- Group revenue +9% (+9% at constant currency), driven by a strong performance in Health Care services

- EBIT growth in line with revenue growth, supported by very good development in Latin America and Asia-Pacific

- Significant net income growth of 27% (+17% excluding special items1)

- Care Coordination with positive growth momentum (revenue +29%) and improved sequential margin of 5% (+60 basis points) in line with expectations

- Full year 2016 guidance confirmed

Key figures - third quarter 2016

| $ million | Q3 2016 | Q3 2015 | |

| Net revenue | 4,598 | 4,231 | +9% |

| Operating income (EBIT) | 670 | 614 | +9% |

| Net income2 | 333 | 262 | +27% |

| Net income (excl. special items)1,2 | 333 | 284 | +17% |

| Basic earnings per share (in $) | 1.09 | 0.86 | +26% |

Key figures – first nine months 2016

| $ million | 9m 2016 | 9m 2015 | |

| Net revenue | 13,224 | 12,390 | +7% |

| Operating income (EBIT) | 1,851 | 1,665 | +11% |

| Net income2 | 855 | 713 | +20% |

| Net income (excl. special items)1,2 | 855 | 735 | +16% |

| Basic earnings per share (in $) | 2.80 | 2.34 | +19% |

“We are very pleased with our performance in the third quarter of 2016, which is the result of a strong execution in all regions, the success of our Global Efficiency Program as well as further expansion of our global footprint,” said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “Care Coordination services maintain excellent growth momentum which will help us to extend our range of health care services even further. Based on our strong result for the third quarter, we hereby confirm our guidance for the full-year 2016.”

Revenue & earnings

Net revenue for the third quarter improved by 9% and reached $4,598 million (+9% at constant currency), mainly driven by a strong performance in Health Care services. Contributing revenues of $3,734 (+10%), Health Care services was largely supported by an improvement in US revenue per treatment (+$3) as well as a strong organic growth. Dialysis products revenue increased by 4% to $864 million in the third quarter, mainly driven by higher sales of machines, dialyzers and products for acute care.

Net revenue in the first nine months of 2016 increased by 7% (Health Care services revenue +8%/+9% at constant currency; dialysis products revenue +2%/+4% at constant currency).

In the third quarter, operating income (EBIT) increased by 9% to $670 million, in line with revenue growth. The operating income margin increased by 10 basis points to 14.6%, underlining a stable earnings quality. The increase in EBIT margin was mainly driven by the positive development in Latin America after the divestiture of our dialysis service business in Venezuela in the previous year’s third quarter as well as a strong performance in Asia-Pacific. The EBIT margin in North America was impacted by higher personnel expenses for dialysis services, partially offset by lower costs for health care supplies and a higher volume with commercial payers.

For the first nine months of 2016, operating income (EBIT) increased by 11% to $1,851 million.

Net interest expense in the third quarter remained at the previous year’s level ($100 million). For the first nine months of 2016, net interest expense increased by 1% to $308 million, mainly due to lower interest income as a result of the repayment of interest bearing notes receivables in the fourth quarter of 2015, partially offset by a lower debt level.

Income tax expense decreased by 2% to $164 million in the third quarter. This translates into an effective tax rate of 28.8%, a decrease of 400 basis points compared to the third quarter of 2015 (32.8%). This decrease was mainly driven by a lower tax expense as a result of released tax liabilities in the third quarter of 2016 due to tax audit settlements with tax authorities, as well as a favorable impact from the prior-year non-tax deductible loss from the divestiture of our dialysis service business in Venezuela.

For the first nine months of 2016, income tax expense increased to $471 million, translating into an effective tax rate of 30.5% (-190 basis points).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 27% to $333 million in the third quarter. Excluding the 2015 impacts of (i) the after tax loss, $26.9 million, from the divestment of our dialysis service business in Venezuela and (ii) the realized portion of the after tax gain, $4.8 million, from the sale of our European marketing rights for certain renal pharmaceuticals to our joint venture, Vifor Fresenius Medical Care Renal Pharma, net income increased from $284 million to $333 million (+17%) in the third quarter. Based on approximately 306.0 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) increased from $0.86 to $1.09 (+26%); EPS excluding special items increased from $0.93 to $1.09 (+17%).

For the first nine months of 2016, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 20% to $855 million.

Segment development

In the third quarter, North America revenue increased by 10% to $3,300 million (72% of total revenue). Health Care services revenue grew by 10% to $3,068 million, of which Care Coordination contributed $618 million (+29%), supported by significant organic revenue growth of 24%. Dialysis care revenue contributed $2,450 million (+6%), driven by increased revenue per treatment and higher volumes of dialysis treatments with commercial payers. Dialysis products revenue grew by 7% to $232 million, due to increased product sales (especially machines and dialyzers). Operating income in North America came in at $536 million (+4%). The operating income margin of 16.2% was in line with the second quarter of 2016, but weaker than the previous year’s third quarter ( 90 basis points). This decline was mainly attributable to higher personnel expenses, a cost impact related to the vesting of long term incentive plan grants and growth in lower-margin Care Coordination, partially offset by lower cost for health care supplies. The operating income margin in Care Coordination came in at 5.0%, an increase of 60 basis points over the second quarter 2016, but below the previous year’s third quarter margin of 6.8%.

For the first nine months of 2016, North America revenue increased by 9% to $9,512 million. Operating income increased by 16% to $1,486 million.

EMEA revenue increased by 2% to $675 million in the third quarter of 2016 (+4% at constant currency). Health Care services revenue for the EMEA segment increased by 8% (+10% at constant currency) to $335 million. This was mainly the result of contributions from acquisitions (8%), partially offset by the negative effect of exchange rate fluctuations (2%). Dialysis treatments increased by 9% in the third quarter. Dialysis products revenue decreased by 3% (-1% at constant currency) to $340 million. The decrease was driven by lower sales of renal drugs (whose marketing rights were sold in 2015) and dialyzers, partially offset by higher sales of machines and bloodlines. Operating income in the EMEA segment decreased by 4% to $125 million in the third quarter due to the prior-year impact from the gain resulting from the sale of European marketing rights for certain renal pharmaceuticals, an unfavorable impact from manufacturing costs as well as higher bad debt expense. This was partially offset by favorable foreign exchange effects. The operating income margin decreased to 18.5% ( 120 basis points).

For the first nine months of 2016, EMEA revenue increased by 1% to $1,982 million (+4% at constant currency) and operating income decreased by 3% to $395 million.

Asia-Pacific revenue grew by 13% (+8% at constant currency) to $427 million in the third quarter. The region recorded $192 million in Health Care services revenue, based on an increase of 5% in dialysis treatments. With an 11% growth in revenue to $235 million (+12% at constant currency), the product business showed an excellent sales performance across the entire dialysis products range. Operating income showed a significant increase (+25%) to $85 million. The operating income margin increased substantially to 19.8% (+190 basis points). This was primarily driven by the positive impact from overall business growth and favorable foreign exchange effects.

For the first nine months of 2016, Asia-Pacific revenue grew by 8% to $1,198 million (+8% at constant currency) and operating income increased by 3% to $225 million.

Latin America delivered revenue of $192 million, an increase of 9% and an impressive improvement of 27% at constant currency. Health Care services revenue increased by 6% to $139 million (+31% at constant currency) as a result of higher organic revenue per treatment primarily driven by a retrospective reimbursement rate increase, contributions from acquisitions and growth in same market treatments, partially offset by the effect of the divested dialysis care business in Venezuela. Dialysis treatments increased by 1% in the third quarter. Dialysis products revenue increased by 19% to $53 million (+18% at constant currency), as a result of higher sales of dialyzers, concentrates and bloodlines. Operating income came in at $20 million supported by the impact from higher revenue in the region, partially offset by unfavorable foreign currency effects and higher costs mainly related to inflation. The operating margin increased to 10.5%.

For the first nine months of 2016, Latin America revenue decreased by 10% to $520 million (+13% at constant currency) and operating income increased by 86% to $47 million.

Cash flow

In the third quarter of 2016, the company generated $439 million in net cash provided by operating activities, representing 9.5% of revenue ($579 million in the third quarter of 2015). The decrease was primarily attributable to a discretionary cash contribution of $100 million to Fresenius Medical Care’s pension plan assets in the United States. The number of DSO (days sales outstanding) came in at 72 days, an increase of 2 days compared to the second quarter of 2016.

In the first nine months of 2016, the company generated net cash provided by operating activities of $1,296 million, representing 9.8% of revenue.

Employees

As of September 30, 2016, Fresenius Medical Care had 108,851 employees (full-time equivalents) worldwide, compared to 102,591 employees at the end of September 2015. This increase of 6% was primarily attributable to our continued organic growth.

Recent events: Acquisition of Sandor Nephro Services in India

In September 2016, Fresenius Medical Care acquired 85% of equity interest in the Indian dialysis group Sandor Nephro Services from a group of investors. Established in 2011, Sandor Nephro Services is India’s second largest dialysis care provider. Under the brand name “Sparsh Nephrocare” the company operates a network of more than 50 dialysis centers across the country. With the acquisition, Fresenius Medical Care has clearly strengthened its core business in one of the fastest growing economies of the world. Sandor Nephro Services is expected to generate revenue of around $3 million in full year 2016. Fresenius Medical Care expects the investment to be accretive in 2017 on earnings after tax.

Outlook 2016 confirmed

Based on the positive business development in the first nine months 2016, Fresenius Medical Care confirms its full year outlook 2016. The company expects a currency-adjusted revenue growth between +7% and +10% for 2016. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by +15% to +20% over the previous year.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the third quarter & first nine months 2016 on Thursday, October 27, 2016 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the PDF document for a complete overview of the results for the third quarter and first nine months of 2016.

12015 basis adjusted for special items (net income effect): divestiture of dialysis service business in Venezuela (-$27m), sale of European marketing rights for certain renal pharmaceuticals (+$5m)

2Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which around 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,579 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 306,366 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

If no timeframe is specified, information refers to Q1-3/2016

Q1-3/2016:

- Sales: €21.3 billion (+5%, +6% in constant currency)

- EBIT1: €3,092 million (+9%, +9% in constant currency)

- Net income1,2: €1,154 million (+14%, +15% in constant currency)

Q3/2016:

- Sales: €7.3 billion (+6%, +7% in constant currency)

- EBIT1: €1,082 million (+5%, +6% in constant currency)

- Net income1,2: €399 million (+9%, +10% in constant currency)

Stephan Sturm, CEO of Fresenius, said: “We achieved substantial earnings growth in the third quarter, following our very strong development in the first half. Each business segment continued to grow organically in every region. That makes us even more confident for the full year 2016. We are also full of optimism about our medium-term prospects. The acquisition of the Spanish hospital group Quirónsalud will further broaden our foundation for continued strong growth. This will be reflected in the ambitious targets for the coming years that we will announce with our forecast for 2017.”

1 2015 before special items2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

Lower end of 2016 Group earnings guidance raised

Based on the Group’s excellent financial results and strong prospects for the remainder of the year, Fresenius raises the lower end of its 2016 Group earnings guidance range. The upper end of the Group’s earnings guidance remains unchanged, due to the offsetting effect of financing costs related to the Quirónsalud acquisition. Net income1,2 is now expected to grow by 12% to 14% in constant currency. Previously, Fresenius expected net income1,2 growth of 11% to 14% in constant currency. The company confirms its Group sales guidance. Sales are expected to increase by 6% to 8% in constant currency.

The net debt/EBITDA3 ratio is expected to be approximately 2.5 at the end of 2016.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA2 2015 before special items3 Calculated at FY average exchange rates for both net debt and EBITDA; excluding potential acquisitionsFor a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

6% sales growth in constant currency

Group sales increased by 5% (6% in constant currency) to €21,345 million (Q1-3/2015: €20,369 million). Organic sales growth was 6%. The minor negative currency translation effects (-1%) were mainly related to the devaluation of Latin American currencies against the Euro. Acquisitions contributed 1% and divestitures reduced sales by 1%. In Q3/2016, Group sales increased by 6% (7% in constant currency) to €7,339 million (Q3/2015: €6,940 million). Organic sales growth was 6%. Acquisitions contributed 1%.

Group sales by region:

15% net income1,2 growth in constant currency

Group EBITDA2 increased by 7% (8% in constant currency) to €3,949 million (Q1-3/2015: €3,674 million). Group EBIT2 increased by 9% (9% in constant currency) to €3,092 million (Q1-3/2015: €2,849 million). The EBIT margin2 increased to 14.5% (Q1-3/2015: 14.0%). In Q3/2016, Group EBIT2 increased by 5% (6% in constant currency) to €1,082 million (Q3/2015: €1,027 million), the EBIT margin2 was 14.7% (Q3/2015: 14.8%).

Group net interest decreased to -€433 million (Q1-3/2015: -€476 million), mainly due to more favorable financing terms and lower net debt.

With 28.1%, the Group tax rate2 was below the previous year (Q1 3/2015: 29.6%). The decrease is mainly due to released tax accruals at Fresenius Medical Care in Q3/2016. In Q3/2016, the Group tax rate was 27.1% (Q3/2015: 29.7%).

Noncontrolling interest increased to €759 million (Q1-3/2015: €661 million), of which 96% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income1,2 , increased by 14% (15% in constant currency) to €1,154 million (Q1-3/2015: €1,009 million). Earnings per share1,2 increased by 13% (15% in constant currency) to €2.11 (Q1-3/2015: €1.86). In Q3/2016, Group net income1,2 increased by 9% (10% in constant currency) to €399 million (Q3/2015: €367 million). Earnings per share1,2 increased by 7% (9% in constant currency) to €0.73 (Q3/2015: €0.68).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA2 2015 before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

Continued investment in growth

Spending on property, plant and equipment was €1,044 million (Q1-3/2015: €950 million), primarily for the modernization and expansion of dialysis clinics, production facilities and hospitals.

Total acquisition spending was €592 million (Q1-3/2015: €272 million), including the acquisition of dialysis clinics and further expansion in the field of care coordination at Fresenius Medical Care, the acquisition of a U.S. pharmaceutical plant for ready-to-administer prefilled syringes at Fresenius Kabi and the acquisition of the municipal hospital Niederberg at Fresenius Helios.

Strong operating cash flow

Operating cash flow increased by 5% to €2,259 million (Q1-3/2015: €2,151 million) with a margin of 10.6% (Q1-3/2015: 10.6%). With €929 million, operating cash flow in Q3/2016 was slightly above the level of the strong prior-year quarter (Q3/2015: €900 million), despite of a US$100 million discretionary cash contribution of Fresenius Medical Care to its pension plan assets in the United States. The cash flow margin was 12.7% (Q3/2015: 13.0%).

Free cash flow before acquisitions and dividends decreased slightly to €1,207 million (Q1-3/2015: €1,219 million). Free cash flow after acquisitions and dividends was €253 million (Q1-3/2015: €574 million).

Solid balance sheet structure

The Group’s total assets increased by 3% (4% in constant currency) to €44,075 million (Dec. 31, 2015: €42,959 million), driven by its growing scale of operations. Current assets grew by 6% (7% in constant currency) to €11,135 million (Dec. 31, 2015: €10,479 million). Non-current assets increased by 1% (3% in constant currency) to €32,940 million (Dec. 31, 2015: € 32,480 million).

Total shareholders’ equity grew by 6% (7% in constant currency) to €19,086 million (Dec. 31, 2015: €18,003 million). The equity ratio increased to 43.3% (Dec. 31, 2015: 41.9%).

Group debt decreased by 2% (1% in constant currency) to €14,530 million (Dec. 31, 2015: € 14,769 million). As of September 30, 2016, the net debt/EBITDA ratio was 2.501,2, (Dec. 31, 2015: 2.681).

1 2015 before special items; at LTM average exchange rates for both net debt and EBITDA2 Pro forma acquisitionsFor a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

Increased number of employees

As of September 30, 2016, the number of employees increased by 4% to 231,432 (Dec. 31, 2015: 222,305).

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's largest provider of products and services for individuals with chronic kidney failure. As of September 30, 2016, Fresenius Medical Care was treating 306,366 patients in 3,579 dialysis clinics. Along with its core business, the company seeks to expand the range of medical services in the field of care coordination.

- 9% sales growth in constant currency in Q3

- 27% net income growth in Q3 (17% before one-time items1)

- 2016 outlook confirmed

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA2 2015 before divestiture of dialysis business in Venezuela (-US$27 million after tax) and European pharmaceutical business (US$5 million after tax)

Sales increased by 7% (8% in constant currency) to US$13,224 million (Q1-3/2015: US$12,390 million). Organic sales growth was 7%. Acquisitions contributed 1%. In Q3/2016, sales increased by 9% (9% in constant currency) to US$4,598 million (Q3/2015: US$4,231 million). Organic sales growth was 7%.

Health Care services sales (dialysis services and care coordination) increased by 8% (9% in constant currency) to US$10,720 million (Q1-3/2015: US$9,929 million). Dialysis product sales increased by 2% (4% in constant currency) to US$2,504 million (Q1-3/2015: US$2,461 million).

In North America, sales increased by 9% to US$9,512 million (Q1-3/2015: US$8,730 million). Health Care services sales grew by 9% to US$8,838 million (Q1-3/2015: US$8,087 million). Dialysis product sales increased by 5% to US$674 million (Q1-3/2015: US$642 million).

Sales outside North America increased by 2% (7% in constant currency) to US$3,700 million (Q1-3/2015: US$3,639 million). Health Care services sales increased by 2% (9% in constant currency) to US$1,882 million (Q1-3/2015: US$1,842 million). Dialysis product sales remained nearly unchanged at (increased by 5% in constant currency to) US$1,819 million (Q1-3/2015: US$1,797 million).

EBIT increased by 11% (12% in constant currency) to US$1,851 million (Q1-3/2015: US$1,665 million). The EBIT margin was 14.0% (Q1-3/2015: 13.4%). EBIT before one-time items1 increased by 10%. In Q3/2016, EBIT increased by 9% (10% in constant currency) to US$670 million (Q3/2015: US$614 million). The EBIT margin was 14.6% (Q3/2015: 14.5%). EBIT before one-time items1 increased by 6%.

Net income2 increased by 20% (20% in constant currency) to US$855 million (Q1-3/2015: US$713 million). Net income before one-time items2,3, increased by 16%. In Q3/2016, net income2 grew by 27% (28% in constant currency) to US$333 million (Q3/2015: US$262 million). Net income before one-time items2,3 increased by 17%.

Operating cash flow decreased by 8% to US$1,296 million (Q1-3/2015: US$1,412 million). The cash flow margin was 9.8% (Q1-3/2015: 11.4%). The decrease is mainly attributable to a discretionary cash contribution of US$100 million to Fresenius Medical Care’s pension plan assets in the United States. As a consequence, in Q3/2016, operating cash flow decreased to US$439 million (Q3/2015: US$579 million) with a cash flow margin of 9.5% (Q3/2015: 13.7%).

Fresenius Medical Care confirms its outlook for 2016. The company expects sales to grow by 7% to 10% in constant currency. Net income1 is expected to increase by 15% to 20%4 .

For further information, please see Fresenius Medical Care’s Investor News at www.freseniusmedicalcare.com.

1 2015 before divestiture of dialysis business in Venezuela (-US$26 million before tax) and European pharmaceutical business (US$8 million before tax)

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

3 2015 before divestiture of dialysis business in Venezuela (-US$27 million after tax) and European pharmaceutical business (US$5 million after tax)

4 2015 before GranuFlo®/NaturaLyte® settlement costs (-US$37 million after tax) and before acquisitions (US$9 million after tax); hence the basis for expected net income growth is US$1,057 million.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products.

- 5% organic sales growth in Q3

- 1% constant currency EBIT1 growth in Q3

- 2016 outlook raised: both, organic sales growth and EBIT1 growth in constant currency of 4% to 6% expected

Sales increased by 4% in constant currency to €4,457 million (Q1-3/2015: €4,431 million). Organic sales growth was 6%. The divestment of the Australian and German oncology compounding business reduced sales by 2%. In Q3/2016, sales increased by 1% (by 3% in constant currency) to €1,511 million (Q3/2015: €1,499 million). Negative currency translation effects (-2%) were mainly related to the devaluation of the Chinese yuan and the Argentine peso against the Euro. Organic sales growth was 5%.

Sales in Europe remained nearly unchanged at €1,569 million (Q1-3/2015: €1,566 million). Organic sales growth was 2%. Divestitures reduced sales by 2%. In Q3/2016, sales of €521 million were slightly above prior-year level (Q3/2015: €514 million). Organic sales growth was 3%.

Sales in North America increased by 5% (organic growth: 5%) to €1,628 million (Q1-3/2015: €1,555 million), mainly driven by new product launches. In Q3/2016, sales increased by 2% (organic growth: 2%) to €542 million (Q3/2015: €529 million).

Sales in Asia-Pacific decreased by 5% (organic growth: 8%) to €821 million (Q1-3/2015: €862 million). Adverse currency translation effects reduced sales by 5%, divestitures by another 8%. In Q3/2016, sales decreased by 3% (organic growth: 9%) to €290 million (Q3/2015: €298 million).

Given adverse currency translation effects, sales in Latin America/Africa decreased by 2% (organic growth: 16%, in particular due to inflation driven price increases) to €439 million (Q1-3/2015: €448 million). In Q3/2016, sales remained unchanged at €158 million (Q3/2015: €158 million). Organic sales growth was 7%.

EBIT1 increased by 5% (7% in constant currency) to €916 million (Q1-3/2015: €872 million). The EBIT margin1 improved to 20.6% (Q1-3/2015: 19.7%). In Q3/2016, EBIT1 remained virtually unchanged at €300 million (Q3/2015: €301 million). EBIT1 increased by 1% in constant currency. The EBIT margin1 was 19.9% (Q3/2015: 20.1%).

Net income2 increased by 11% (12% in constant currency) to €532 million (Q1-3/2015: €479 million). In Q3/2016, net income2 increased by 2% (3% in constant currency) to €173 million (Q3/2015: €170 million).

Operating cash flow increased by 10% to €646 million (Q1-3/2015: €589 million) with a margin of 14.5% (Q1-3/2015: 13.3%). In Q3/2016, operating cash flow increased by 32% to €311 million (Q3/2015: €235 million), due to a catch-up from Q2/2016 and temporarily reduced net working capital requirements. The cash flow margin increased to 20.6% (Q3/2015: 15.7%).

Fresenius Kabi raises its outlook for 2016 and now expects both organic sales growth and EBIT1 growth in constant currency of 4% to 6%. Previously, Fresenius Kabi had projected 3% to 5% for both metrics.

1 2015 before special items2 Net income attributable to shareholders of Fresenius Kabi AG; 2015 before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

Fresenius Helios

Fresenius Helios is Germany’s largest hospital operator. HELIOS operates 112 hospitals, thereof 88 acute care clinics (including seven maximum care hospitals in Berlin-Buch, Duisburg, Erfurt, Krefeld, Schwerin, Wiesbaden and Wuppertal) and 24 post-acute care clinics. HELIOS treats more than 4.7 million patients per year, thereof approximately 1.3 million inpatients, and operates approximately 35,000 beds.

- 4% organic sales growth in Q3

- 20 bps sequential EBIT margin increase

- 2016 outlook confirmed

Sales increased by 5% to €4,382 million (Q1-3/2015: €4,167 million). Organic sales growth was 4%. Acquisitions increased sales by 1%. In Q3/2016, sales increased by 6% to €1,470 million (Q3/2015: €1,393 million). Organic sales growth was 4%.

EBIT1 grew by 7% to €507 million (Q1-3/2015: €472 million). The EBIT margin1 increased to 11.6% (Q1-3/2015: 11.3%). In Q3/2016, EBIT1 increased by 6% to €175 million (Q3/2015: €165 million). Sequentially, the EBIT margin increased by 20 bps to 11.9%.

Net income2 increased by 14% to €402 million (Q1-3/2015: €352 million). In Q3/2016, net income2 increased by 11% to €140 million (Q3/2015: €126 million).

Operating cash flow increased by 13% to €437 million (Q1-3/2015: €386 million) with a margin of 10.0% (Q1-3/2015: 9.3%). In Q3/2016 operating cash flow increased by 34% to €207 million (Q3/2015: €155 million), mainly driven by decreased working capital. The cash flow margin increased to 14.1% (Q3/2015: 11.1%).

Fresenius Helios confirms its outlook for 2016 and projects organic sales growth of 3% to 5%. EBIT is expected to increase to €670 to €700 million.

Fresenius Helios expects the acquisition of Quirónsalud to close in Q1/2017.

1 2015 before special items2 Net income attributable to shareholders of HELIOS Kliniken GmbH; 2015 before special itemsFor a detailed overview of special items please see the reconciliation tables on pages 15-16 of the .pdf file.

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management.

- Strong order intake of €209 million in Q3

- 2016 outlook confirmed

Sales increased by 1% (1% in constant currency) to €740 million (Q1-3/2015: €731 million). Organic sales growth was 2%. Sales in the project business decreased by 2% to €325 million (Q1-3/2015: €333 million). Sales in the service business grew by 4% to €415 million (Q1-3/2015: €398 million). In Q3/2016, sales remained unchanged at €268 million (Q3/2015: €268 million). Organic sales growth was 1%.

EBIT increased by 3% to €31 million (Q1-3/2015: €30 million). The EBIT margin increased to 4.2% (Q1-3/2015: 4.1%). In Q3/2016, EBIT increased by 7% to €15 million (Q3/2015: €14 million). The EBIT margin increased to 5.6% (Q3/2015: 5.2%).

Net income1 grew by 5% to €21 million (Q1-3/2015: €20 million). In Q3/2016, net income1 of €10 million was at prior-year level (Q3/2015: €10 million).

Order intake increased by 42% to €674 million (Q1-3/2015: €476 million). In Q3/2016, order intake increased by 9% to €209 million (Q3/2015: €192 million). As of September 30, 2016, order backlog grew to €1,995 million (December 31, 2015: €1,650 million).

Fresenius Vamed confirms its outlook for 2016 and expects organic sales growth in the range of 5% to 10% and EBIT growth of 5% to 10%.

1 Net income attributable to shareholders of VAMED AG

Conference Call

As part of the publication of the results for the first nine months of 2016, a conference call will be held on October 27, 2016 at 2 p.m. CEDT (8 a.m. EDT). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/media. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to pages 25, 40, 56f., 100f. and 194 of the Annual Report 2015 of Fresenius SE & Co. KGaA. Constant currencies for income and expenses are calculated using prior year average rates; constant currencies for assets and liabilities are calculated using the mid-closing rate on the date of the respective statement of financial position (cf. Annual Report 2015, page 111). (www.fresenius.com/financial_reporting/Fresenius_GB_US_GAAP_2015_englisch.pdf).

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, is celebrating its 20th anniversary. The company, founded in 1996 when Fresenius merged its dialysis business with the U.S.-based dialysis services provider National Medical Care, now has more than 100,000 employees, operates approximately 3,500 dialysis clinics in over 45 countries, and treats some 300,000 patients. Every 0.7 seconds Fresenius Medical Care starts a dialysis treatment for a patient somewhere in the world. Over the past 20 years the number of patients under treatment in the company’s dialysis clinics has more than quintupled while the production of dialysis filters (dialyzers) has increased ten-fold, earnings more than eleven-fold, and sales almost twelve-fold.

The start of this success story dates back to the 1960s, when Fresenius began importing dialysis machines and dialyzers made by different companies and distributing them in Germany, gaining significant market share. The company launched its own dialysis machine in 1979 – the A2008, which became the world's top seller. Fresenius Medical Care subsequently expanded this market-leading position with successor models, and now produces more than half of all the dialysis machines sold in the world. In the early 1980s the company developed the first dialysis filters out of polysulfone, opening up a new era in the treatment of kidney disease: Dialyzers made from polysulfone are especially effective at cleaning the patient’s blood, and remain the industry standard today.

Success in dialysis products ultimately paved the way for the entry into dialysis services, which came in 1996, when Fresenius acquired National Medical Care and combined it with its own dialysis business to give birth to Fresenius Medical Care. The new company was listed on the Frankfurt and New York exchanges that year, and joined Germany’s benchmark DAX index in 1999.

Since its founding, Fresenius Medical Care has been the world’s leading provider of products and services for people with chronic kidney failure. The company has steadily strengthened this position as it consistently set new milestones: In 1999, the 100,000th dialysis machine was produced at the company’s Schweinfurt, Germany plant. In 2003, for the first time, the company treated more than 100,000 patients and made over 50 million dialyzers in a single year. Its 500 millionth dialyzer was produced in 2007 and, in 2013, its billionth. The year before, the 500,000th Fresenius Medical Care dialysis machine had come off the assembly line in Schweinfurt.

The company is constantly improving dialysis technology and introducing new, innovative treatment concepts. Earlier this year it launched the latest generation in hemodialysis machines, the 6008 CAREsystem, which delivers the highest therapy standards while optimizing dialysis treatment and improving economic efficiency.

A number of major strategic acquisitions over the years have contributed to Fresenius Medical Care’s strong growth. The company acquired Renal Care Group, the third-largest operator of dialysis centers in the United States, in 2006, followed by the purchase of another major U.S. dialysis center operator, Liberty Dialysis, in 2011. That same year, the acquisition of Euromedic significantly expanded Fresenius Medical Care’s presence in Central and Eastern Europe.

Fresenius Medical Care expects continued strong growth, with annual sales forecast to increase from $16.7 billion in 2015 to $28 billion in 2020. The company expects that, along with continued strong growth in its core business of dialysis products and the treatment of dialysis patients, dialysis-related medical services will contribute to achieving this target. These services include the provision of vascular access as well as in-patient and acute care by specialist physicians.

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “We are committed to enhancing the quality of life of people suffering from kidney disease. Achieving advances in dialysis by providing our patients with innovative therapies and the best possible products has been our motivation for 20 years, and it remains so today. We are in an outstanding position to continue Fresenius Medical Care’s unique success story in the coming years.”

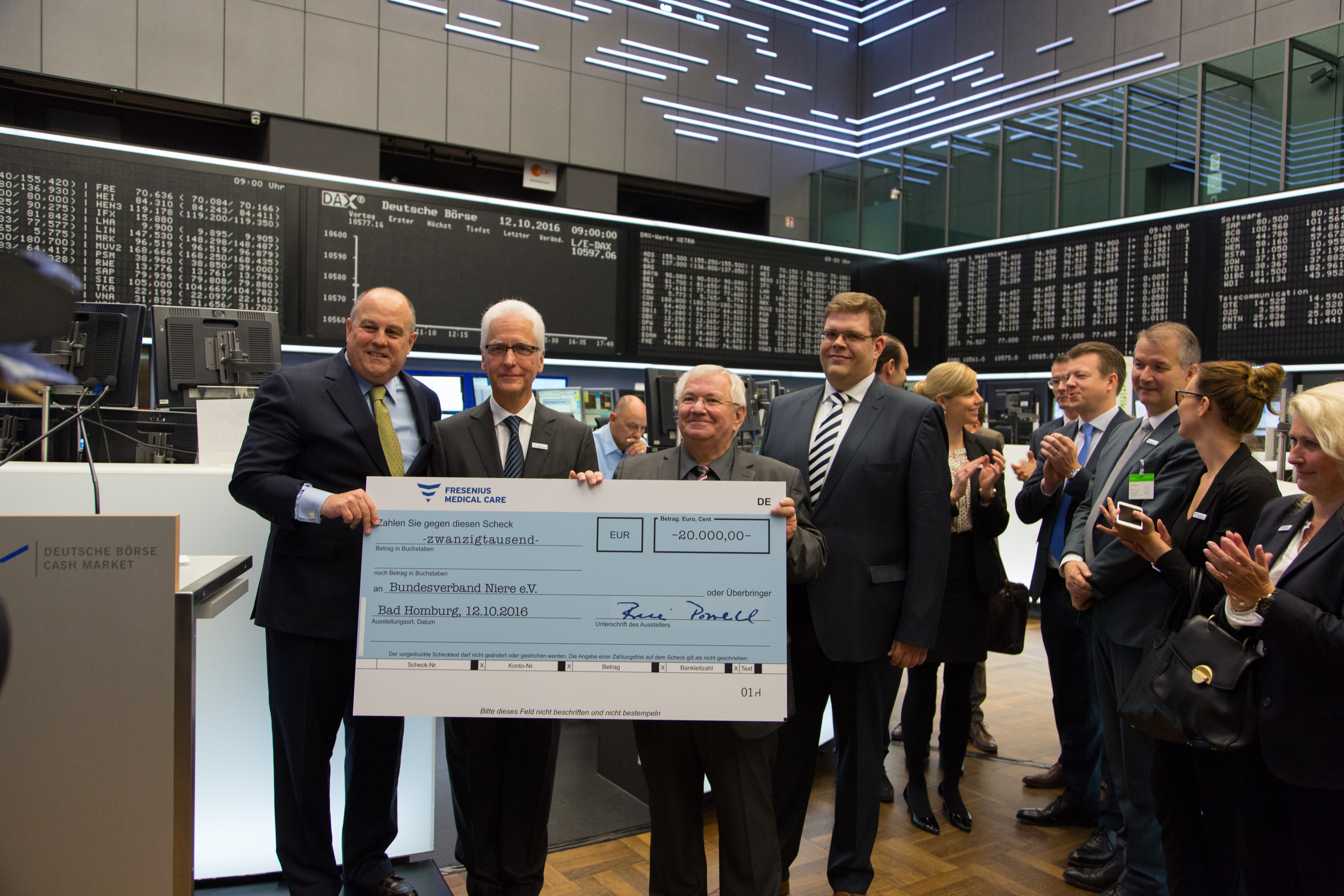

To mark 20 years since the founding of Fresenius Medical Care and the company’s listing on the stock exchange, Rice Powell will ring in the start of the Frankfurt Stock Exchange’s daily trading on October 12. Immediately after, he will present a €20,000 donation to “Bundesverband Niere,” a German charity that works to improve the lives of chronic kidney disease patients. The event can be seen live on the Internet at 8:50 a.m. under the following link: https://youtu.be/yjkSYGORuwo (Replay)

Message to Editors: An electronic press kit on the 20th anniversary of Fresenius Medical Care, containing texts, photos and videos for editorial use can be found under:

http://www.freseniusmedicalcare.com/en/media-center/events/20-years-fresenius-medical-care/

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Adds 43 hospitals across Spain and sales of approximately €2.5 billion1 to HELIOS’ leading German network

- Mutual best-practice transfer to further enhance quality patient care in both markets, creating a European leader in hospital management

- Substantial growth opportunities and cost synergies

- Highly accretive to Group earnings per share from 2017

Fresenius Helios acquires IDC Salud Holding S.L.U. (“Quirónsalud”), Spain’s largest private hospital operator, for a purchase price of €5.76 billion2. Quirónsalud’s network is comprised of 43 hospitals, 39 outpatient centers and around 300 Occupational Risk Prevention (“ORP”) centers located in all economically important areas in Spain. The company has about 35,000 employees and offers the full spectrum of inpatient and outpatient care. Quirónsalud was created by the merger of IDC Salud (“IDC”) and Grupo Hospitalario Quirón (“GHQ”) in 2014.

Quirónsalud has posted organic sales growth of more than 5% p.a. in recent years. Growth is driven by an above-market increase of patient admissions due to excellent quality of care combined with consistently short waiting times.

Quirónsalud is also a pioneer in public-private partnership (“PPP”) models, operating five hospitals (four in Madrid and one in Barcelona) that are integrated within the public healthcare network. Under the PPP agreements, Quirónsalud is assigned responsibility for the publicly insured inhabitants of certain coverage areas and receives remuneration based on capitation or activity performed.

Greenfield hospital projects and acquisitions have also contributed to Quirónsalud’s overall strong sales growth. Going forward, cross-selling between the recently acquired ORPs and Quirónsalud’s hospitals are expected to be yet another growth driver.

For 2016, Quirónsalud expects sales of approximately €2.5 billion and EBITDA of €460 to €480 million. In 2017, EBITDA is expected to be in the range of €520 to €550 million. The purchase price corresponds to approximately 10.8x at the mid-point of the 2017 EBITDA range.

Key drivers of the anticipated EBITDA growth are already implemented synergy projects related to the 2014 merger of IDC and GHQ, recent acquisitions, well-advanced efficiency projects as well as operating leverage. Neither greenfield projects, further acquisitions nor synergies with HELIOS are included in the 2017 projections. In the medium-term, the merger of HELIOS and Quirónsalud is expected to lead to incremental pre-tax synergies of approximately €50 million p.a. without meaningful implementation expenses.

Stephan Sturm, CEO of Fresenius, said: “This acquisition combines two leaders in terms of quality and size. Our patients will benefit from the exchange of knowledge and ideas. For Fresenius, this acquisition is another strategic step towards offering quality and yet affordable care for patients worldwide.”

Francesco De Meo, CEO of Fresenius Helios, said: “We are acquiring the largest private hospital operator in Spain, Europe’s number four. Quirónsalud has shown an impressive development and stands for best-in-class quality in patient care. Quirónsalud and HELIOS perfectly fit together as we can leverage on each other’s experience and knowledge. The new group will preserve both brands, Quirónsalud in Spain and Helios in Germany. I am particularly delighted that Víctor Madera will, beyond his ongoing role as CEO of Quirónsalud, play a very active role in our combined group. We aim to achieve the best for our patients in Germany and Spain, and, together with our Spanish partners, intend to leave a mark in the European health care system.”

Víctor Madera, founder and CEO of Quirónsalud, said: “I am extremely pleased to join such a splendid organization as HELIOS and very much look forward to a fruitful cooperation with Francesco De Meo. I am firmly convinced that HELIOS and Quirónsalud are ideal partners to achieve the best care for our patients in both Germany and Spain.”

Fresenius Helios acquires 100% of the share capital in Quirónsalud. Sellers are the private equity group CVC Capital Partners, Víctor Madera and other members of Quirónsalud’s management board.

Fresenius will issue 6,108,176 shares valued at €400 million to Víctor Madera who has agreed to a two year lock-up period. The balance of the purchase price will be debt-financed.

Group net debt/EBITDA will temporarily increase to approximately 3.1. Already in mid-2017, the leverage ratio is expected to return to the 2.5 to 3.0 target range.

The transaction is subject to regulatory approval by the relevant antitrust authorities and is expected to close in Q4/2016 or Q1/2017.

The transaction is expected to be highly accretive to Group net income3 and EPS3 already in 2017.

Given the expected meaningful accretion to Group sales and earnings, Fresenius will publish new mid-term targets as part of its full-year 2016 reporting.

12016 estimate

2On a cash and debt-free basis

3Net income attributable to shareholders of Fresenius SE & Co. KGaA

Telephone Conference

A telephone conference concerning the acquisition of Quirónsalud will be held at 2.00 p.m. CEST on Tuesday, 6 September, 2016. You are cordially invited to follow the conference call in a live broadcast via the Internet. Following the call, a replay will be available on our website.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today announced to acquire 85% of equity interest in Indian dialysis group Sandor Nephro Services from a group of investors. The parties involved agreed not to disclose financial terms of the transaction.

Established in 2011, Sandor Nephro Services is India’s second largest dialysis care provider. Under the brand name “Sparsh Nephrocare” the company operates a network of more than 50 dialysis centers across the country. With the acquisition, Fresenius Medical Care will clearly strengthen its core business in one of the fastest growing economies of the world.

Sandor Nephro Services is expected to generate revenue of around $3 million in full year 2016. Fresenius Medical Care expects the investment to be accretive in 2017 on earnings after tax.

India’s economy is characterized by a rising middle class and a healthcare spending which grows at an average rate of 12% per year. According to estimates, within India’s population of around 1.3 billion people, there are about 1 million people suffering from chronic kidney disease. A major part of this patient base still has no sufficient access to dialysis treatments.

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “With the acquisition of Sandor Nephro Services we will reach a new scale in the dialysis business in India. We have been in India for more than 15 years primarily with our product portfolio and we are now taking the next important step. This is a unique opportunity to become one of the major players in a market where we expect a strong growth in the overall economy and where we will help treating chronically ill dialysis patients.”

“We are very pleased to join the Fresenius Medical Care Group. After building up one of the most successful dialysis chains in India, we now have a strong partner on our side to further grow the business,” said Saurav Panda who co-founded Sparsh Nephrocare together with Gaurav Porwal. Both committed themselves to stay with the company for at least three years.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- Group revenue +5% (+7% at constant currency), driven by very good results in health care services

- Considerable net income growth of 22%, supported by lower costs for health care supplies and Global Efficiency Program

- Strong operating performance in North America: revenue +8%, operating income (EBIT) +20%

- Care Coordination maintains significant revenue growth (+21%) and continues to invest in infrastructure

- Fresenius Medical Care on track to achieve full year guidance

Key figures – second quarter 2016

Net revenue: $4,420 million, +5 %

Operating income: (EBIT) $641 million, +17 %

Net income1: $294 million, +22 %

Basic earnings per share: $0.96, +22 %

Key figures – first half 2016

Net revenue: $8,626 million, +6 %

Operating income (EBIT): $1,181million, +12 %

Net income1: $522 million, +16 %

Basic earnings per share: $1.71, +15 %

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

“Following a solid start to the year, we have accelerated our growth in the second quarter”, said Rice Powell, Chief Executive Officer of Fresenius Medical Care. “Our strong earnings growth demonstrates our ability to further improve our cost base and the success of our Global Efficiency Program. I am extremely pleased with our excellent operational performance in the core dialysis services business. Care Coordination maintains strong topline growth and we continue to invest in the infrastructure of this business. Despite unfavorable foreign currency developments and continuous cost pressure, we are confident we will achieve our full year guidance.”

Revenue & earnings

Net revenue for the second quarter improved by 5% and reached $4,420 million (+7% at constant currency), driven by very good health care services revenue growth in North America. Health care services revenue increased by 7% to $3,571 million, mainly due to organic revenue growth. Dialysis products revenue decreased by 1% to $849 million in the second quarter, impacted by negative currency developments (+2% at constant currency) and compared to an exceptionally strong performance in the previous year’s second quarter. The revenue increase at constant exchange rates was driven by higher sales of dialyzers and machines.

Net revenue in the first half of 2016 increased by 6% (health care services revenue +7%/+9% at constant currency; dialysis products revenue +1%/+4% at constant currency).

In the second quarter, operating income (EBIT) increased by 17% to $641 million. The operating income margin increased to 14.5%, due to strong operating performance across all segments. The increase in North America was supported by lower costs for health care supplies and a favorable impact from higher volume with commercial payors. This was partially offset by higher personnel expenses related to dialysis services in the North America segment. The increase in the Asia-Pacific segment was driven by favorable exchange rate effects and higher business growth.

For the first half of 2016, operating income (EBIT) increased by 12% to $1,181 million.

Net interest expense in the second quarter remained at the previous year’s level ($102 million). For the first half of 2016, net interest expense increased by 2% to $208 million.

Income tax expense increased to $169 million in the second quarter. This translates into an effective tax rate of 31.3%, an increase of 90 basis points compared to Q2 2015 (30.4%). This increase was mainly driven by a relative to income before taxes lower increase of tax-free income attributable to noncontrolling interests.

For the first half of 2016, tax expense increased to $306 million, translating into an effective tax rate of 31.5% (-70 basis points).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 22% to $294 million in the second quarter, mainly driven by the strong performance of the North America segment. Based on approximately 305.5 million shares (weighted average number of shares outstanding), basic earnings per share (EPS) increased accordingly to $0.96 (+22%), compared to $0.79 in the previous year’s second quarter.

For the first half of 2016, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increasead by 16% to $522 million.

Segment development

In the second quarter, North America revenue increased by 8% to $3,168 million (72% of total revenue). Health care services revenue grew by 8% to $2,938 million, of which Care Coordination contributed $564 million (+21%), supported by considerable organic revenue growth of 17%. Dialysis care revenue contributed $2,374 million (+5%), driven by growth in dialysis treatments and increases in revenue per treatment. Dialysis products revenue grew by 2% to $230 million, due to increased product sales (especially machines and dialyzers). Operating income in North America came in at $513 million (+20%). The substantially improved operating income margin of 16.2% (+170 basis points) was attributable to lower costs for health care supplies, a favorable impact from commercial payors, lower legal expenses and increased income from equity method investees. This was partially offset by higher personnel expenses related to dialysis services and a lower margin in Care Coordination. The margin decrease in Care Coordination was driven by increased costs for hospitalist and intensivist services due to further infrastructure development, partially offset by one-time gains from the endovascular and cardiovascular services business.

For the first half of 2016, North America revenue increased by 9% to $6,212 million. Operating income increased by 24% to $949 million.

EMEA revenue increased by 1% to $676 million in the second quarter of 2016 (+3% at constant currency). Health care services revenue for the EMEA segment increased by 7% (+9% at constant curreny) to $331 million. This was the result of contributions from acquisitions (7%) and organic revenue growth (3%), partially offset by the negative effect of exchange rate fluctuations (2%) and the effect of closed or sold clinics (1%). Dialysis treatments increased by 9% in the second quarter. Dialysis products revenue decreased by 4% (-3% at constant currency) to $345 million. The decrease was driven by lower sales of dialyzers, machines, renal pharmaceuticals and bloodlines, partially offset by higher sales of products for acute care treatments and peritoneal dialysis products. Operating income in the EMEA segment increased by 4% to $139 million in the second quarter, due to favorable foreign exchange effects and a positive impact from manufacturing driven by higher volumes and production efficiencies. The operating income margin increased to 20.6% (+50 basis points).

For the first half of 2016, EMEA revenue increased by 1% to $1,307 million and operating income decreased by 2% to $269 million.

Asia-Pacific revenue grew by 5% (+6% at constant currency) to $397 million in the second quarter. The region recorded $177 million in health care services revenue, based on an increase of 4% in dialysis treatments. With a 4% growth in revenue to $220 million (+9% at constant currency), the product business showed a very good sales performance across the entire dialysis products range. Operating income showed a strong increase (+12%) to $75 million. The operating income margin increased to 18.9% (+110 basis points). This was driven by favorable foreign currency effects and the positive underlying business performance, in particular in China and India.

For the first half of 2016, Asia-Pacific revenue grew by 6% to $771 million (+8% at constant currency) and operating income decreased by 8% to $140 million.

Latin America delivered revenue of $175 million, a decrease of 14% and an improvement of 9% at constant currency. Health care services revenue decreased by 17% to $125 million (+9% at constant currency) as a result of negative foreign currency effects and the effect of closed or sold clinics (mainly in Venezuela). Dialysis treatments decreased accordingly by 7% in the second quarter. This was partially offset by the strong organic revenue growth of 19%. Dialysis products revenue decreased by 5% to $50 million (+8% at constant currency). The 8% increase at constant curreny was driven by higher sales of dialyzers, hemodialysis solutions and concentrates, machines and bloodlines, partially offset by lower sales of peritoneal dialysis products. Operating income came in at $16 million (+4%) with the operating margin increasing to 9.3%. The margin increase was primarily driven by favorable foreign exchange effects.

For the first half of 2016, Latin America revenue decreased by 18% to $328 million (+7% at constant currency) and operating income decreased by 19% to $27 million.

Cash flow

In the second quarter of 2016, the company generated $678 million in net cash provided by operating activities, representing 15.3% of revenue ($385 million in Q2 2015). The strong increase was primarily driven by an adjustment during the first quarter which impacted invoicing and was largely resolved during the second quarter. In addition, the timing of working capital items and higher earnings had a positive effect on cash flow. These effects were partially offset by higher income tax payments. The number of DSO (days sales outstanding) came in at 70 days, a reduction of 4 days compared to the first quarter of 2016.

In the first half of 2016, the company generated net cash provided by operating activities of $857 million, representing 9.9% of revenue.

Employees

As of June 30, 2016, Fresenius Medical Care had 106,556 employees (full-time equivalents) worldwide, compared to 102,893 employees at the end of June 2015. This increase was attributable to our continued organic growth.

Recent events: 6008 CAREsystem

In May 2016, Fresenius Medical Care launched the 6008 CAREsystem, a new innovative hemodialysis therapy system enabling better care for chronic patients. To enable significantly reduced complexity in therapy delivery, the system uses a new, all-in-one disposable with completely pre-connected bloodlines for all treatment modalities. More than 150,000 treatments have already been performed with the system.

Outlook 2016 confirmed

Based on the positive business development in the first half of 2016, Fresenius Medical Care confirms its full year outlook 2016. The company expects a currency-adjusted revenue growth between +7% and +10% for 2016. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by +15% to +20% over the previous year.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the second quarter/first half 2016 on Tuesday, August 2, 2016 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Please refer to the attachments for a complete overview of the results for the second quarter and first half of 2016.

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases of which about 2.8 million patients worldwide regularly undergo dialysis treatment. Through its network of 3,504 dialysis clinics, Fresenius Medical Care provides dialysis treatments for 301,548 patients around the globe. Fresenius Medical Care is also the leading provider of dialysis products such as dialysis machines or dialyzers. Along with the core business, the company focuses on expanding the range of related medical services in the field of Care Coordination. Fresenius Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

If no timeframe is specified, information refers to H1/2016

Q2/2016:

- Sales: €7.1 billion (+2%, +5% in constant currency)

- EBIT1: €1,051 million (+8%, +11% in constant currency)

- Net income1,2: €393 million (+12%, +15% in constant currency)

H1/2016:

- Sales: €14.0 billion (+4%, +6% in constant currency)

- EBIT1: €2,010 million (+10%, +11% in constant currency)

- Net income1,2: €755 million (+18%, +18% in constant currency)

1 2015 before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 13-14 of the pdf file.

Stephan Sturm, CEO of Fresenius, said: “Once again, all four business segments contributed to strong organic growth. This confirms Fresenius’ sound strategic position as a healthcare Group. We have continued to grow even in regions where economies have slowed. This confirms the stability of our markets and businesses. Even compared with an excellent prior-year quarter, Fresenius has again achieved double-digit earnings growth. This confirms that we are providing the right products and services to patients worldwide. Fresenius has now delivered the 50th consecutive quarter of earnings growth. We continue to look forward with great confidence, and are raising our 2016 earnings guidance.”

2016 Group earnings guidance raised

Based on the Group’s excellent financial results in the first half of 2016 and strong prospects for the remainder of the year, Fresenius raises its 2016 Group earnings guidance. Net income1,2 is now expected to grow by 11% to 14% in constant currency. Previously, Fresenius expected net income1,2 growth of 8% to 12% in constant currency. The company confirms its Group sales guidance. Sales are expected to increase by 6% to 8% in constant currency.

The net debt/EBITDA3 ratio is expected to be approximately 2.5 at the end of 2016.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 2015 before special items

3 Calculated at FY average exchange rates for both net debt and EBITDA; excluding potential acquisitions

For a detailed overview of special items please see the reconciliation tables on page 13-14 of the pdf file.

6% sales growth in constant currency

Group sales increased by 4% (6% in constant currency) to €14,006 million (H1/2015: €13,429 million). Organic sales growth was 6%. Acquisitions contributed 1% and divestitures reduced sales by 1%. Negative currency translation effects (-2%) were mainly driven by the devaluation of Latin American currencies against the Euro. In Q2/2016, Group sales increased by 2% (5% in constant currency) to €7,092 million (Q2/2015: €6,946 million). Organic sales growth was 5%. Acquisitions contributed 1%, while divestitures reduced sales by 1%.

Group sales by region:

18% net income1,2 growth in constant currency

Group EBITDA2 increased by 9% (10% in constant currency) to €2,576 million (H1/2015: €2,364 million). Group EBIT2 increased by 10% (11% in constant currency) to €2,010 million (H1/2015: €1,822 million). The EBIT margin2 increased to 14.4% (H1/2015: 13.6%). In Q2/2016, Group EBIT2 increased by 8% (11% in constant currency) to €1,051 million (Q2/2015: €971 million), the EBIT margin was 14.8% (Q2/2015: 14.0%).

Group net interest decreased to -€291 million (H1/2015: -€330 million), mainly due to more favorable financing terms and lower net debt.

With 28.6%, the Group tax rate (before special items) was on Q1/2016 level (28.4%) and hence in line with expectations. In Q2/2016, the Group tax rate was 28.7% (Q2/2015: 29.0%).

Noncontrolling interest increased to €473 million (H1/2015: €409 million), of which 96% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income , increased by 18% (18% in constant currency) to €755 million (H1/2015: €642 million). Earnings per share1,2 increased by 17% (18% in constant currency) to €1.38 (H1/2015: €1.18). In Q2/2016, Group net income1,2 increased by 12% (15% in constant currency) to €393 million (Q2/2015: €350 million). Earnings per share1,2 increased by 12% (14% in constant currency) to €0.72 (Q2/2015: €0.64).

Continued investment in growth

Spending on property, plant and equipment was €670 million (H1/2015: €611 million), primarily for the modernization and expansion of dialysis clinics, production facilities and hospitals. Total acquisition spending was €505 million (H1/2015: €194 million).

Cash flow development

Operating cash flow increased by 6% to €1,330 million (H1/2015: €1,251 million) with a margin of 9.5% (H1/2015: 9.3%). Operating cash flow in Q2/2016 increased to €996 million (Q2/2015: €720 million). The cash flow margin increased to 14.0% (Q2/2015: 10.4%). As expected, the operating cashflow of Fresenius Medical Care improved considerably in Q2/2016.

Free cash flow before acquisitions and dividends increased slightly to €650 million (H1/2015: €646 million). Free cash flow after acquisitions and dividends was -€206 million (H1/2015: €107 million).

Solid balance sheet structure

The Group’s total assets increased by 2% (3% in constant currency) to €43,821 million (Dec. 31, 2015: €42,959 million). The increase is mainly driven by business expansion. Current assets grew by 5% (6% in constant currency) to €11,000 million (Dec. 31, 2015: €10,479 million). Non-current assets increased by 1% (2% in constant currency) to €32,821 million (Dec. 31, 2015: € 32,480 million).

Total shareholders’ equity grew by 3% (also 3% in constant currency) to €18,458 million (Dec. 31, 2015: €18,003 million). The equity ratio increased to 42.1% (Dec. 31, 2015: 41.9%).

Group debt increased by 1% (2% in constant currency) to €14,960 million (Dec. 31, 2015: € 14,769 million). As of June 30, 2016, the net debt/EBITDA ratio was 2.62 , (Dec. 31, 2015: 2.681).

12015 before special items; at LTM average exchange rates for both net debt and EBITDA

2Pro forma acquisitions

For a detailed overview of special items please see the reconciliation tables on page 13-14 of the pdf file.

Increased number of employees

As of June 30, 2016, the number of employees increased by 2% to 227,856 (Dec. 31, 2015: 222,305).

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of June 30, 2016, Fresenius Medical Care was treating 301,548 patients in 3,504 dialysis clinics. Along with its core business, the company seeks to expand the range of medical services in the field of care coordination.

- 7% sales growth in constant currency in Q2

- 22% net income growth in Q2

- 2016 outlook confirmed

Sales increased by 6% (8% in constant currency) to US$8,626 million (H1/2015: US$8,159 million). Organic sales growth was 7%. Acquisitions contributed 1%. Currency translation effects reduced sales by 2%. In Q2/2016, sales increased by 5% (7% in constant currency) to US$4,420 million (Q2/2015: US$4,199 million). Organic sales growth was 6%.

Health Care services sales (dialysis services and care coordination) increased by 7% (9% in constant currency) to US$6,985 million (H1/2015: US$6,527 million). Dialysis product sales increased by 1% (4% in constant currency) to US$1,640 million (H1/2015: US$1,631 million).

In North America, sales increased by 9% to US$6,212 million (H1/2015: US$5,717 million). Health Care services sales grew by 9% to US$5,770 million (H1/2015: US$5,293 million). Dialysis product sales increased by 4% to US$441 million (H1/2015: US$424 million).

Sales outside North America decreased by 1% (increased by 6% in constant currency) to US$2,406 million (H1/2015: US$2,427 million). Health Care services sales decreased by 2% (increased by 7% in constant currency) to US$1,215 million (H1/2015: US$1,234 million). Dialysis product sales remained nearly unchanged at (increased by 5% in constant currency to) US$1,191 million (H1/2015: US$1,193 million).

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

EBIT increased by 12% (13% in constant currency) to US$1,181 million (H1/2015: US$1,051 million). The EBIT margin was 13.7% (H1/2015: 12.9%). In Q2/2016, EBIT increased by 17% (17% in constant currency) to US$641 million (Q2/2015: US$547 million). The EBIT margin was 14.5% (Q2/2015: 13.0%).

Net income increased by 16% (16% in constant currency) to US$522 million (H1/2015: US$450 million). In Q2/2016, net income grew by 22% (22% in constant currency) to US$294 million (Q2/2015: US$241 million).

Operating cash flow increased by 3% to US$857 million (H1/2015: US$832 million). The cash flow margin was 9.9% (H1/2015: 10.2%). In Q2/2016, operating cash flow increased to US$678 million (Q2/2015: US$385 million) with a cash flow margin of 15.3% (Q2/2015: 9.2%). The sequential improvement is mainly driven by the anticipated catch-up effect after the adjustment in invoicing in Q1/2016.

Fresenius Medical Care confirms its outlook for 2016. The company expects sales to grow by 7% to 10% in constant currency and net income1 is expected to increase by 15% to 20% in 2016.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 2015 before GranuFlo®/NaturaLyte® settlement costs (-US$37 million after tax) and before acquisitions (US$9 million after tax); hence the basis for expected net income growth is US$1,057 million.

For further information, please see Fresenius Medical Care’s Press Release at www.freseniusmedicalcare.com.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products.

- 3% organic sales growth in Q2

- 1% constant currency EBIT1 growth in Q2

- 2016 outlook raised: both, organic sales growth and EBIT1 growth in constant currency of 3% to 5% expected

Sales increased slightly (by 4% in constant currency) to €2,946 million (H1/2015: €2,932 million). Organic sales growth was 6%. Divestitures reduced sales by 2%. In Q2/2016, sales decreased by 4% (increased by 1% in constant currency) to €1,476 million (Q2/2015: €1,538 million). Negative currency translation effects (-5%) were mainly driven by the devaluation of the Chinese yuan, the U.S. dollar and the Argentine peso against the Euro. Organic sales growth was 3%.

Sales in Europe remained nearly unchanged at €1,048 million (H1/2015: €1,052 million). Organic sales growth was 2%. Divestitures reduced sales by 1%. Also in Q2/2016, sales were almost unchanged at €536 million (Q2/2015: €534 million). Organic sales growth was 2%.

Sales in North America increased by 6% (organic growth: 6%) to €1,086 million (H1/2015: €1,026 million), driven by persisting drug shortages as well as new product launches in Q1/2016. In Q2/2016, sales decreased by 8% (organic: 6%) to €510 million (Q2/2015: €553 million), mainly due to the high prior-year basis driven by significant new product launches.

1 2015 before special items

2 Net income attributable to shareholders of Fresenius Kabi AG; 2015 before special items

For a detailed overview of special items please see the reconciliation tables on page 13-14.

Sales in Asia-Pacific decreased by 6% (organic growth: 7%) to €531 million (H1/2015: €564 million). Adverse currency translation effects reduced sales by 5%, divestitures by another 8%. In Q2/2016, sales decreased by 6% (organic growth: 8%) to €277 million (Q2/2015: €296 million).

Given adverse currency translation effects, sales in Latin America/Africa decreased by 3% (organic growth: 21%, in particular due to inflation driven price increases) to €281 million (H1/2015: €290 million). In Q2/2016, sales decreased by 1% (organic growth 22%) to €153 million (Q2/2015: €155 million).

EBIT2 increased by 8% (10% in constant currency) to €616 million (H1/2015: €571 million). The EBIT margin2 improved to 20.9% (H1/2015: 19.5%). In Q2/2016, EBIT2 decreased by 2% (increased by 1% in constant currency) to €307 million (Q2/2015: €314 million). The EBIT margin2 increased to 20.8% (Q2/2015: 20.4%).

Net income1 increased by 16% (37% in constant currency) to €359 million (H1/2015: €309 million). In Q2/2016, net income1 increased by 7% (30% in constant currency) to €180 million (Q2/2015: €169 million).

Given adverse currency translation effects, operating cash flow decreased by 5% to €335 million (H1/2015: €354 million) with a margin of 11.4% (H1/2015: 12.1%). While operating cash flow reached a very strong €211 million in Q2/2016, it could not match the exceptional prior-year quarter (Q2/2015: €271 million). The same applies to the margin of 14.3% (Q2/2015: 17.6%).

Fresenius Kabi raises its outlook for 2016 and now expects organic sales growth of 3% to 5% and EBIT2 growth in constant currency of 3% to 5%. Previously, Fresenius Kabi projected low single-digit organic sales growth and EBIT2 in constant currency to be roughly flat compared with 2015.

1 Net income attributable to shareholders of Fresenius Kabi AG; 2015 before special items

2 2015 before special items

For a detailed overview of special items please see the reconciliation tables on page 13-14 of the pdf file.

Fresenius Helios

Fresenius Helios is Germany’s largest hospital operator. HELIOS operates 112 hospitals, thereof 88 acute care clinics (including seven maximum care hospitals in Berlin-Buch, Duisburg, Erfurt, Krefeld, Schwerin, Wiesbaden and Wuppertal) and 24 post-acute care clinics. HELIOS treats more than 4.7 million patients per year, thereof approximately 1.3 million inpatients, and operates more than 34,000 beds.

- 6% organic sales growth in Q2

- 60 bps sequential EBIT margin increase

- 2016 outlook confirmed

Sales increased by 5% to €2,912 million (H1/2015: €2,774 million). Organic sales growth was 4% (H1/2015: 3%). Acquisitions and divestitures had no material effect. In Q2/2016, sales increased by 7% to €1,477 million (Q2/2015: €1,383 million). Organic sales growth was 6% (Q2/2015: 2%).

EBIT1 grew by 8% to €332 million (H1/2015: €307 million). The EBIT margin1 increased to 11.4% (H1/2015: 11.1%). In Q2/2016, EBIT1 increased by 8% to €173 million (Q2/2015: €160 million). Sequentially, the EBIT margin increased by 60 bps to 11.7%.

Net income2 increased by 16% to €262 million (H1/2015: €226 million). In Q2/2016, net income2 increased by 16% to €138 million (Q2/2015: €119 million).

Fresenius Helios confirms its outlook for 2016 and projects organic sales growth of 3% to 5%. EBIT is expected to increase to €670 to €700 million.

1 2015 before special items

2 Net income attributable to shareholders of HELIOS Kliniken GmbH; 2015 before special items

For a detailed overview of special items please see the reconciliation tables on page 13-14 of the pdf file.

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management, to total operational management.

- Sales development reflects typical quarterly fluctuations in the project business

- Strong order intake of €228 million in Q2

- 2016 outlook confirmed

Sales increased by 2% (2% in constant currency) to €472 million (H1/2015: €463 million). Organic sales growth was 3%. Sales in the project business decreased by 3% to €195 million (H1/2015: €202 million). Sales in the service business grew by 6% to €277 million (H1/2015: €261 million). In Q2/2016, sales remained nearly unchanged at €254 million (Q2/2015: €255 million). Organic sales growth was 1%.