November 5, 2025

Fresenius Q3/25: Disciplined execution drives continued strong performance – guidance raised

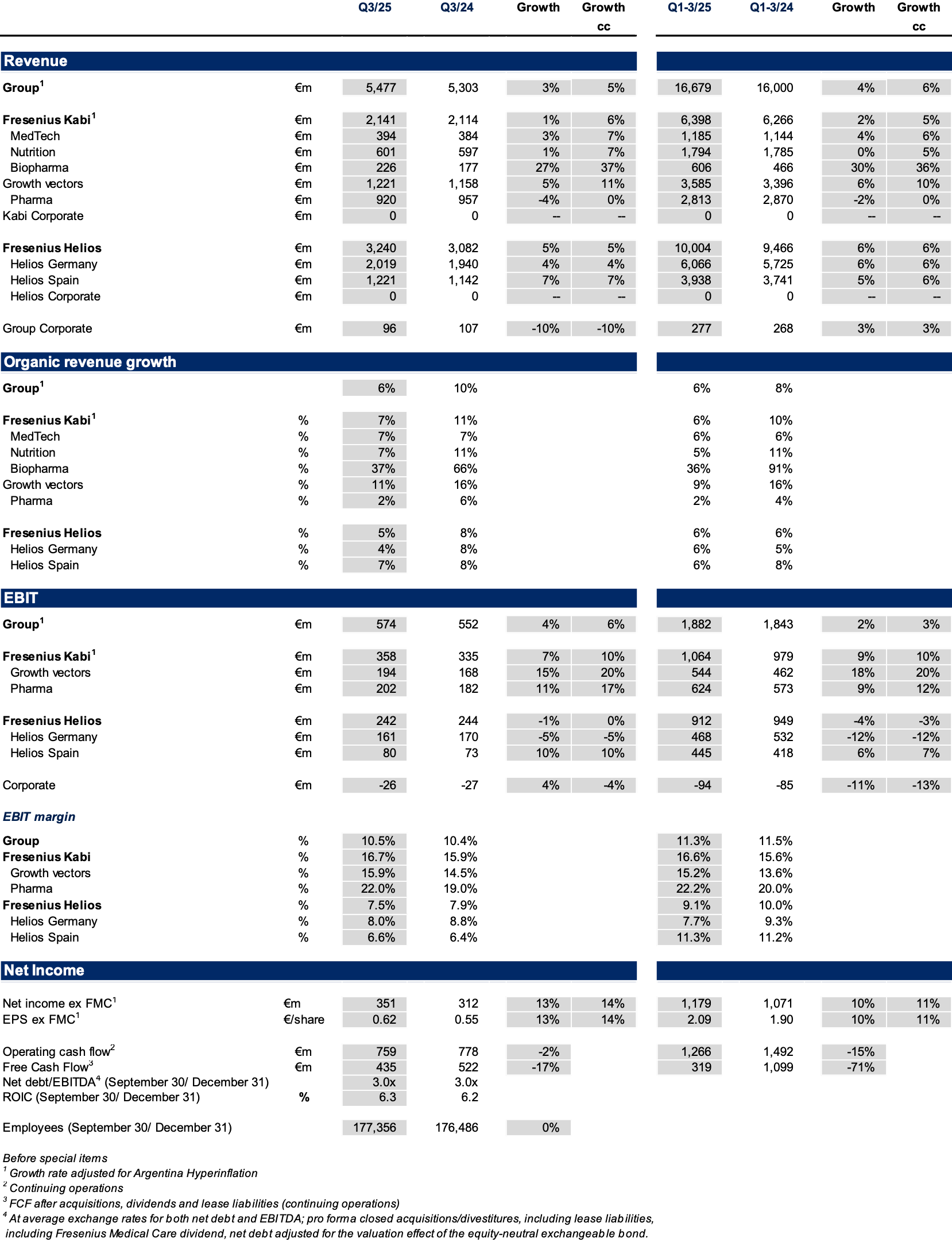

An overview of key financial figures is available at the end of the release.

Q3/2025: Strong organic revenue and excellent EPS growth; EBIT growth guidance raised

- Group revenue1 at €5,477 million with organic growth of 6%1,2 driven by consistent delivery across Fresenius Kabi and Fresenius Helios.

- Group EBIT1 at €574 million with 6%3 growth in constant currency; growth accelerated from Q2/2025 driven by the strong operating performance at Fresenius Kabi, and a solid development at Fresenius Helios despite usual seasonality in Spain and the high prior-year base due to energy relief payments in Germany; Group EBIT margin1 improved to 10.5%.

- Core EPS1,4 increased by excellent 14%3 in constant currency to €0.62 based on strong operating results and significantly decreased interest expense.

- Net debt/EBITDA ratio at 3.0x1,5 within the self-imposed target corridor driven by strong cash flow delivery.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

5 At average exchange rates for both net debt and EBITDA; pro forma closed acquisitions/divestitures, including lease liabilities, including Fresenius Medical Care dividend, net debt adjusted for the valuation effect of the equity-neutral exchangeable bond

Michael Sen, CEO of Fresenius:

"Fresenius is accelerating with purpose, and our transformation is delivering tangible results. Our disciplined execution and performance-oriented culture have resulted in 14% growth in Core EPS, a 6% increase in organic revenue growth, and margin improvements, enabling us to raise our full-year EBIT guidance to 4%-8%.

Fresenius Kabi and Fresenius Helios continue to perform well, while investments in digital health and advanced therapies are reshaping patient care. Despite the current macroeconomic environment, we continue to perform and meet our commitments. With Rejuvenate now driving measurable progress and a clear focus on patient care, we are creating sustainable value for patients, partners, and shareholders – today and into the future."

Guidance raised for Fiscal Year 20251

Based on the strong earnings growth in Q1-3/2025, Fresenius raised the Group EBIT growth guidance:

Fresenius Group2: organic revenue growth3 in the range of 5 to 7%; constant currency EBIT growth4 now expected in the range of 4% to 8% (previous: 3 to 7%)

Fresenius Kabi5: organic revenue growth3 in the mid- to high-single-digit percentage range; EBIT margin of 16.0% to 16.5%

Fresenius Helios6: organic revenue growth in the mid-single-digit percentage range; EBIT margin around 10%

The strong performance in Q1-3/2025 gives the scope to deliberately take some investments in Q4/2025, for example in R&D. This is in line with Fresenius’ strategic roadmap for the Rejuvenate phase to upgrade core and scale platforms and with a view on future performance, i.e. investing in further long-term profitable growth.

1 Before special items

2 2024 base: €21,526 million (revenue) and €2,489 million (EBIT)

3 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

4 Growth rate adjusted for Argentina hyperinflation

5 2024 base: €8,414 million (revenue) and €1,319 million (EBIT)

6 2024 base: €12,739 million (revenue) and €1,288 million (EBIT)

Assumptions to guidance: When Fresenius gave guidance in February 2025, the company acknowledged the fast-moving macro-economic and geopolitical environment, resulting in a higher level of operational uncertainty. Fresenius’ guidance continues to reflect current factors and known uncertainties such as impacts from tariffs to the extend they can currently be assessed. The guidance does not take into account potential extreme scenarios that could affect the company, its peers, and the healthcare sector as a whole.

Fresenius Group – Business development Q3/2025

In Q3/2025, the strong operating performance at Fresenius Kabi, and solid development at Fresenius Helios led to consistent Group organic revenue1 growth of 6%2 with revenues reaching €5,477 million.

Group EBIT before special items amounted to €574 million, a sequential acceleration with an increase of 6%3 in constant currency despite the absence of energy relief payments at Helios Germany, the usual seasonality at the Spanish hospital business in the third quarter, and the impact of the Volume Based Procurement of the nutrition product Ketosteril in China at Fresenius Kabi. Group EBIT margin1 improved to 10.5% (Q3/24: 10.4%). The Helios Performance Programme is advancing with material contributions expected in Q4/2025 with likely some spill-over into 2026. The strong Q3/2025 EBIT development was additionally supported by positive phasing effects.

Group net income1,4 increased by excellent 14%3 in constant currency to €351 million strongly outpacing revenue growth. The good operating performance of the core businesses, further productivity gains at Fresenius Kabi and strict cost discipline at Fresenius Helios drove this strong performance, and was supported by the significantly decreased year-over-year interest expenses. In the third quarter alone, interest expenses decreased by €35 million.

Core Earnings per share1,4 rose by excellent 14%3 in constant currency to €0.62.

1 Before special items

2 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

3 Growth rate adjusted for Argentina hyperinflation

4 Excluding Fresenius Medical Care

Operating Companies – Business development Q3/2025

Fresenius Kabi showed strong organic growth at the upper end of the structural growth range with Growth Vectors driving the performance, headed by continued Biopharma strength; EBIT margin above the 2025 guidance range supported by productivity gains and some contributions realized earlier than originally expected.

Organic revenue growth of 7%1 driven by the Growth Vectors, also benefitting from some inflation related pricing effects in Argentina; disciplined execution on product rollouts led to contributions already realized in Q3/2025 that were originally expected for Q4; revenue increased to €2,141 million; growth as reported was negatively impacted by currency effects; increase in constant currency of 6%2.

- Growth Vectors with excellent organic revenue1 growth of 11%: MedTech 7%, Nutrition 7%, Biopharma 37%.

- Nutrition revenue: €601 million driven by strong growth in all regions except China; Latin America and Europe contributing nicely; continued strong market demand in the U.S. for lipid emulsions; China declined albeit slightly less than anticipated with respect to the Volume Based Procurement (VBP) tender impact on nutrition product Ketosteril.

- Biopharma revenue: €226 million with growth mainly driven by the tocilizumab biosimilar Tyenne ramp up in Europe and the U.S.; first delivery of Tyenne vials for the EU market from fully vertically integrated supply chain; exclusive distribution contract for ustekinumab biosimilar Otulfi with CivicaScript in the U.S., first sales expected in Q4/2025.

- MedTech revenue: €394 million with broad-based growth across all regions, Transfusion & Cell Therapy (TCT) and Infusion and Nutrition Systems (INS) both showed solid growth.

- Pharma revenue: €920 million, organic revenue at solid 2%1 growth relative to a strong prior-year base; good volume demand and disciplined pricing in Europe, as well as continued growth in I.V. solutions in the U.S.

- EBIT3 of Fresenius Kabi with 10%2 constant currency increase to €358 million driven by operating leverage and productivity gains; despite the effects of the tender for Ketosteril in China, EBIT margin3 increased to 16.7% mainly driven by the significant margin expansion of the Growth Vectors compared to the prior-year quarter and the excellent profitability at Pharma. The strong performance year-to-date gives the scope to deliberately take some targeted investments in Q4/2025, for example in R&D.

- EBIT3 of the Growth Vectors increased by very strong 20%2 in constant currency and amounted to €194 million; EBIT margin3 improved by 140 bps to 15.9%, moving close to Kabi’s structural margin band.

- EBIT3 of Pharma increased 17%2 in constant currency to €202 million driven by Europe and the U.S as well as by ongoing productivity gains. EBIT margin3 at 22.0%.

1 Organic growth rate adjusted for accounting effects related to Argentina hyperinflation

2 Growth rate adjusted for Argentina hyperinflation

3 Before special items

Fresenius Helios with strong organic revenue growth; sequential margin improvement at Helios Germany driven by progressing Performance Programme; EBIT margin at Helios Spain as expected reflecting the usual seasonality; EBIT growth supported by earlier than expected contributions.

Strong 5% organic revenue growth driven by year-over-year activity levels increase at both, Helios Germany and Helios Spain; revenue increased by 5% in constant currency to €3,240 million.

- Helios Germany’s organic revenue growth was solid at 4% despite the elevated prior year revenue base resulting from technical reclassifications, reflecting strong admission growth and positive price effects; revenues at €2,019 million.

- Helios Spain with strong organic revenue growth of 7% to €1,221 million driven by good activity growth year-over-year, particularly in the ORP business, and price effects.

- EBIT1 of Fresenius Helios at €242 million and thus at constant currency growth broadly in line with the prior-year quarter; overall the EBIT development was impacted by the high prior-year base related to the energy relief payments in Germany as well as to the usual seasonality in Spain in the third quarter. This was partially compensated by the advancements of the performance program in Germany; EBIT margin1 of Fresenius Helios was at 7.5%.

- EBIT1 of Helios Germany decreased by -5% to €161 million against the high prior-year base which included energy relief funds; EBIT margin1 is walking up its way standing at 8.0% compared to 7.5% in Q2/2025 and 6.6% in Q4/2024, which was the first quarter without energy relief funds.

- EBIT1 of Helios Spain increased by 10% in constant currency to €80 million; EBIT margin1 at 6.6%, impacted by the summer season.

- Helios performance programme is advancing; material contributions expected in Q4/2025 with likely some spill-over into 2026 as some of the levers are process-related and will take time to deliver and realize benefits.

1 Before special items

Group figures Q3 and Q1-3 2025

Conference call and Audio webcast

As part of the publication of the Q3/2025 results, a conference call will be held on November 5, 2025 at 1:30 p.m. CEST / 7:30 a.m. EDT. All investors are cordially invited to follow the conference call in a live audio webcast at https://www.fresenius.com/investors. Following the call, a replay will be available on our website.

Information on Fresenius share and ADRs

Note on the presentation of financial figures

- If no timeframe is specified, information refers to Q3/2025.

- Consolidated results for Q3/2025 as well as for Q3/2024 include special items. An overview of the results for Q3/2025 - before and after special items – is available on our website.

- Growth rates in constant currency of Fresenius Kabi are adjusted. Adjustments relate to the hyperinflation in Argentina. Accordingly, constant currency growth rates of the Fresenius Group are also adjusted.

- Information on the performance indicators is available on our website at https://www.fresenius.com/alternative-performance-measures.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, the availability of financing and unforeseen impacts of international conflicts. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.