treatment. In the first half, revenue grew by 18% to EUR 391 million (+16% at constant currency, +17% organic).

Operating income decreased to EUR -6 million in the second quarter, resulting in a margin of -3.0% (Q2 2021: 1.5%). At constant currency, the decline in operating income was mainly due to inflationary cost increases and unfavorable foreign currency transaction effects, partially offset by lower bad debt expense. In the first half, operating income decreased by 46% to EUR 5 million (-71% at constant currency), resulting in a margin of 1.3% (H1 2021: 2.8%).

Cash flow development

In the second quarter, Fresenius Medical Care generated EUR 751 million of operating cash flow (Q2 2021: EUR 921 million), resulting in a margin of 15.8% (Q2 2021: 21.3%). The decrease was mainly due to an unfavorable development of days sales outstanding as well as a decrease in net income2, partially offset by U.S. government relief funding. In the first half, operating cash flow amounted to EUR 910 million (H1 2021: EUR 1,129 million), resulting in a margin of 9.8% (H1 2021: 13.2%).

Free cash flow4 amounted to EUR 582 million (Q2 2021: EUR 720 million) in the second quarter, resulting in a margin of 12.2% (Q2 2021: 16.7%). In the first half, free cash flow amounted to EUR 581 million (H1 2021: EUR 749 million), resulting in a margin of 6.2% (H1 2021: 8.8%).

4 Net cash provided by / used in operating activities, after capital expenditures, before acquisitions, investments, and dividends

Patients, clinics and employees

As of June 30, 2022, Fresenius Medical Care treated 345,687 patients in 4,163 dialysis clinics worldwide and had 123,153 employees (full-time equivalents) globally, compared to 123,538 employees as of June 30, 2021.

FME25 update

With savings of EUR 26 million in the first half of the year, Fresenius Medical Care is on track to achieve its savings target of EUR 40-70 million in 2022 as part of the FME25 transformation program. Key achievements in the first half of the year include the announcement of the first two leadership levels below the Management Board and the corresponding organizational structure in line with the future operating model. The Company has also made significant progress in the transformation of global G&A functions. In addition to the ongoing and already identified FME25 measures, Fresenius Medical Care is currently in the process of reviewing potential additional initiatives in both designated operating segments (Care Delivery and Care Enablement) as part of the transformation program.

Outlook

As announced on July 27, 2022, Fresenius Medical Care expects revenue to grow at a low single digit percentage rate and net income2 to decline at around a high teens percentage range. Revenue and net income guidance are both on a constant currency basis and before special items5.

These targets are based on the following operating income relevant assumptions:

- Macro-economic inflation and supply chain costs of around EUR 220 million

- COVID-19: impact of accumulated excess mortality of around EUR 100 million

- U.S. labor costs expected to be around EUR 100 million, net of support from U.S. Provider Relief Fund, in excess of the 3% base wage inflation assumption

- U.S. ballot initiative expense of EUR 20 to 30 million

- Business growth of EUR 70 million

- Personal protective equipment cost reduction of around EUR 20 million

- FME25 savings of EUR 40 to 70 million

- Remeasurement effects on the fair value of investments are expected to be volatile but neutral on a full year basis; for guidance relevant comparison, the Humacyte investment remeasurement is treated as special item

- No meaningful further impact from natural gas shortages or suspension of gas supply to affect manufacturing sites

5 These targets are based on the 2021 results excluding the costs related to FME25 of EUR 49 million (for Net Income). They are in constant currency and exclude special items. Special items include further costs related to FME25, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

Please refer to our statement of earnings included in the attachments as separate PDF files for a complete overview of the results of the second quarter and first half of 2022. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to COVID-19, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Implementation of measures as presented herein may be subject to information and consultation procedures with works councils and other employee representative bodies, as per local laws and practice. Consultation procedures may lead to changes on proposed measures.

- Business development marked by significantly worsening headwinds at Fresenius Medical Care and increased macroeconomic challenges

- Fresenius Medical Care Business development impacted by unprecedented U.S. labor market situation and worsening macroeconomic environment

- Fresenius Kabi with solid organic sales growth despite tough prior-year-quarter

- Fresenius Helios with continued good admissions growth in Germany and Spain

- Fresenius Vamed still impacted by ongoing headwinds; service business supported by increasing elective treatment activity

- Cost and efficiency program evolving according to plan

If no timeframe is specified, information refers to Q2/2022.

1 Before special items, Q1/22 restated following remeasurement Humacyte investment

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 Excluding Ivenix acquisition

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

FY/22 Group guidance

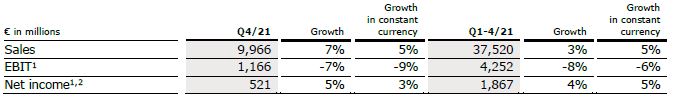

As announced on July 27, 2022, at constant currency, the Company now anticipates Group sales1 to grow in a low-to-mid single-digit percentage range (previously: mid-single digit percentage range) and Group net income2,3 to decline in a low-to-mid single-digit percentage range (previously: increase in a low-single-digit percentage range).

Without the already closed acquisitions of Ivenix and the already completed acquisition of a majority stake in mAbxience as well as any further potential acquisitions, Fresenius expects the net debt/EBITDA4 ratio (December 31, 2021: 3.51x5) to be slightly above the top end of the self-imposed target corridor of 3.0x to 3.5x by the end of 2022.

Assumptions for guidance FY/22

Due to the meaningfully increased uncertainty and volatility related to the war in Ukraine, the ongoing impacts of the COVID-19 pandemic, and a rapidly worsening global macro-economic development, Fresenius now expects significantly more pronounced headwinds in 2022 from supply chain disruptions and cost inflation, including energy prices. Furthermore, Fresenius expects significant negative effects from ongoing labor shortages and associated wage inflation, especially at Fresenius Medical Care in the U.S.

The war in Ukraine is directly and indirectly affecting Fresenius Group operations. The direct adverse effects of the war amounted to €20 million at net income6 level of Fresenius Group in H1/22 and are treated as a special item. Fresenius will continue to closely monitor the potential further consequences of the war, including balance sheet valuations. The guidance does not consider a significant disruption of gas or electricity supplies in Europe.

COVID-19 will continue to impact Fresenius Group operations in 2022. An unlikely but possible significant deterioration of the situation triggering containment measures that could have a significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/22 guidance.

Furthermore, the updated assumptions for Fresenius Medical Care's FY/22 guidance are also fully applicable to Fresenius Group's FY/22 guidance. All of these assumptions are subject to considerable uncertainty. The acquisitions of Ivenix and of the majority stake in mAbxience as well as any further potential acquisitions remain excluded from guidance.

1 FY/21 base: €37,520 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €1,867 million; before special items; FY/22: before special items

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions; before special items; including lease liabilities

5 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; before special items; including lease liabilities

6 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 20-23.

Cost and efficiency program

The Group’s cost and efficiency program is running according to plan and Fresenius confirms its increased savings targets provided in February 2022 of at least €150 million p.a. after tax and minority interest in 2023. For the years thereafter, a further significant increase in sustainable cost savings is expected.

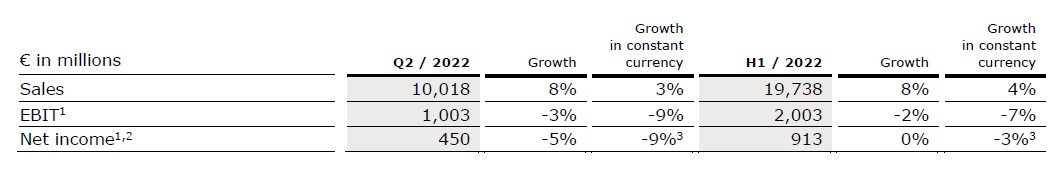

3% sales increase in constant currency

Group sales increased by 8% (3% in constant currency) to €10,018 million (Q2/21: €9,246 million). Organic growth was 2%. Acquisitions/divestitures contributed net 1% to growth. Currency translation increased sales growth by 5%. Excluding estimated COVID-19 effects1, Group sales growth would have been 2% to 3% in constant currency (Q2/21: 6% to 7%).

In H1/22, Group sales increased by 8% (4% in constant currency) to €19,738 million (H1/21: €18,230 million). Organic growth was 3%. Acquisitions/divestitures contributed net 1% to growth. Currency translation increased sales growth by 4%. Excluding estimated COVID-19 effects1, Group sales growth would have been 4% to 5% in constant currency (H1/21: 5% to 6%).

9% net income2,3,4 decline in constant currency

Group EBITDA before special items remained stable (-6% in constant currency) at €1,682 million (Q2/212: €1,674 million). Reported Group EBITDA was €1,528 million (Q2/21: €1,662 million).

In H1/22, Group EBITDA before special items increased by 1% (-4% in constant currency) to €3,344 million (H1/212: €3,305 million). Reported Group EBITDA was €3,123 million (H1/21: €3,290 million).

Group EBIT before special items decreased by 3% (-9% in constant currency) to €1,003 million (Q2/212: €1,033 million). The decrease was mainly driven by worsened labor shortages and related meaningfully increased wage inflation at Fresenius Medical Care in the U.S. as well as elevated material and logistic costs. The EBIT margin before special items was 10.0% (Q2/212: 11.2%). Reported Group EBIT was €845 million (Q2/21: €1,021 million).

In H1/22, Group EBIT before special items decreased by 2% (-7% in constant currency) to €2,003 million (H1/212: €2,042 million). The EBIT margin before special items was 10.1% (H1/212: 11.2%). Reported Group EBIT was €1,747 million (H1/21: €2,027 million).

1 For estimated COVID-19 effects please see table on page 18 of the pdf.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

4 Excluding Ivenix acquisition

Group net interest before special items improved to -€116 million (Q2/21: -€121 million) mainly due to positive one-time effects despite an increased interest rate environment. Reported Group net interest also improved to -€116 million (Q2/21: -€121 million). In H1/22, Group net interest before special items improved to -€235 million (H1/211: -€258 million). Reported Group net interest also improved to -€234 million (H1/21: -€258 million).

Group tax rate before special items was 23.0% (Q2/211: 21.5%) while the reported Group tax rate was 22.6% (Q2/21: 21.3%). In H1/22, Group tax rate before special items was 22.9% (H1/211: 22.1%) while the reported Group tax rate was 23.1% (H1/2021: 22.0%).

Noncontrolling interests before special items were -€233 million (Q2/211: -€241 million) of which 90% were attributable to the noncontrolling interests in Fresenius Medical Care. Reported noncontrolling interests were -€181 million (Q2/21: -€237 million). In H1/22, Noncontrolling interests before special items were -€451 million (H1/211: -€478 million) of which 89% were attributable to the noncontrolling interests in Fresenius Medical Care. Reported noncontrolling interests were -€367 million (H1/21: -€473 million).

Group net income2 before special items decreased by 5% (-9%3 in constant currency) to €450 million (Q2/211: €475 million). The decrease was mainly driven by worsened labor shortages and related meaningfully increased wage inflation at Fresenius Medical Care in the U.S. as well as elevated material and logistic costs. Excluding estimated COVID-19 effects4, Group net income2 before special items was -16% to -12% in constant currency (Q2/21: 10% to 14%). Reported Group net income2 decreased to €383 million (Q2/21: €471 million).

In H1/22, Group net income2 before special items remained stable (-3%3 in constant currency) at €913 million (H1/211: €911 million). Excluding estimated COVID-19 effects4, Group net income2 before special items was -10% to -6% in constant currency (H1/21: 4% to 8%). Reported Group net income2 decreased to €796 million (H1/21: €906 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 Excluding Ivenix acquisition

4 For estimated COVID-19 effects please see table on page 18 of the pdf.

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

Earnings per share1 before special items decreased by 6% (-11% in constant currency) to €0.80 (Q2/212: €0.85). Reported earnings per share1 were €0.68 (Q2/21: €0.84). In H1/22, earnings per share1 before special items remained stable (-4% in constant currency) at €1.63 (H1/212: €1.63). Reported earnings per share1 were €1.42 (H1/21: €1.62).

Continued investment in growth

Spending on property, plant and equipment was €419 million corresponding to 4% of sales (Q2/21: €509 million; 6% of sales). These investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics. In H1/22, spending on property, plant and equipment was €757 million corresponding to 4% of sales (H1/21: €893 million; 5% of sales).

Total acquisition spending was €291 million (Q2/21: €491 million), mainly for the acquisition of Ivenix by Fresenius Kabi and dialysis clinics at Fresenius Medical Care. In H1/22, total acquisition spending was €453 million (H1/21: €640 million).

Cash flow development

Group operating cash flow decreased to €1,017 million (Q2/21: €1,451 million) with a margin of 10.2% (Q2/21: 15.7%), mainly driven by working capital build-up from higher raw material inventories and receivables, among others, as well as phasing effects. Free cash flow before acquisitions and dividends decreased to €581 million (Q2/21: €952 million). Free cash flow after acquisitions and dividends decreased to -€391 million (Q2/21: -€359 million).

In H1/22, Group operating cash flow decreased to €1,118 million (H1/21: €2,103 million) with a margin of 5.7% (H1/21: 11.5%). Free cash flow before acquisitions and dividends decreased to €326 million (H1/21: €1,193 million). Free cash flow after acquisitions and dividends decreased to -€794 million (H1/21: -€242 million).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

Solid balance sheet structure

Group total assets increased by 6% (1% in constant currency) to €76,112 million (Dec. 31, 2021: €71,962 million) given currency translation effects and the expansion of business activities. Current assets increased by 8% (4% in constant currency) to €18,818 million (Dec. 31, 2021: €17,461 million), mainly driven by the increase of trade accounts receivables. Non-current assets increased by 5% (1% in constant currency) to €57,294 million (Dec. 31, 2021: €54,501 million).

Total shareholders’ equity increased by 9% (3% in constant currency) to €32,033 million (Dec. 31, 2021: €29,288 million). The equity ratio was 42.1% (Dec. 31, 2021: 40.7%).

Group debt increased by 4% (2% in constant currency) at €28,368 million (Dec. 31, 2021: € 27,155 million). Group net debt increased by 8% (5% in constant currency) to € 26,239 million (Dec. 31, 2021: € 24,391 million).

As of June 30, 2022, the net debt/EBITDA ratio increased to 3.72x1,2 (Dec. 31, 2021: 3.51x1,2) mainly driven by dividend payments, lower EBITDA contribution as well as acquisition spending. The net debt/EBITDA as of June 30, 2022 excluding the already closed acquisition of Ivenix was 3.681,2.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

Increased number of employees

As of June 30, 2022, the Fresenius Group had 318,647 employees worldwide (December 31, 2021: 316,078).

Business Segments

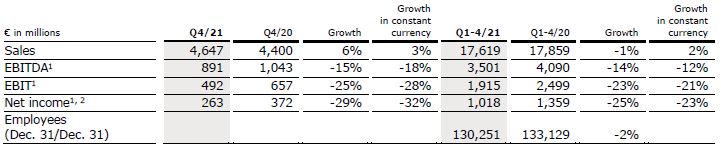

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of June 30, 2022, Fresenius Medical Care was treating 345,687 patients in 4,163 dialysis clinics. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care.

- Business development impacted by unprecedented U.S. labor market situation and worsening macroeconomic environment driving cost inflation and supply chain disruptions

- Meaningful decline in COVID-19-related excess mortality

- Solid support by positive exchange rates

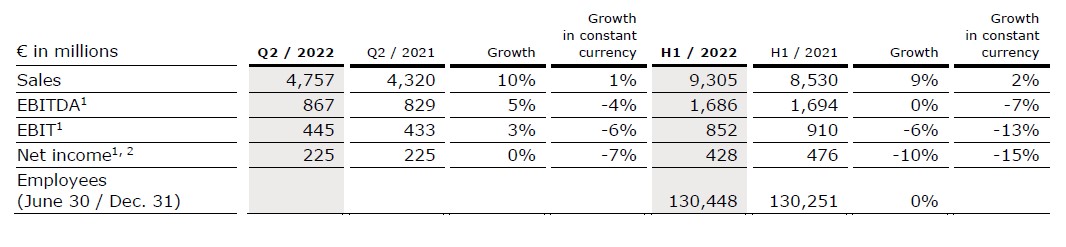

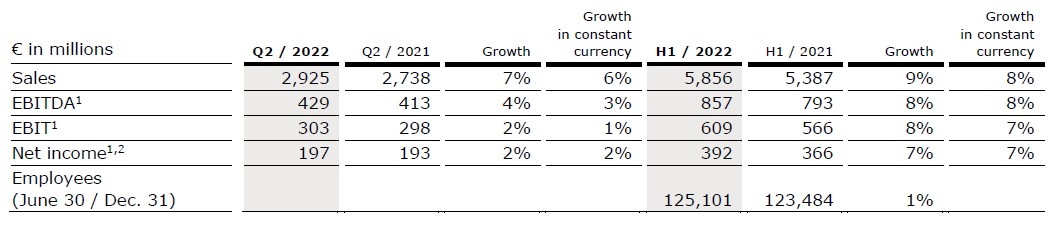

Sales increased by 10% (1% in constant currency) to €4,757 million (Q2/21: €4,320 million). Organic growth was 0%. Currency translation increased sales growth by 9%. In H1/22, sales increased by 9% (2% in constant currency) to €9,305 million (H1/21: €8,530 million). Organic growth was 1%. Currency translation increased sales growth by 7%.

EBIT decreased by 20% (-27% in constant currency) to €341 million (Q2/21: €424 million) resulting in a margin of 7.2% (Q2/21: 9.8%). EBIT before special items, i.e. costs incurred for FME25, the impacts related to the war in Ukraine, the impact of hyperinflation in Turkey and the remeasurement effect on the fair value of the investment in Humacyte, Inc. increased by 3% (-6% in constant currency) to €445 million (Q2/21: €433 million), resulting in a margin1 of 9.4% (Q2/21: 10.0%). At constant currency, the decline was mainly due to higher labor costs as well as inflationary and supply chain cost increases. This was partially offset by Provider Relief Funding received from the U.S. government to compensate for certain COVID-19-related costs.

1 Before special items

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

In H1/22, EBIT decreased by 23% (-29% in constant currency) to €688 million (H1/21: €898 million) resulting in a margin of 7.4% (H1/21: 10.5%). EBIT6 before special items decreased by 6% (-13% in constant currency) to €852 million (H1/21: €910 million), resulting in a margin1 of 9.2% (H1/21: 10.7%).

Net income2 decreased by 33% (-39% in constant currency) to €147 million (Q2/21: €219 million). Net income2 before special items remained stable (-7% in constant currency) at €225 million (Q2/21: €225 million) mainly due to the mentioned negative effects on operating income.

In H1/22, net income2 decreased by 35% (-39% in constant currency) to €305 million (H1/21: €468 million). Net income2 before special items decreased by 10% (-15% in constant currency) to €428 million (H1/21: €476 million).

Operating cash flow was €751 million (Q2/21: €921 million) with a margin of 15.8% (Q2/21: 21.3%). The decrease was mainly due to an unfavorable development of days sales outstanding as well as a decrease in net income2, partially offset by U.S. government relief funding. In H1/22, operating cash flow was €910 million (H1/21: €1,129 million) with a margin of 9.8% (H1/21: 13.2%).

As announced on July 27, 2022, Fresenius Medical Care expects revenue3 to grow at a low single digit percentage rate and net income2,4 to decline at around a high teens percentage range.

Revenue and net income guidance are both on a constant currency basis and before special items5.

Given the uncertain labor situation and macro-economic inflationary environment and the substantially reduced earnings base compared to 2020, Fresenius Medical Care does not expect today to be able to achieve the meaningfully higher compounded annual average increases that would now be needed to accomplish its 2025 targets. Against this background, Fresenius Medical Care has cut its financial targets for FY 2022 and withdrawn its 2025 targets.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Before special items

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 FY/21 base: €17,619 million

4 FY/21 base: €1,018 million, before special items; FY/22 before special items

5 These targets are based on the 2021 results excluding the costs related to FME25 of EUR 49 million (for Net Income). They are in constant currency and exclude special items. Special items include further costs related to FME25, the impact of the War in Ukraine, the impact of Hyperinflation in Turkey, the Humacyte investment remeasurement and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

For a detailed overview of special items please see the reconciliation tables on pages 20-23.

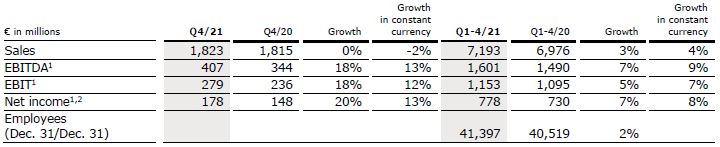

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

- North America with solid organic sales growth despite macroeconomic headwinds

- Asia-Pacific impacted by price pressure from NVBP tenders in China

- Biosimilars business progressing well; completing acquisition of majority stake in mAbxience

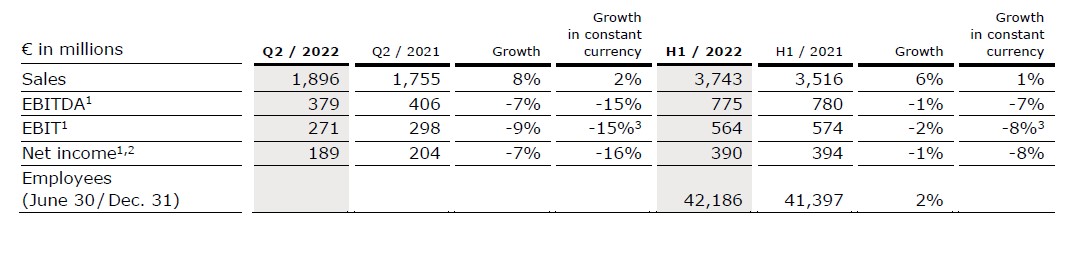

Sales increased by 8% (2% in constant currency) to €1,896 million (Q2/21: €1,755 million). Organic growth was 2%. In H1/22, sales increased by 6% (1% in constant currency) to €3,743 million (H1/21: €3,516 million). Organic growth was 1%. Positive currency translation effects of 6% in Q2/22 and 5% in H1/22 were mainly related to the U.S. dollar and Chinese yuan.

Sales in North America increased by 16% (organic growth: 3%) to €606 million (Q2/21: €522 million). The significant sales growth was mainly driven by positive currency effects while organic growth continued to be impacted a high level of COVID-related absenteeism of production staff, ongoing competitive pressure and supply chain challenges. In H1/22, sales in North America increased by 10% (organic growth: 0%) to €1,185 million (H1/21: €1,080 million).

Sales in Europe increased by 4% (organic growth: 4%) to €658 million (Q2/21: €634 million) driven by a broad-based positive development and biosimilars. In H1/22, sales in Europe increased by 3% (organic growth: 3%) to €1,298 million (H1/21: €1,260 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 Excluding Ivenix acquisition

For a detailed overview of special items please see the reconciliation tables on pages 20-23.

Sales in Asia-Pacific increased by 4% (organic growth: -4%) to €425 million (Q2/21: €409 million). Organic growth was primarily affected by price pressure from the NVBP (National Volume-Based Procurement) tenders in China while Asia-Pacific ex China showed healthy underlying growth. In H1/22, sales in Asia-Pacific increased by 7% (organic growth: -1%) to €858 million (H1/21: €801 million).

Sales in Latin America/Africa increased by 9% (organic growth: 2%) to €207 million (Q2/21: €190 million), over a high prior-year COVID-19-related base. In H1/22, sales in Latin America/Africa increased by 7% (organic growth: 2%) to €402 million (H1/21: €375 million).

Sales in the Biosimilars business was €29 million. In H1/22, sales in the Biosimilars business was €52 million, consistent with Fresenius Kabi’s expectations. The U.S. Food and Drug Administration (FDA) has accepted for review Fresenius Kabi's Biologics License Application (BLA) for MSB11456, a biosimilar candidate of Actemra®4 (tocilizumab). Moreover, Fresenius Kabi closed the majority stake acquisition of mAbxience Holding S.L., a leading international biopharmaceutical company. The transaction was announced in March 2022. The acquisition significantly strengthens Fresenius Kabi’s footprint in the biopharmaceuticals space. The purchase price will be a combination of c. €495 million upfront payment and milestone payments, strictly tied to the achievement of commercial and development targets.

EBIT1 decreased by 9% (-15%2 in constant currency) to €271 million (Q2/21: €298 million) with an EBIT margin1 of 14.3% (Q2/21: 17.0%). Ongoing competitive pressure, staff shortages, supply chain challenges as well as accelerated input cost inflation weighed on the financial performance. In H1/22, EBIT1 decreased by 2% (-8%2 in constant currency) to €564 million (H1/21: €574 million) with an EBIT margin1 of 15.1% (H1/21: 16.3%).

Net income1,3 decreased by 7% (-16% in constant currency) to €189 million (Q2/21: €204 million). In H1/22, net income1,3 decreased by 1% (-8% in constant currency) to €390 million (H1/21: €394 million).

Operating cash flow decreased to €109 million (Q2/21: €197 million) with a margin of 5.7% (Q2/21: 11.2%), mainly driven by a working capital build-up from e.g. higher raw material inventories. In H1/22, operating cash flow decreased to €242 million (H1/21: €475 million) with a margin of 6.5% (H1/21: 13.5%).

1 Before special items

2 Excluding Ivenix acquisition

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

4 Actemra® is a registered trademark of Chugai Seiyaku Kabushiki Kaisha Corp., a member of the Roche Group

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

For FY/22, Fresenius Kabi confirms its outlook and expects organic sales1 growth in a low-single-digit percentage range. Constant currency EBIT2 is expected to decline in a high-single- to low-double-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects. The financial effects from the acquisitions of Ivenix and the majority stake in mAbxience remain excluded from guidance.

Save the date: Fresenius will host a virtual Meet the Management event on its business segment Fresenius Kabi on Friday, October 7, 2022 (virtual event).

1 FY/21 base: €7,193 million

2 FY/21 base: €1,153 million, before special items, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

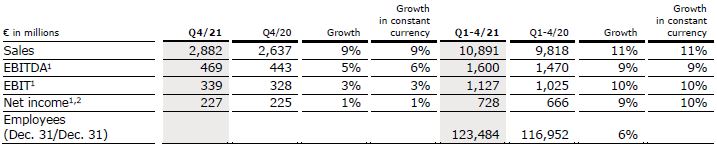

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany, Helios Spain and Helios Fertility. Helios Germany operates 87 hospitals, ~130 outpatient centers and 6 prevention centers. Helios Spain operates 50 hospitals, 97 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 8 hospitals and as a provider of medical diagnostics. Helios Fertility offers a wide spectrum of state-of-the-art services in the field of fertility treatments.

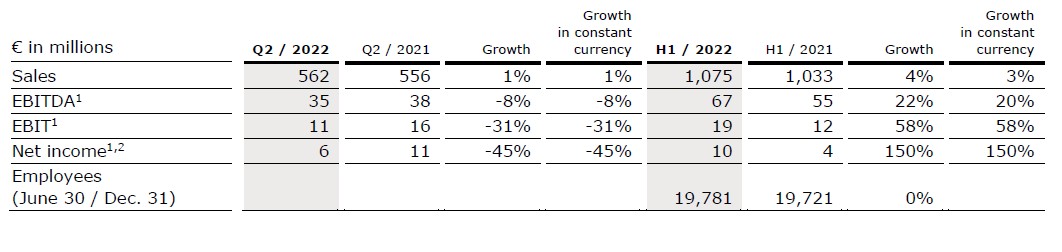

- Fresenius Helios with solid organic growth in Germany and Spain based on increased number of admissions

- Helios Fertility with solid financial performance

Sales increased by 7% (6% in constant currency) to €2,925 million (Q2/21: €2,738 million). Organic growth was 5%. Acquisitions, mainly at Helios Fertility, contributed 1% to sales growth. In H1/22, sales increased by 9% (8% in constant currency) to €5,856 million (H1/21: €5,387 million). Organic growth was 6%. Acquisitions contributed 2% to sales growth.

Sales of Helios Germany increased by 5% (organic growth: 4%) to €1,758 million (Q2/21: €1,675 million), mainly driven by increasing admissions, which are however still below pre-pandemic levels. Acquisitions contributed 1% to sales growth. In H1/22, sales of Helios Germany increased by 6% (organic growth: 5%) to €3,541 million (H1/21: €3,348 million). Acquisitions contributed 1% to sales growth.

Sales of Helios Spain increased by 8% (7% in constant currency) to €1,101 million (Q2/21: €1,020 million). Organic growth of 6% was driven by consistently high activity levels. The hospitals in Latin America also contributed to sales growth. Acquisitions contributed 2% to sales growth. In H1/22, sales of Helios Spain increased by 10% (9% in constant currency) to €2,190 million (H1/21: €1,996 million). Organic growth was 9%.

Sales of the Helios Fertility were €65 million (Q2/21: €42 million). In H1/22, sales of the Helios Fertility were €122 million.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

EBIT1 increased by 2% (1% in constant currency) to €303 million (Q2/21: €298 million) with an EBIT margin1 of 10.4% (Q2/21: 10.9%). In H1/22, EBIT1 increased by 8% (7% in constant currency) to €609 million (H1/21: €566 million) with an EBIT margin1 of 10.4% (H1/21: 10.5%).

EBIT1 of Helios Germany increased by 1% to €154 million (Q2/21: €152 million) with an EBIT margin1 of 8.8% (Q2/21: 9.1%). COVID-related elevated staff absenteeism weighed on profitability. Inflationary effects had only a small negative impact. In H1/22, EBIT1 of Helios Germany increased by 2% to €308 million (H1/21: €302 million) with an EBIT margin1 of 8.7% (H1/21: 9.0%).

EBIT1 of Helios Spain increased by 1% (0% in constant currency) to €148 million (Q2/21: €147 million) due to an extraordinary high prior-year quarter comp. The Latin American business also showed a good performance. The EBIT margin1 was 13.4% (Q2/21: 14.4%). In H1/22, EBIT1 of Helios Spain increased by 10% (10% in constant currency) to €301 million (H1/21: €273 million). The EBIT margin1 was 13.7% (H1/21: 13.7%).

EBIT1 of Helios Fertility was €7 million with an EBIT margin1 of 10.8% (Q2/21: €5 million). In H1/22, EBIT1 of Helios Fertility was €11 million with an EBIT margin1 of 9.0%.

Net income1,2 increased by 2% (2% in constant currency) to €197 million (Q2/21: €193 million). In H1/22, net income1,2 increased by 7% (7% in constant currency) to €392 million (H1/21: €366 million).

Operating cash flow decreased to €194 million (Q2/21: €223 million) with a margin of

6.6% (Q2/21: 8.1%) following COVID-19-related delays in budget negotiations in Germany. In H1/22, operating cash flow decreased to €58 million (H1/21: €438 million) with a margin of 1.0% (H1/21: 8.1%)

For FY/22, Fresenius Helios confirms its outlook and expects organic sales3 growth in a low- to mid-single-digit percentage range and constant currency EBIT4 growth in a mid-single-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/21 base: €10,891 million

4 FY/21 base: €1,127 million, before special items, FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 20-23 of the pdf.

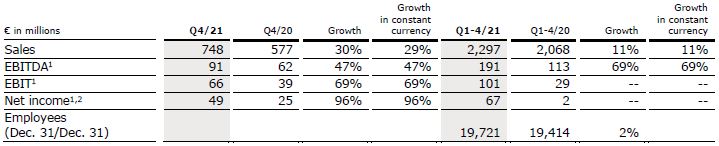

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

- Project business still marked by the Ukraine war and COVID-19-related headwinds in project execution as well as global supply chain challenges and cost inflation

- Service business supported by increasing elective treatment activity

- Order backlog at all-time high

Sales increased by 1% (1% in constant currency) to €562 million (Q2/21: €556 million). Organic growth was 1%. In H1/22, sales increased by 4% (3% in constant currency) to €1,075 million (H1/21: €1,033 million). Organic growth was 4%.

Sales in the service business increased by 6% (6% in constant currency) to €417 million (Q2/21: €392 million) due to recovering elective treatments. Sales in the project business decreased by 12% (-12% in constant currency) to €145 million (Q2/21: €164 million),

driven by the Ukraine war and COVID-19-related headwinds as well as global supply chain challenges. In H1/22, sales in the service business increased by 9% (8% in constant currency) to €822 million (H1/21: €755 million). Sales in the project business decreased by 9% (-9% in constant currency) to €253 million (H1/21: €278 million).

EBIT1 decreased by 31% to €11 million (Q2/21: €16 million) with an EBIT margin1 of 2.0% (Q2/21: 2.9%) driven by the Ukraine war and COVID-19-related headwinds as well as global supply chain challenges. In H1/22, EBIT1 increased by 58% to €19 million (H1/21: €12 million) with an EBIT margin1 of 1.8% (H1/21: 1.2%).

1 Before special items

2 Net income attributable to shareholders of VAMED AG

For a detailed overview of special items please see the reconciliation tables on pages 20-23.

Net income1,2 decreased by 45% to €6 million (Q2/21: €11 million). In H1/22, Net income1,2 increased to €10 million (H1/21: €4 million).

Order intake was €253 million (Q2/21: €713 million). In H1/22 order intake was €516 million (H1/21: €851 million). As of June 30, 2022, order backlog was at €3,732 million (December 31, 2021: €3,473 million).

Operating cash flow decreased to €7 million (Q2/21: €58 million) with a margin of 1.2% (Q2/21: 10.4%), due to phasing effects and COVID-19-related delays in the project business as well as some working capital build-ups. In H1/22, operating cash flow decreased to -€38 million (H1/21: €14 million) with a margin of -3.5% (H1/21: 1.4%).

For FY/22, Fresenius Vamed confirms its outlook and expects organic sales3 growth in a high-single to low-double-digit percentage range and constant currency EBIT4 to return to absolute pre-COVID-19 levels (FY/19: €134 million). Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of VAMED AG

3 FY/21 base: €2,297 million

4 FY/21 base: €101 million, before special items; FY/22 before special items

For a detailed overview of special items please see the reconciliation tables on pages 20-23

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Kabi closed the majority stake acquisition of mAbxience Holding S.L. (“mAbxience”), a leading international biopharmaceutical company. The transaction was announced in March 2022.

The acquisition significantly strengthens Fresenius Kabi’s footprint in the biopharmaceuticals space by broadening the product portfolio and expanding its production network with three state-of-the-art facilities for the production of biologic drug substance. This will enable Fresenius Kabi to cover the entire biopharmaceuticals value chain in the future and create flexible, competitive capacities for the production of the expanded biosimilars portfolio. The additional production capacities are expected to generate significant cost synergies with regard to the company's own biosimilars portfolio. Furthermore, the acquisition enables further expansion in the high-growth CDMO (Contract Development and Manufacturing Organization) market for biologics.

The purchase price will be a combination of c. €495 million upfront payment and milestone payments, strictly tied to the achievement of commercial and development targets. The contractual provisions also include a put / call option scheme regarding the sellers’ and future co-owners’ remaining shares in mAbxience (45%).

Fresenius Medical Care’s financial performance in Q2/22 was significantly impacted by worsened labor shortages and related meaningfully increased wage inflation in the U.S. The further deterioration of the macro-economic environment resulted in accelerated non-wage inflation, particularly higher supply chain costs.

Against this backdrop and growing indications for a persistent unfavorable development of these and other factors, Fresenius Medical Care has revised its outlook for FY/22.

All other Fresenius Group segments confirm their respective outlook for FY/22 for both revenue and EBIT.

However, as a consequence of the development at Fresenius Medical Care, and despite all other Fresenius Group segments confirming their respective outlook for both revenue and EBIT, Fresenius now also revises its Group outlook for FY/22. At constant currency, the Company now anticipates Group sales1 to grow in a low-to-mid single-digit percentage range (previously: mid-single digit percentage range) and Group net income2,3 to decline in a low-to-mid single-digit percentage range (previously: increase in a low-single-digit percentage range).

1FY/21 base: €37,520 million

2Net income attributable to shareholders of Fresenius SE & Co. KGaA

3FY/21 base: €1,867 million; before special items; FY/22: before special items

Stephan Sturm, CEO of Fresenius, said: “As a globally active healthcare group, we, too, have inevitably been impacted by – in many cases massive – cost increases, growing problems in the global supply chains, and staff shortages. And unlike companies in other industries, we cannot simply pass on the resulting cost burdens in the short term by raising our prices. To the extent possible and foreseeable, we factored these burdens into the guidance we provided in February and May. In the meantime, though, it has become apparent that patient-facing healthcare services in the United States are affected even more heavily, hence also Fresenius Medical Care. It will take fortitude and energy to overcome this particularly challenging phase, and I am therefore very pleased that Carla Kriwet will assume her new position as CEO of Fresenius Medical Care quite a bit earlier than initially planned. I am confident that, together with her colleagues, she will find the right solutions and lead Fresenius Medical Care into a successful future.”

“Our goal at Fresenius is, and remains, to create more value: for our patients, our employees and our shareholders,” added Sturm. “We are working tirelessly, guided by our clear strategic priorities, to achieve this. And we continue to see good prospects, despite the current burdens and difficulties resulting from global crises. Not least because, from our strong market positions, we moved early to capitalize on the right trends, such as home dialysis. Healthcare is a market of the future that we want to play an important role in shaping, and where we intend to continue our sustained, profitable growth.”

Assumptions for guidance FY/22

Due to the meaningfully increased uncertainty and volatility related to the war in Ukraine, the ongoing impacts of the COVID-19 pandemic, and a rapidly worsening global macro-economic development, Fresenius now expects significantly more pronounced headwinds in 2022 from supply chain disruptions and cost inflation, including energy prices. Furthermore, Fresenius expects significant negative effects from ongoing labor shortages and associated wage inflation, especially at Fresenius Medical Care in the U.S.

The war in Ukraine is directly and indirectly affecting Fresenius Group operations. The direct adverse effects of the war amounted to €20 million at net income1 level of Fresenius Group in H1/22 and are treated as a special item. Fresenius will continue to closely monitor the potential further consequences of the war, including balance sheet valuations. The guidance does not consider a significant disruption of gas or electricity supplies in Europe.

COVID-19 will continue to impact Fresenius Group operations in 2022. An unlikely but possible significant deterioration of the situation triggering containment measures that could have a significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/22 guidance.

Furthermore, the updated assumptions for Fresenius Medical Care's FY/22 guidance are also fully applicable to Fresenius Group's FY/22 guidance.All of these assumptions are subject to considerable uncertainty. The acquisition of Ivenix and the announced acquisition of the majority stake in mAbxience as well as any further potential acquisitions remain excluded from guidance.

Group medium-term targets

As a result of the updated expectations for FY/22, Fresenius now believes its medium-term net income1 target is no longer achievable. Fresenius had expected Group organic net income1 growth to be at the bottom end of the 5% to 9% compounded annual growth rate (CAGR) range for 2020 to 2023. At the same time, Fresenius specifies its Group organic sales growth target to reach the low-end of the targeted 4% to 7% compounded annual growth rate (CAGR) range for 2020 to 2023.

Cost and efficiency program

The Group’s cost and efficiency program is running according to plan and Fresenius confirms its increased savings targets provided in February 2022 of at least €150 million p.a. after tax and minority interest in 2023. For the years thereafter, a further significant increase in sustainable cost savings is expected.

Management Board change at Fresenius Medical Care

Dr. Carla Kriwet will now join Fresenius Medical Care as CEO on October 1, 2022, earlier than previously announced and Rice Powell will step down as CEO effective September 30, 2022.

Preliminary Q2 and H1/22 results2

1Net income attributable to shareholders of Fresenius SE & Co. KGaA

2EBIT and net income before special items

3Excluding Ivenix acquisition

Fresenius Kabi preliminary financial results

Sales in Q2/22 increased by 8% (2% in constant currency) to €1,896 million (Q2/21: €1,755 million). Organic growth was 2%. The positive currency translation effects of 6% in Q2/22 were mainly related to the U.S. dollar and Chinese yuan.

Sales in North America increased by 16% (organic growth: 3%) to €606 million (Q2/21: €522 million), strongly supported by U.S. Dollar-related currency translation effects. Sales in Europe increased by 4% (organic growth: 4%) to €658 million (Q2/21: €634 million). Sales in Asia-Pacific increased by 4% (organic growth: -4%) to €425 million (Q2/21: €409 million). Positive currency translation effects contributed to reported sales growth. Sales in Latin America/Africa increased by 9% (organic growth: 2%) to €207 million (Q2/21: €190 million). Sales for the Biosimilars business were €29 million.

EBIT1 decreased by 9% (-15% in constant currency) to €271 million (Q2/21: €298 million). The EBIT margin1 was 14.3% (Q2/21: 17.0%).

Fresenius Kabi EBIT by region

Fresenius Kabi confirms its FY/22 outlook and expects organic sales3 growth in a low-single-digit percentage range. Constant currency EBIT2,4 is expected to decline in a high-single- to low-double-digit percentage range. The sales and EBIT outlook ranges include expected COVID-19 effects and exclude the effects of the acquisitions Ivenix and mAbxience.

1Before special items

2Excluding Ivenix acquisition

3FY/21 base: €7,193 million

4FY/21 base: €1,153 million, before special items, FY/22 before special items

Fresenius Helios preliminary financial results

Sales increased by 7% (6% in constant currency) to €2,925 million (Q2/21: €2,738 million). Organic growth was 5%. Acquisitions contributed 1% to sales growth.

Sales of Helios Germany increased by 5% (organic growth: 4%) to €1,758 million (Q2/21: €1,675 million). Sales of Helios Spain increased by 8% (7% in constant currency) to €1,101 million (Q2/21: €1,020 million). Organic growth was 6%. Sales of Helios Fertility were €65 million (Q2/21: €42 million).

EBIT1 of Fresenius Helios increased by 2% (1% in constant currency) to €303 million (Q2/21: €298 million) with an EBIT margin1 of 10.4% (Q2/21: 10.9%).

EBIT of Helios Germany increased by 1% to €154 million (Q2/21: €152 million) with an EBIT margin of 8.8% (Q2/21: 9.1%). EBIT of Helios Spain increased by 1% (0% in constant currency) to €148 million (Q2/21: €147 million). The EBIT margin was 13.4% (Q2/21: 14.4%). EBIT1 of Helios Fertility was €7 million with an EBIT1 margin of 10.8% (Q2/21: €5 million).

Fresenius Helios confirms its FY/22 outlook and expects organic sales2 growth in a low-to mid-single-digit percentage range and constant currency EBIT3 growth in a mid-single-digit percentage range. The sales and EBIT outlook ranges include expected COVID-19 effects.

Fresenius Vamed preliminary financial results

Sales increased by 1% (1% in constant currency) to €562 million (Q2/21: €556 million). Organic growth was 1%.

Sales in the service business increased by 6% (6% in constant currency) to €417 million (Q2/21: €392 million). Sales in the project business decreased by 12% (-12% in constant currency) to €145 million (Q2/21: €164 million).

EBIT1 decreased by 31% to €11 million (Q2/21: €16 million) with an EBIT margin1 of 2.0% (Q2/21: 2.9%).

Order intake was €253 million (Q2/21: €713 million). As of June 30, 2022, order backlog was at €3,732 million (December 31, 2021: €3,473 million).

Fresenius Vamed confirms its FY/22 outlook and expects organic sales4 growth in a high-single to low-double-digit percentage range and constant currency EBIT5 to return to absolute pre-COVID-19 levels (FY/19: €134 million). The sales and EBIT outlook ranges include expected COVID-19 effects.

1Before special items

2FY/21 base: €10,891 million

3FY/21 base: €1,127 million, before special items, FY/22 before special items

4FY/21 base: €2,297 million

5FY/21 base: €101 million, before special items; FY/22 before special items

Detailed financial results publication and Conference Call

As part of the publication of the preliminary results for Q2/2022, a conference call will be held on July 28, 2022 at 1:30 p.m. CEDT (7:30 a.m. EDT) replacing the originally planned call from August 2, 2022.

All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

On August 2, 2022, Fresenius will publish detailed Q2/22 and H1/22 financials.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Outlook:

- Revised FY 2022 targets: revenue to grow at the low end of the previously guided low to mid-single digit percentage range and net income to decline around a high teens percentage range.

- Despite most burdens assumed to be temporary, 2025 targets withdrawn due to uncertainty of labor and macro-economic inflationary environment

- Unprecedented U.S. labor market situation constraining capacity and accelerating wage inflation

- Worsening macroeconomic environment driving cost inflation and supply chain disruptions

- FME25: Transformation to new operating model and savings generation on track

- Start date for Dr. Carla Kriwet as CEO advanced to October 1, 2022

Helen Giza, Deputy CEO and Chief Financial Officer of Fresenius Medical Care, said: “At the end of the first quarter we assumed extended labor shortages but clearly did not expect such a significant and rapid deterioration. Increased staff shortages, higher staff turnover rates and growing reliance on contract labor continue to increase our cost base, despite support received from the U.S. Provider Relief Fund. At the same time, these factors are constraining our capacity and hence our ability to deliver the volume recovery in Health Care Services that we had assumed for the back half of the year. The already challenging macroeconomic environment has significantly deteriorated – driving non-wage cost inflation and supply chain disruptions. Today we have to assume that these effects will have a very pronounced impact on our business development in the remainder of 2022. Even though most of the current burdens are assumed to be temporary, the uncertainty of these effects is widening the gap to our targets and making a potential catch-up unlikely. As a consequence, we have cut our financial targets for the fiscal year 2022 and feel it prudent to withdraw our 2025 targets. We continue to assess opportunities to accelerate and broaden our FME25 transformation program. We strongly believe our business model and the underlying growth drivers to be intact. Our strategy to drive growth in home dialysis and value-based care is more relevant than ever.”

Fresenius Medical Care, the world's leading provider of products and services for individuals with kidney diseases, has announced that revenue and net income2 for the second quarter of 2022 are anticipated to come in below the Company’s expectations. Based on preliminary figures and at constant currency, Fresenius Medical Care expects revenue to increase year-on-year by 1%. For net income excluding special items3 and at constant currency the Company expects a decrease by 7% compared to the previous year’s quarter. Against the background of these preliminary results as well as the significantly changed developments and corresponding materially worsened assumptions for the remainder of the year outlined below, Fresenius Medical Care has cut its financial targets for FY 2022 and withdrawn its 2025 targets.

1 Special items include costs related to the FME25 program, the impact of the War in Ukraine, the impact of hyperinflation in Turkiye, the remeasurement effect on the fair value of the investment in Humacyte, Inc. (Humacyte investment remeasurement) and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the Company’s financial targets which have been defined excluding special items.

2 Attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA | 2021 and 2022 figures exclude special items (2021: Costs related to the FME25 program; 2022: Costs related to the FME25 program, impact of the War in Ukraine, impact of Hyperinflation in Turkiye, Humacyte investment remeasurement

Increased headwinds from labor and inflation

The unprecedented U.S. labor market challenges materially worsened in the second quarter. For Fresenius Medical Care, this resulted in meaningfully higher than assumed wage inflation, surcharges, retention payments and additional costs for contract labor to contain the increasing staff shortages.

Despite these additional investments in labor, including application of monies received from the U.S. government's Provider Relief Fund, staff shortages and turnover rates have continued to increase. The Company’s growth in the second quarter was affected by the number of clinics with constrained ability to accept new patients for treatment. Assuming that the unprecedented pressures from the U.S. labor market will persist in the second half of the year, Fresenius Medical Care no longer expects to achieve organic revenue growth in North American Health Care Services in 2022.

The already existing challenging macroeconomic environment has further significantly deteriorated in the second quarter, driving accelerated non-wage cost inflation. This has been exacerbated by the ongoing war in Ukraine and its global economic impact. These effects are expected to persist for the remainder of the year, resulting in higher logistics costs, raw material and energy prices as well as further supply chain disruptions.

Based on preliminary figures, COVID-19-related excess mortality in the second quarter sequentially declined in line with the Company’s projections. However, infection rates remained on a high level resulting in a continued need and costs for isolation clinics and shifts as well as a higher than assumed spend for personal protective equipment.

In the second quarter, revenue in the Healthcare Services business was negatively impacted by meaningful yet unforeseen declines in co-insurance, increases in patient choice of higher deductibles plans, and lower than expected collections in aged accounts receivable.

Revised financial targets for FY 2022

Given the significantly increased headwinds outlined above, Fresenius Medical Care now expects revenue to grow at the low end of the previously guided low to mid-single digit percentage range. For net income2 the Company now expects a decline of around a high teens percentage range compared to the previously guided growth of a low to mid-single digit percentage range. Revenue and net income guidance are both on a constant currency basis and before special items4.

These targets are based on the following operating income relevant assumptions:

- Macro-economic inflation and supply chain costs of around EUR 220 million instead of EUR 50 million previously assumed

- COVID-19: Impact of accumulated excess mortality of around EUR 100 million

- U.S. labor costs expected to be around EUR 100 million, net of support from U.S. Provider Relief Fund, in excess of the 3% base wage inflation assumption

- U.S. ballot initiative expense of EUR 20 to 30 million

- Business growth of EUR 70 million instead of EUR 250 million previously assumed

- Personal protective equipment cost reduction to be around EUR 20 million instead of EUR 50 million previously assumed

- FME25 savings of EUR 40 to 70 million

- Remeasurement effects on the fair value of investments are expected to be volatile but neutral on a full year basis; for guidance relevant comparison, the Humacyte investment remeasurement is treated as special item

- No meaningful further impact from natural gas shortages or suspension of gas supply to affect manufacturing sites

4 These targets are based on the 2021 results excluding the costs related to FME25 of EUR 49 million (for Net Income). They are in constant currency and exclude special items. Special items include further costs related to FME25, the impact of the War in Ukraine, the impact of Hyperinflation in Turkiye, the Humacyte investment remeasurement and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

Most of the unprecedented challenges outlined above are assumed to be temporary. However, given the uncertain labor situation and macro-economic inflationary environment and the substantially reduced earnings base compared to 2020, Fresenius Medical Care does not expect today to be able to achieve the meaningfully higher compounded annual average increases that would now be needed to accomplish its 2025 targets. Fresenius Medical Care remains committed to its growth strategy and will consistently pursue the initiatives defined therein.

Preliminary consolidated figures

Revenue increased by 10% to EUR 4,757 million (+1% at constant currency, +0% organic) in the second quarter.

Health Care Services revenue grew by 11% to EUR 3,782 million (+1% at constant currency, +0% organic). Growth at constant currency was mainly driven by contributions from acquisitions.

Health Care Products revenue increased by 6% to EUR 975 million (+1% at constant currency, +1% organic). Constant currency growth was mainly driven by higher sales of in-center disposables, partially offset by lower sales of acute cardiopulmonary products.

In the first half, revenue grew by 9% to EUR 9,305 million (+2% at constant currency, +1% organic). Health Care Services revenue increased by 10% to EUR 7,389 million (+2% at constant currency, +1% organic); Health Care Products revenue grew by 6% to EUR 1,916 million (+2% at constant currency, +2% organic).

Operating income decreased by 20% to EUR 341 million (-27% at constant currency) in the second quarter, resulting in a margin of 7.2% (Q2 2021: 9.8%). Operating income excluding special items, i.e. costs incurred for FME25, the impacts related to the war in Ukraine, the impact of hyperinflation in Turkiye, and the remeasurement effect on the fair value of the investment in Humacyte, Inc. (Humacyte investment remeasurement), increased by 3% to EUR 445 million (-6% at constant currency), resulting in a margin of 9.4% (Q2 2021: 10.0%). At constant currency, the decline was mainly due to higher labor costs as well as inflationary and supply chain cost increases. This was partially offset by Provider Relief Funding received from the U.S. government to compensate for certain COVID-19-related costs.

In the first half, operating income declined by 23% to EUR 688 million (-29% at constant currency), resulting in a margin of 7.4% (H1 2021: 10.5%). Excluding special items, operating income decreased by 6% to EUR 852 million (-13% at constant currency), resulting in a margin of 9.2% (H1 2021: 10.7%).

Net income2 decreased by 33% to EUR 147 million (-39% at constant currency). Excluding special items, net income2 was stable and amounted to EUR 225 million (-7% at constant currency). At constant currency, the decline was mainly due to the mentioned negative effects on operating income. Basic earnings per share (EPS) decreased by 33% to EUR 0.50 (-39% at constant currency). Excluding special items, EPS was stable and amounted to EUR 0.77 (-7% at constant currency).

In the first half, net income2 declined by 35% to EUR 305 million (-39% at constant currency). Excluding special items, net income2 decreased by 10% to EUR 428 million

(-15% at constant currency). EPS decreased by 35% to EUR 1.04 (-39% at constant currency). Excluding special items, EPS declined by 10% to EUR 1.46 (-15% at constant currency).

Regional developments5

5 Based on preliminary figures

In North America, revenue increased by 12% to EUR 3,294 million (-1% at constant currency, -2% organic) in the second quarter. At constant currency, this was mainly due to a decline in organic growth – which was driven by COVID-19 as well as by declines in co-insurance, increases in patient choice of higher deductibles plans, and lower than expected collections in aged accounts receivable in the Health Care Services business – and due to lower sales of in-center disposables, machines for chronic treatment, renal pharmaceuticals and home hemodialysis products. These effects were only partially offset by contributions from acquisitions. In the first half, revenue grew by 10% to

EUR 6,464 million (+0% at constant currency, -1% organic).

Operating income in North America decreased by 14% to EUR 340 million (-24% at constant currency) in the second quarter, resulting in a margin of 10.3% (Q2 2021: 13.5%). At constant currency, the decline in operating income was mainly due to higher labor costs, the Humacyte investment remeasurement, declines in co-insurance, increases in patient choice of higher deductibles plans, and lower than expected collections in aged accounts receivable, the impact of COVID-19, as well as inflationary and supply chain costs. This was partially offset by provider relief funding received from the U.S. government to compensate for certain COVID-19-related costs. In the first half, operating income declined by 19% to EUR 644 million (-26% at constant currency), resulting in a margin of 10.0% (H1 2021: 13.6%).

Revenue in the EMEA region increased by 5% to EUR 727 million in the second quarter (+7% at constant currency, +6% organic). At constant currency, this was mainly due to organic growth in Health Care Services and Health Care Products, both including the effects of hyperinflation in Turkiye. Growth in Health Care Products was driven by higher sales of in-center disposables, machines for chronic treatment and renal pharmaceuticals, partially offset by lower sales of acute cardiopulmonary products. In the first half, revenue grew by 3% to EUR 1,401 million (+5% at constant currency, +4% organic).

Operating income in EMEA decreased by 19% to EUR 60 million (-18% at constant currency) in the second quarter, resulting in a margin of 8.2% (Q2 2021: 10.6%). At constant currency, the decline in operating income was mainly due to inflationary cost increases, the impact of hyperinflation in Turkiye and costs associated with the FME25 program, partially offset by favorable currency transaction effects. In the first half, operating income declined by 21% to EUR 121 million (-18% at constant currency), resulting in a margin of 8.6% (H1 2021: 11.2%).

In Asia-Pacific, revenue increased by 6% to EUR 516 million (+2% at constant currency, +2% organic) in the second quarter. At constant currency, this was mainly driven by organic growth in the Health Care Services business. In the first half, revenue increased by 7% to EUR 1,023 million (+3% at constant currency, +3% organic).

Operating income decreased by 16% to EUR 71 million (-16% at constant currency) in the second quarter, resulting in a margin of 13.8% (Q2 2021: 17.3%). At constant currency, the decline in operating income was mainly due to an unfavorable impact from growth in lower margin businesses and inflationary cost increases. In the first half, operating income was stable and amounted to EUR 170 million (-1% at constant currency), resulting in a margin of 16.6% (H1 2021: 17.7%).

Latin America revenue increased by 21% to EUR 207 million (+17% at constant currency, +18% organic) in the second quarter, mainly driven by organic growth in the Health Care Services business, as well as higher sales of in-center disposables and machines for chronic treatment. In the first half, revenue grew by 18% to EUR 391 million (+16% at constant currency, +17% organic).

Operating income decreased to EUR -6 million in the second quarter, resulting in a margin of -3.0% (Q2 2021: 1.5%). At constant currency, the decline in operating income was mainly due to inflationary cost increases and unfavorable foreign currency transaction effects, partially offset by lower bad debt expense. In the first half, operating income decreased by 46% to EUR 5 million (-71% at constant currency), resulting in a margin of 1.3% (H1 2021: 2.8%).

Patients, clinics and employees5

As of June 30, 2022, Fresenius Medical Care treated 345,687 patients in 4,163 dialysis clinics worldwide and had 123.153 employees (full-time equivalents) globally, compared to 123,538 employees as of June 30, 2021.

FME25 update

With savings of EUR 26 million in the first half of the year, Fresenius Medical Care is on track to achieve its savings target of EUR 40-70 million in 2022 as part of the FME25 transformation program. Key achievements in the first half of the year include the announcement of the first two leadership levels below the Management Board and the corresponding organizational structure as well as the finalization of country governance in line with the future operating model. The Company has also made significant progress in the transformation of global functions such as Finance, Digital Technology & Innovation as well as Procurement. In addition to the ongoing and already identified FME25 measures, Fresenius Medical Care is currently in the process of reviewing potential additional initiatives in both designated operating segments (Care Delivery and Care Enablement) as part of the transformation program.

New CEO start advanced

The start of Dr. Carla Kriwet as CEO of Fresenius Medical Care has been advanced to October 1, 2022. Rice Powell will step down as CEO effective September 30, 2022.

Conference call

Fresenius Medical Care will host a conference call on July 28, 2022 at 9:00 a.m. CEST to discuss the preliminary results for the second quarter and first half of 2022. This conference call will replace the earnings call originally scheduled for August 2, 2022. Details will be available on www.freseniusmedicalcare.com in the “Investors/Publications” section. A replay will be available shortly after the call. The Company will publish its full results for the first quarter and second half of 2022 on August 2, 2022.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to COVID-19, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Implementation of measures as presented herein may be subject to information and consultation procedures with works councils and other employee representative bodies, as per local laws and practice. Consultation procedures may lead to changes on proposed measures.