Fresenius Helios will be linking digitalization even more closely with its core activities in inpatient and outpatient healthcare. The company will strengthen areas such as the digitalization of clinical processes and clinical decision making, for example through the responsible use of artificial intelligence.

Furthermore, a Digital Innovation Officer within the German Helios organization will explore innovative directions in digitalization. The implementation of digitalization processes and solutions will be the core task of the newly created function of the Head of Transformation Management at Helios. Also Quirónsalud in Spain is successfully driving forward the expansion of its leading digital processes.

In this context, Fresenius Helios will discontinue the activities of Curalie, which specializes in health apps, from the end of 2023. The Curalie subsidiaries meditec and ibs will be sold. Respective binding agreements have been signed. The business operations of the parent company Curalie GmbH and its other subsidiaries will be discontinued. The measures are in line with #FutureFresenius' intention to further focus business activities and reduce complexity.

- Fresenius makes use of the governmental compensation and reimbursement payments of up to €300 million (from the current perspective) provided for in the relief package for compensating additional costs caused by the increase in energy prices and implements the associated restrictions.

- Fresenius subsequently suspends dividend for fiscal year 2023; Fresenius Management Board members and management bodies of other companies covered by the statutory bans cannot be granted bonuses or other variable compensation components for fiscal year 2023.

- With the combination of the cash inflow of compensation and reimbursement payments and the dividend suspension, Fresenius reduces its leverage ratio (net debt/EBITDA) by around 20 to 25 basis points.

- Increasing the value of the company is clear priority on the way to #FutureFresenius.

Today, the Fresenius Management Board has decided to make use of the compensation and reimbursement payments for German hospitals in the amount of up to €300 million (from the current perspective) provided for by the "Energy Relief Package" (“Entlastungspaket Energiehilfen“) under the Hospital Financing Act (“Krankenhausfinanzierungsgesetz”) to cover increased energy costs. Today's decision of the Management Board is subject to the approval of the Supervisory Board of Fresenius Management SE, which is expected to decide on this matter on December 6, 2023. Fresenius' use of the compensation and reimbursement payments is subject to far-reaching conditions.

Fresenius therefore implements the related restrictions of the legislator. Fresenius Management Board will propose to the Annual General Meeting 2024 of Fresenius SE & Co. KGaA not to distribute a dividend for the fiscal year 2023. In addition, the Management Board members of Fresenius Management SE and management bodies of other companies covered by the statutory bans cannot be granted bonuses or other variable compensation components in the fiscal year 2023.

The decision is in line with the central objective of the #FutureFresenius strategy: the sustainable development and value enhancement of the company. The cash inflow of compensation and reimbursement payments as well as the dividend suspension will reduce the company's debt and consequently improve the leverage ratio by around 20 to 25 basis points. The reduction in debt will have a positive effect on net interest expense and ultimately on earnings per share. Furthermore, the compensation and reimbursement payments of up to €300 million (from the current perspective) will largely offset the additional costs of Helios Germany in 2023 caused directly or indirectly by the increase in energy prices.

"#FutureFresenius is our guideline for making and implementing strategically important decisions. Against this background, this is the right step for our company. We are strengthening our company’s intrinsic value. The lower level of debt affords us greater flexibility to make even better use of our market opportunities. We act with foresight and keep an eye on the sustainable development of the company and thus the future of patient care," said Fresenius CEO Michael Sen.

Fresenius is of the opinion that the statutory bans provided for in the "Energy Relief Package" („Entlastungspaket Energiehilfen“) are unconstitutional and that Fresenius' fundamental rights have been violated in view of the significant interference in the hospital financing system associated with this. Fresenius is therefore examining whether and in what form legal action should be taken.

In addition to operating performance improvement of the core business, the successfully progressing cost and efficiency program, the simplification of the Group structure through the deconsolidation of Fresenius Medical Care as well as the divestments of non-core businesses within the business segments, the compensation and reimbursement payments and the suspension of the dividend support the long-term strengthening of the Company.

Notwithstanding the legally required suspension of dividend payments for the fiscal year 2023, Fresenius maintains its dividend policy for the future. In line with its progressive dividend policy, Fresenius continues to aim to increase the dividend in line with growth in earnings per share (in constant currency, before special items), or at least maintain the dividend at the previous year's level.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts.

Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Deconsolidation is a landmark in the implementation of the #FutureFresenius program and a historic day for both companies

- Reducing complexity is a prerequisite for greater flexibility as well as more efficient and faster decision-making and the basis for long-lasting economic success

- Fresenius remains the largest shareholder of Fresenius Medical Care with an unchanged 32 percent of the share capital

Fresenius has successfully completed the deconsolidation of Fresenius Medical Care: The change in legal form was entered in the commercial register on November 30, 2023, and thereby took effect after the Senate of the Bamberg Higher Regional Court had granted Fresenius Medical Care's applications for approval in full.

"The deconsolidation of Fresenius Medical Care is a landmark in the implementation of our #FutureFresenius strategy and a historic day for both companies. We are reducing complexity and creating the conditions for greater flexibility and more efficient and faster decision-making. Fresenius Medical Care will gain a greater degree of freedom as a result of the deconsolidation. This also means greater responsibility. Both companies can now concentrate on what they do best: working for the well-being of patients in their respective segments," said Michael Sen, CEO of Fresenius. "We are redirecting the company's focus with #FutureFresenius and creating the basis for long-lasting economic success. The solid business performance in recent quarters shows that this is the right path for us."

The shareholders of Fresenius Medical Care had already approved the change in legal form from a partnership limited by shares (KGaA) to a stock corporation (AG) by a majority of more than 99% at an Extraordinary General Meeting held on July 14, 2023. Following the change in legal form, Fresenius Medical Care is no longer part of the consolidated subsidiaries of Fresenius. Fresenius continues to hold 32 percent of Fresenius Medical Care's share capital and therefore remains the company's largest shareholder. With the deconsolidation, Fresenius Medical Care's accounting treatment will change from IFRS 5 to equity method accounting.

Fresenius Medical Care was formed in 1996 from the merger of Fresenius' dialysis division with the U.S. dialysis provider National Medical Care (NMC). The combination of Fresenius' product business and NMC's service business has made the company the world's leading and uniquely vertically integrated dialysis provider. Since then, Fresenius Medical Care has increased considerably in size and value as a result of organic growth and acquisitions: Revenue and the number of patients have increased sevenfold, while the number of employees has increased fivefold.

This press release contains forward-looking statements that are subject to certain risks and uncertainties. Future results may differ substantially from those currently anticipated due to various risk factors and uncertainties, such as changes in the business, economic, and competitive situation, changes in legislation, results of clinical trials, exchange rate fluctuations, uncertainties regarding litigation or investigative proceedings, the availability of financing, and unforeseen effects of international conflicts. Fresenius assumes no responsibility to update the forward-looking statements contained in this press release.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, resolved a legal dispute with the U.S. government, for accounts receivable in legal dispute, and entered into a final and legally binding settlement agreement today, whereby the company will receive a payment from the U.S. government.

Fresenius Medical Care had filed a complaint against the United States in 2019. This complaint sought to recover monies owed to the company by the U. S. Department of Defense under the Tricare program, for services on or before January 11, 2023.

Tricare provides reimbursement for dialysis treatments and other medical care provided to members of the military services, their dependents and retirees. The litigation challenged unpublished administrative actions by Tricare administrators to reduce the rate of compensation paid for dialysis treatments provided to Tricare beneficiaries based on a recasting of invoicing codes. Tricare administrators had acknowledged the unpublished administrative action and declined to change or abandon it.

The now executed settlement agreement resolves the dispute underlying the complaint and concludes the litigation.

As a consequence of the settlement agreement, both revenue and operating income will be positively impacted. In previous reporting periods, the negative impact related to this matter had not been treated as special item due to its operational nature. Fresenius Medical Care therefore expects a net positive impact on operating income (guidance basis)1 of approx. EUR 175 million in the 4th quarter 2023.

The company had previously expected in fiscal year 2023 operating income (guidance basis)1 to grow by a low-single-digit percentage rate, compared to previous year (2022 basis: EUR 1,540 million).

As a consequence of the settlement agreement, Fresenius Medical Care today raises its earnings outlook. The company now expects operating income (guidance basis)1 to grow by 12 to 14 percent in fiscal year 2023, compared to previous year. All other elements of the 2023 outlook, as published, remain unchanged.

In line with its disciplined financial policy, Fresenius Medical Care intends to use the agreed settlement payment to reduce its net financial debt and therefore deleverage the balance sheet.

1 Operating income, as presented in the outlook, is on a constant currency basis and excluding special items. Special items will be provided as separate KPI (“Operating income excluding special items”) to capture effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the Company’s financial targets which have been defined excluding special items.

As described in FME’s public reports for FY 2022, special items included costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement and the net gain related to InterWell Health. Additionally, the FY 2022 basis for the 2023 outlook was adjusted for U.S. Provider Relief Funding. For FY 2023, special items include costs related to the FME25 program, the Humacyte investment remeasurement, the costs associated with the legal form conversion and effects from legacy portfolio optimization.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Next step in implementing #FutureFresenius

- Divestment of Eugin Group simplifies portfolio

- Proceeds create financial flexibility

Fresenius divests Eugin Group to global fertility group IVI RMA (a KKR portfolio company) and GED Capital for up to €500 million including earn-outs. Eugin is a global leader in fertility and reproduction services offering a comprehensive range of treatments and solutions for patients on their journey to parenthood. In 2022, Eugin generated sales of €227 million.

Michael Sen, CEO of Fresenius, said: “Today, we reached another milestone in the implementation of #FutureFresenius. The decision to divest Eugin comes after careful consideration, and we believe it is in the best interest of all parties involved. This will allow us to further prioritize and strengthen our efforts in our core business areas, which, in turn, will also benefit our patients. This transaction demonstrates our active portfolio management and underlines our commitment to a simplified structure, sharper focus and accelerated performance.”

“We are thrilled to add Eugin’s operations in the US and Canada to the IVI RMA group. Our ethos of compassionate, personalized care will help ensure we deliver a world-class patient experience and successful outcomes for more patients,” said Javier Sanchez Prieto, CEO of IVI RMA. “We are pleased to have partnered with GED in this creative transaction. We’re confident that our shared vision and complementary strengths make this partnership greater than the sum of its parts, allowing IVI RMA to continue its growth in North America and GED to invest behind a leading platform in Europe and Latin America.”

Subject to regulatory approvals, closing of the transaction is expected to take place in Q1 2024.

The sale only comprises the Eugin Group. Fresenius Helios' well-established legacy business of fertility treatments in selected hospitals and outpatient centers of Quirónsalud and Helios Germany will remain with Fresenius Helios and continue to offer fertility treatments.

Lazard is acting as financial advisor and Freshfields Bruckhaus Deringer is serving as legal advisor to Fresenius.

About IVI RMA Global

IVI RMA is a world-leading Reproductive Medicine group, backed by KKR. It is committed to providing evidence-based fertility solutions with the greatest chance of success in the shortest time necessary to patients seeking treatment anywhere in the world. IVI RMA employs more than 4,400 people across +150 locations in 14 countries. The group maintains a team of highly trained physicians as well as renowned scientists and researchers, aligned with its vision of pioneering in the field of Reproductive Medicine.

About GED

GED is a Spanish, private, and independent asset manager, founded in 1996 by a group of professionals with large experience in the sector and with a consolidated industrial and management track record. It currently manages more than 1,000 million euros through different investment vehicles. This acquisition is the seventh transaction of the GED’s Fund VI, and the third within the health sector.

Fresenius is a global healthcare group. We offer system-critical products and services for leading therapies for care of critically and chronically ill patients. The Fresenius Group comprises the Operating Companies Fresenius Kabi and Fresenius Helios and the Investment Companies Fresenius Medical Care (in accordance with IFRS 5) and Fresenius Vamed.

- Continued solid organic growth in Care Enablement and Care Delivery including sequentially stable same market treatment growth in the U.S.

- Successful execution on turnaround plan driving productivity improvements in Care Delivery and pricing in Care Enablement

- FME25 transformation savings fully on track

- Continued execution on portfolio optimization strategy

- FY 2023 earnings outlook raised

Helen Giza, Chief Executive Officer of Fresenius Medical Care, said: “Our unwavering focus on executing against our strategic plan and the successful implementation of turnaround measures to date, continue to translate into improved operating performance. Notably in the third quarter, we continued to unlock sustainable savings with our FME25 program, further improved our labor productivity and continued to execute on our portfolio optimization plan. Given our improving performance for the first nine months of the year and solid expectations for the remainder of the year, we confidently upgrade our full year earnings outlook.”

Successful execution against the strategic plan

Fresenius Medical Care has continuously advanced its structural change. After implementing the new operating model along with the corresponding new financial reporting, the simplification of the governance structure through a legal form conversion remains on track to be completed by 1 December 2023.

Fresenius Medical Care continues to successfully execute on its operational efficiency and turnaround plans. In the third quarter, the FME25 transformation program delivered EUR 97 million of savings, resulting in EUR 232 million for the first nine months of the year. The Company is fully on track to achieve sustainable savings of EUR 250 to 300 million by year end 2023 and EUR 650 million by year end 2025.

Moreover, Fresenius Medical Care is executing its portfolio optimization plan to exit non-core and dilutive assets. In the third quarter, the Company entered into an agreement to sell National Cardiovascular Partners (NCP) with 21 facilities providing outpatient cardiac catheterization and vascular laboratory services, which are included in the U.S. Care Delivery business, in connection with its Legacy Portfolio Optimization program.

1 For FY 2022, special items included costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement and the net gain related to InterWell Health. Additionally, the FY 2022 basis for the 2023 outlook was adjusted for U.S. Provider Relief Funding. For FY 2023, special items include costs related to the FME25 program, the Humacyte investment remeasurement, the costs associated with the legal form conversion and effects from legacy portfolio optimization. For further details please see the reconciliation attached to the Press Release.

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

In line with the Company’s disciplined financial policy, Fresenius Medical Care has already refinanced a bond of EUR 650 million, maturing in November 2023. The Company is using a mix of long-term bank financing at very attractive financing conditions as well as cash and short-term debt. Upcoming extraordinary cash inflows will enable the Company to further delever.

Revenue development supported by solid organic growth

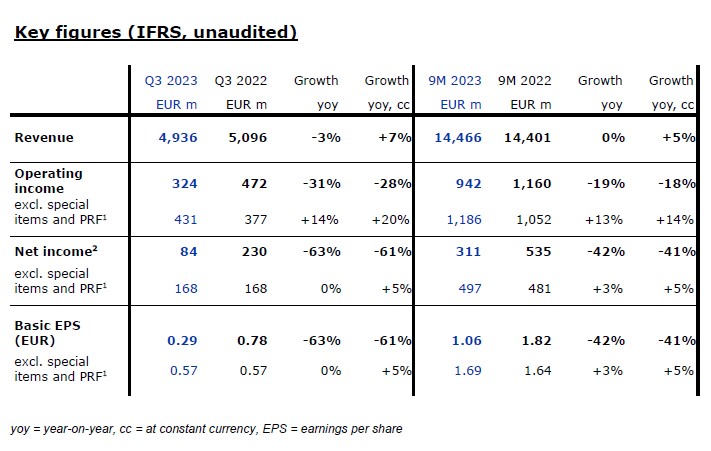

Revenue decreased by 3% to EUR 4,936 million in the third quarter (+7% at constant currency, +7% organic).

Care Delivery revenue decreased by 4% to EUR 3,974 million (+6% at constant currency, +7% organic).

In Care Delivery U.S., revenue declined by 3% (+4% at constant currency, +5% organic). A negative exchange rate effect and a decrease in dialysis days was partially offset by organic growth, which was supported by a favorable impact from the value-based care business, reimbursement rate increases and a favorable payor mix. The annualization effect of COVID-19-related excess mortality in the late-stage CKD (Chronic Kidney Disease) and ESRD (End-Stage Renal Disease) population continues to weigh on same market treatment growth (-0.4%). Adjusted for the exit from less profitable acute care contracts same market treatment growth was at +0.2%.

In Care Delivery International, revenue declined by 7% (+14% at constant currency, +16% organic). A negative exchange rate effect and the impact of closed or sold clinics was partially offset by organic growth, which was driven by a significant effect of hyperinflation in various markets. Despite the annualization effect of COVID-19-related excess mortality, same market treatment growth was positive at 1.6%.

Care Enablement revenue declined by 3% to EUR 1,330 million (+5% at constant currency, +5% organic). The negative exchange rate effects have been partly offset by higher sales of in-center disposables, machines for chronic treatment and home hemodialysis products as well as higher average sales prices.

Within Inter-segment eliminations, revenue for products transferred between the operating segments at fair market value declined by 10% to EUR 368 million (-1% at constant currency).

In the first nine months, revenue was stable at EUR 14,466 million (+5% at constant currency, +5% organic). Care Delivery revenue was stable at EUR 11,602 million (+4% at constant currency, +5% organic), with stable revenue for Care Delivery U.S. (+2% at constant currency, +3% organic), and a revenue decline of 1% for Care Delivery International (+13% at constant currency, +14% organic). Care Enablement revenue was stable at EUR 3,965 million (+5% at constant currency, +5% organic). Inter-segment eliminations declined by 5% and amounted to EUR 1,101 million (stable at constant currency).3

3 The Company transfers products between segments at fair market value. The associated internal revenues and expenses and any remaining internally generated profit or loss for the product transfers are recorded within the operating segments initially, are eliminated upon consolidation and are included within “Inter-segment eliminations”.

Earnings development driven by productivity improvements and FME25 savings

Operating income decreased by 31% to EUR 324 million (-28% at constant currency), resulting in a margin of 6.6% (Q3 2022: 9.3%). Operating income excluding special items and U.S. Provider Relief Funding (PRF)1 increased by 14% to EUR 431 million (+20% at constant currency), resulting in a margin of 8.7% (Q3 2022: 7.4%).

Operating income in Care Delivery decreased by 34% to EUR 332 million (-29% at constant currency), resulting in a margin of 8.4% (Q3 2022: 12.1%). Operating income excluding special items and PRF1 increased by 11% to EUR 410 million (+17% at constant currency), resulting in a margin of 10.3% (Q3 2022: 9.0%). This was mainly driven by business growth, savings from the FME25 program and lower personnel expenses resulting from improved productivity. The operating income development was negatively impacted by lower income attributable to a non-recurring consent payment for certain pharmaceuticals, inflationary cost increases as well as by foreign currency translation.

Operating income in Care Enablement amounted to EUR -1 million (Q3 2022: EUR -26 million), resulting in a margin of -0.1% (Q3 2022: -1.9%). Operating income excluding special items increased by 197% to EUR 22 million (+217% at constant currency), resulting in a margin of 1.7% (Q3 2022: 0.5%). The improvement compared to the previous year’s quarter was mainly driven by increased volumes, improved pricing and savings from the FME25 program. These effects were partially offset by inflationary cost increases and negative foreign currency transaction effects.

Operating income for Corporate amounted to EUR -8 million (Q3 2022: EUR -7 million). Excluding special items, operating income amounted to EUR -2 million (Q3 2022: EUR -6 million).

In the first nine months, operating income decreased by 19% to EUR 942 million (-18% at constant currency), resulting in a margin of 6.5% (9M 2022: 8.1%). Excluding special items and PRF1, operating income increased by 13% to EUR 1,186 million (+14% at constant currency), resulting in a margin of 8.2% (9M 2022: 7.3%). In Care Delivery, operating income declined by 19% to EUR 1,001 million (-18% at constant currency), resulting in a margin of 8.6% (9M 2022: 10.6%). In Care Enablement, operating income decreased to EUR -24 million (9M 2022: EUR 33 million), resulting in a margin of -0.6% (9M 2022: 0.8%). Operating income for Corporate amounted to EUR -23 million (9M 2022: EUR -101 million).

Net income2 decreased by 63% to EUR 84 million (-61% at constant currency). Excluding special items and PRF1, net income2 remained stable at EUR 168 million (+5% at constant currency).

In the first nine months, net income2 declined by 42% to EUR 311 million (-41% at constant currency). Excluding special items and PRF1, net income2 increased by 3% to EUR 497 million (+5% at constant currency).

Basic earnings per share (EPS) decreased by 63% to EUR 0.29 (-61% at constant currency). EPS excluding special items and PRF1 remained stable at EUR 0.57 (+5% at constant currency).

In the first nine months, EPS declined by 42% to EUR 1.06 (-41% at constant currency). Excluding special items and PRF1, EPS increased by 3% to EUR 1.69 (+5% at constant currency).

Strong cash flow development

In the third quarter, Fresenius Medical Care generated EUR 760 million of operating cash flow (Q3 2022: EUR 658 million), resulting in a margin of 15.4% (Q3 2022: 12.9%). The increase in net cash provided by operating activities is the result of the change in certain working capital items, in particular due to the recoupment of advanced payments during 2022, which had been received under the U. S. Medicare Accelerated and Advance Payment Program in 2020.

In the first nine months, operating cashflow amounted to EUR 1,910 million (9M 2022: EUR 1,568 million), resulting in a margin of 13.2% (9M 2022: 10.9%).

Free cash flow4 amounted to EUR 626 million in the third quarter (Q3 2022:

EUR 501 million), resulting in a margin of 12.7% (Q3 2022: 9.8%). In the first nine months, Fresenius Medical Care generated free cash flow of EUR 1,480 million (9M 2022: EUR 1,082 million), resulting in a margin of 10.2% (9M 2022: 7.5%).

Outlook

The Company continues to expect for 2023 revenue to grow at a low to mid-single digit percentage rate (2022 basis: EUR 19,398 million).

Based on the earnings development for the first nine months of the year and solid business expectations for the remainder of the year, Fresenius Medical Care raises its earnings outlook for 2023. The Company now expects operating income to grow at a low-single digit percentage rate (2022 basis: EUR 1,540 million; previous target: remain flat or decline by up to a low-single digit percentage rate)5.

The Company’s target to achieve an operating income margin of 10 to 14% by 2025 remains unchanged.

4 Net cash provided by / used in operating activities, after capital expenditures, before acquisitions, investments, and dividends

5 Revenue and operating income, as referred to in the outlook, are both on a constant currency basis and excluding special items. Special items will be provided as separate KPI (“Revenue excluding special items”, “Operating income excluding special items”) to capture effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the Company’s financial targets which have been defined excluding special items.

For FY 2022, special items included costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement, and the net gain related to InterWell Health. Additionally, the basis (FY 2022) for the 2023 outlook was adjusted for Provider Relief Funding. For FY 2023, special items include costs related to the FME25 program, the Humacyte investment remeasurement, the costs associated with the legal form conversion and effects from legacy portfolio optimization. For further details please see the reconciliation attached to the Press Release.

Patients, clinics and employees

As of September 30, 2023, Fresenius Medical Care treated 341,793 patients in 4,014 dialysis clinics worldwide and had 123,106 employees (headcount) globally, compared to 130,295 employees as of September 30, 2022.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the third quarter on November 2, 2023 at 3:30 p.m. CET / 10:30 a.m. EDT. Details will be available on the Fresenius Medical Care website in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included at the end of this news and to the attachments as separate PDF files for a complete overview of the results of the third quarter and first nine months of 2023. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to COVID-19, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Implementation of measures as presented herein may be subject to information and consultation procedures with works councils and other employee representative bodies, as per local laws and practice. Consultation procedures may lead to changes on proposed measures.

- Excellent Group revenue growth of 6% in constant currency to €5.5 billion; driven by Operating Companies and Fresenius Vamed

- Group EBIT increased 10% in constant currency, reflecting strong performance of Operating Companies; Fresenius Vamed with operational improvement

- Fresenius Kabi with strong organic revenue growth of 7% at top-end of structural growth band; EBIT margin remains within structural band at 14.3%

- Fresenius Helios with strong organic revenue growth of 5% at top-end of structural growth band despite usual summer effect in Spain

- Fresenius Vamed transformation progressing

- Deconsolidation of Fresenius Medical Care effective by December 2023

- Divestments advancing: exit of hospital operations in Peru

- FY/23 structural productivity savings target of ~€200 million excluding Fresenius Medical Care already achieved in first nine months

- Group revenue outlook confirmed, Group EBIT outlook improved

- Application of IFRS 5: Fresenius Group financials for the first time presented excluding Fresenius Medical Care

Michael Sen, CEO of Fresenius: “Fresenius had a great 3rd Quarter 2023. We made progress on every part of our #FutureFresenius program, including simplification of our corporate structure, and achieved cost savings well ahead of our targets for the full year 2023. At the same time, we are moving ahead with the divestment of non-core businesses. The focus on our two Operating Companies, Kabi and Helios, is paying off, with strong revenue and earnings development. Both businesses again announced important innovations, new products and strong partnerships to improve patient outcomes. And this gets a lot of recognition even beyond the industry. Given our strong performance throughout the first three quarters of the year, we are improving our operating earnings outlook for 2023 and expect constant currency Group EBIT to remain broadly flat year on year. This momentum will allow us to continue to build trust, deliver consistent performance, and stay focused on our purpose: Advancing Patient Care.”

Fresenius Group – Business Development

Group revenue increased by 2% (6% in constant currency) to €5,518 million (Q3/22: €5,386 million). Organic growth was 6%. Acquisitions/divestitures contributed net 0% to growth. In total, currency translation had a negative effect of 4% on revenue growth. The Operating Companies increased revenue by 1% (5% in constant currency).

Group EBITDA before special items increased by 9% (11% in constant currency) to €821 million (Q3/221: €755 million). Reported Group EBITDA was €661 million (Q3/22: €691 million).

Group EBIT before special items increased by 8% (10% in constant currency) to €519 million (Q3/221: €480 million), mainly driven by the good earnings development at the Operating Companies. The EBIT margin before special items was 9.4% (Q3/221: 8.9%). Reported Group EBIT was €346 million (Q3/22: €416 million). The Operating Companies achieved an EBIT increase of 8% (10% in constant currency) and an EBIT margin of 10.3%.

Group net interest before special items increased to -€109 million (Q3/221: -€67 million) mainly due to financing activities in a higher interest rate environment. Reported Group net interest was -€100 million (Q3/22: -€67 million).

1 Before special items

The Group tax rate before special items was 24.1% (Q3/221: 22.5%). Reported Group tax rate was 37.0%. The higher tax rate in Q3/23 is mainly due to the negative net income at Fresenius Vamed for which deferred tax assets could not be recognized (Q3/22: 23.5%).

Group net income2 before special items decreased by 7% (-5% in constant currency) to €344 million (Q3/221: €371 million). The decrease was driven by rising interest costs and a higher tax rate as well as lower net income from operations to be deconsolidated (Fresenius Medical Care). Reported Group net income2 decreased to -€406 million (Q3/22: €321 million). The negative net income is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect has no cash impact.

Earnings per share2 before special items decreased by 8% (-6% in constant currency) to €0.61 (Q3/221: €0.66). Reported earnings per share2 were -€0.72 (Q3/22: €0.57). The negative net income is due to the Fresenius Medical Care valuation effect according to IFRS 5 of €594 million. This effect is without any cash impact.

Group operating cash flow increased to €648 million (Q3/22: €598 million), mainly driven by the good cash flow development at Fresenius Kabi. Free cash flow before acquisitions, dividends and lease liabilities remained broadly stable at €376 million (Q3/22: €375 million).

As of September 30, 2023, the net debt/EBITDA ratio was 4.03x1,3 (Dec. 31, 2022: 3.80x1,3). This is a reduction of 15 basis points compared to Q2/23.

The groupwide cost savings program progresses significantly ahead of plan. Under the program, Fresenius realized ~€200 million of structural cost savings at EBIT level in Q1-3/23. With that, all savings originally expected for 2023 are already realized. In the same period, one-time costs of around €90 million incurred to achieve these savings. This is well below what the Company initially accounted for and testament that our one-time costs are tightly managed.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend

On Group level including Fresenius Medical Care, the savings in Q1-3/23 amount to ~€430 million. In the same period, one-time costs of ~€190 million incurred to achieve these savings.

Operating Company Fresenius Kabi

In Q3, revenue decreased by 2% to €2,021 million (Q3/22: €2,071 million), driven by negative currency exchange effects (increased 7 % in constant currency). Organic growth was 7%. The largest contribution to revenues came from the Pharma (IV Drugs & Fluids) business. There, revenue decreased by 5% (0% in constant currency, organic growth: 1%) and amounted to €941 million (Q3/22: €995 million). Organic growth was mainly driven by a robust development across the regions. The Biopharma business recorded the strongest increase in revenues of 74% (99% in constant currency, organic growth: 71%) to €111 million (Q3/22: €64 million), which is mainly driven by the successful product launches in Europe and the U.S. as well as by licensing agreements.

EBIT1 of Fresenius Kabi increased by 3% (6% in constant currency) to €289 million (Q3/22: €280 million) due to the good operating performance and the well-progressing cost saving initiatives. EBIT margin1 was 14.3% (Q3/22: 13.5%) and thus within the structural EBIT margin band. Net income1,2 increased by 3% (7% in constant currency) to €189 million (Q3/22: €184 million). Operating cash flow increased to €380 million (Q3/22: €301 million) with a margin of 18.8% (Q3/22: 14.5%), mainly driven by strong business performance and improved working capital management.

For FY/23, Fresenius Kabi expects organic revenue3 growth in a mid-single-digit percentage range. The EBIT margin4 is expected to be around 14% (structural margin band: 14% to 17%).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA.

3 FY/22 base: €7,850 million

4 FY/22 base: EBIT margin: 13.8%, before special items; FY/23 before special items

Just recently, Fresenius Kabi announced the European market launch of Tyenne®. This is the first tocilizumab biosimilar to be launched in the European Union for the treatment of a variety of inflammatory and autoimmune diseases such as rheumatoid arthritis. The growing portfolio of biosimilars for inflammatory and immune diseases and oncology is further evidence of Fresenius Kabi's successful Vision 2026 growth strategy. In this context, Fresenius Kabi and Lupagen Inc. have signed a development and supply agreement for technologies designed to bring the delivery of cell and gene therapies to the bedside. Cell and gene therapies have shown promise in the treatment of a variety of diseases, including cancer, hematological, autoimmune and rare diseases.

Operating Company Fresenius Helios

In Q3, revenue increased by 4% (5% in constant currency) to 2,953 million (Q3/22: €2,829 million). Organic growth was 5%. Revenue of Helios Germany increased by 4% (organic growth: 4%) to €1,800 million (Q3/22: €1,731 million), mainly driven by increasing admissions and positive price mix effects. Revenue of Helios Spain increased by 5% (5% in constant currency) to €1,088 million (Q3/22: €1,037 million), driven by ongoing high activity levels despite the usual summer effect in Spain. The clinics in Latin America also showed a good performance. Organic growth was 5%. Revenue of Helios Fertility increased by 3% (11% in constant currency) to €64 million (Q3/22: €62 million) driven by positive mix effects. Organic growth was 10%.

EBIT1 of Fresenius Helios increased by 8% (8% in constant currency) to €239 million (Q3/22: €222 million) with an EBIT margin1 of 8.1% (Q3/22: 7.8%).

The strongest increase was recorded by Helios Germany, where EBIT1 increased by 11% to €157 million (Q3/22: €141 million) with an EBIT margin1 of 8.7% (Q3/22: 8.1%). The EBIT development was supported by the well progressing cost savings program and the Government compensation for higher energy costs.

Net income1,2 decreased by 4% (-4% in constant currency) to €132 million (Q3/22: €138 million). Operating cash flow decreased to €208 million (Q3/22: €353 million), mainly due to phasing effects of receivables in Spain and the very good cashflow in the prior year.

For FY/23, Fresenius Helios expects organic revenue3 growth in a mid-single-digit percentage range. The EBIT margin4 is expected to be within the structural margin band of 9% to 11%.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/22 base: €11,716 million

4 FY/22 base: EBIT margin: 10.1%, before special items, FY/23 before special items

Digitalization is an important topic in the healthcare sector, and Fresenius Helios is pushing ahead with it. For example, the Helios ENDO clinic in Hamburg is piloting the use of Artificial Intelligence (AI) in building automation with a so-called “digital twin”. As a pioneer in the use of AI in hospital building technology, Fresenius is thus taking an important step towards its goal of becoming climate neutral by 2040. The Spanish hospital chain Quirónsalud has also continued to develop its activities: a state-of-the-art medical center with 18 specialties was opened in Madrid during the reporting period. Such investments pay off: five Quirónsalud hospitals have been recognized by a renowned U.S. news magazine in its "World's Best Specialized Hospitals 2024" ranking.

Deconsolidation of Fresenius Medical Care

The deconsolidation process of Fresenius Medical Care is on track. The competent Higher Regional Court in Bamberg has fully approved the application for release that Fresenius Medical Care had filed with regard to the legal actions brought against the change of the legal form into a stock corporation. Accordingly, the change of the legal form can be registered with the commercial register. Fresenius expects the deconsolidation to become effective by December 2023. From then on, Fresenius Medical Care AG & Co. KGaA will operate as Fresenius Medical Care AG.

As a result of the approval of the change of legal form by the Extraordinary General Meeting on July 14, 2023, Fresenius Medical Care is for the first time in Q3/23 presented as a single item in the financial statements of the Fresenius Group.

Fresenius Medical Care is now classified in accordance with IFRS 5 as "Operations to be deconsolidated” and presented in a single line item in Fresenius’s balance sheet, the P&L and the cash flow statement.

IFRS 5 requires the valuation of Fresenius Medical Care at fair value. As of September 30, 2023, the market capitalization of about €12 billion was below the consolidated shareholders’ equity of Fresenius Medical Care of about €14 billion. This results in a valuation effect of €2 billion, of which ~€0.6 billion are attributable to the shareholders of Fresenius SE & Co. KGaA. This effect is reported as a special item without any cash impact.

Transformation Fresenius Vamed

In Q3/23, further progress was made in the transformation of Fresenius Vamed. The company has started a comprehensive strategic assessment of its business activities and initiated a far-reaching restructuring program to increase the company’s profitability. With a positive EBIT of €10 million in Q3/23 (Q2/23: -€20 million), Fresenius Vamed is ahead of its originally expected target for Q3/23. The encouraging development was especially driven by the High-End Services (HES) and Health Facility Operations (HFO) businesses. For Q4/23, a further solid development is expected.

In Q3/23, negative special items mainly related to closing down activities, asset re-evaluations and restructuring costs resulted in write-downs and provisions of €109 million. The negative special items were predominantly booked as non-cash items. In Q1-3/23, negative special items of €441 million were incurred.

By 2025, Fresenius Vamed is expected to reach the structural EBIT margin band of 4% to 6% set out in the #FutureFresenius Financial Framework.

FY/23 Group earnings outlook improved

Based on the consistent performance of the Operating Companies through the year, Fresenius improves the 2023 earnings outlook and now expects constant currency Group EBIT1 to remain broadly flat compared to FY/2022 (previous: EBIT1 expected to remain broadly flat to decline up to a mid-single-digit percentage rate). Group organic revenue2 continues to be expected to grow in a mid-single-digit percentage range.

Fresenius expects the net debt/EBITDA3 ratio excluding Fresenius Medical Care to be below 4.0x by the end of 2023, therefore further improving from 4.03x4 as of September 30, 2023 (December 31, 2022: 3.80x4). This assumption does not include potential divestment activities. The self-imposed target corridor for the leverage ratio remains unchanged at 3.0x to 3.5x.

1 FY/22 base: €2,190 million, before special items; FY/23: before special items

2 FY/22 base: €21,532 million

3 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; before special items; including lease liabilities, including Fresenius Medical Care dividend

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, has appointed Craig Cordola (52) as new Management Board member for the globally operating Care Delivery segment. Cordola will start on January 1, 2024, as Chief Executive Officer of Care Delivery. He will be based in Waltham, Massachusetts.

Craig Cordola will succeed William (Bill) Valle (63) as part of a planned transition after Mr. Valle informed the Management Board of his intention to retire from the company at the end of 2023. Bill joined Fresenius Medical Care in 2009. He has been leading the globally operating Care Delivery segment since 2022. Previously, he served as CEO for North America since 2017. He has been a member of the Management Board since 2017. Prior to that, he was Executive Vice President responsible for the dialysis service business and vascular access business of Fresenius Medical Care North America from 2014 to 2017. Over the last decade he was responsible for the transformation of the U.S. business into a multi-dimensional integrated kidney care provider.

Craig Cordola is currently Executive Vice President of Ascension Capital, where he is responsible for strategic investments. Previously, he was Executive Vice President and Chief Operating Officer for Ascension. Prior to joining Ascension in 2017, Mr. Cordola held several senior executive and leadership positions at Memorial Hermann Health System in Houston, Texas. He is a Fellow of the American College of Healthcare Executives and holds a degree in Psychology from The University of Texas at Austin. He also earned dual degrees with a Master of Healthcare Administration (MHA) and a Master of Business Administration (MBA) from the University of Houston-Clear Lake.

Michael Sen, Chairman of the Supervisory Board of Fresenius Medical Care Management AG, said: “We are delighted to have Craig Cordola join the Management Board of Fresenius Medical Care as the leader of the global Care Delivery organization. Craig has a wealth of knowledge and experience managing large healthcare systems and organizations. With this expertise, he will be a crucial player in the Management Board in implementing Fresenius Medical Care's turnaround and focusing on patient care.” Michael Sen added: “On behalf of the entire Supervisory Board, I would like to express my sincere appreciation to Bill for his excellent work over the past years, his passion for the well-being of patients and his contribution to the development of Fresenius Medical Care. We wish him all the best for his retirement.”

Helen Giza, CEO and Chair of the Management Board, said: “Craig joins Fresenius Medical Care with many years of proven track record of operational management experience and successfully driving profitable business growth in different companies in the U.S. healthcare services industry. He will be a valuable member of my leadership team continuing our turnaround and transformation while leading Care Delivery into its next chapter. I would like to thank Bill for his many years of leadership and remarkable contributions to Fresenius Medical Care throughout his tenure with us, his passion for our patients and employees shines through in everything he does. I wish him well in his retirement.”

Craig Cordola said: “I am excited to join Fresenius Medical Care, the global leader in kidney care and leading healthcare brand across this industry. I cannot wait to partner with its leaders – and all of its team members – as we transform our organization to continue to serve patients and communities that suffer from renal disease.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius sells its 70 percent stake in IDCQ CRP, a co-holding entity of the hospital Clínica Ricardo Palma in Lima, Peru. The stake is acquired by entities of the Verme family which already hold a stake in the hospital, together with other local investors.

This exit from the hospital market in Peru is a further step to strengthening #FutureFresenius and is in line with the company's intention to divest certain assets announced earlier this year. Subject to antitrust review, the all-cash transaction is expected to close in the first quarter of 2024.

mAbxience, a Fresenius Kabi majority-owned Group, today announced a strategic partnership with Abbott to commercialize several biosimilars focusing on oncology, women’s health and respiratory diseases in emerging markets including Latin America, Southeast Asia, the Middle East, and Africa. The first molecules are expected to be launched in 2025. mAbxience will manufacture the biosimilars in its state-of-the art and Good Manufacturing Practices (GMP)-approved facilities in Spain and Argentina. Additionally, mAbxience will be responsible for driving the clinical milestones for some of the molecules still undergoing development. The biosimilars will be commercialized by Abbott.

This strategic partnership strengthens mAbxience’s global presence and expands access to cutting-edge healthcare solutions in underserved regions.

Pagination

- Previous page

- Page 5

- Next page