Fresenius Kabi and the pharmaceutical company medac have agreed to cooperate in Germany in the area of treatments for rheumatic illnesses. On June 1, medac’s sales representatives will begin offering the adalimumab biosimilar IDACIO® as an additional therapy option to the rheumatologists and dermatologists they work with. This biosimilar, developed by Fresenius Kabi and launched last year in Europe, is used to treat autoimmune illnesses such as arthritis and psoriasis. medac is a leading provider of methotrexate (metex® PEN, metex® FS) for the parenteral treatment of patients with chronic inflammatory diseases. Since affected patients are often treated with a combination of methotrexate and adalimumab, the partnership between Fresenius Kabi and medac will offer patients and doctors new benefits and synergies in therapy offerings as well as consulting.

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. Securities may not be offered or sold in the United States of America (“US”) absent registration under the US Securities Act of 1933, as amended, or an exemption from registration. The securities described on the following pages are not offered for sale in the US or to "US persons" (as defined in Regulation S under the US Securities Act of 1933, as amended).

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE US, CANADA, JAPAN OR AUSTRALIA OR WHO ARE US PERSONS (AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT OF 1933, AS AMENDED), OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of the United States of America, Canada, Japan or Australia or a "US person" (as defined in Regulation S under the US Securities Act of 1933, as amended),

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius Medical Care, the world’s largest provider of dialysis products and services, today successfully placed bonds in two tranches with an aggregate volume of €1.25 billion:

- €500 million bonds with a 6-year maturity and a coupon of 1.000% were issued at a price of 99.405% resulting in a yield of 1.103%,

- €750 million bonds with a 10-year maturity and a coupon of 1.500% were issued at a price of 99.742% resulting in a yield of 1.528%.

The proceeds will be used for general corporate purposes, including refinancing of existing financial liabilities.

Helen Giza, CFO of Fresenius Medical Care, said: “I am very pleased with this successful bond issuance, showing our ability to raise debt at attractive conditions also in this challenging market environment. With this, we are enhancing our strong financial position which is the basis for investing in our sustainable long-term growth.”

The bonds were drawn under the European Medium Term Note (EMTN) Program by Fresenius Medical Care. The company has applied to the Luxembourg Stock Exchange to admit the bonds to trading on its regulated market.

The envisaged settlement date is May 29, 2020.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities of Fresenius Medical Care to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent such registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement neither constitutes an offer to sell nor a solicitation to buy any securities of Fresenius Medical Care. The securities referred to in this announcement have already been sold.

No action has been taken that would permit an offering of the securities or possession or distribution of this announcement in any jurisdiction where action for that purpose is required. Persons into whose possession this announcement comes are required to inform themselves about and to observe any such restrictions. This announcement has been prepared on the basis that any offer of Notes in any member state of the European Economic Area (EEA) (each, a “Member State”) will only be made (i) pursuant to a prospectus prepared by Fresenius Medical Care pursuant to Regulation (EU) 1129/2017 (the “Prospectus Regulation”), or (ii) pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius Medical Care does not undertake any responsibility to update the forward-looking statements in this announcement.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. The information in this announcement is subject to change.

- Fresenius Medical Care with strong sales growth in Q1

- Fresenius Kabi with expected dip in China partially offset by spike in demand for drugs and devices for COVID-19 patients in Europe and the US

- Helios Germany supported by law to ease financial burden on hospitals

- Helios Spain’s significant contribution to combat COVID-19 faces reimbursement uncertainties

- Fresenius Vamed with solid Q1, however already marked by COVID-19 related post-acute patient losses and project delays

- Original guidance for 2020 excluding any effects of the COVID-19 pandemic maintained; Guidance update to include COVID-19 effects expected with Q2/20 financial results

- Group financial position remains strong

If no timeframe is specified, information refers to Q1/2020

2020 and 2019 according to IFRS 16

1 Not comparable to FY/20 guidance as inclusive of COVID-19 effects

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Stephan Sturm, CEO of Fresenius, said: “The COVID-19 pandemic has created unprecedented challenges for Fresenius. We are doing everything we can to continue providing the best possible care for our patients around the world. The last few weeks have shown that we have a crucial role to play in the health care systems around the world, and never more so than at a time of crisis. Our success to date is due, above all, to the tremendous dedication and commitment of our employees. Our solid first-quarter business results demonstrate the resilience of our operations and business models. It is, however, too early to say with any certainty what impact COVID-19 will have on the company’s full business year. What can be said with certainty is that we will keep working hard for our patients, and will continue to make an important contribution to overcoming this pandemic.”

Group guidance for FY/20 – Impact of COVID-19 on outlook cannot be reliably assessed at this time

Fresenius’ FY guidance published on February 20, 2020 did not take into account effects of the COVID-19 pandemic. It projected sales growth1 of 4% to 7% in constant currency and net income growth2,3 of 1% to 5% in constant currency. Fresenius anticipates that, following the solid start to the year, COVID-19 will continue to impact its business; at this time, however, a reliable assessment and quantification of the positive and negative effects is not possible. The Group hence maintains its original guidance, excluding any COVID-19 effects. Fresenius will revisit this guidance when communicating its Q2/20 results with the aim to incorporate a reliable assessment of COVID-19 effects.

This approach also applies for the Group’s net debt/EBITDA target. The original guidance, excluding effects of the COVID-19 pandemic, projects net debt/EBITDA4 to be towards the top-end of the self-imposed target corridor of 3.0x to 3.5x at the end of 2020.

Fresenius expects to see a more pronounced negative COVID-19 effect on its financial results in the second quarter than in the first quarter of 2020.

1 FY/19 base: €35,409 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/19 base: €1,879 million; before special items (transaction-related expenses, revaluations of biosimilars contingent purchase price liabilities, gain related to divestitures of Care Coordination activities at FMC, expenses associated with the cost optimization program at FMC); FY/20: before special items

4 Both net debt and EBITDA calculated at expected annual average exchange rates; excluding further potential acquisitions

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

7% sales growth in constant currency

Group sales increased by 8% (7% in constant currency) to €9,135 million in Q1/20 (Q1/19: €8,495 million) driven by all business segments. COVID-19 had only a slight negative effect on sales growth. Organic sales growth was 5%. Acquisitions/divestitures contributed net 2% to growth. Positive currency translation effects of 1% were mainly driven by the U.S. dollar strengthening against the euro.

1% net income1,2 growth in constant currency

Group EBITDA increased by 3% (2% in constant currency) to €1,755 million (Q1/191: €1,701 million).

Group EBIT remained on prior year’s level (-2% in constant currency) at €1,125 million (Q1/191: €1,130 million), impacted by negative COVID-19 effects. At Fresenius Kabi additional demand for drugs and devices to treat COVID-19 patients late in the quarter only partially offset the anticipated headwinds in China during most of the quarter. Helios Spain also faced very significant negative COVID-19 effects in March, mainly at its private hospital and ORP businesses. The EBIT margin was 12.3% (Q1/191: 13.3%).

Group net interest before special items improved to -€174 million in Q1/20 (Q1/19: -€181 million) mainly due to successful refinancing activities. Reported Group net interest improved to -€182 million (Q1/19: -€184 million).

The Group tax rate before special items was 22.6% (Q1/19: 23.3%). The reported Group tax rate was 22.6% (Q1/19: 23.3%).

Noncontrolling interest before special items was -€271 million (Q1/19: -€271 million), of which 96% was attributable to the noncontrolling interest in Fresenius Medical Care. Reported Group noncontrolling interest was -€271 million (Q1/19: -€261 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Group net income1 before special items increased by 2% (1% in constant currency) to €465 million (Q1/19: €457 million). Reported Group net income1 was €459 million (Q1/19: €453 million). COVID-19 had a significant negative effect on net income growth.

Earnings per share1 before special items increased by 1% (1% in constant currency) to €0.83 (Q1/19: €0.82). Reported earnings per share1 were €0.82 (Q1/19: €0.81).

Continued investment in growth

Spending on property, plant and equipment was €547 million corresponding to 6% of sales (Q1/19: €441 million; 5% of sales). The investments in Q1/20 served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals, and day clinics. Subject to duration and magnitude of the COVID-19 pandemic, Fresenius may face delays of investment projects planned for 2020.

Total acquisition spending was €412 million (Q1/19: €1,923 million), mainly for the acquisition of two hospitals in Colombia by Fresenius Helios.

Cash flow development

Group operating cash flow increased to €878 million (Q1/19: €289 million) with a margin of 9.6% (Q1/19: 3.4%). Growth was driven by a favorable working capital development at both Fresenius Medical Care and Fresenius Kabi. Free cash flow before acquisitions and dividends was €305 million (Q1/19: -€168 million). Free cash flow after acquisitions and dividends was -€40 million (Q1/19: -€2,111 million, driven by the acquisition of NxStage by Fresenius Medical Care).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Solid balance sheet structure

Group total assets increased by 3% (3% in constant currency) to €68,972 million (Dec. 31, 2019: €67,006 million). Current assets increased by 7% (8% in constant currency) to €16,341 million (Dec. 31, 2019: €15,264 million). Non-current assets increased by 2% (1% in constant currency) to €52,631 million (Dec. 31, 2019: €51,742 million).

Total shareholders’ equity increased by 1% (1% in constant currency) to €26,956 million (Dec. 31, 2019: €26,580 million). The equity ratio was 39.1%.

Group debt increased by 5% (4% in constant currency) to €28,557 million (Dec. 31, 2019: €?27,258 million). Group net debt increased by 4% (3% in constant currency) to €?26,529 million (Dec. 31, 2019: €?25,604 million) driven by the closing of two hospital acquisitions in Colombia by Fresenius Helios and execution of the share buy-back program at Fresenius Medical Care as well as currency translation effects.

As of March 31, 2020, the net debt/EBITDA ratio increased to 3.68x1,2 (Dec. 31, 2019: 3.61x1,2) mainly due to the acquisitions made by Fresenius Helios, the share-buy back program at Fresenius Medical Care and negative COVID-19 effects on EBITDA.

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

2 Before special items

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Increased number of employees

As of March 31, 2020, the number of employees was 299,594 (Dec. 31, 2019: 294,134).

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of March 31, 2020, Fresenius Medical Care was treating 348,703 patients in 4,002 dialysis clinics. Along with its core business, the company provides related medical services in the field of Care Coordination.

- 9% revenue increase supported by growth in all regions

- Solid cash-flow development

- Financial targets confirmed

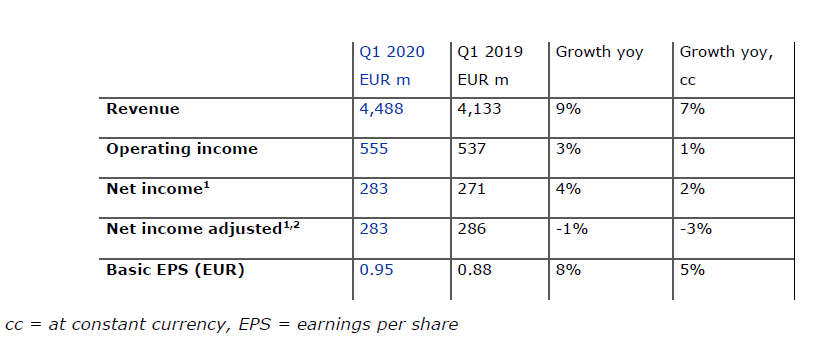

Fresenius Medical Care increased sales by 9% (7% in constant currency) to €4,488 million (Q1/19: €4,133 million). Organic sales growth was 4%. Positive currency translation effects of 2% were mainly related to the U.S. dollar strengthening against the euro.

Reported EBIT increased by 3% (1% in constant currency) to €555 million (Q1/19: €537 million) mainly driven by a favorable impact from higher treatment volume and lower costs for pharmaceuticals. The reported EBIT margin was 12.4% (Q1/19: 13.0%). The decrease in margin was largely due to the unfavorable COVID-19 pandemic effect and the prior year reduction of a contingent consideration liability related to Xenios. EBIT on an adjusted basis was flat (decreased by 3% in constant currency) at €555 million (Q1/19: €557 million). The EBIT margin on an adjusted basis was 12.4% (Q1/19: 13.5%).

1 Q1/19 before special

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Reported net income1 grew by 4% (2% in constant currency) to €283 million (Q1/19: 271 million) and decreased on an adjusted basis by 1% (-3% in constant currency) to €283 million (Q1/19: €286 million).

Operating cash flow was €584 million (Q1/19: €76 million) with a margin of 13.0% (Q1/19: 1.8%). The increase was largely driven by working capital improvement, including a positive effect from cash collections, timing of payments and change in year over year inventory levels.

Fresenius Medical Care’s FY guidance published on February 20, 2020 did not take into account COVID-19 effects. Since it is too early to reliably assess and quantify the positive and negative effects of the COVID-19 pandemic, the Company confirms its 2020 outlook of expected sales2 and net income1,3 growth both within a mid to high single digit percentage range in constant currency. These targets are based on the adjusted results 2019 including the effects of the operations of the NxStage acquisition and the IFRS 16 implementation.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 FY/19 base: €17,477 million

3 FY/19 base: €1,236 million (FY/20: before special items)

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

- Insignificant COVID-19 effect on sales growth, moderate negative effect on EBIT growth

- Anticipated softer demand in China during most of Q1/20 due to fewer elective surgeries followed by gradual resumption towards normal operations late in the quarter

- Increased demand for essential drugs and devices for the treatment of COVID-19 patients in North America and Europe late in Q1/20

- No major interruption at any production site

Fresenius Kabi increased sales by 5% (6% in constant currency) to €1,789 million (Q1/19: €1,701 million). Organic sales growth was 6%. Negative currency translation effects of 1% were mainly related to weakness of the Argentinian peso and the Brazilian real.

Sales in North America increased by 7% (organic growth: 5%) to €669 million (Q1/19: €623 million). Sales in Europe grew by 10% (organic growth: 10%) to €631 million (Q1/19: €573 million). In both regions, sales were driven by a spike of demand for sedation drugs, pain killers and infusion pumps starting late in Q1/20.

Sales in Asia-Pacific decreased by 6% (organic growth: -6%) to €319 million (Q1/19: €341 million). As anticipated, softer demand for clinical nutrition products and IV drugs in China was driven by the COVID-19 related postponement of elective treatments.

Sales in Latin America/Africa increased by 4% (organic growth: 16%) to €170 million (Q1/19: €164 million).

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

EBIT before special items decreased by 5% (-5% in constant currency) to €289 million (Q1/191: €304 million) with an EBIT margin of 16.2% (Q1/191: 17.9%). The COVID-19 pandemic had a moderate net negative effect on EBIT.

Net income1,2 decreased by 2% (-3% in constant currency) to €197 million (Q1/19: €202 million).

Operating cash flow was €174 million (Q1/19: €145 million) with a margin of 9.7% (Q1/19: 8.5%), driven by an improved working capital position.

Since it is too early to reliably assess and quantify the positive and negative effects of the COVID-19 pandemic, Fresenius Kabi maintains its 2020 outlook of expected organic sales3 growth of 3% to 6% and an EBIT4 development of -4% to 0% in constant currency, excluding any effects from COVID-19.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/19 base: €6,919 million

4 FY/19 base: €1,205 million, before special items, FY/20: before special items

For a detailed overview of special items please see the reconciliation tables on pages 17-18 of the PDF document.

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain (Quirónsalud). Helios Germany operates 86 hospitals, ~125 outpatient centers and 7 prevention centers. Quirónsalud operates 46 hospitals, 72 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 6 hospitals and as a provider of medical diagnostics.

- Strong business development in January and February; from March, postponement and cancellation of elective treatments

- Excluding slight negative COVID-19 effect, Q1/20 sales growth moderately above outlook range; significant negative COVID-19 effect on EBIT

- Law to ease financial burden on hospitals to offset large part of COVID-19 related sales losses and cost increases in Germany

- Some remaining uncertainties regarding the compensation of Spanish hospitals for their efforts to combat the COVID-19 pandemic

Fresenius Helios increased sales by 7% (organic growth: 5%) to €2,466 million (Q1/19: €2,311 million).

Sales of Helios Germany increased by 8% (organic growth: 8%) to €1,603 million (Q1/19: €1,485 million). Organic sales growth was positively influenced by pricing effects and admissions growth in January and February. From March, COVID-19 had an insignificant net effect as foregone sales from elective admissions were largely offset by the law to ease the financial burden on hospitals.

Sales of Helios Spain increased by 4% (organic growth: 1%) to €863 million (Q1/19: €826 million) driven by the recent hospital acquisitions in Colombia. COVID-19 related foregone elective surgeries significantly weighed on organic sales growth from March.

EBIT of Fresenius Helios increased by 2% to €274 million (Q1/19: €268 million) with an EBIT margin of 11.1% (Q1/19: 11.6%).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

EBIT of Helios Germany increased by 11% to €165 million (Q1/19: €149 million) with an EBIT margin of 10.3% (Q1/19: 10.0%). EBIT was positively influenced by pricing effects and admissions growth in January and February. From March, COVID-19 had an insignificant net effect as foregone EBIT from elective admissions was largely offset by the law to ease the financial burden on hospitals.

EBIT of Helios Spain decreased by 7% to €112 million (Q1/19: €121 million) with an EBIT margin of 13.0% (Q1/19: 14.6%). January and February showed positive admission growth. From March, COVID-19 had a very significant negative effect on EBIT as foregone elective treatments met higher costs amidst the comprehensive efforts to combat the pandemic.

Net income1 increased by 1% to €176 million (Q1/19: €174 million).

Operating cash flow increased to €145 million (Q1/19: €103 million) with a margin of 5.9% (Q1/19: 4.5%), driven by a good operating performance in both regions.

Since it is too early to reliably assess and quantify the positive and negative effects of the COVID-19 pandemic, Fresenius Helios maintains its 2020 outlook of expected organic sales2 growth of 3% to 6% and EBIT3 growth of 3% to 7% in constant currency, excluding any effects from COVID-19.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 FY/19 base: €9,234 million

3 FY/19 base: €1,025 million

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

- Both project and service business contributing to organic sales growth of 10%

- Slight negative COVID-19 effect on sales, very significant negative effect on EBIT growth

- Post-acute care services impacted by COVID-19 related postponements of elective surgeries and health authority enforced closures of rehabilitation clinics; technical services insignificantly impacted by COVID-19

- Further COVID-19 related delays of project business orders and execution expected throughout 2020

Fresenius Vamed increased sales by 13% to €499 million (Q1/19: €440 million). Organic sales growth was 10%. Acquisitions contributed 3% to growth. Both service and project business showed strong growth momentum. COVID-19 had only a slight negative effect on sales.

Sales in the service business grew by 8% to €357 million (Q1/19: €332 million). Sales of the project business increased by 31% to €142 million (Q1/19: €108 million).

EBIT increased by 17% to €14 million (Q1/19: €12 million) with an EBIT margin of 2.8% (Q1/19: 2.7%). COVID-19 had a very significant negative effect on EBIT growth. Capacities in the post-acute care clinics were left idle given a generally lower intake of elective surgery patients from acute-care hospitals as well as authority-instigated restrictions or even closures of individual facilities.

1 Net income attributable to shareholders of VAMED AG

Net income1 increased by 17% to €7 million (Q1/19: €6 million).

Order intake was €124 million (Q1/19: €383 million). Order intake in the prior year was exceptionally strong. As of March 31, 2020, order backlog was at €2,846 million (December 31, 2019: €2,865 million) and already marked by COVID-19 related project delays.

Operating cash flow decreased to -€20 million (Q1/19: -€15 million) with a margin of

-4.0% (Q1/19: -3.4%), given continuing phasing effects, some delays in the international project business as well as working capital build-ups.

Since it is too early to reliably assess and quantify the positive and negative effects of the COVID-19 pandemic, Fresenius Vamed maintains its 2020 outlook of expected organic sales2 growth of 4% to 7% and EBIT3 growth of 5% to 9% in constant currency, excluding any effects from COVID-19.

1 Net income attributable to shareholders of VAMED AG

2 FY/19 base: €2,206 million

3 FY/19 base: €134 million

Conference Call

As part of the publication of the results for Q1 2020, a conference call will be held on May 6, 2020 at 1:30 p.m. CEDT (7:30 a.m. EDT). All investors are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/investors. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- 9% revenue increase supported by growth in all regions

- Positive earnings growth despite negative impact from COVID-19 pandemic

- Solid cash-flow development

- Financial targets for FY2020 confirmed

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “In these unprecedented times, it is our first and foremost priority to maintain the continuity and high quality of care. For months now, our employees have been working tirelessly to ensure that our patients receive their life-saving dialysis treatments. I cannot thank them enough. We appreciate the financial commitment that the U.S. administration has given in April to support healthcare providers. The strong revenue growth in the first quarter shows that the underlying business development remains intact and that our business model is resilient. In a global pandemic that is redefining priorities in other areas of the healthcare system, dialysis remains essential for millions of patients worldwide.”

Fresenius Medical Care’s contribution in the fight against COVID-19

In order to ensure the continuity and high quality of care for dialysis patients during the COVID-19 pandemic and support its employees around the globe, Fresenius Medical Care has taken wide-ranging measures at a very early stage. The focus is on reducing the risk of infection in dialysis clinics for patients and employees.

Despite countries’ lockdown efforts to contain the COVID-19 pandemic, Fresenius Medical Care did not experience any major disruptions in its manufacturing facilities. As of today, all manufacturing plants worldwide are in operation and supply chains remain intact.

Costs in respect to the COVID-19 pandemic have been incurred for additional measures, like personal protective equipment, dedicated capacities for isolated treatments, additional personnel expense, patient transportation as well as increased distribution logistic costs.

Under the CARES Act (Coronavirus Aid, Relief, and Economic Security Act), the U.S. government initiated significant financial support for the health sector. This is intended, for example, to compensate for the increased costs for healthcare providers as a result of the COVID-19 pandemic and the corresponding protective measures. While Fresenius Medical Care had to adsorb a sizable negative impact in Q1, there is no benefit from the CARES Act included in the reported results.

In the U.S., Fresenius Medical Care is cooperating with other dialysis providers, to create isolation clinics and dedicated shifts for patients who are or may be infected with COVID-19. A critical aim of this collaboration is to keep dialysis patients out of the hospital whenever possible, freeing up limited hospital resources. In doing so, Fresenius Medical Care not only fulfils its responsibility towards patients, employees and families, but also makes an important contribution to the healthcare system and society as a whole.

Key figures (IFRS)

2020 targets confirmed: mid to high single digit growth rates

On the basis of the guidance given in February, which excludes the impact from the COVID-19 pandemic, Fresenius Medical Care expects both revenue and net income to grow at a mid to high single digit rate in 2020. These targets are in constant currency, exclude special items3 and are based on the adjusted results 2019 including the effects of the operations of the NxStage acquisition and the IFRS 16 implementation.

Patients, Clinics and Employees

As of March 31, 2020, Fresenius Medical Care treated 348,703 patients in 4,002 dialysis clinics worldwide. At the end of the first quarter, the Company had 121,403 employees (full-time equivalents) worldwide, compared to 118,308 employees as of March 31, 2019.

Strong revenue growth in the first quarter

Revenue increased by 9% to EUR 4,488 million (+7% at constant currency), with organic growth of 4%. Health Care Services revenue rose by 8% to EUR 3,595 million (+7% at constant currency), driven by growth in same market treatments, contributions from acquisitions and an increase in dialysis days. Health Care Products revenue grew by 10% and amounted to EUR 893 million (+9% at constant currency). This increase was mainly due to higher sales of products for acute care treatments, renal pharmaceuticals and bloodlines partially offset by lower sales of dialysis machines.

Operating income increased by 3% to EUR 555 million (+1% at constant currency), mainly driven by a favorable impact from higher treatment volume and lower costs for pharmaceuticals. The operating income margin amounted to 12.4% (Q1 2019: 13.0%). The decrease in margin was largely due to the unfavorable COVID-19 pandemic effect and the prior year reduction of a contingent consideration liability related to Xenios.

Despite the negative impact from the COVID-19 pandemic net income1 grew by 4% to EUR 283 million (+2% at constant currency) and declined on an adjusted basis by only 1% (-3% at constant currency). On the defined basis of the 2020 targets - excluding the negative impact from the COVID-19 pandemic - net income growth in the first quarter is at the top end of the target range for 2020.

Basic earnings per share (EPS) increased by 8% to EUR 0.95 (+5% at constant currency) driven by the earnings effects described above coupled with a decrease in the average weighted shares outstanding.

Solid cash-flow development

Fresenius Medical Care generated EUR 584 million of operating cash flow (Q1 2019: EUR 76 million) resulting in a margin of 13.0% (Q1 2019: 1.8%). The increase was largely driven by working capital improvement, including a positive effect from cash collections, timing of payments and change in year over year inventory levels.

Free cash flow (net cash used in operating activities, after capital expenditures, before acquisitions and investments) amounted to EUR 304 million (Q1 2019: EUR -123 million), resulting in a margin of 6.8% (Q1 2019: -3.0%).

Regional developments

In North America, revenue increased by 10% to EUR 3,186 million (+7% at constant currency, +3% organic). Operating income grew by 24% to EUR 463 million (+21% at constant currency), resulting in a margin of 14.5 % (Q1 2019: 12.9%). Despite the negative impact from the COVID-19 pandemic, the operating income margin increased mainly due to lower costs for pharmaceuticals and gains from divestitures.

EMEA revenue increased by 4% to EUR 679 million (+4% at constant currency, +3% organic). Operating income decreased by 27% to EUR 101 million (-27% at constant currency), resulting in a margin of 14.9% (Q1 2019: 21.1%). The decrease in operating income margin was mainly due to the prior year reduction of a contingent consideration liability related to Xenios.

In Asia-Pacific, revenue grew by 4% to EUR 443 million (+3% at constant currency, +2% organic). Operating income decreased by 19% to EUR 77 million (-20% at constant currency), resulting in a margin of 17.3 % (Q1 2019: 22.1). The decrease in operating income margin was mainly due to impacts from unfavorable foreign currency transaction effects, lower product sales as well as expansion into in-center dialysis services.

Latin America revenue increased by 4% to EUR 168 million (+24% at constant currency, +17% organic). Operating income decreased by 40% to EUR 7 million (-40% at constant currency), resulting in a margin of 4.1% (Q1 2019: 7.1%). The decrease in operating income margin was mainly due to unfavorable foreign currency impacts.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 For a reconciliation of adjusted figures, please refer to the table at the end of the press release

3 Special items are effects that are unusual in nature and have not been foreseeable or not

foreseeable in size or impact at the time of giving guidance.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the first quarter 2020 on May 6, 2020 at 3:30 p.m. CEDT (UTC +2) / 09:30 a.m. EDT (UTC -4). Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included at the end of this news and to the attachments as separate PDF-files for a complete overview of the results for the first quarter 2020. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. Securities may not be offered or sold in the United States of America (“US”) absent registration under the US Securities Act of 1933, as amended, or an exemption from registration. The securities described on the following pages are not offered for sale in the US or to "US persons" (as defined in Regulation S under the US Securities Act of 1933, as amended).

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE US, CANADA, JAPAN OR AUSTRALIA OR WHO ARE US PERSONS (AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT OF 1933, AS AMENDED), OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of the United States of America, Canada, Japan or Australia or a "US person" (as defined in Regulation S under the US Securities Act of 1933, as amended),

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius today successfully placed bonds with a volume of €750 million. The bonds have a maturity of 7.5 years and an annual coupon of 1.625%. The issue price is 99.021% and the resulting yield amounts to 1.766%.

The proceeds will be used for general corporate purposes, including refinancing of existing financial liabilities.

The bonds were drawn under the Fresenius European Medium Term Note (EMTN) Program and issued by Fresenius SE & Co. KGaA.

Fresenius has applied to the Luxembourg Stock Exchange to admit the bonds to trading on its regulated market.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement is an advertisement and not a prospectus. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus to be issued by the company in connection with the offering of such securities. Copies of the prospectus will, following publication, be available free of charge from Fresenius SE & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement has been prepared on the basis that any offer of securities in any Member State of the European Economic Area (EEA) will be made pursuant to the prospectus prepared by Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company and Fresenius Finance Ireland II Public Limited Company in combination with the relevant final terms relating to such securities or pursuant to an exemption under Regulation (EU) 1129/2017 (the Prospectus Regulation) from the requirement to publish a prospectus for offers of securities. Neither Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company nor Fresenius Finance Ireland II Public Limited Company have authorized, nor do they authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company and Fresenius Finance Ireland II Public Limited Company or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Neither Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company nor Fresenius Finance Ireland II Public Limited Company undertake any responsibility to update the forward-looking statements in this announcement.

Fresenius Medical Care, the world’s leading provider of dialysis products and services, postpones its 2020 Annual General Meeting, which was scheduled for May 19, to a later date this year due to the coronavirus pandemic. The resolutions regarding the allocation of the distributable profit and the payout of the dividend will be postponed accordingly.

As soon as conditions allow again for a reliable planning and safe implementation of the Annual General Meeting, Fresenius Medical Care will announce the new date.

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “The decision to postpone our Annual General Meeting was not an easy one for us to take. But the protection and health of our shareholders and employees is very important to us. In light of this exceptional situation, a postponement is the only sensible option.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

- New date will be specified and communicated as soon as reliable planning is possible

- Health and safety of shareholders and employees is our priority

Due to the coronavirus pandemic, Fresenius SE & Co. KGaA postpones its Annual General Meeting scheduled for 20 May 2020 to a later date within the current financial year. As one of the consequences, this will lead to a postponement of the resolutions regarding the appropriation of net income 2019 and the payout of the dividend. The Company will set and communicate a new date as soon as the conditions for reliable planning and safe execution of the Annual General Meeting are once again in place.

“At present, the primary task is to slow down the spread of the coronavirus and thus to contain it as far as possible. With this decision, we are also supporting this common goal. The health and safety of our shareholders and employees have highest priority,” said Stephan Sturm, CEO of Fresenius.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

- Helios Germany is increasing number of intensive care beds by two thirds

- Law to ease financial burden on hospitals likely to offset large part of sales losses and cost increases

- Digital healthcare offerings facilitate continuous medical care for chronically ill and rehabilitation patients

Helios Germany, Germany’s largest private hospital operator and part of the Fresenius Group, is undertaking comprehensive measures to combat the COVID-19 pandemic. In accordance with the German government’s request, surgical procedures are being delayed whenever medically justifiable. The freed-up capacity is reserved for the imminent treatment of COVID-19 patients. Postponed operations should be performed later this year and next. In parallel, Helios Germany will increase the number of ICU beds in its network by two-thirds, from 900 to more than 1,500. This will be accomplished by deploying centrally held equipment reserves across its network as well as by selectively upgrading intermediate care beds and converting operation theatres with already installed ventilator systems.

In order to utilize the incremental capacity most effectively, Helios Germany has selectively adjusted shift models and is prepared to deploy specialist staff across its network to hospitals with particular needs.

Helios Germany is closely monitoring its inventories of important hospital supplies – including disinfectants and protective clothing – and building additional reserves.

Stephan Sturm, CEO of Fresenius, said: “Society is facing very challenging weeks and months ahead. Commitment, sound judgement and close cooperation will all be needed to contain the spread of the coronavirus. At the same time, the best possible care must be provided to patients. Our deepest thanks go to doctors, nurses and care personnel, whether they work at Fresenius or elsewhere: They are needed more than ever, and show tremendous dedication day after day. As a healthcare Group we have a special responsibility in this situation. We must, and we will, meet this responsibility.”

To ease the financial burden on the country’s hospitals during the COVID-19 pandemic, Germany’s Federal Ministry of Health submitted earlier this week a draft law, which was passed by the Bundestag on Wednesday. Among its key provisions:

- Compensation payment of €560 per foregone treatment day compared to 2019.

- Reimbursement of care costs with a flat-rate payment of at least €185 per treatment day.

- Reimbursement of increased costs for protective clothing and other supplies with a flat-rate payment of €50 per patient.

- Public health insurers will settle all treatment invoices in 2020 within five days.

- Significant reduction of health insurers’ (MDK) audit quota and abolition of minimum fines for this year and 2021.

- Co-investment of €50,000 for each new intensive care bed; costs above this amount may be reimbursed by individual state governments.

Fresenius Helios generally welcomes these measures. Assuming the pandemic substantially subsides by the summer, management currently estimates that the financial impact on Helios Germany in 2020, although negative, will not be very significant.

Dr. Francesco De Meo, CEO of Fresenius Helios, said: “It is our approach to combine ethically responsible care for our patients with a high degree of efficiency. To this end, we have invested heavily in our clinics, in our medical technology and also in strengthening our staff in recent years. This is paying off now. The close networking of our hospitals gives us the necessary flexibility to deploy personnel and materials exactly where patients need them most. And we gain insights very swiftly by sharing experiences with our colleagues, through the European exchange that is embedded in Fresenius‘ global network. We are therefore ideally positioned in the joint fight against COVID-19.”

Fresenius is committed to the care of patients with a high infection risk. Given the current treatment restrictions and infection risks, there are significant challenges for the chronically ill to visit local medical practices and get the treatment and support they need. Particularly for these patients, digital healthcare offerings can be a suitable alternative. Following its acquisition of Digitale Gesundheitsgruppe, Fresenius’ subsidiary Curalie now offers an even wider range of digital healthcare services for patients with chronic illnesses such as diabetes, kidney disease and heart disease, through to rehabilitation patients in orthopedic aftercare. For the duration of the current COVID-19 pandemic, Curalie will make its digital healthcare services available free of charge. Thus, Fresenius and Curalie are helping to ensure continuous medical care to these vulnerable patients.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

With virtually all of Fresenius Kabi’s manufacturing staff in China returning to work post government-imposed COVID-19 quarantine restrictions, the company is ramping-up production back to normal levels. With a further stabilization of the situation, Fresenius Kabi also expects a gradual resumption of its sales force activities in China. Even though Fresenius Kabi faced challenges due to the COVID-19 pandemic and the quarantine measures, there was no major interruption of production. Thus, the company can supply the Chinese population with essential pharmaceuticals and medical devices.

- All Quirónsalud hospitals are fully operational and managed by Quirónsalud in close coordination with the health authorities

- Rumors about a “nationalization” are without any basis

Quirónsalud, the largest private hospital group in Spain and part of Fresenius Helios, is fully committed to supporting the national effort against COVID-19 with all available resources. Since the start of the crisis, Quirónsalud has worked in close and trustful cooperation with national and regional healthcare authorities to provide the best possible treatment to the greatest possible number of patients.

Quirónsalud’s network currently comprises about 400 ICU beds for adults in almost 50 hospitals across Spain. The company is undertaking significant efforts to further increase this number in the short term, while continuing to treat other patients who urgently need medical support such as for chemotherapy, giving birth, and other emergencies.

Despite the high number of suspected and confirmed COVID-19 cases entering Quirónsalud’s hospitals, the company has kept every hospital fully operational. This is to a large extent due to the outstanding commitment of Quirónsalud’s medical and nursing staff, who deserve the utmost recognition and gratitude. So far, Quirónsalud has also been able to secure sufficient quantities of medical materials for all its hospitals, despite rapidly rising demand for critical supplies.

In the course of the formal declaration of a ‘State of Alarm’, the Spanish government has temporarily obtained the right to direct all hospitals in the country, allowing the healthcare authorities to leverage all available resources to treat COVID-19 patients as effectively as possible. Such an option is embedded in the established crisis management plans of many other European countries as well. Quirónsalud fully supports this measure, as it allows centralized capacity management, and hence rapid responses to changing circumstances and a full dedication of the entire system to fight the coronavirus.

Rumors about a “nationalization” of Spain’s private hospital system are clearly wrong and without any basis. Quirónsalud continues to manage its hospitals, and is already operating the additional beds requested by the authorities, in the joint effort against the COVID-19 threat for the benefit of Spain and the broader society.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Pagination

- Previous page

- Page 18

- Next page