Fresenius has successfully signed a €2 billion syndicated revolving credit facility with an international consortium of 29 core relationship banks. It has a maturity of five years with two one-year extension options and can be drawn in various currencies.

The new credit facility replaces the existing €1.1 billion and US$500 million revolving credit facilities, originally entered into in 2012 and amended from time to time. It is intended to serve as a backup line for general corporate purposes. The increased volume will further strengthen Fresenius’ liquidity profile and increase the company’s financial flexibility.

A key component of the new credit facility is the link to sustainability: Emphasizing Fresenius’ commitment to embed sustainability in all aspects of its business, the credit facility’s margin will be adjusted up or down according to changes in Fresenius’ sustainability performance. This is Fresenius’ first sustainability-linked financial transaction, demonstrating the increasing importance of sustainable financing.

Rachel Empey, Chief Financial Officer of Fresenius, said: “Sustainability is deeply rooted in our thinking and actions, at all levels. That is why it is important to us to take sustainability into account in our financing strategy. At the same time, with this credit facility we have increased our financial flexibility and further optimized our financing structure. In this way we are supporting investments in future growth and securing the company’s long-term success.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, has successfully signed a new syndicated revolving credit facility with a group of 34 core relationship banks. It has a volume of EUR 2 billion with a term of five years plus two one-year extension options (“5+1+1” years) and can be drawn in different currencies.

The new credit facility replaces the existing USD 900 million and EUR 600 million revolving credit facilities, initially signed in 2012 and amended from time to time, and will serve as a backup line for general corporate purposes. The increased volume will further strengthen Fresenius Medical Care’s liquidity profile and enhance the company’s financial flexibility.

Supporting the company’s commitment to create value in ecological, social and economic terms, a sustainability component has been embedded in the credit facility. Based on this structure, the credit facility’s margin will rise or fall depending on the company's sustainability performance. This is Fresenius Medical Care’s first sustainability-linked financing instrument.

Helen Giza, Chief Financial Officer of Fresenius Medical Care, said: “With the refinancing of the credit agreement we have further optimized our financing structure. The new facility improves Fresenius Medical Care’s liquidity profile and gives us greater financial flexibility for our long-term growth strategy. It also extends our focus on sustainability to our financing instruments. By linking the new credit agreement to our sustainability efforts, we are underlining our integrated approach to sustainability throughout all aspects of the business.”

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care has joined econsense, a network of German companies joined in the goal of shaping the transformation to a sustainable economy and society. The dialogue and cross-industry exchange of practical expertise within econsense, which now counts 40 major companies as members, will support Fresenius Medical Care’s sustainability management. Sustainability is an integral part of Fresenius Medical Care’s mission and vision and is also reflected in the corporate strategy. For the company, successful sustainability management means creating long-term economic, ecological and social value in order to provide patients with high-quality products and services while minimizing the impact of our activities on the environment.

The healthcare group Fresenius remains on course for growth despite continuing burdens caused by the COVID-19 pandemic. This was confirmed by Stephan Sturm, CEO of Fresenius, at today’s Annual General Meeting: “We have a challenging year behind us, and the challenges persist,” Sturm said in his speech. “Although the coronavirus burdened our business, we still performed well for the year and reached our targets. We launched initiatives to become more efficient and profitable, and we have set down a plan for accelerated growth through 2023.”

The measures are targeted to result in cost savings of at least €100 million annually after tax and minority interest in 2023, with some further potential to increase thereafter. Sturm said: “I have great confidence in our strategy. Our future continues to look good. We will be needed. We will provide ever more people with ever better medicine. We will again grow dynamically in the coming years. And by doing this we will make Fresenius even more valuable.”

Today’s Annual General Meeting was the last one presided over by Dr. Gerd Krick, the long-serving Chairman of the Supervisory Board. He announced in October that, after 46 years in the service of Fresenius, he would not seek re-election to the Supervisory Board. Michael Diekmann, Deputy Chairman of the Supervisory Board, praised Krick’s key role in the successful development of Fresenius as a Member of the Management Board, CEO and then Chairman of the Supervisory Board.

“You shaped and influenced Fresenius like no one else, and Fresenius owes you thanks,” said Diekmann. “There are not many entrepreneurs who can built a medium-sized enterprise into a global company, active around the world. But you succeeded in doing just that. Along with vision and strategic foresight, that required iron discipline, passion and the courage to take big decisions and then consistently implement them.”

Krick’s successor is the former CEO of DZ Bank, Wolfgang Kirsch, who became a member of the Supervisory Board of Fresenius Management SE on January 1, 2020. The shareholders elected Kirsch as a new member of the Supervisory Board of Fresenius SE & Co. KGaA with a 98.52 percent majority. In its constituent meeting immediately following the Annual General Meeting, the new Supervisory Board elected him as Chairman and appointed Dr. Gerd Krick as Honorary Chairman. The five additional shareholder representatives were all re-elected to another term.

Shareholders approved with a large majority of 99.61 percent the 28th consecutive dividend increase proposed by the General Partner and the Supervisory Board. The dividend was raised by 5 percent, to €0.88 per share.

Also with a large majority, of 92.23 percent, shareholders passed a new compensation system for the Management Board. In addition to key financial indicators, it will take into account sustainability targets relating to environmental, social and governance aspects.

Shareholder majorities of 99.28 and 91.34 percent, respectively, approved the actions of the Management and Supervisory Boards in 2020.

At the Annual General Meeting of Fresenius SE & Co. KGaA, 72.76 percent of the subscribed capital was represented. Due to the pandemic, the meeting was held exclusively over the Internet in order to protect the health of all participants.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world's leading provider of products and services for individuals with renal diseases, expects continued challenges due to the ongoing COVID-19 pandemic yet remains confident about the future. At today’s Annual General Meeting, Chief Executive Officer Rice Powell confirmed the company’s targets for 2025: In the coming five years the company expects compounded annual growth rates in the mid-single-digit percentage range for revenue and in the high-single-digit percentage range for net income.

In his speech to shareholders, Powell outlined the FME25 program to increase profitability, which was announced in February: “In a rapidly changing environment, I believe that it is crucial for us as a company to become more agile, more capable of adapting faster. As CEO of Fresenius Medical Care, this is my responsibility towards our patients and employees. We intend to achieve this by transforming and adapting our operating model. I am looking forward to helping to shape this change and create an even better future for Fresenius Medical Care and its patients.”

The company, which is celebrating its 25th anniversary this year, operates the leading and largest dialysis network worldwide. Powell emphasized: “We will not rest in our efforts to provide ever better services for our patients, payors and health care systems. A new leap in renal care is imminent – and with our innovative and dedicated team of more than 125,000 employees, Fresenius Medical Care is at the forefront of progress.”

A large shareholder majority of 99.27 percent approved the company’s 24th consecutive dividend increase. The dividend will be raised by 12 percent, from €1.20 to €1.34 per share.

Shareholders also approved by large majorities the proposals for the regular elections to the Supervisory Board: Dr. Dieter Schenk, Rolf A. Classon, Dr. Dorothea Wenzel, Pascale Witz and Prof. Dr. Gregor Zünd were re-elected, while Gregory Sorensen, CEO of DeepHealth, Inc., is replacing William P. Johnston, who is leaving the board for age reasons.

Shareholder majorities of 99.69 and 95.64 percent, respectively, approved the actions of the General Partner and the Supervisory Board in 2020.

At the Annual General Meeting, 81.50 percent of the registered capital was represented. Because of the pandemic, the meeting was held as a purely virtual event in order to protect the health of everyone involved.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, has agreed to issue bonds with an aggregate principal amount of USD 1.5 billion across two tranches:

- USD 850 million bonds with a maturity in December 2026 and an annual coupon of 1.875% and

- USD 650 million bonds with a maturity in December 2031 and an annual coupon of 3.000%.

The proceeds will be used for general corporate purposes, including the refinancing of outstanding indebtedness.

The expected settlement date is May 18, 2021.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent such registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The securities are being offered only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and outside the United States, only to certain non-U.S. investors pursuant to Regulation S. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement has been prepared on the basis that any offer of bonds in any Member State of the European Economic Area (each, a Member State) will only be made pursuant to an exemption under Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”), from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution only to persons who (i) are outside the United Kingdom; (ii) who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), (iii) are high net worth entities falling within article 49(2)(a) to (d) of the Order; or (iv) other persons to whom it may otherwise be lawfully communicated (all such persons together being referred to as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement has been prepared on the basis that any offer of bonds in the United Kingdom will only be made pursuant to an exemption under Section 86 of the Financial Services and Markets Act 2000 from the requirement to publish a prospectus for offers of securities. Fresenius Medical Care has not authorized, nor does it authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius Medical Care or any other person to publish or supplement a prospectus for such offer.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. impacts of COVID-19, changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius Medical Care does not undertake any responsibility to update the forward-looking statements in this announcement.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. The information in this announcement is subject to change.

- Organic treatment growth impacted by COVID-19 pandemic as expected

- Reported revenue and earnings continued to be adversely affected by exchange rate effects

- Earnings development supported by phasing and expected lower SG&A expense anticipated to reverse throughout the year

- Vaccination of patients accelerated to 51 percent globally

- Financial targets for FY 2021 confirmed

Rice Powell, Chief Executive Officer of Fresenius Medical Care, said: “The COVID-19 pandemic continues to plague our societies and especially our vulnerable patients. We are very grateful that we are increasingly allowed to directly vaccinate our dialysis patients in our clinics. By doing so, we can support healthcare systems, contribute to saving lives and overcoming this health crisis as fast as possible. While we have seen significant progress in the roll-out and adoption of vaccinations globally, COVID-19 infection rates in several countries remain high. This will, unfortunately, continue to affect many of our patients. Consequently, this will also continue to impact our organic growth and weigh on our earnings development throughout the year. As the underlying development in the first three months was in line with our expectations, we confirm our guidance for the full year 2021.”

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

COVID-19 impact on organic growth continues to accumulate as expected

The adverse COVID-19 impact on organic growth in the Health Care Services business amounted to around 350 basis points in the first quarter. While monthly excess mortality continuously declined since February, it is expected to further accumulate and peak in the second quarter.

Besides Fresenius Medical Care’s comprehensive measures to reduce infection risks and maintain safe operations in its dialysis centers, vaccinations are crucial for containing the COVID-19 pandemic. In several countries, Fresenius Medical Care has made its dialysis clinics available for the direct vaccination of patients and, where requested, the general public. At the end of March, the U.S. government agreed to directly allocate COVID-19 vaccine to dialysis centers nationwide. At Fresenius Medical Care’s U.S. facilities, more than 64% of patients and 47% of dialysis center staff have been at least partially vaccinated. The Company is making further progress every day. On a global basis, about 51 percent of Fresenius Medical Care’s patients have received at least one vaccination.

Outlook

Fresenius Medical Care confirms its outlook for FY 2021 as outlined on February 23, 2021. The Company expects revenue to grow at a low- to mid-single digit percentage rate and net income to decline at a high-teens to mid-twenties percentage rate against the 2020 base.2

2 These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of EUR 195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

The Company continues to monitor closely the latest COVID-19-related developments in respect to additional variants of the virus and potential surges in different regions.

Fresenius Medical Care will experience an adverse earnings effect due to the U.S. government delaying the CKCC models (Comprehensive Kidney Care Contracting) by nine months to January 1, 2022. This effect will be offset by the further extension of the U.S. Medicare sequestration relief from April 1, 2021 until the end of 2021.

To support its 2025 strategy, further strengthen profitability and compensate for the negative earnings effects of the COVID-19 pandemic, Fresenius Medical Care has initiated the FME25 program. The Company is currently undergoing a detailed review of its global operating model and will provide an update in the second half of 2021.

Driving value-based care

Fresenius Medical Care aims to build sustainable partnerships with payors to support the transition from a fee-for-service to a pay-for-performance healthcare system. This applies equally to reimbursement models of commercial and public insurers. In the U.S., Fresenius Medical Care recently extended its value-based arrangement with Aetna, Inc., a provider of health insurance and related services and subsidiary of CVS Health Corporation, to include patients enrolled in Medicare Advantage. In late 2020, Fresenius Medical Care expanded its cooperation with health insurer Humana and thereby implemented the existing clinical network contract as a value-based payment model.

Revenue and earnings impacted by COVID-19 and exchange rate effects

Revenue declined by 6% to EUR 4,210 million (+1% at constant currency). Organic growth amounted to 1%.

Health Care Services revenue decreased by 7% to EUR 3,325 million (+1% at constant currency, +1% organic). The decline was mainly due to a negative exchange rate effect, the absence of a prior-year partial reversal of a revenue recognition adjustment, the impact from COVID-19 and lower reimbursement for calcimimetics.

Health Care Products revenue declined by 1% to EUR 885 million (+4% at constant currency, +5% organic). Headwinds from exchange rates and lower sales of acute care products as well as in-center disposables were partially offset by higher sales of machines for chronic treatment, peritoneal dialysis products and home hemodialysis products.

Operating income decreased by 15% to EUR 474 million (-8% at constant currency), resulting in a margin of 11.3% (Q1 2020: 12.4%). The decrease was mainly driven by effects from COVID-19 across all regions, higher personnel expenses and a significant negative exchange rate effect. In addition, operating income was negatively affected by a positive prior-year effect from the divestiture of cardiovascular clinics and a prior-year partial reversal of a revenue recognition adjustment. These negative effects were partially offset by an improved payor mix, mainly driven by Medicare Advantage, and expected lower SG&A expense, which are anticipated to reverse in the remainder of the year.

Net income1 declined by 12% to EUR 249 million (-6% at constant currency). Besides the above-mentioned operating earnings effects, net income was supported by a 27% decrease of net interest expense to EUR 76 million (Q1 2020: EUR 104 million).

The first quarter 2020 included negative COVID-19 effects that reversed in Q2 2020, including the compensation received under the CARES Act, and therewith increase the base for the second quarter 2021. These base effects impact the phasing of net income growth in 2021.

Basic earnings per share (EPS) decreased by 10% to EUR 0.85 (-4% at constant currency). The decline as a result of the above-mentioned earnings effects was partially offset by a decrease in the average weighted number of shares outstanding due to the redemption of shares following the completed share buyback program.

Cash flow development

Fresenius Medical Care generated EUR 208 million of operating cash flow (Q1 2020: EUR 584 million), resulting in a margin of 4.9% (Q1 2020: 13.0%). The decline was driven by the seasonality in invoicing and periodic delays in payment of public health care organizations.

Free cash flow3 amounted to EUR 29 million (Q1 2020: EUR 304 million), resulting in a margin of 0.7% (Q1 2020: 6.8%).

3 Net cash used in operating activities, after capital expenditures, before acquisitions, investments and dividends

Regional developments

In North America, revenue declined by 9% to EUR 2,899 million (-1% at constant currency, -1% organic). Besides a sizable negative exchange rate effect, this was mainly due to a substantial negative impact of COVID-19 on the Services business and lower reimbursement for calcimimetics.

Operating income in North America declined by 14% to EUR 399 million (-6% at constant currency), resulting in a margin of 13.7% (Q1 2020: 14.5%). The decrease was mainly due to the effects of COVID-19, higher personnel expense, headwinds from exchange rates, a positive prior-year effect from the divestiture of cardiovascular clinics, a prior-year partial reversal of a revenue recognition adjustment and a lower contribution from calcimimetics. This was mitigated by an improved payor mix, mainly driven by an increased Medicare Advantage share, contributions from acquisitions and lower SG&A expense due to favorable phasing.

Revenue in EMEA decreased by 1% and amounted to EUR 670 million (+1% at constant currency, +1% organic). This was mainly driven by the unfavorable effects of COVID-19 and negative exchange rate effects.

Operating income in the EMEA region declined by 21% to EUR 80 million (-21% at constant currency), resulting in a margin of 11.9% (Q1 2020: 14.9%). The prior-year base benefitted from the revaluation of an investment. In addition, the decline was mainly driven by an unfavorable country mix in the Products business, a decrease in dialysis days as well as higher cost for personnel and supplies in certain countries. This was partially offset by lower bad debt expense.

In Asia-Pacific, revenue increased by 6% to EUR 471 million (+10% at constant currency, +11% organic), mainly due to organic growth in the Services and Product businesses as well as contributions from acquisitions. This was partially offset by the effect of clinics closed or sold in the prior year.

Operating income grew by 11% to EUR 85 million (+14% at constant currency), resulting in a margin of 18.1% (Q1 2020: 17.3%). The prior-year base benefited from a gain from the deconsolidation of clinics. The increase was mainly driven by business growth and a favorable impact from manufacturing.

Including a very significant headwind from exchange rates and a negative effect from COVID-19, Latin America revenue decreased by 5% to EUR 159 million (+17% at constant currency, +15% organic). Operating income in Latin America declined by 3% to EUR 7 million (+3% at constant currency), resulting in a margin of 4.2% (Q1: 2020: 4.1%).

Patients, Clinics and Employees

As of March 31, 2021, Fresenius Medical Care treated 344,476 patients in 4,110 dialysis clinics worldwide. At the end of the first quarter, the Company had 124,995 employees (full-time equivalents) worldwide, compared to 121,403 employees as of March 31, 2020.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the first quarter of 2021 on May 6, 2021 at 3:30 p.m. CET / 9:30 a.m. ET. Details will be available on the company’s website www.freseniusmedicalcare.com in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included in the PDF-file for a complete overview of the results of the first quarter of 2021. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

-

Guidance for 2021 confirmed

-

Fresenius Medical Care delivers solid first quarter

-

Fresenius Kabi shows strong performance in Emerging Markets whilst headwinds continue to impact North American business

-

Helios Germany continues to be compensated by government for foregone elective treatments; Helios Spain delivers significant sales and earnings growth given recovery of treatment activity

-

Fresenius Vamed continues to suffer from COVID-19 related project delays; technical high-end service business remains robust

-

Preparation of Group-wide initiatives to improve efficiency and profitability progressing

If no timeframe is specified, information refers to Q1/2021.

In Q1/2021 no special items incurred.

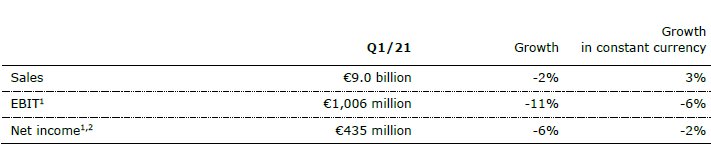

1Before special items

2Net income attributable to shareholders of Fresenius SE & Co. KGaA

Stephan Sturm, CEO of Fresenius, said: “In view of the adversity and uncertainties that COVID-19 continues to bring, we are satisfied with our start in 2021. We achieved continued organic growth, although the pandemic had a lesser impact on the prior-year quarter. That makes me optimistic that we can reach our targets. The progress being made with vaccinations worldwide is another reason for confidence, even though it is too early to sound the all-clear. In the coming months, we will still be dealing with the pandemic’s many and wide-ranging effects. As before, we will do this with full responsibility for the patients entrusted to us. At the same time, we are moving ahead with our planning for cost and efficiency measures. These measures will create a strong foundation for accelerated and sustainable growth against the backdrop of long-term growth trends supporting our core businesses. Growth that contributes to ever better medicine for ever more people.”

COVID-19 assumptions for guidance FY/21

Q1/21 was characterized by a regionally varying development of the COVID-19 pandemic. Given continued high infection numbers as well as an increasing number of virus mutations, large-scale constraints of public and private life have been re-enacted in various countries. Vaccination programs are progressing worldwide at, however, varying pace.

COVID-19 will continue to impact Fresenius’ operations in 2021. Current burdens and constraints caused by COVID-19 are expected to recede only in H2/21. The expected improvement in the Group’s relevant business environment from H2/21 is heavily dependent on continuously increasing levels of vaccination coverage in Fresenius’ relevant markets. These assumptions are subject to considerable uncertainty.

A deterioration of the situation requiring further containment measures in one or more of Fresenius’ major markets, although becoming somewhat less likely does remain a risk. Any resulting significant and direct impact on the health care sector without any appropriate compensation is not reflected in the Group’s FY/21 guidance.

FY/21 Group guidance confirmed

For FY/21, Fresenius continues to project sales growth1 in a low-to-mid single-digit percentage range and at least broadly stable net income2,3 year-over-year, both in constant currency. Implicitly, net income2 for the Group excluding Fresenius Medical Care is expected to grow in a mid-to-high single-digit percentage range in constant currency.

Fresenius projects net debt/EBITDA4 to be around the top-end of the self-imposed target corridor of 3.0x to 3.5x by the end of FY/21.

To sustainably enhance profitability, Fresenius is preparing group-wide strategic efficiency initiatives. These initiatives are expected to consist of operational excellence and cost-saving measures, targeted strengthening of future growth areas and portfolio optimizations. They are targeted to result in cost savings of at least €100 million p.a. after tax and minority interest in 2023 with some further potential to increase thereafter. Achieving these sustainable efficiencies will require significant up-front expenses. On average for the years 2021 to 2023, those expenses are expected to be in the order of magnitude of €100 million p.a. after tax and minority interest. They will be classified as special items.

1 FY/20 base: €36,277 million

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/20 base: €1,796 million, before special items; FY/21: before special items

4 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures; excluding further potential acquisitions; before special items

For a detailed overview of special items please see the reconciliation table in the PDF document.

3% sales increase in constant currency

Group sales decreased by 2% (increased by 3% in constant currency) to €8,984 million (Q1/20: €9,135 million). Organic growth was 2%. Acquisitions/divestitures contributed net 1% to growth. Currency translation reduced sales growth by 5%. Excluding estimated COVID-19 effects1, Group sales growth would have been 4% to 5% in constant currency (Q1/20: 7% to 8%).

2% net income2,3 decrease in constant currency

Group EBITDA before special items and reported Group EBITDA decreased by 7% (-2% in constant currency) to €1,628 million (Q1/20: €1,755 million).

Group EBIT before special items and reported Group EBIT decreased by 11% (-6% in constant currency) to €1,006 million (Q1/20: €1,125 million). The constant currency decrease is primarily due to COVID-19 related headwinds. Both the EBIT margin before special items and the reported EBIT margin were 11.2% (Q1/20: 12.3%).

Group net interest before special items improved to -€137 million (Q1/202: -€174 million) mainly due to successful refinancing activities, lower interest rates as well as currency translation effects. Reported Group net interest also improved to -€137 million (Q1/20: -€182 million).

Both the Group tax rate before special items and the reported tax rate were 22.8% (Q1/20: 22.6%).

Both Noncontrolling interests before special items and reported noncontrolling interests were -€236 million (Q1/20: -€271 million) of which 95% were attributable to the noncontrolling interests in Fresenius Medical Care.

1 For estimated COVID-19 effects in Q1/21 and Q1/20 please see table in the PDF document.

2 Before special items

3 Net income attributable to shareholders of Fresenius SE & Co. KGaA

For a detailed overview of special items please see the reconciliation table in the PDF document.

Group net income1 before special items decreased by 6% (-2% in constant currency) to €435 million (Q1/202: €465 million). The absolute negative COVID-19 effect was more pronounced in Q1/21 compared to the prior-year quarter. Excluding estimated COVID-19 effects3, Group net income1 before special items would have grown 0% to 4% in constant currency (Q1/20: 6% to 10%). Reported Group net income1 decreased to €435 million (Q1/20: €459 million).

Earnings per share1 before special items decreased by 6% (-2% in constant currency) to €0.78 (Q1/202: €0.83). Reported earnings per share1 were also €0.78 (Q1/20: €0.82).

Continued investment in growth

Spending on property, plant and equipment was €384 million corresponding to 4% of sales (Q1/20: €547 million; 6% of sales). These investments served primarily for the modernization and expansion of dialysis clinics, production facilities as well as hospitals and day clinics.

Total acquisition spending was €149 million (Q1/20: €412 million), mainly for the acquisition of dialysis clinics at Fresenius Medical Care.

Cash flow development

Group operating cash flow decreased to €652 million (Q1/20: €878 million) with a margin of 7.3% (Q1/20: 9.6%), driven by a seasonal fluctuation in Fresenius Medical Care's invoicing and working capital movements in North America. Free cash flow before acquisitions and dividends decreased to €241 million (Q1/20: €305 million). Free cash flow after acquisitions and dividends increased to €117 million (Q1/20: -€40 million).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 Before special items

3 For estimated COVID-19 effects in Q1/21 and Q1/20 please see table in the PDF document.

For a detailed overview of special items please see the reconciliation table in the PDF document.

Solid balance sheet structure

Group total assets increased by 3% (1% in constant currency) to €68,966 million (Dec. 31, 2020: €66,646 million) given currency translation effects and the expansion of business activities. Current assets increased by 6% (4% in constant currency) to €16,693 million (Dec. 31, 2020: €15,772 million), mainly driven by the increase of trade accounts receivables. Non-current assets increased by 3% (0% in constant currency) to €52,273 million (Dec. 31, 2020: €50,874 million).

Total shareholders’ equity increased by 6% (3% in constant currency) to €27,514 million (Dec. 31, 2020: €26,023 million). The equity ratio was 39.9% (Dec. 31, 2020: 39.0%).

Group debt increased by 2% (1% in constant currency) to €26,508 million (Dec. 31, 2020: € 25,913 million). Group net debt increased by 2% (1% in constant currency) to € 24,631 million (Dec. 31, 2020: € 24,076 million).

As of March 31, 2021, the net debt/EBITDA ratio increased to 3.52x1,2 (Dec. 31, 2020: 3.44x1,2) driven by COVID-19 effects weighing on EBITDA as well as increased net debt.

Number of employees

As of March 31, 2021, the Fresenius Group had 310,842 employees worldwide (December 31, 2020: 311,269).

1 At LTM average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures

2 Before special items

For a detailed overview of special items please see the reconciliation table in the PDF document.

Business Segments

Fresenius Medical Care (Financial data according to Fresenius Medical Care press release)

Fresenius Medical Care is the world's largest provider of products and services for individuals with renal diseases. As of March 31, 2021, Fresenius Medical Care was treating 344,476 patients in 4,110 dialysis clinics. Along with its core business, the Renal Care Continuum, the company focuses on expanding in complementary areas and in the field of critical care.

• Organic treatment growth impacted by COVID-19 pandemic as expected

• Reported revenue and earnings continued to be adversely affected by exchange rate effects

• Earnings development supported by phasing and expected lower SG&A expense anticipated to reverse throughout the year

• Financial targets for FY 2021 confirmed

Sales of Fresenius Medical Care decreased by 6% (increased by 1% in constant currency) to €4,210 million (Q1/20: €4,488 million). Thus, currency translation had a negative effect of 7%. Organic growth was 1%.

EBIT decreased by 15% (-8% in constant currency) to €474 million (Q1/20: €555 million) resulting in a margin of 11.3% (Q1/20: 12.4%). The decrease was mainly driven by effects from COVID-19 across all regions, higher personnel expenses and a significant negative exchange rate effect. Additionally, EBIT was negatively affected by a positive prior-year effect from the divestiture of cardiovascular clinics and a prior-year partial reversal of a revenue recognition adjustment. These negative effects were partially offset by an improved payor mix mainly driven by Medicare Advantage and expected lower SG&A expenses, which are anticipated to reverse in the remainder of the year.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

Net income1 decreased by 12% (-6% in constant currency) to €249 million (Q1/20: €283 million). Besides the above-mentioned operating earnings effects, net income was supported by a 27% decrease of net interest expense to €76 million (Q1/20: €104 million).

The first quarter 2020 included negative COVID-19 effects that reversed in Q2 2020, including the compensation received under the CARES Act, and therewith increase the base for the second quarter 2021. These base effects impact the phasing of net income growth in 2021.

Operating cash flow was €208 million (Q1/20: €584 million) with a margin of 4.9% (Q1/20: 13.0%). The decline was driven by the seasonality in invoicing and periodic delays in payment of public health care organizations.

For FY/21, Fresenius Medical Care confirms its outlook as outlined on February 23, 2021. The Company expects revenue2 to grow at a low-to-mid single-digit percentage range and net income1,3 to decline at a high-teens to mid-twenties percentage range against the 2020 base4.

For further information, please see Fresenius Medical Care’s press release at www.freseniusmedicalcare.com.

1 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2 FY/20 base: €17,859 million

3 FY/20 base: €1,359 million, before special items; FY/21: before special items

4 These targets are based on the 2020 results excluding the impairment of goodwill and trade names in the Latin America Segment of €195 million. They are inclusive of anticipated COVID-19 effects, in constant currency and exclude special items. Special items include costs related to FME25 and other effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance.

Fresenius Kabi

Fresenius Kabi offers intravenously administered generic drugs, clinical nutrition and infusion therapies for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products. In the biosimilars business, Fresenius Kabi develops products with a focus on oncology and autoimmune diseases.

• North America performance impacted by COVID-19 and temporary manufacturing issues

• Solid performance in Europe masked by prior-year COVID-19 related demand spike

• Emerging Markets showed strong sales and earnings growth; China with excellent performance given dynamic recovery of elective treatment activity

Sales decreased by 2% (increased by 4% in constant currency) to €1,761 million (Q1/20: €1,789 million). Organic growth was 3%. Negative currency translation effects of 6% were mainly related to weakness of the US dollar, the Brazilian real and the Argentinian peso.

Sales in North America decreased by 17% (organic growth: -9%) to €558 million (Q1/20: €669 million). The decrease was driven by fewer elective treatments, competitive pressure, missing sales from a customer in Chapter 11 as well as temporary manufacturing issues which outweighed extra demand for COVID-19 related products.

Sales in Europe decreased by 1% (organic growth: -1%) to €626 million (Q1/20: €631 million) mainly related to the strong demand for COVID-19 related drugs in the prior year quarter.

Sales in Asia-Pacific increased by 23% (organic growth: 26%) to €392 million (Q1/20: €319 million). The growth is mainly due to a dynamic recovery of elective procedures and a meaningful COVID-19 impact lowering the prior year basis in China as well as a growing recovery in other Asian markets.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

Sales in Latin America/Africa increased by 9% (organic growth: 28%) to €185 million (Q1/20: €170 million) due to ongoing COVID-19 related extra demand.

EBIT1 decreased by 4% (increased by 2% in constant currency) to €276 million (Q1/20: €289 million) with an EBIT margin of 15.7% (Q1/20:16.2%). The increase in constant currency was tempered by underutilized production capacities in the US, competitive pressure coupled with selective supply constraints due to temporary manufacturing issues and the missing contribution from sales to a customer now in Chapter 11. EBIT was supported by positive COVID-19 effects, lower corporate costs due to travel restrictions and phasing of projects.

Net income1,2 decreased by 4% (increased by 3% in constant currency) to €190 million (Q1/201: €197 million).

Operating cash flow increased to €278 million (Q1/20: €174 million) with a margin of 15.8% (Q1/20: 9.7%) mainly due to working capital improvements driven by cash collections.

For FY/21, Fresenius Kabi confirms its outlook and expects organic sales3 growth in a low-to-mid single-digit percentage range. Constant currency EBIT4 is expected to show a stable development up to low single-digit percentage growth. Both sales and EBIT outlook include expected COVID-19 effects.

1 Before special items

2 Net income attributable to shareholders of Fresenius SE & Co. KGaA

3 FY/20 base: €6,976 million

4 FY/20 base: €1,095 million, before special items; FY/21: before special items

Fresenius Helios

Fresenius Helios is Europe's leading private hospital operator. The company comprises Helios Germany and Helios Spain. Helios Germany operates 89 hospitals, ~130 outpatient centers and 6 prevention centers. Helios Spain operates 47 hospitals, 74 outpatient centers and around 300 occupational risk prevention centers. In addition, the company is active in Latin America with 6 hospitals and as a provider of medical diagnostics.

• Helios Spain delivers significant organic sales and earnings growth given recovery of treatment activity

• Helios Germany continues to be compensated by government for foregone elective treatments

• Growth additionally fueled by contributions from acquisitions in Germany and Latin America

Sales increased by 7% (8% in constant currency) to €2,649 million (Q1/20: €2,466 million). Organic growth was 4%. Acquisitions contributed 4% to sales growth.

Sales of Helios Germany increased by 4% (organic growth: 0%) to €1,673 million (Q1/20: €1,603 million). COVID-19 effects were mitigated by government compensation in regions with high COVID-19 incidences. The hospital acquisitions from the Order of Malta contributed 4% to sales growth.

Sales of Helios Spain increased by 13% (14% in constant currency) to €976 million (Q1/20: €863 million). Organic growth of 11% was driven by a strong recovery of elective procedures, a consistently high level of outpatient treatments and strong demand for occupational risk prevention (ORP) services. In addition, the hospitals in Latin America showed a strong performance. The hospital acquisitions in Colombia contributed 3% to sales growth.

EBIT of Fresenius Helios decreased by 2% (-1% in constant currency) to €268 million (Q1/20: €274 million) with an EBIT margin of 10.1% (Q1/20: 11.1%).

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

EBIT of Helios Germany decreased by 9% to €150 million (Q1/20: €165 million) with an EBIT margin of 9.0% (Q1/20: 10.3%). Government compensation broadly mitigated COVID-19 effects. The decrease was primarily caused by the impact of the carve-out of nursing expenses from the overall DRGs and the positive development of January and February last year.

EBIT of Helios Spain increased by 13% (14% in constant currency) to €126 million (Q1/20: €112 million) with an EBIT margin of 12.9% (Q1/20: 13.0%). Healthy organic sales growth led to a meaningfully improved coverage of the fixed cost base. The hospital acquisitions in Colombia made an additional contribution.

Net income1 decreased by 2% (-1% in constant currency) to €173 million (Q1/20: €176 million).

Operating cash flow increased to €215 million (Q1/20: €145 million) with a margin of 8.1% (Q1/20: 5.9%), mainly due to working capital improvements driven by cash collections.

For FY/21, Fresenius Helios confirms its outlook and expects organic sales2 growth in a low-to-mid single-digit percentage range and constant currency EBIT3 growth in a mid-to-high single-digit percentage range. Both sales and EBIT outlook include expected COVID-19 effects.

1 Net income attributable to shareholders of Fresenius SE & Co. KGaA

2 FY/20 base: €9,818 million

3 FY/20 base: €1,025 million; FY/21 before special items

Fresenius Vamed

Fresenius Vamed manages projects and provides services for hospitals and other health care facilities worldwide and is a leading post-acute care provider in Central Europe. The portfolio ranges along the entire value chain: from project development, planning, and turnkey construction, via maintenance and technical management to total operational management.

• Continued significant negative COVID-19 impact

• Project business marked by COVID-19 related delays, cancellations and global supply chain restraints

• Rehabilitation business remains impacted by fewer elective surgeries

• Technical high-end service business remains robust

Sales decreased by 4% (-4% in constant currency) to €477 million (Q1/20: €499 million). Organic growth was -4%.

Sales in the service business increased by 2% (2% in constant currency) to €363 million (Q1/20: €357 million). Sales in the project business decreased by 20% (-20% in constant currency) to €114 million (Q1/20: €142 million), driven by postponements and cancellations of projects.

EBIT decreased by 129% (-129% in constant currency) to -€4 million (Q1/20: €14 million) with an EBIT margin of -0.8% (Q1/20: 2.8%). Large parts of the post-acute care clinic capacities were left partially empty given a generally lower intake of elective surgery patients from acute-care hospitals. Health-authority-induced restrictions or even closures of facilities also had a negative effect. In the project business, project delays and global supply chain restraints triggered incremental expenses.

1 Net income attributable to shareholders of VAMED AG

Net income1 decreased to -€7 million (Q1/20: €7 million).

Order intake was €138 million (Q1/20: €124 million). As of March 31, 2021, order backlog was at €3,082 million (December 31, 2020: €3,055 million). Order intake continued to be marked by COVID-19 related cancellations and project delays.

Operating cash flow decreased to -€44 million (Q1/20: -€20 million) with a margin of -9.2% (Q1/20: -4.0%), mainly related to the lower net income contribution.

For FY/21, Fresenius Vamed confirms its outlook and expects organic sales2 growth in a mid-to-high single-digit percentage range and EBIT3 to grow to a high double-digit Euro million amount. Both sales and EBIT outlook include expected negative COVID-19 effects.

1 Net income attributable to shareholders of VAMED AG

2 FY/20 base: €2,068 million

3 FY/20 base: €29 million; FY/21 before special items

Conference Call

As part of the publication of the results for Q1/2021, a conference call will be held on May 6, 2021 at 1:30 p.m. CEDT (7:30 a.m. EDT). You are cordially invited to follow the conference call in a live broadcast over the Internet at www.fresenius.com/media-calender. Following the call, a replay will be available on our website.. Following the call, a replay will be available on our website.

For additional information on the performance indicators used please refer to our website https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. Securities may not be offered or sold in the United States of America (“US”) absent registration under the US Securities Act of 1933, as amended, or an exemption from registration. The securities described on the following pages are not offered for sale in the US or to "US persons" (as defined in Regulation S under the US Securities Act of 1933, as amended).

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE US, CANADA, JAPAN OR AUSTRALIA OR WHO ARE US PERSONS (AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT OF 1933, AS AMENDED), OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of the United States of America, Canada, Japan or Australia or a "US person" (as defined in Regulation S under the US Securities Act of 1933, as amended),

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR JAPAN.

Fresenius today successfully placed bonds with an aggregate volume of €1.5 billion across three tranches:

- €500 million bonds with a maturity in October 2025 and an annual coupon of 0%,

- €500 million bonds with a maturity in October 2028 and an annual coupon of 0.5% and

- €500 million bonds with a maturity in October 2031 and an annual coupon of 0.875%.

The proceeds will be used for general corporate purposes, including refinancing of existing financial liabilities.

The bonds were drawn under the Fresenius Debt Issuance Program (DIP) and issued by Fresenius Finance Ireland plc., a wholly owned subsidiary of Fresenius SE & Co. KGaA. The company has applied to the Luxembourg Stock Exchange to admit the bonds to trading on its regulated market.

The envisaged settlement date is April 1, 2021.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada or Japan. There will be no public offer of the securities in the United States.

This announcement is a general information and not a prospectus. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus to be issued by the company in connection with the offering of such securities. Copies of the prospectus will, following publication, be available free of charge from Fresenius SE & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement has been prepared on the basis that any offer of securities in any Member State of the European Economic Area (EEA) will be made pursuant to the prospectus prepared by Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company and Fresenius Finance Ireland II Public Limited Company in combination with the relevant final terms relating to such securities or pursuant to an exemption under Regulation (EU) 1129/2017 (the Prospectus Regulation) from the requirement to publish a prospectus for offers of securities. Neither Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company nor Fresenius Finance Ireland II Public Limited Company have authorized, nor do they authorize, the making of any offer of securities in circumstances in which an obligation arises for Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company and Fresenius Finance Ireland II Public Limited Company or any other person to publish or supplement a prospectus for such offer.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Neither Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company nor Fresenius Finance Ireland II Public Limited Company undertake any responsibility to update the forward-looking statements in this announcement.

Susanne Zeidler and Dr. Frank Appel proposed for election to the Supervisory Board of Fresenius Management SE

Michael Sen (52) will become the new Chief Executive Officer of Fresenius Kabi AG. The Supervisory Board of Fresenius Management SE has unanimously appointed him to the Management Board of Fresenius effective on April 12, 2021. He succeeds Mats Henriksson (53), who is leaving the company due to different views on Fresenius Kabi’s future direction.

Michael Sen was a member of the Management Board of Siemens AG from April 2017 to March 2020, where he was responsible for the healthcare business Siemens Healthineers and for Siemens’ energy business. Prior to that, from 2015 to 2017, he was Chief Financial Officer of E.ON SE. At the start of his professional career, Michael Sen completed an apprenticeship at Siemens in Berlin and then studied business administration at the Technical University of Berlin. After graduation, he took on various management roles at Siemens starting in 1996 in both operating businesses and central divisions. From 2008 to 2015, he was a member of the Executive Team and CFO of Siemens Healthcare.

Mats Henriksson joined the Management Board of Fresenius Kabi on September 1, 1999. From 2001 to February 2012, he was responsible for the company’s Asia-Pacific region. From March 1, 2012, he served as Deputy Chairman of the Management Board of Fresenius Kabi, and on January 1, 2013 was appointed Chairman of the Management Board of Fresenius Kabi.

Dr. Gerd Krick, Chairman of the Supervisory Board of Fresenius, said: "Mats Henriksson played a major role in the development of Fresenius Kabi from the very beginning. From the acquisition and integration of Pharmacia & Upjohn, which became Fresenius Kabi in 1999, to the very successful expansion in Asia under his responsibility and the entry into the promising biosimilars business, he has made numerous important contributions to the growth of this Fresenius business segment. Mats Henriksson is handing over a well-managed business to his successor. On behalf of the entire Supervisory Board, I would like to thank him most sincerely. I wish him every success and the best for his future."

Wolfgang Kirsch, the designated Chairman of the Supervisory Board of Fresenius, said: "Fresenius has developed extremely dynamically and successfully over the past years, from a medium-sized company to a global healthcare group with sales of more than €36 billion today. With the recently presented growth strategy, the Management Board, under the proven leadership of Stephan Sturm, is setting the course for the company's sustained, successful further development. My colleagues on the Supervisory Board and I fully support this strategy, including the announced, ongoing and open review of the Group structure. Michael Sen is an experienced manager in the healthcare sector who complements our team very well. The Management Board of Fresenius is ideally positioned to successfully implement the strategy in the coming years and to continue Fresenius' growth story."

Stephan Sturm, CEO of Fresenius, said: "I have worked closely, trustfully and successfully with Mats Henriksson for many years. I thank him, and I personally wish him all the best. At the same time, I look forward to working with Michael Sen in the future. Fresenius Kabi's business addresses several attractive growth areas in medicine. It is and will remain of central strategic importance for our healthcare group. Together, we will work in the coming years to make this company even stronger – for the benefit of the growing number of patients who depend on our important drugs and products and for our shareholders."

Michael Sen said: "Fresenius Kabi is committed to improving the quality of life of patients around the world. In my future role, I would like to continue to put patient well-being at the center of everything we do and play my part in continuing the company's successful development. I am very much looking forward to working with Stephan Sturm and the entire team on the Management Board of Fresenius, and of course with my more than 40,000 new colleagues at Fresenius Kabi worldwide. With courage, dedication and creativity, we can and will still achieve a lot together."

The Supervisory Board of Fresenius Management SE also unanimously resolved to propose Susanne Zeidler (60), Chief Financial Officer of Deutsche Beteiligungs AG (DBAG) since November 2012, and Dr. Frank Appel (59), Chief Executive Officer of Deutsche Post DHL Group since February 2008, for election to the Supervisory Board of Fresenius Management SE.

Susanne Zeidler worked for the auditing and consulting firm KPMG between 1990 and 2010. Lastly, as a partner, she was responsible for KPMG's business with foundations and other non-profit organizations, which, as a qualified auditor and tax advisor, she had helped to establish from 2006 onwards. Prior to that, from 1990 to 1999, she was involved in the valuations of medium-sized and listed companies in various industries, and between 2000 and 2005 was the partner responsible for KPMG's internal audit review. Before joining the Management Board of DBAG, Susanne Zeidler was Managing Director at the headquarters of the international charity organization "Kirche in Not" ("Aid to the Church") from the beginning of 2011.

Dr. Frank Appel has worked for Deutsche Post DHL Group since 2000, initially as Managing Director Corporate Development, and from 2002 as Board Member responsible for Global Business Services and Key Account Management Global Customer Solutions. In 2005, he was responsible for the acquisition and integration of the British logistics company Exel. In February 2008, he was appointed Chief Executive Officer. A graduate chemist with a PhD in neurobiology, he began his professional career in 1993 at the management consultancy McKinsey, where he became a member of German Business Management in 1999 before joining Deutsche Post DHL Group.

As already announced in October 2020, Dr. Gerd Krick (82) will leave the Supervisory Boards of Fresenius Management SE and the listed Fresenius SE & Co. KGaA when his term ends at the close of the Annual General Meeting in May 2021. Wolfgang Kirsch (65), a member of the Supervisory Board of Fresenius Management SE since January 1, 2020, is to take over from him as Chairman of both Supervisory Boards. In recognition and deep appreciation of his long decades of accomplishment and invaluable work on behalf of Fresenius, Dr. Krick shall be named Honorary Chairman of both Supervisory Boards.

Klaus-Peter Müller (76) will be stepping down from the Supervisory Board of Fresenius Management SE at the end of his term in May 2021. At the listed Fresenius SE & Co. KGaA, Klaus-Peter Müller will stand for reelection to the Supervisory Board at the Annual General Meeting in May with the aim of chairing the Audit Committee for a further year.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Pagination

- Previous page

- Page 14

- Next page