November 1, 2023

Fresenius Medical Care continues to execute on turnaround plan and raises 2023 earnings outlook due to strong operational performance in first nine months and solid business outlook for the fourth quarter

- Continued solid organic growth in Care Enablement and Care Delivery including sequentially stable same market treatment growth in the U.S.

- Successful execution on turnaround plan driving productivity improvements in Care Delivery and pricing in Care Enablement

- FME25 transformation savings fully on track

- Continued execution on portfolio optimization strategy

- FY 2023 earnings outlook raised

Helen Giza, Chief Executive Officer of Fresenius Medical Care, said: “Our unwavering focus on executing against our strategic plan and the successful implementation of turnaround measures to date, continue to translate into improved operating performance. Notably in the third quarter, we continued to unlock sustainable savings with our FME25 program, further improved our labor productivity and continued to execute on our portfolio optimization plan. Given our improving performance for the first nine months of the year and solid expectations for the remainder of the year, we confidently upgrade our full year earnings outlook.”

Successful execution against the strategic plan

Fresenius Medical Care has continuously advanced its structural change. After implementing the new operating model along with the corresponding new financial reporting, the simplification of the governance structure through a legal form conversion remains on track to be completed by 1 December 2023.

Fresenius Medical Care continues to successfully execute on its operational efficiency and turnaround plans. In the third quarter, the FME25 transformation program delivered EUR 97 million of savings, resulting in EUR 232 million for the first nine months of the year. The Company is fully on track to achieve sustainable savings of EUR 250 to 300 million by year end 2023 and EUR 650 million by year end 2025.

Moreover, Fresenius Medical Care is executing its portfolio optimization plan to exit non-core and dilutive assets. In the third quarter, the Company entered into an agreement to sell National Cardiovascular Partners (NCP) with 21 facilities providing outpatient cardiac catheterization and vascular laboratory services, which are included in the U.S. Care Delivery business, in connection with its Legacy Portfolio Optimization program.

1 For FY 2022, special items included costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement and the net gain related to InterWell Health. Additionally, the FY 2022 basis for the 2023 outlook was adjusted for U.S. Provider Relief Funding. For FY 2023, special items include costs related to the FME25 program, the Humacyte investment remeasurement, the costs associated with the legal form conversion and effects from legacy portfolio optimization. For further details please see the reconciliation attached to the Press Release.

2 Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

In line with the Company’s disciplined financial policy, Fresenius Medical Care has already refinanced a bond of EUR 650 million, maturing in November 2023. The Company is using a mix of long-term bank financing at very attractive financing conditions as well as cash and short-term debt. Upcoming extraordinary cash inflows will enable the Company to further delever.

Revenue development supported by solid organic growth

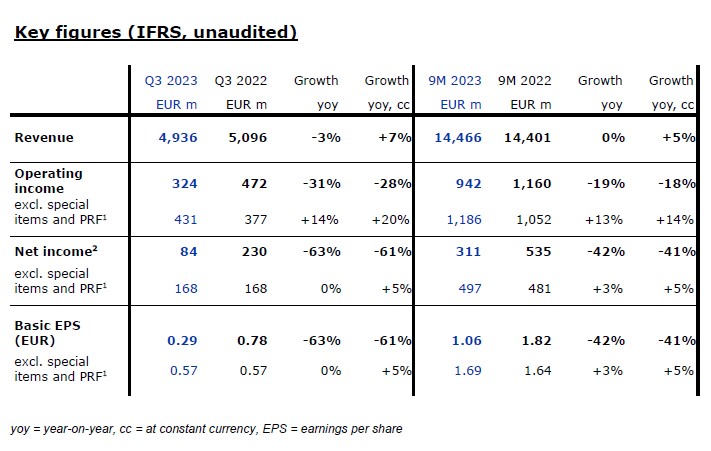

Revenue decreased by 3% to EUR 4,936 million in the third quarter (+7% at constant currency, +7% organic).

Care Delivery revenue decreased by 4% to EUR 3,974 million (+6% at constant currency, +7% organic).

In Care Delivery U.S., revenue declined by 3% (+4% at constant currency, +5% organic). A negative exchange rate effect and a decrease in dialysis days was partially offset by organic growth, which was supported by a favorable impact from the value-based care business, reimbursement rate increases and a favorable payor mix. The annualization effect of COVID-19-related excess mortality in the late-stage CKD (Chronic Kidney Disease) and ESRD (End-Stage Renal Disease) population continues to weigh on same market treatment growth (-0.4%). Adjusted for the exit from less profitable acute care contracts same market treatment growth was at +0.2%.

In Care Delivery International, revenue declined by 7% (+14% at constant currency, +16% organic). A negative exchange rate effect and the impact of closed or sold clinics was partially offset by organic growth, which was driven by a significant effect of hyperinflation in various markets. Despite the annualization effect of COVID-19-related excess mortality, same market treatment growth was positive at 1.6%.

Care Enablement revenue declined by 3% to EUR 1,330 million (+5% at constant currency, +5% organic). The negative exchange rate effects have been partly offset by higher sales of in-center disposables, machines for chronic treatment and home hemodialysis products as well as higher average sales prices.

Within Inter-segment eliminations, revenue for products transferred between the operating segments at fair market value declined by 10% to EUR 368 million (-1% at constant currency).

In the first nine months, revenue was stable at EUR 14,466 million (+5% at constant currency, +5% organic). Care Delivery revenue was stable at EUR 11,602 million (+4% at constant currency, +5% organic), with stable revenue for Care Delivery U.S. (+2% at constant currency, +3% organic), and a revenue decline of 1% for Care Delivery International (+13% at constant currency, +14% organic). Care Enablement revenue was stable at EUR 3,965 million (+5% at constant currency, +5% organic). Inter-segment eliminations declined by 5% and amounted to EUR 1,101 million (stable at constant currency).3

3 The Company transfers products between segments at fair market value. The associated internal revenues and expenses and any remaining internally generated profit or loss for the product transfers are recorded within the operating segments initially, are eliminated upon consolidation and are included within “Inter-segment eliminations”.

Earnings development driven by productivity improvements and FME25 savings

Operating income decreased by 31% to EUR 324 million (-28% at constant currency), resulting in a margin of 6.6% (Q3 2022: 9.3%). Operating income excluding special items and U.S. Provider Relief Funding (PRF)1 increased by 14% to EUR 431 million (+20% at constant currency), resulting in a margin of 8.7% (Q3 2022: 7.4%).

Operating income in Care Delivery decreased by 34% to EUR 332 million (-29% at constant currency), resulting in a margin of 8.4% (Q3 2022: 12.1%). Operating income excluding special items and PRF1 increased by 11% to EUR 410 million (+17% at constant currency), resulting in a margin of 10.3% (Q3 2022: 9.0%). This was mainly driven by business growth, savings from the FME25 program and lower personnel expenses resulting from improved productivity. The operating income development was negatively impacted by lower income attributable to a non-recurring consent payment for certain pharmaceuticals, inflationary cost increases as well as by foreign currency translation.

Operating income in Care Enablement amounted to EUR -1 million (Q3 2022: EUR -26 million), resulting in a margin of -0.1% (Q3 2022: -1.9%). Operating income excluding special items increased by 197% to EUR 22 million (+217% at constant currency), resulting in a margin of 1.7% (Q3 2022: 0.5%). The improvement compared to the previous year’s quarter was mainly driven by increased volumes, improved pricing and savings from the FME25 program. These effects were partially offset by inflationary cost increases and negative foreign currency transaction effects.

Operating income for Corporate amounted to EUR -8 million (Q3 2022: EUR -7 million). Excluding special items, operating income amounted to EUR -2 million (Q3 2022: EUR -6 million).

In the first nine months, operating income decreased by 19% to EUR 942 million (-18% at constant currency), resulting in a margin of 6.5% (9M 2022: 8.1%). Excluding special items and PRF1, operating income increased by 13% to EUR 1,186 million (+14% at constant currency), resulting in a margin of 8.2% (9M 2022: 7.3%). In Care Delivery, operating income declined by 19% to EUR 1,001 million (-18% at constant currency), resulting in a margin of 8.6% (9M 2022: 10.6%). In Care Enablement, operating income decreased to EUR -24 million (9M 2022: EUR 33 million), resulting in a margin of -0.6% (9M 2022: 0.8%). Operating income for Corporate amounted to EUR -23 million (9M 2022: EUR -101 million).

Net income2 decreased by 63% to EUR 84 million (-61% at constant currency). Excluding special items and PRF1, net income2 remained stable at EUR 168 million (+5% at constant currency).

In the first nine months, net income2 declined by 42% to EUR 311 million (-41% at constant currency). Excluding special items and PRF1, net income2 increased by 3% to EUR 497 million (+5% at constant currency).

Basic earnings per share (EPS) decreased by 63% to EUR 0.29 (-61% at constant currency). EPS excluding special items and PRF1 remained stable at EUR 0.57 (+5% at constant currency).

In the first nine months, EPS declined by 42% to EUR 1.06 (-41% at constant currency). Excluding special items and PRF1, EPS increased by 3% to EUR 1.69 (+5% at constant currency).

Strong cash flow development

In the third quarter, Fresenius Medical Care generated EUR 760 million of operating cash flow (Q3 2022: EUR 658 million), resulting in a margin of 15.4% (Q3 2022: 12.9%). The increase in net cash provided by operating activities is the result of the change in certain working capital items, in particular due to the recoupment of advanced payments during 2022, which had been received under the U. S. Medicare Accelerated and Advance Payment Program in 2020.

In the first nine months, operating cashflow amounted to EUR 1,910 million (9M 2022: EUR 1,568 million), resulting in a margin of 13.2% (9M 2022: 10.9%).

Free cash flow4 amounted to EUR 626 million in the third quarter (Q3 2022:

EUR 501 million), resulting in a margin of 12.7% (Q3 2022: 9.8%). In the first nine months, Fresenius Medical Care generated free cash flow of EUR 1,480 million (9M 2022: EUR 1,082 million), resulting in a margin of 10.2% (9M 2022: 7.5%).

Outlook

The Company continues to expect for 2023 revenue to grow at a low to mid-single digit percentage rate (2022 basis: EUR 19,398 million).

Based on the earnings development for the first nine months of the year and solid business expectations for the remainder of the year, Fresenius Medical Care raises its earnings outlook for 2023. The Company now expects operating income to grow at a low-single digit percentage rate (2022 basis: EUR 1,540 million; previous target: remain flat or decline by up to a low-single digit percentage rate)5.

The Company’s target to achieve an operating income margin of 10 to 14% by 2025 remains unchanged.

4 Net cash provided by / used in operating activities, after capital expenditures, before acquisitions, investments, and dividends

5 Revenue and operating income, as referred to in the outlook, are both on a constant currency basis and excluding special items. Special items will be provided as separate KPI (“Revenue excluding special items”, “Operating income excluding special items”) to capture effects that are unusual in nature and have not been foreseeable or not foreseeable in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the Company’s financial targets which have been defined excluding special items.

For FY 2022, special items included costs related to the FME25 program, the impact of the war in Ukraine, the impact of hyperinflation in Turkiye, the Humacyte investment remeasurement, and the net gain related to InterWell Health. Additionally, the basis (FY 2022) for the 2023 outlook was adjusted for Provider Relief Funding. For FY 2023, special items include costs related to the FME25 program, the Humacyte investment remeasurement, the costs associated with the legal form conversion and effects from legacy portfolio optimization. For further details please see the reconciliation attached to the Press Release.

Patients, clinics and employees

As of September 30, 2023, Fresenius Medical Care treated 341,793 patients in 4,014 dialysis clinics worldwide and had 123,106 employees (headcount) globally, compared to 130,295 employees as of September 30, 2022.

Conference call

Fresenius Medical Care will host a conference call to discuss the results of the third quarter on November 2, 2023 at 3:30 p.m. CET / 10:30 a.m. EDT. Details will be available on the Fresenius Medical Care website in the “Investors” section. A replay will be available shortly after the call.

Please refer to our statement of earnings included at the end of this news and to the attachments as separate PDF files for a complete overview of the results of the third quarter and first nine months of 2023. Our 6-K disclosure provides more details.

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes, regulatory approvals, impacts related to COVID-19, results of clinical studies, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA's reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

Implementation of measures as presented herein may be subject to information and consultation procedures with works councils and other employee representative bodies, as per local laws and practice. Consultation procedures may lead to changes on proposed measures.