Fresenius Kabi, part of the global healthcare company Fresenius, announced today it has received two awards for supply and service excellence from Vizient®, the largest provider-driven healthcare performance improvement company in the U.S.

The Supplier of the Year Awards recognize outstanding suppliers by category that support Vizient’s mission to strengthen providers’ delivery of better, more affordable care.

“These awards from Vizient are an important acknowledgment of the company’s commitment to long-term, sustainable drug supply,” said Arun Verma, president, Fresenius Kabi USA and a member of the Executive Leadership Team at Fresenius Kabi AG. “The Vizient Supply Assurance award is especially gratifying as it recognizes our efforts to assure continuity of supply for essential medicines and technologies."

The rate of change, a key parameter for determining the price increase for the reimbursement of hospital treatments in 2026 in Germany, has been set at 5.17%. The change in hospital costs is the other parameter used in the annual determination of the reimbursement increase. The final DRG inflator should be determined at the latest by the end of the year.

The information and documents contained on the following pages of this website are for information purposes only. These materials do neither constitute an offer nor an invitation to subscribe to or to purchase securities, nor any investment advice or service, and are not meant to serve as a basis for any kind of obligation, contractual or otherwise. Securities may not be offered or sold in the United States of America (“US”) absent registration under the US Securities Act of 1933, as amended, or an exemption from registration. The securities described on the following pages are not offered for sale in the US or to "US persons" (as defined in Regulation S under the US Securities Act of 1933, as amended).

THE FOLLOWING INFORMATION AND DOCUMENTS ARE NOT DIRECTED AT AND ARE NOT INTENDED FOR USE BY (I) PERSONS WHO ARE RESIDENTS OF OR LOCATED IN THE US, CANADA, JAPAN OR AUSTRALIA OR WHO ARE US PERSONS (AS DEFINED IN REGULATION S UNDER THE US SECURITIES ACT OF 1933, AS AMENDED), OR (II) PERSONS IN ANY OTHER JURISDICTION WHERE THE COMMUNICATION OR RECEIPT OF SUCH INFORMATION IS RESTRICTED IN SUCH A WAY THAT PROVIDES THAT SUCH PERSONS SHALL NOT RECEIVE IT. SUCH PERSONS, OR PERSONS ACTING FOR THE BENEFIT OF ANY SUCH PERSONS, ARE NOT PERMITTED TO VISIT THE FOLLOWING PAGES OF THE WEBSITE.

To visit the following parts of this website you must confirm that

(i) you are not a resident of the United States of America, Canada, Japan or Australia or a "US person" (as defined in Regulation S under the US Securities Act of 1933, as amended),

(ii) you are not a person to whom the communication of the information contained on the website is restricted,

(iii) you will not distribute any of the information and documents contained thereon to any such person, and

(iv) you are not acting for the benefit of any such person.

By clicking on the "Accept" button below, you will be deemed to have made this confirmation.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA, SINGAPORE OR JAPAN.

After being absent from the Euro bond market for almost two years, Fresenius today successfully placed bonds with an aggregate volume of €1 billion across two tranches:

- €500 million bonds with a maturity in September 2029 and an annual coupon of 2.75% and

- €500 million bonds with a maturity in March 2034 and an annual coupon of 3.50%.

Today’s transaction follows the successful signing of a new €400 million loan agreement with the European Investment Bank.

The proceeds of the transaction will be used for general corporate purposes, including the refinancing of existing financial liabilities. Concurrently with the bond issuance Fresenius announced its intention to early repay the outstanding €500 million 4.250% bond due May 28, 2026, via a make-whole call, subject to the successful settlement of the bond issuance.

The bonds were drawn under the Fresenius Debt Issuance Program and issued by Fresenius SE & Co. KGaA. Fresenius has applied to the Luxembourg Stock Exchange to admit the bonds to trading on its regulated market.

The envisaged settlement date of the bonds is September 15, 2025.

With this transaction, Fresenius has successfully covered its funding needs for 2025 and further increased the financial flexibility in line with the company’s prudent financing strategy.

Fresenius remains committed to its investment grade rating and its self-imposed target leverage corridor of 2.5 to 3.0x net debt/EBITDA. Deleveraging and a strong balance sheet focus combined with clear capital allocation priorities are key aspects to deliver on #FutureFresenius.

IMPORTANT NOTICE

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, Singapore or the United States of America (the “United States”) or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada, Japan or Singapore or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada, Japan or Singapore. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada, Japan or Singapore. There will be no public offer of the securities in the United States.

This announcement contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Neither Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company nor Fresenius Finance Ireland II Public Limited Company undertake any responsibility to update the forward-looking statements in this announcement.

This announcement is a general information and not a prospectus. It has been prepared on the basis that any offer of securities in any Member State of the European Economic Area ("EEA") will be made pursuant to the prospectus and any supplement thereto prepared by Fresenius SE & Co. KGaA, Fresenius Finance Ireland Public Limited Company and Fresenius Finance Ireland II Public Limited Company in combination with the relevant final terms relating to such securities or pursuant to an exemption under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) from the requirement to publish a prospectus for offers of securities. Investors should not purchase or subscribe for any securities referred to in this announcement except on the basis of information in the prospectus, as supplemented, in combination with the relevant final terms relating to such securities, to be issued by the company in connection with the offering of such securities. The applicable final terms for such securities, when published, will be available on the website of the Luxembourg Stock Exchange (www.LuxSE.com) together with the prospectus and any supplement thereto. Copies of the prospectus are also available free of charge from Fresenius SE & Co. KGaA at Else-Kröner Strasse 1, 61352 Bad Homburg, Germany.

This announcement is directed at and/or for distribution in the United Kingdom only to (i) persons who have professional experience in matters relating to investments falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities falling within article 49(2)(a) to (d) of the Order (all such persons are referred to herein as “relevant persons”). This announcement is directed only at relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents. Any investment or investment activity to which this announcement relates is available only to relevant persons and will be engaged in only with relevant persons.

- The European Investment Bank (EIB) loan of €400 million will support Fresenius investments to increase availability of innovative medicines and biosimilars across Europe.

- The loan demonstrates EIB’s ongoing commitment to high-quality and affordable healthcare.

- This financing is a further step in the #FutureFresenius agenda.

Fresenius, a global healthcare company, will receive a new €400 million loan from the European Investment Bank (EIB) to strengthen Fresenius’ European research and development (R&D) activities. The financing will be used to support expansion of Fresenius Kabi's manufacturing of medical products and biosimilars in European countries.

The EIB-backed investments aim to strengthen resilience of pharmaceutical production in the EU and contribute to security of supply and financial relief for European healthcare systems. This will facilitate access to modern and affordable healthcare.

Sara Hennicken, CFO of Fresenius: "Our mission at Fresenius is to save and improve people’s lives. Investing in our core business with the development of innovative, affordable healthcare products is a key element of Rejuvenate, the current phase of our #FutureFresenius journey. Consequently, the continued trust of the European Investment Bank means more to us than just attractive financing; it is a valued recognition of our contribution to a healthy European future."

Nicola Beer, Vice President of the EIB: “Our long-standing partnership with Fresenius is a testament to the EIB’s enduring commitment to accessible, high-quality healthcare throughout Europe. By supporting the accelerated development of biosimilar and generic pharmaceuticals by Fresenius across several European countries, we are helping to deliver innovative, affordable solutions for millions of patients while strengthening the EU’s resilience in medicine supply and research excellence. Together, we are scaling up scientific advances and manufacturing capability, paving the way for a healthier, more sustainable future.”

Generic drugs account for around 70% of prescriptions in Europe but represent only just under 20% of pharmaceutical costs, according to an IQVIA research.

As a manufacturer of pharmaceuticals, biosimilars, clinical nutrition and medical technologies with around 20 manufacturing plants and multiple R&D centers across Europe, Fresenius stands for the reliable supply of essential medicines.

Over the last 5 years, Fresenius has invested more than €1 billion in European manufacturing in key markets. These investments are intended to meet European demand. The aim of Fresenius' local-for-local strategy is to manufacture products for European patients in Europe.

Over the last 5 years, the EIB has provided more than €22 billion in financing for the health and life sciences sector, including €4 billion in countries outside the EU.

The EIB has backed long term innovation investments by Fresenius for around 20 years.

About the EIB

The European Investment Bank (ElB) is the long-term lending institution of the European Union, owned by its Member States. Built around eight core priorities, we finance investments that contribute to EU policy objectives by bolstering climate action and the environment, digitalisation and technological innovation, security and defence, cohesion, agriculture and bioeconomy, social infrastructure, the capital markets union, and a stronger Europe in a more peaceful and prosperous world.

The EIB Group, which also includes the European Investment Fund (EIF), signed nearly €89 billion in new financing for over 900 high-impact projects in 2024, boosting Europe’s competitiveness and security.

All projects financed by the EIB Group are in line with the Paris Climate Agreement, as pledged in our Climate Bank Roadmap. Almost 60% of the EIB Group’s annual financing supports projects directly contributing to climate change mitigation, adaptation, and a healthier environment.

Fostering market integration and mobilising investment, the Group supported a record of over €100 billion in new investment for Europe’s energy security in 2024 and mobilised €110 billion in growth capital for startups, scale-ups and European pioneers. Approximately half of the EIB's financing within the European Union is directed towards cohesion regions, where per capita income is lower than the EU average.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Physicians, researchers, and partner institutions across Europe aim to deliver innovative, personalized therapies more quickly

Development project focused on a hospital-based modular platform, based on technology initially developed by Fresenius Kabi

The EASYGEN project is a public-private partnership, with €8 million backed by EU funding through the Innovative Health Initiative

Important step in #FutureFresenius program

The global healthcare company Fresenius is collaborating with other companies and academic institutions with the goals of accelerating the manufacturing of CAR-T cell therapy, making it more cost-effective, and improving patient access across Europe. Led by Fresenius, the newly launched EASYGEN (Easy workflow integration for gene therapy) consortium will focus on efforts to develop a modular, hospital-based platform capable of manufacturing personalized cell therapies in just a few days, rather than weeks. The project is a public-private partnership, with €8 million in funding provided by the EU through the Innovative Health Initiative (IHI). It leverages technology originally developed by the Cell and Gene Therapy team of Fresenius Kabi, part of Fresenius.

Dr. Christian Hauer, President MedTech at Fresenius Kabi, said: “This project contributes to expanding our MedTech platform, making it an important step on our path to #FutureFresenius. The aim is not only to develop cutting-edge medical technologies, but also to make them available quickly, safely, and close to the patient. In this way, we are actively working to shape the healthcare of tomorrow.”

“EASYGEN brings together physicians, researchers, and partner institutions from across Europe with the goal of collaboratively advancing innovative, personalized therapies such as CAR-T cells for cancer treatment. Automation can help reduce production complexity of these therapies, with the aim of making it easier to scale these life-saving treatments and improve patient access,” added Prof. Dr. med. Ralf Kuhlen, Chief Medical Officer at Fresenius.

CAR-T therapy is a breakthrough treatment that involves genetically modifying a patient’s T cells to target cancer. It requires complex, time-intensive production in specialized facilities often far from patients. Limited manufacturing capacity and supply chain delays can potentially prevent timely patient access. Despite clinical eligibility, access to CAR-T cell therapy remains limited for patients across Europe. This is particularly evident in diffuse large B-cell lymphoma (LBCL), a type of cancer that is one of the most common indications: Across five European countries, the average treatment rate is below 20%. While approximately 30% of eligible patients receive CAR-T therapy in France, the figure drops to just 11% in Italy.1

Fresenius is actively involved in cell and gene therapy. Fresenius Kabi provides medical technology for these therapies, including automated cell processing systems such as Lovo and Cue. Fresenius Helios, for example, at its Helios Hospital Berlin-Buch, has been offering CAR-T cell therapy as a standard treatment for relapsed cases since 2019. The clinic is also conducting clinical trials to further explore the potential of CAR-T therapies. Quirónsalud, Fresenius’ Spanish hospital business, has established specialized oncology units that offer CAR-T cell therapy as part of their advanced cancer treatment portfolio, particularly for hematologic malignancies.

EASYGEN is led by Fresenius and academically co-led by Fraunhofer Institute, IZI, Leipzig – one of Europe’s foremost immunotherapy research centers in collaboration with Prof. Dr. Michael Hudecek, a leader in CAR-T cell engineering and Prof. Dr. Ulrike Köhl, a pioneer in translational cellular immunotherapies.

1 IQVIA Institute for Human Data Science. (03/ 2025). Achieving CAR T-cell Therapy Health System Readiness: An Assessment of Barriers and Opportunities.

Consortium partners – 18 organizations across 8 countries

Industry & clinical leaders: Fresenius (Coordinator, Germany), Helios Hospital Berlin-Buch (Germany), Quirónsalud (Spain), Fenwal Inc. (USA), Cellix Ltd. (Ireland), Charles River (Germany), Pro-Liance Global Solutions (Germany), TQ Therapeutics (Germany), Philips Electronics Nederland B.V. (Netherlands).

Academic & research institutions: Fraunhofer IESE (Germany), Fraunhofer IZI (Germany), Helmholtz-Zentrum Dresden-Rossendorf (Germany), Technical University of Denmark (Denmark), Frankfurt School of Finance & Management (Germany), European Society for Blood & Marrow Transplantation (Netherlands), Bar-Ilan University (Israel), University of Glasgow (UK), University of Navarra (Spain).

* * *

Learn more about CAR-T cell therapy: Interview Prof. Bertram Glaß, Chief Physician for Hematology and Cell Therapy at Helios Hospital Berlin-Buch: www.fresenius.com/car-t-cell-therapy

* * *

About EASYGEN

EASYGEN is a five-year research project supported by the Innovative Health Initiative Joint Undertaking (IHI JU) under grant agreement No 101194710. The JU receives support from the European Union’s Horizon Europe research and innovation programme and COCIR, EFPIA, Europa Bío, MedTech Europe, Vaccines Europe and industry partners. Selected under the IHI call “User-centric technologies and optimized hospital workflows for a sustainable healthcare workforce”, the project aims to develop an integrated, automated platform that enables point-of-care CAR-T cell manufacturing—cutting production time, reducing costs, and expanding access to next-generation immunotherapies.

Disclaimer: Funded by the European Union, the private members, and those contributing partners of the IHI JU. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the aforementioned parties. Neither of the aforementioned parties can be held responsible for them.

Copyright: Johannes Krzeslack

Image Description

In the front row, from left to right: Dr. Sonja Steppan (Easygen Principal Investigator, Fresenius SE), Prof. Dr. Michael Hudecek (Fraunhofer IZI), Theresa Kagerbauer (TQ Therapeutics), Dr. Agnes Vosen (HZDR), Christopher Wegener (Fresenius Kabi), Vaclovas Radvilas (EBMT), Dr. Julia Schüler (Charles River), Dr. Julia Busch-Casler (HZDR), Nicole Spanier-Baro (Fraunhofer IESE), Vivienne Williams (Cellix Limited), Prof. Dr. Bertram Glaß (Helios), Prof. Dr. Ulrike Köhl (Fraunhofer IZI), Rebecca Scheiwe (Fresenius SE). In the back row, from left to right: Prof. Dr. Ralf Kuhlen (Fresenius SE), Prof. Dr. Jens O. Brunner (DTU), Dominik Narres (Fresenius SE), Thomas Brzoska (Pro-Liance Global Solutions), Dr. David Krones (Fraunhofer IZI), Dr. Sabine Bertsch (Pro-Liance Global Solutions), Dr. Ralf Hoffmann (Philips), Christin Zündorf (TQ Therapeutics), Dr. Anna Dünkel (Fraunhofer IZI).

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

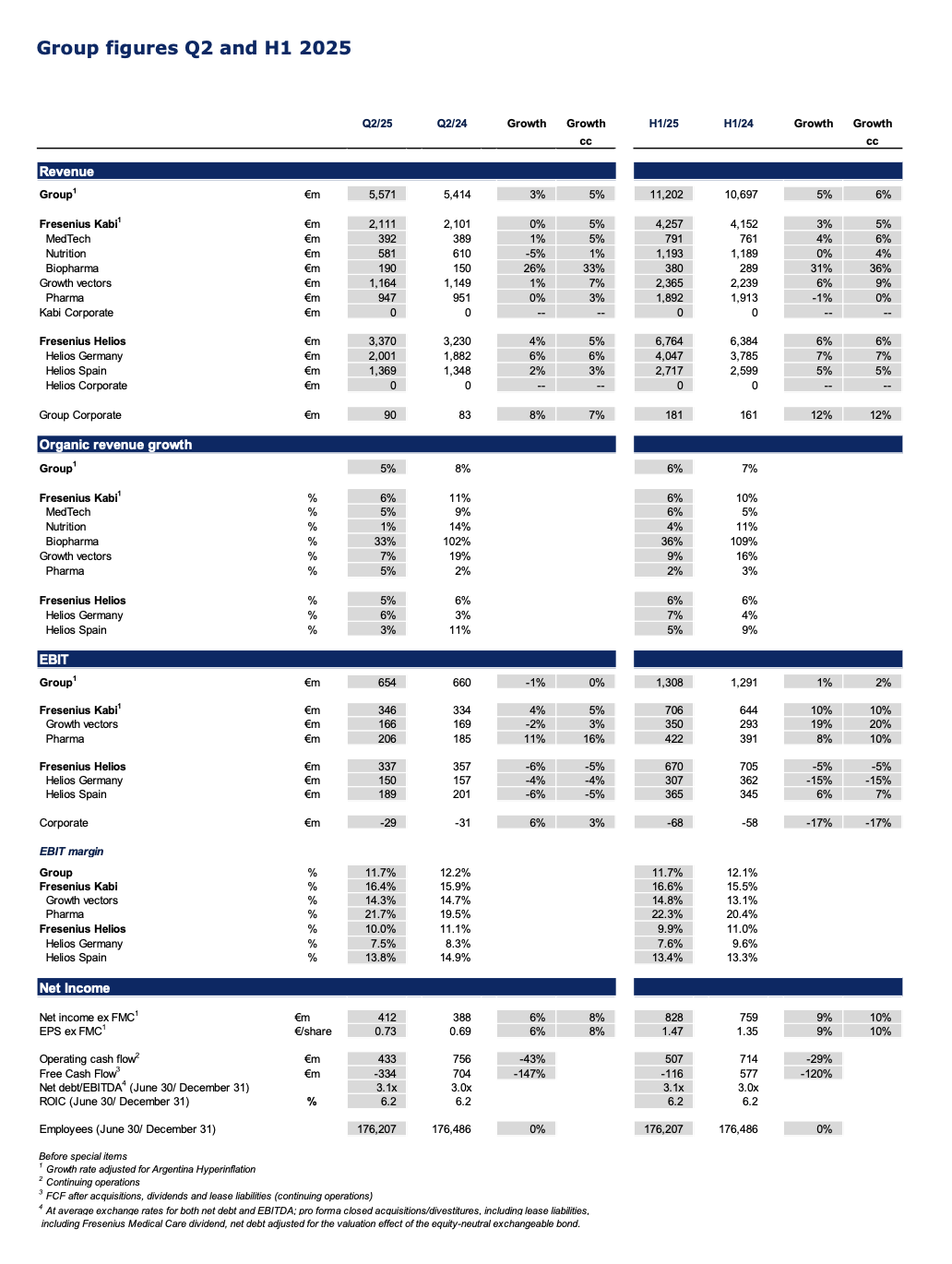

An overview of key financial figures is available at the end of the release.

Q2/2025: Ongoing strong revenue and EPS growth, guidance for organic revenue growth raised

Group revenue1 at €5,571 million with organic growth of 5%1,2 driven by consistent delivery across the core businesses Fresenius Kabi and Fresenius Helios as well as ongoing execution of #FutureFresenius.

Group EBIT1 broadly stable3 in constant currency at €654 million impacted by the headwinds from ceased energy relief payments at Helios Germany and the loss of the volume-based procurement tender for the nutrition product Ketosteril in China at Fresenius Kabi; Group EBIT margin1 at 11.7%.

Net income1,4 with strong 8%3 growth in constant currency to €412 million outpacing revenue growth.

EPS1,4 rose by strong 8%3 in constant currency to €0.73 demonstrating continued bottom-line delivery based on operating strength and significantly decreased interest expenses.

Net debt/EBITDA ratio at 3.1x1,5 driven by resumed dividend payment in Q2/25.

Pro rata sale of Fresenius Medical Care shares to maintain current stake in response to the announced Fresenius Medical Care share buyback program.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond

Michael Sen, CEO of Fresenius: “Fresenius has demonstrated a resilient and consistent performance in the first half of 2025, with another quarter of strong momentum reflected by 8% Core EPS growth. Fresenius Kabi and Fresenius Helios continue to deliver strong results despite macroeconomic challenges, thanks to our focused strategy and disciplined execution. This performance enables us to raise our guidance, increasing our full-year expectations for revenue growth to between 5% and 7%. #FutureFresenius is paying off.

Our ambitions remain unchanged: Our current strategy phase Rejuvenate will focus on organic growth through disciplined capital allocation - upgrading our core, and scaling our platforms to enhance performance further. We are committed to delivering profitable growth through targeted investments in health and digital innovation, which together will create and enhance value for our stakeholders."

Guidance raised for Fiscal Year 20251

Based on the consistent growth at the top-end of the 2025 guidance in H1/25, organic revenue guidance was raised:

Fresenius Group2: organic revenue growth3 now expected in the range of 5 to 7% (previous: 4 to 6%); constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1 Before special items

2 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4 Growth rate adjusted for Argentina hyperinflation

5 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q2/25

In Q2/2025, the good operating performance of Fresenius Kabi and Fresenius Helios led to a 5%1 Group organic revenue2 increase to €5,571 million.

As expected, Group EBIT before special items was broadly stable3 in constant currency, and amounted to €654 million. This is related to the headwinds from the absence of energy relief payments at Helios Germany and the Volume Based Procurement of the nutrition product Ketosteril in China at Fresenius Kabi. Despite the negative effects, Group EBIT margin was 11.7% (Q2/24: 12.2%). The Helios Performance Programme is advancing with increasing contributions expected in the second half of the year.

Earnings per share2,4 rose by a strong 8%3 in constant currency to €0.73, driven by the operating strength and the significantly decreased interest expenses.

Following the announcement of Fresenius Medical Care AG (FME) in June 2025 to initiate a share buyback program, Fresenius intends to sell shares of FME on a pro rata basis to maintain its current stake of around 28.6% in FME. The final size and tranching of the sale of shares will be determined based on the structure of the share buyback program of FME. As previously announced, Fresenius remains a committed shareholder and will retain no less than 25 per cent plus one share of FME.

Fresenius will use the proceeds to invest in its core business in line with the #FutureFresenius strategy and Fresenius' stated capital allocation priorities, including further strengthening the balance sheet, reducing leverage, and delivering shareholder value and long-term growth.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Operating Companies – Business development Q2/25

Fresenius Kabi delivered a strong performance; Growth Vectors with ongoing momentum, continued Biopharma strength; licensing agreement to commercialize a proposed vedolizumab biosimilar candidate

Organic revenue growth of 6%1 mainly driven by the Growth Vectors and the good contribution from Pharma; reflecting the less pronounced positive Argentina pricing effects; revenue was broadly flat at €2,111 million due to currency effects; increased by 5%2 in constant currency.

Growth Vectors with good organic revenue1 increase of 7%: MedTech 5%, Nutrition 1%, Biopharma 33%.

- Nutrition revenue: €581 million, growth clearly influenced by the tender impact from the Volume Based Procurement (VBP) on Ketosteril in China (ex Ketosteril healthy organic growth in line with ambition range), good development in Latin America and Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

- Biopharma revenue: €190 million, positive development mainly driven by the Tyenne biosimilar ramp up in Europe and the U.S. as well as Idacio; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) launched in the U.S. and approved in Europe; expansion of autoimmune biosimilars portfolio: licensing agreement with Polpharma Biologics to commercialize a proposed vedolizumab biosimilar candidate (excluding region MENA).

- MedTech revenue: €392 million, increase driven by the expansion in Cell Therapy in the U.S., and solid growth in Europe.

Pharma revenue: €947 million, strong organic revenue development1 with 5% growth based on good volumes including I.V. fluids in the U.S., and Europe with favourable pricing.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Growth rate adjusted for Argentina hyperinflation

EBIT1 of Fresenius Kabi with 5%2 constant currency increase to €346 million, driven by the strong margin development of the Pharma, MedTech and Biopharma business and ongoing improvements in the cost base. The EBIT margin1 was at the upper end of the guidance range at 16.4% despite transaction exchange rate effects and headwinds on the Nutrition business in China.

EBIT1 of the Growth Vectors increased 3%2 in constant currency against the backdrop of the Ketosteril effect, and amounted to €166 million; EBIT margin1 at 14.3%.

EBIT1 of Pharma increased 16%2 in constant currency to €206 million. EBIT margin1 was strong at 21.7% due to ongoing cost savings and some one-timers.

Fresenius Helios with solid organic revenue growth; expected softness in profitability at Helios Germany partially offset by good development at Helios Spain; Helios Performance Programme is advancing.

Strong 5% organic revenue growth driven by Helios Germany (6% organic growth); Helios Spain at 3% organic growth (H1/25: 5%) linked to the Easter effect, which resulted into less activity at the beginning of Q2/25 and impacted growth predominantly at Helios Spain; revenue before special items increased by 5% in constant currency to €3,370 million.

Helios Germany with revenue1 of €2,001 million; growth mainly driven by price effects, as well as good activity levels and case mix.

Helios Spain with revenue of €1,369 million, impacted by the Easter timing and currency translation effects related to the clinics in Latin America. The clinics in Latin America showed a good operational performance.

EBIT1 of Fresenius Helios as expected declined -5% in constant currency to €337 million impacted by the absence of energy relief funds in Germany. This expected softness was partially compensated by the excellent profitability at Helios Spain. EBIT margin1 of Fresenius Helios was resilient at 10.0%.

1 Before special items

2 Growth rate adjusted for Argentina hyperinflation.

EBIT1 of Helios Germany decreased by -4% to €150 million against the high prior-year base which included energy relief funds; EBIT margin at 7.5% improved by 90 bps compared to Q4/24 (6.6%), the first quarter without energy relief funds.

EBIT1 of Helios Spain decreased by -5% in constant currency to €189 million related to a very strong prior-year base and the Easter effect; EBIT margin1 at a strong 13.8%.

Helios performance programme is advancing; ramp-up in H2/25 expected with more meaningful EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1 Before special items

* * *

Conference call and Audio webcast

As part of the publication of the Q2/2025 results, a conference call will be held on August 6, 2025 at 1:30 p.m. CEST / 7:30 a.m. EDT. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

* * *

* * *

Note on the presentation of financial figures

If no timeframe is specified, information refers to Q2/2025.

Consolidated results for Q2/25 as well as for Q2/24 include special items. An overview of the results for Q2/2025 - before and after special items – is available on our website.

Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

The results of Fresenius Helios and accordingly of the Fresenius Group for Q2/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

Anke Schmidt (55) has been appointed Head of Corporate Communications at Fresenius, effective June 1, 2025. She will succeed Dennis Hofmann, who has headed the global communications function at Fresenius since September 2022 and has decided to leave the company on his own request to pursue new opportunities. Anke Schmidt will report directly to the CEO of Fresenius, Michael Sen.

“With Anke Schmidt we have won an internationally experienced and highly recognized communications expert for Fresenius. With her many years of experience at DAX 40 companies, she will further strengthen our positioning as a leading global healthcare company and continue to build our brand, while also driving the strategic development of the communications function. Especially in this current phase of #FutureFresenius, Rejuvenate, it is about setting new impulses to shape an innovative, relevant, and sustainably successful Fresenius,” says Michael Sen, CEO of Fresenius. “Dennis Hofmann has reorganized and strengthened the global communications function at Fresenius in recent years. Under his leadership, the communications team played a decisive role in positioning Fresenius in the initial phase of its transformation. I would like to sincerely thank him for his great work and commitment and to wish him all the best for his future endeavors.”

Before joining Fresenius, Anke Schmidt served as Global Vice President Corporate Communications & Government Relations at Beiersdorf from 2020 onwards. Prior to that, she spent 24 years in various senior roles in Communications, Government Relations, and Human Resources at BASF, both in Germany and abroad. From 2016 to 2020, she was responsible for BASF Group’s Corporate Communications & Government Relations. Anke Schmidt studied French, economics, and political science at the University of Hamburg and the Université de Nantes in France.

# # #

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) is a global healthcare company headquartered in Bad Homburg v. d. Höhe, Germany. In the 2024 fiscal year, Fresenius generated €21.5 billion in annual revenue. Fresenius currently counts over 176,000 employees. The Fresenius Group comprises the operating companies Fresenius Kabi and Fresenius Helios as well as an investment in Fresenius Medical Care. With around 140 hospitals and countless outpatient facilities, Fresenius Helios is the leading private hospital operator in Germany and Spain, treating around 26 million patients every year. Fresenius Kabi’s product portfolio touches the lives of 450 million patients annually and includes a range of highly complex biopharmaceuticals, clinical nutrition, medical technology, and intravenous generic drugs and fluids. Fresenius was established in 1912 by the Frankfurt pharmacist Dr. Eduard Fresenius. After his death, Else Kröner took over management of the company in 1952. She laid the foundations for a global enterprise that today pursues the goal of improving people’s health. The largest shareholder is the non-profit Else Kröner-Fresenius Foundation, which is dedicated to advancing medical research and supporting humanitarian projects.

For more information visit the Company’s website at www.fresenius.com.

Visit our media center: www.fresenius.com/media-center

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

- Management Board and Supervisory Board approved by a large majority

- Dividend of 1.00 euro per share agreed

- Wolfgang Kirsch re-elected as Chairman of the Supervisory Board

At today’s Annual General Meeting (AGM) in Frankfurt am Main, Germany, the shareholders of Fresenius SE & Co. KGaA approved the proposals of the General Partner and the Supervisory Board with a large majority.

The actions of the General Partner and the Supervisory Board in 2024 were approved by 99.66 percent and 97.36 percent respectively. 99.98 percent voted in favor of approving the annual financial statements. 95.83 percent of the shareholders approved the compensation report for the 2024 financial year and 99.37 percent approved the dividend proposal of 1.00 euro per share. The resolutions on the remuneration for the members of the Supervisory Board and extending the authorization to hold virtual annual general meetings were also adopted with large majorities. 77.93 percent of the share capital was represented at the AGM.

Following the AGM, the newly appointed Supervisory Board of Fresenius SE & Co. KGaA re-elected Wolfgang Kirsch as its chair during its constituent meeting. Michael Diekmann and Grit Genster were also confirmed as deputy chairs and Susanne Zeidler was confirmed as chair of the Audit Committee. The shareholders previously re-elected Prof. Dr. Iris Löw-Friedrich and Dr. Christoph Zindel to the Supervisory Board in addition to Kirsch, Diekmann, and Zeidler. After 14 years in office, Prof. Dr. med. D. Michael Albrecht stepped down from the Supervisory Board. The AGM elected Prof. Dr. Ralf Kiesslich, Chairman of the Board of the University Medical Centre in Mainz, as his successor. The six employee representatives had already been elected beforehand. All Supervisory Board members were appointed for the period until the end of the 2029 AGM.

The new Supervisory Board of Fresenius SE & Co. KGaA comprises the following members:

Wolfgang Kirsch (Chairman)

Michael Diekmann (Deputy Chair)

Grit Genster (Deputy Chair)

Bernd Behlert

Tania Lara Campaña

Carsten Georg

Prof. Dr. Ralf Kiesslich

Prof. Dr. Iris Löw-Friedrich

Holger Michel

Oscar Romero de Paco

Susanne Zeidler

Dr. Christoph Zindel

* * *

About Fresenius

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) is a global healthcare company headquartered in Bad Homburg v. d. Höhe, Germany. In the 2024 fiscal year, Fresenius generated €21.5 billion in annual revenue. Fresenius currently counts over 176,000 employees. The Fresenius Group comprises the operating companies Fresenius Kabi and Fresenius Helios as well as an investment in Fresenius Medical Care. With around 140 hospitals and countless outpatient facilities, Fresenius Helios is the leading private hospital operator in Germany and Spain, treating around 26 million patients every year. Fresenius Kabi’s product portfolio touches the lives of 450 million patients annually and includes a range of highly complex biopharmaceuticals, clinical nutrition, medical technology, and intravenous generic drugs and fluids. Fresenius was established in 1912 by the Frankfurt pharmacist Dr. Eduard Fresenius. After his death, Else Kröner took over management of the company in 1952. She laid the foundations for a global enterprise that today pursues the goal of improving people’s health. The largest shareholder is the non-profit Else Kröner-Fresenius Foundation, which is dedicated to advancing medical research and supporting humanitarian projects.

For more information visit the Company’s website at www.fresenius.com

Follow us on social media: www.fresenius.com/socialmedia

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

- The disciplined implementation of #FutureFresenius has made Fresenius a simpler, more focused, and stronger company.

- With the next phase, Rejuvenate, the focus in the years ahead will be on strengthening the core businesses, scaling platforms, and elevating performance.

- Dividend of 1.00 euro per share proposed.

Thanks to the successful ongoing implementation of its #FutureFresenius strategy, Fresenius considers itself well-positioned to continue to deliver profitable growth and create long-term value. “With #FutureFresenius, the company has a coherent strategy that it will continue to implement consistently and successfully in the interests of all stakeholders. The Supervisory Board firmly believes that Fresenius fulfils all the requirements needed to achieve its ambitious goals. We support the course that the Management Board is pursuing. On behalf of the Supervisory Board, I thank the Management Board and all employees for their outstanding work,” said Wolfgang Kirsch, Chairman of the Supervisory Board, at this year’s Annual General Meeting (AGM) in Frankfurt am Main today.

“The successful implementation of #FutureFresenius means Fresenius is now simpler, more focused, stronger, and more resilient. We are now in a better position to anticipate change more quickly and, if necessary, respond more effectively,” said Michael Sen, CEO of Fresenius. “Fresenius is essential to healthcare systems around the world – through our hospitals and our products, without which patient care would not be possible.” Furthermore, the company’s “Local for Local” strategy, focused on local value creation, manufacturing, and jobs, also strengthens its resilience.

Fresenius began the year from a position of strength and launched the next phase of its #FutureFresenius strategy, Rejuvenate. Reducing the shares in Fresenius Medical Care in March this year was the first milestone. Fresenius used the proceeds to strengthen its balance sheet and further fuel innovation. Rejuvenate is about advancing and strengthening its core businesses. In addition, the company will scale up its three platforms – (Bio)Pharma, MedTech, and Care Provision – to unlock new long-term growth opportunities and achieve higher earnings.

In the 2024 financial year, Fresenius once again increased the pace of growth in revenue and earnings. “Last year, we not only kept our promises but even exceeded our expectations and raised our guidance twice,” said Sen. The company achieved this through its efforts, to which all operating businesses contributed. Productivity also increased, and the self-imposed target corridor for the leverage ratio was achieved for the first time in seven years. By 2024, Fresenius had reduced its net debt by 2 billion euros and achieved an operating cash flow of 2.4 billion euros. A dividend of 1.00 euro per share was proposed for the past financial year during the Annual General Meeting.

Fresenius also considers itself on track for 2025. “Our mission to save and improve human lives continues to drive us forward in the new financial year. With the next phase of #FutureFresenius, we want to continue our success story in 2025,” said Sen, referring to the strong start to the year. In early May, Fresenius confirmed its guidance for the full year 2025 following excellent growth in revenue and earnings during the first quarter.

The AGM will be held in person, with several hundred shareholders attending this year’s event at Messe Frankfurt.

* * *

The letter by Wolfgang Kirsch, Chairman of the Supervisory Board of Fresenius, and the speech by Michael Sen, Chief Executive Officer of Fresenius, can be downloaded here: Annual General Meeting | FSE

About Fresenius

Fresenius SE & Co. KGaA (Frankfurt/Xetra: FRE) is a global healthcare company headquartered n Bad Homburg v. d. Höhe, Germany. In the 2024 fiscal year, Fresenius generated €21.5 billion in annual revenue. Fresenius currently counts over 176,000 employees. The Fresenius Group comprises the operating companies Fresenius Kabi and Fresenius Helios as well as an investment in Fresenius Medical Care. With around 140 hospitals and countless outpatient facilities, Fresenius Helios is the leading private hospital operator in Germany and Spain, treating around 26 million patients every year. Fresenius Kabi’s product portfolio touches the lives of 450 million patients annually and includes a range of highly complex biopharmaceuticals, clinical nutrition, medical technology, and intravenous generic drugs and fluids. Fresenius was established in 1912 by the Frankfurt pharmacist Dr. Eduard Fresenius. After his death, Else Kröner took over management of the company in 1952. She laid the foundations for a global enterprise that today pursues the goal of improving people’s health. The largest shareholder is the non-profit Else Kröner-Fresenius Foundation, which is dedicated to advancing medical research and supporting humanitarian projects.

For more information visit the Company’s website at www.fresenius.com

Follow us on social media: www.fresenius.com/socialmedia

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673 Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

An overview of key financial figures is available at the end of the release.

Q1/2025: Strong top line and excellent EPS growth, outlook confirmed

- Group revenue1 at €5.63 billion with strong organic growth of 7%1,2 driven by consistent delivery of Fresenius Kabi and a strong performance at Fresenius Helios.

- Group EBIT1 at €654 million, increase of 4%3 in constant currency on the back of strong operating performance at Kabi; absence of energy relief payments weighing on Helios Germany; Group EBIT margin1 of 11.6%.

- Net income1,4 grew by an excellent 12%3 in constant currency to €416 million significantly outpacing revenue growth

- EPS1,4 rose by excellent 12%3 in constant currency to €0.74 resulting from broad based operational strength and lower interest expenses.

- Operating cash flow from continuing operations of €74 million significantly improved year-on-year driven by operating development and increased focus on cash generation.

- Leverage ratio within target corridor: Net debt/EBITDA ratio at 3.0x1,5 showing 80 bps improvement in the last twelve months.

- #FutureFresenius Rejuvenate phase: Pivotal milestone delivered with the reduction of participation in Fresenius Medical Care stake enhancing strategic flexibility while setting basis for long-term profitable growth.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

3 Growth rate adjusted for Argentina hyperinflation.

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond.

Michael Sen, CEO of Fresenius: “We've kick-started 2025 with an excellent performance across the business and confirm our full-year guidance. Organic revenue increased by 7% driven by the consistent delivery of Fresenius Kabi and Fresenius Helios. This along with continued improvements in operations and lower interest costs led to an impressive EPS growth of 12%. Following the reduction of our stake in Fresenius Medical Care, a first and pivotal milestone in our history, we now start the Rejuvenate phase of #FutureFresenius from an even stronger position; this step underscores our commitment to creating long-term value. With a strengthened balance sheet and capital allocation priorities to further invest in our growth platforms, while also increasing our US presence, Fresenius is well positioned to deliver future profitable growth and innovation.”

Outlook confirmed for Fiscal Year 20251

Fresenius Group2: organic revenue growth3 of 4% to 6%, constant currency EBIT growth4 in the range of 3% to 7%

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

Assumptions to guidance: When Fresenius gave guidance in February, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as potential impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

1 Before special items

2 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation.

4 Growth rate adjusted for Argentina hyperinflation

5 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Fresenius Group – Business development Q1/25

Fresenius entered with excellent momentum into the year with strong organic growth above the top-end of the 2025 guidance. The consistent positive delivery of Fresenius Kabi and the strong performance at Fresenius Helios drove a 7%1 Group organic revenue2 increase to €5.63 billion. Due to a continued strong operating performance, Group EBIT before special items increased 4%3 in constant currency to €654 million despite the high prior-year quarter which included energy relief fundings at Helios Germany. Particularly, a strong performance at Kabi and Helios in Spain contributed to the EBIT growth. The Helios Performance Programme delivers some first contributions with more significant contributions expected in the second half of the year. Earnings per share2,4 rose by an excellent 12%3 in constant currency to €0.74, driven by a broad-based operational strength and improved interest costs against the backdrop of a strong cash flow development and successful deleveraging.

In Q1/25, Fresenius reached a pivotal milestone in #FutureFresenius with the reduction of participation in Fresenius Medical Care and the issuance of an exchangeable bond with Fresenius Medical Care shares underlying. These transactions underline Fresenius' clear commitment to long-term value creation and were the first visible signs of the Rejuvenate phase, which will focus on three key aspects in the coming years:

- Upgrade Core: Fresenius will continue to strengthen its core businesses. This includes, for example, reinforcing R&D pipelines, further increasing financial strength, and enhancing corporate culture.

-

Scale Platforms: By strategically scaling its (Bio)Pharma, MedTech, and Care Provision platforms, Fresenius can make an important contribution to meeting the challenges facing healthcare systems around the world. The priorities are:

-

Driving innovation at (Bio-)Pharma

-

Expand MedTech to provide and connect technology solutions for critical clinical areas such as emergency rooms, operating rooms and intensive care units.

-

Accelerate digitization of care provision

-

-

Elevate Performance: Overall, Rejuvenate is designed to help the company achieve higher levels of performance and make Fresenius even more innovative and relevant.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Operating Companies – Business development Q1/25

Fresenius Kabi delivered a strong start to the year, Biopharma moving close to structural EBIT margin band

- Organic revenue growth of 6%1 clearly driven by the Growth vectors; revenue increased by 5% to €2,146 million; positive Argentina pricing effects continued but less pronounced.

-

Growth vectors with strong organic revenue1 increase of 11%: MedTech 7%, Nutrition 7%, Biopharma 40%.

-

Nutrition revenue: €612 million, benefited from positive pricing effects in Argentina and the good development in Europe; in the U.S. ongoing successful roll-out of lipid emulsions.

-

Biopharma revenue: €190 million, mainly driven by the growth of Tyenne in Europe and the U.S.; launch of Ustekinumab biosimilar Otulfi® in EU and the U.S.; denosumab biosimilars Conexxence® (denosumab-bnht) and Bomyntra® (denosumab-bnht) approved by FDA.

-

MedTech revenue: €399 million, driven by strong growth related to the Ivenix pump rollout in the U.S, and broad-based positive development across most regions.

-

-

Pharma revenue: €946 million, flat organic revenue development1 against a high prior-year base; positive pricing development in Europe was offset by a softer development in the U.S. and China.

-

China business continued to be impacted by a general economic weakness, price declines in connection with tenders, and hospital budget controls.

-

EBIT2 of Fresenius Kabi with 16%3 constant currency increase to €360 million, driven by the strong revenue development of the Growth vectors and ongoing improvements in the cost base. The EBIT-margin2 was very strong at 16.8%, a 170 bps yoy expansion.

-

EBIT2 of the Growth Vectors increased 45%3 in constant currency to €184 million against the backdrop of a broad-based positive development; EBIT margin2 at 15.3% increased by 390 bps year-on-year, Biopharma moving close to structural EBIT margin band.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Before special items

3 Growth rate adjusted for Argentina hyperinflation

- EBIT1 of Pharma increased 5%2 in constant currency to €216 million. EBIT margin1 was strong at 22.9% driven in particular by ongoing cost savings and a strong pricing development in Europe.

Fresenius Helios with excellent organic revenue growth; Helios Performance Programme evolving in-line with expectations.

- Very strong 8% organic revenue growth clearly above the structural growth band driven equally by Helios Germany (8% organic growth) and Helios Spain (8% organic growth); From a year-on-year perspective, Q1 also benefitted from the Easter effect falling in the second quarter this year; revenue before special items increased by 8% to €3,394 million.

- Helios Germany with revenue of €2,046 million; growth mainly driven by price effects: positive development of admissions and case mix.

- Helios Spain with revenue of €1,348 million, driven by strong activity levels and favourable price effects. The clinics in Latin America also showed a good performance.

-

EBIT1 of Fresenius Helios declined 4% to €333 million as the support from energy relief funds phased out by the end of Q3/24. This expected softness was partially compensated by excellent profitability at Helios Spain. EBIT margin1 was solid at 9.8% driven by Helios Spain with a margin of 13.1% and 23% EBIT growth.

-

EBIT1 of Helios Germany decreased by 23% to €157 million against the high prior-year base which included energy relief funds; EBIT margin at 7.7% improved by 110 bps sequentially (Q4/24: 6.6%).

-

Helios performance programme delivers some first contributions; ramp-up in H2/25 with more significant EBIT contributions, as some of the levers are process-related and will take time to deliver and realize benefits.

1 Before special items

2 Growth rate adjusted for Argentina hyperinflation

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q1/2024.

- Consolidated results for Q1/25 as well as for Q1/24 include special items. An overview of the results for Q1/2025 - before and after special items – is available on our website.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, in constant currency growth rates of the Fresenius Group are also adjusted.

- The results of Fresenius Helios and accordingly of the Fresenius Group for Q1/24 are adjusted by the sale of the fertility services group Eugin and the divestment of the majority stake in the hospital Clínica Ricardo Palma hospital in Lima, Peru.

- Information on the performance indicators is available on our website at www.fresenius.com/alternative-performance-measures.

* * *

Conference call and Audio webcast

As part of the publication First Quarter 2025 results, a conference call will be held on May 7, 2025 at 1:30 p.m. CET (7:30 a.m. EST). All investors are cordially invited to follow the conference call in a live audio webcast at www.fresenius.com/investors. Following the call, a replay will be available on our website.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Wolfgang Kirsch

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany / Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Michael Sen (Chairman), Pierluigi Antonelli, Sara Hennicken, Robert Möller, Dr. Michael Moser

Chairman of the Supervisory Board: Wolfgang Kirsch

Pagination

- Page 1

- Next page