February 26, 2013

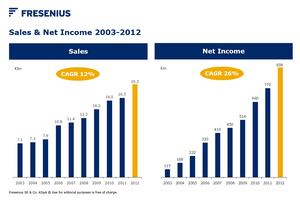

Centennial year with record sales and earnings – Group net income exceeds guidance – Positive outlook for 2013

Fiscal year 2012:

- Sales*: €19.3 billion (+18% at actual rates, +13% in constant currency)

- EBIT**: €3.1 billion (+20% at actual rates, +14% in constant currency)

- Net income***: €938 million (+22% at actual rates, +17% in constant currency)

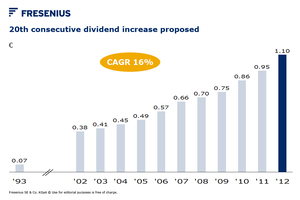

- 16% dividend increase to €1.10 per share proposed

Positive Group outlook for 2013:

- Sales growth of 7% to 10% in constant currency

- Net income**** growth of 7% to 12% in constant currency

- Fresenius expects to reach 2014 Group net income target of more than €1 billion one year ahead of plan****.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -€161 million solely relates to Fresenius Medical Care North America.

**2012 adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders and other one-time costs of €86 million at Fresenius Medical Care.

***Net income attributable to shareholders of Fresenius SE & Co. KGaA – adjusted for a non-taxable investment gain of €34 million and other one-time costs of €17 million at Fresenius Medical Care and for one-time costs of €29 million related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

****Net income attributable to shareholders of Fresenius SE & Co. KGaA; 2013 adjusted for one-time integration costs of Fenwal, Inc. (~€ 50 million pre tax); 2012 adjusted as per footnote ***

Ulf Mark Schneider, CEO of Fresenius, said: "Fresenius has a proven track record of dynamic growth, with an eightfold increase in net income over the last decade. In its centennial year, our growth story continued with new records for sales and earnings. We saw strong organic growth, double-digit earnings increases and significant acquisitions in all our business segments. The pursuit of medical progress with affordable high-quality products and services and helping seriously ill people is at the heart of everything we do. We will continue to pursue this goal as we enter our second century with confidence and commitment."

New Dividend Policy

The Management Board will propose to the Supervisory Board a dividend of €1.10 per share (2011: €0.95). The total dividend distribution is expected to be €196 million. This marks our 20th consecutive dividend increase.

The 16% increase reflects our new dividend policy, which aligns dividend with earnings per share growth (before special items) and broadly maintains a pay-out ratio of 20% to 25%.

Positive Group outlook 2013

For 2013, Fresenius projects sales growth of 7% to 10% in constant currency. Net income* is expected to increase by 7% to 12% in constant currency.

The Group plans to invest ~5% of sales in property, plant and equipment.

The net debt/EBITDA ratio is projected to be at the lower end of the targeted range of 2.5 to 3.0 by the end of 2013.

*Net income attributable to shareholders of Fresenius SE & Co. KGaA; 2013 adjusted for one-time integration costs of Fenwal, Inc. (~€ 50 million pre tax); 2012 adjusted for a non-taxable investment gain and other one-time costs at Fresenius Medical Care as well as for one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders.

Continued strong sales growth

Group sales increased by 18% (constant currency: 13%) to €19,290 million (2011 : €16,361 million), fully in line with the June 2012 guidance increase. Organic sales growth was 6%. Acquisitions contributed a further 8%. Divestitures reduced sales growth by 1%. Currency translation had a positive effect of 5%. This is mainly attributable to the strengthening of the U.S. dollar against the euro by an average of 8% in 2012 compared to the previous year.

Sales in the business segments developed as follows:

Organic sales growth was 5% in North America and 4% in Europe. In Asia-Pacific organic sales growth reached 12%. In Latin America organic sales growth was 22%, driving sales to more than €1 billion for the first time. The sales decrease in Africa was due to the volatility in Fresenius Vamed's project business.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -€161 million solely relates to Fresenius Medical Care North America.

Excellent earnings growth

Group EBITDA* grew by 19% (constant currency: 13%) to €3,851 million (2011: €3,237 million). Group EBIT* increased by 20% (constant currency: 14%) to €3,075 million (2011: €2,563 million). The EBIT margin improved by 20 basis points

to 15.9% (2011: 15.7%).

Group net interest was -€666 million (2011: -€531 million), primarily driven by higher incremental debt due to acquisition financing and currency translation effects. Interest expense in the fourth quarter included a special charge related to the early refinancing of the Company's Credit Agreement.

The other financial result of -€35 million comprises one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders, primarily related to financing commitments.

The Group tax rate** improved to 29.1% (2011: 30.7%).

Noncontrolling interest increased to €769 million (2011: €638 million), of which 92% was attributable to the noncontrolling interest in Fresenius Medical Care.

Group net income*** increased by 22% (constant currency: 17%) to €938 million (2011: €770 million). Earnings per share3 improved by 15% to €5.42 (2011: €4.73). The average number of shares increased to approx. 173 million in 2012, primarily due to capital increase in May.

A reconciliation to adjusted earnings according to U.S. GAAP can be found on page 16 in the pdf of this press release.

Group net income attributable to shareholders of Fresenius SE & Co. KGaA was €926 million or €5.35 per share including the non-taxable investment gain and other one-time costs at Fresenius Medical Care as well as one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders.

*Adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders and other one-time costs of €86 million at Fresenius Medical Care.

**Adjusted for the non-taxable investment gain and one-time costs at Fresenius Medical Care and for one-time costs related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

***Net income attributable to shareholders of Fresenius SE & Co. KGaA – adjusted for a non-taxable investment gain of €34 million and other one-time costs of €17 million at Fresenius Medical Care and for one-time costs of €29 million related to the offer to RHÖN-KLINIKUM AG shareholders. 2011 adjusted for the effects of mark-to-market accounting of the Mandatory Exchangeable Bonds and the Contingent Value Rights.

Continued investment in growth

The Fresenius Group spent €1,007 million on property, plant and equipment (2011: €783 million). Acquisition spending was €3,172 million (2011: €1,612 million). This relates primarily to the acquisitions of Liberty Dialysis Holdings, Inc., Damp Group and Fenwal Holdings, Inc.

Excellent cash flow development

Operating cash flow increased by 44% to €2,438 million (2011: €1,689 million).

This was mainly driven by strong earnings growth and tight working capital management, especially regarding trade accounts receivable. The cash flow margin improved to 12.6% (2011: 10.3%). Net capital expenditure was €952 million (2011: €758 million).

Free cash flow before acquisitions and dividends increased by 60% to €1,486 million (2011: €931 million). Free cash flow after acquisitions and dividends was -€1,259 million (2011: -€748 million).

Solid balance sheet structure

The Group's total assets increased by 17% (constant currency: 18%) to €30,664 million (Dec. 31, 2011: €26,321 million). Current assets grew by 13% to €8,113 million (Dec. 31, 2011: €7,151 million). Non-current assets increased by 18% to €22,551 million (Dec. 31, 2011: €19,170 million), mainly due to acquisitions.

Total shareholders' equity increased by 21% to €12,758 million (Dec. 31, 2011: €10,577 million), mainly due to the excellent earnings development and the capital increase from May 2012. The equity ratio was 41.6% (Dec. 31, 2011: 40.2%).

Group debt grew by 13% to €11,028 million (Dec. 31, 2011: €9,799 million), due to acquisition financing. Net debt increased by 11% to €10,143 million (Dec. 31, 2011: €9,164 million). As of December 31, 2012, the net debt/EBITDA ratio* was 2.56 (Dec. 31, 2011: 2.83).

*Pro forma including Damp Group, Liberty Dialysis Holdings, Inc. and Fenwal Holding, Inc., adjusted for one-time costs of €6 million (non-financing expenses) related to the offer to RHÖN-KLINIKUM AG shareholders, and one-time costs of €86 million at Fresenius Medical Care.

Number of employees increases

As of December 31, 2012, the Fresenius Group increased the number of its employees by 13% to 169,324 (Dec. 31, 2011: 149,351), mainly due to acquisitions.

Fresenius Biotech

Fresenius Biotech develops innovative therapies with trifunctional antibodies for the treatment of cancer. In the field of polyclonal antibodies, Fresenius Biotech has successfully marketed ATG-Fresenius S for many years. ATG-Fresenius S is an immunosuppressive agent used to prevent and treat graft rejection following organ transplantation.

Fresenius Biotech's sales increased by 14% to €34.9 million (2011: €30.7 million).

Removab sales grew by 3% to €4.1 million (2011: €4.0 million). ATG Fresenius S sales increased by 15% to €30.8 million (2011: €26.7 million). Fresenius Biotech's EBIT was -€26 million (2011: -€30 million).

In December 2012, Fresenius announced the decision to discontinue its Fresenius Biotech subsidiary. The Company is in talks with several parties about a sale of Fresenius Biotech, while simultaneously assessing the equally viable option of continuing the immunosuppressive drug ATG-Fresenius S within the Fresenius Group. ATG-Fresenius S has been well established in the hospital market for decades, and is consistently profitable. Fresenius will divest the trifunctional antibody Removab (catumaxomab) business. Withdrawing from Removab will have a positive effect on Group earnings starting in 2013.

Business Segments

Fresenius Medical Care

Fresenius Medical Care is the world's leading provider of services and products for patients with chronic kidney failure. As of December 31, 2012, Fresenius Medical Care was treating 257,916 patients in 3,160 dialysis clinics.

- Strong sales growth of 10% and EBIT growth of 12%

- Excellent operating cash flow margin of 14.8%

- Outlook 2013: sales >US$14.6 billion; net income in the range of

US$1.1 billion and US$1.2 billion

Sales increased by 10% to US$13,800 million (20111: US$12,571 million). Organic sales growth was 5%. Acquisitions contributed a further 8%. Divestitures reduced sales growth by 1%. Currency translation had a negative effect of 2%.

Sales in dialysis services increased by 13% (constant currency: 15%) to US$10,492 million (2011: US$9,283 million). Dialysis product sales grew by 1% (constant currency: 5%) to US$3,308 million (2011: US$3,288 million).

In North America sales grew by 14% to US$9,031 million (2011: US$7,926 million). Dialysis services sales grew by 16% to US$8,230 million (2011: US$7,113 million). Average revenue per treatment in the United States was US$355 (2011: US$348). Dialysis product sales were US$801 million (2011: US$813 million).

Sales outside North America ("International" segment) grew by 2% (constant currency: 9%) to US$4,740 million (2011: US$4,628 million). Sales in dialysis services increased by 4% (constant currency: 11%) to US$2,262 million (2011: US$2,170 million). Dialysis product sales grew by 1% to US$ 2,478 million (2011: US$2,458 million) at actual rates. In constant currency, dialysis product sales grew by 7%.

EBIT** increased by 12% to US$2,329 million (2011: US$2,075 million), partially due to special collection efforts for dialysis services performed in prior years. The EBIT margin increased to 16.9% (2011: 16.5%) primarily due to the improved EBIT margin in North America of 19.0% (2011: 18.1%). In the International segment the EBIT margin was 17.1% (2011: 17.4%).

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 11% to US$1,187 million (2011: US$1,071 million). This includes a non-taxable investment gain of US$140 million related to the acquisition of Liberty Dialysis Holdings, Inc., including its 51% stake in Renal Advantage Partners, LLC (RAI), as well as other one-time costs of US$71 million after tax. The latter comprises the effects regarding the amendment of the agreement for Venofer and a donation to the American Society of Nephrology. Excluding these effects, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA increased by 4% to US$1,118 million.

The operating cash flow increased by 41% to US$2,039 million (2011: US$1,446 million) , driven by ongoing excellent receivables management and including other one-time costs of US$71 million after tax. The cash flow margin improved to 14.8% (2011: 11.5%).

For 2013, Fresenius Medical Care expects sales to grow to more than US$14.6 billion. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to be between US$1.1 billion and US$1.2 billion.

For further information, please see Fresenius Medical Care's press release at www.fmc-ag.com.

*2011 sales were adjusted according to a U.S. GAAP accounting change. The sales adjustment of -US$224 million solely relates to Fresenius Medical Care North America.

**2012 adjusted for other one-time costs of US$110 million related to the amendment of the agreement for Venofer and a donation to the American Society of Nephrology.

***Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA – 2012 adjusted for a non-taxable investment gain of US$140 million and other one-time costs of US$71 million as per footnote **

Fresenius Kabi

Fresenius Kabi offers infusion therapies, intravenously administered generic drugs and clinical nutrition for seriously and chronically ill patients in the hospital and outpatient environments. The company is also a leading supplier of medical devices and transfusion technology products.

- Excellent organic sales growth of 9%

- EBIT margin of 20.6% at all-time high – exceeding outlook

- Outlook 2013: Sales growth of 12% to 14% in constant currency;

EBIT margin of 19% to 20% excl. Fenwal and 18% to 19% incl. Fenwal

Sales increased by 15% to €4,539 million (2011: €3,964 million). Organic sales growth was 9%. Currency translation had an effect of 5%. Acquisitions contributed a further 1%.

Sales in North America increased by 23% to €1,236 million (2011: €1,002 million). Excellent organic growth of 11% was mainly supported by product launches and continued competitor supply constraints. In Europe sales grew by 7% (organic growth: 6%) to €1,953 million (2011: €1,826 million). In Asia-Pacific sales increased by 23% (organic growth: 13%) to €863 million (2011: €702 million). Sales in Latin America and Africa increased by 12% (organic growth: 14%) to €487 million (2011: €434 million).

EBIT grew by 16% to €934 million (2011: €803 million). EBIT growth was driven in particular by excellent earnings growth in North America and in emerging markets. The EBIT margin increased by 30 basis points to 20.6% (2011: 20.3%).

Net income* increased by 25% to €444 million (2011: €354 million).

Fresenius Kabi's operating cash flow increased by 29% to €596 million (2011: €462 million). Incoming payments of overdue trade accounts receivable contributed to the strong increase. The cash flow margin reached 13.1% (2011: 11.7%). Cash flow before acquisitions und dividends increased to €357 million (2011: €289 million).

In December 2012, Fresenius Kabi successfully closed the acquisition of Fenwal Holdings, Inc.

Over the last three years, Fresenius Kabi achieved outstanding organic sales growth with CAGR of 10%, reaching the very top of its 7% to 10% mid-term target range. In 2013, Fresenius Kabi expects further significant growth supported by the full-year consolidation of Fenwal and continued organic growth in emerging markets and Europe. In North America, we expect the I.V. drug supply constraints to alleviate and competitors to re-enter the U.S. market for Propofol. Fresenius Kabi has been sole supplier for Propofol in the United States. since the end of March 2012. For 2013, Fresenius Kabi projects sales growth of 12% to 14% in constant currency. Organic sales growth is expected in the range of 3% to 5%. The company projects an EBIT margin of 19% to 20% excluding Fenwal and of 18% to 19% including Fenwal. EBIT in constant currency is expected to exceed 2012 EBIT. The guidance includes expected one-time charges to remediate manufacturing issues following recent FDA audits at the Grand Island, USA, and Kalyani, India, facilities. It also includes a gain related to the sale of the respiratory homecare business in France.

For the mid-term, Fresenius Kabi targets annual organic sales growth of 7% to 10% and an EBIT margin in the range of 18% to 21%. By 2015, the company expects sales to reach approx. €6 billion and EBIT to reach more than €1.1 billion.

Fresenius Kabi guidance adjusted for one-time integration costs of Fenwal, Inc. (~€50 million pre tax); also see Group guidance

*Net income attributable to shareholders of Fresenius Kabi AG

Fresenius Helios

Fresenius Helios is one of the largest private hospital operators in Germany. HELIOS owns 72 hospitals, including six maximum care hospitals in Berlin-Buch, Duisburg, Erfurt, Krefeld, Schwerin and Wuppertal. HELIOS treats more than 2.9 million patients per year, thereof more than 770,000 inpatients, and operates more than 23,000 beds.

- Organic sales growth of 5% – at upper end of guidance

- EBIT of €322 million – exceeding outlook

- Outlook 2013: Organic sales growth of 3% to 5%;

EBIT in the range of €360 to €380 million

Sales increased by 20% to €3,200 million (2011: €2,665 million). Organic sales growth was 5%, while acquisitions contributed 17% to sales growth. Divestitures reduced sales growth by 2%.

EBIT grew by 19% to €322 million (2011: €270 million). The EBIT margin was at previous year's level of 10.1% despite the consolidation of Damp Group and Duisburg.

Net income* increased by 25% to €203 million (2011: €163 million).

Sales of the established hospitals grew by 5% to €2,743 million. EBIT improved by 18% to €321 million. The EBIT margin increased to 11.7% (2011: 10.3%). Sales of the acquired hospitals (consolidation ≤1 year) were €457 million, EBIT was €1 million. Restructuring of these hospitals is on track.

In November 2012, Fresenius Helios announced that it had agreed to acquire a hospital in North-Rhine Westphalia with 2011 sales of approximately €20 million. HELIOS anticipates closing of the transaction at the end of the first or at the beginning of the second quarter 2013.

For 2013, Fresenius Helios expects to achieve organic sales growth of 3% to 5%. EBIT is projected to increase to between €360 million and €380 million.

Fresenius Helios targets sales of €4 billion to €4.25 billion by 2015, driven by organic growth and acquisitions.

One-time costs relating to the offer to the shareholders of RHÖN-KLINIKUM AG are included in the segment "Corporate/Other".

*Net income attributable to shareholders of HELIOS Kliniken GmbH

Fresenius Vamed

Fresenius Vamed offers engineering and services for hospitals and other health care facilities.

- Strong sales growth of 15% and EBIT growth of 16% - significantly exceeding outlook

- Order intake at all-time high

- Outlook 2013: Sales growth of 8% to 12%; EBIT growth of 5% to 10%

Sales increased by 15% to €846 million (2011: €737 million). Organic sales growth was 5%, acquisitions contributed a further 10% to sales growth. Sales in the project business increased by 2% to €506 million (2011: €494 million). Sales in the service business grew by 40% to €340 million (2011: €243 million). Acquisitions contributed 29% due to the acquisition of H.C. Hospital Consulting in Italy and the transfer of HELIOS' post-acute care clinic Zihlschlacht in Switzerland. Organic sales growth in the service business reached 11%.

EBIT improved by 16% to €51 million (2011: €44 million). The EBIT margin remained at the previous year's level of 6.0%. Net income was €35 million (2011: €34 million).

Order intake increased by 9% to €657 million (2011: €604 million). In the fourth quarter, order intake rose to a quarterly all-time high of €335 million. This includes two contracts for the construction of health care facilities in Africa with a total order volume of €157 million. As of December 31, 2012, Fresenius Vamed's order backlog was at an all-time high of €987 million (Dec. 31, 2011: €845 million).

In 2013, Fresenius Vamed expects to achieve sales growth of 8% to 12%. EBIT is projected to increase by 5% to 10%.

Fresenius Vamed targets sales of €1 billion by 2014.

*Net income attributable to shareholders of VAMED AG

Press Conference and Video Webcast

As part of the publication of the results for fiscal year 2012, a press conference will be held at the Fresenius headquarters in Bad Homburg on February 26, 2012 at 10 a.m. CET. You are cordially invited to follow the conference in a live broadcast over the Internet at www.fresenius.com (see Press / Audio-Video Service). Following the meeting, a recording of the conference will be available as video-on-demand.

Fresenius is a health care group with international operations, providing products and services for dialysis, hospital and outpatient medical care. In 2012, Group sales were €19.3 billion. On December 31, 2012, the Fresenius Group had 169,324 employees worldwide.

For more information visit the Company's website at www.fresenius.com.

This release contains forward-looking statements that are subject to various risks and uncertainties. Future results could differ materially from those described in these forward-looking statements due to certain factors, e.g. changes in business, economic and competitive conditions, regulatory reforms, results of clinical trials, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. Fresenius does not undertake any responsibility to update the forward-looking statements in this release.

Fresenius SE & Co. KGaA

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11852

Chairman of the Supervisory Board: Dr. Gerd Krick

General Partner: Fresenius Management SE

Registered Office: Bad Homburg, Germany

Commercial Register: Amtsgericht Bad Homburg, HRB 11673

Management Board: Dr. Ulf M. Schneider (Chairman), Dr. Francesco De Meo, Dr. Jürgen Götz, Mats Henriksson, Rice Powell, Stephan Sturm, Dr. Ernst Wastler

Chairman of the Supervisory Board: Dr. Gerd Krick